Shopify: Great Prospects But Be Patient

Summary

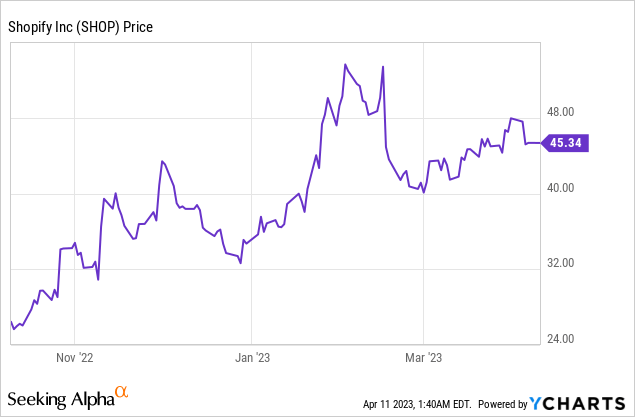

- Shopify has rallied nearly 100% since last October.

- The company still has ample expansion opportunities in the massive and growing e-commerce market.

- The shift to enterprise customers should also be a strong growth driver.

- However, it is quite exposed to the macro economy due to its transaction-based model and current valuation is also elevated.

- I rate the company as a hold.

JHVEPhoto

Investment Thesis

Shopify (NYSE:SHOP) has been one of the best-performing growth companies in the past decade, with shares up over 1,500% since 2015. The company suffered early last year but has rebounded nearly 100% from its 52-week low in October, as declining inflation boosted the sentiment of growth stocks.

Shopify has great prospects and is well-positioned to benefit from the ongoing expansion of e-commerce, but I also think there are some notable near-term concerns. The company may see a significant impact on financials as the increased reliance on transaction-based revenue made it much more exposed to the economy. After the rally, the valuation has also become quite elevated compared to peers with similar growth rates. I believe the upside should be limited here therefore I rate it as a hold and will wait for future pullbacks.

Market Opportunities

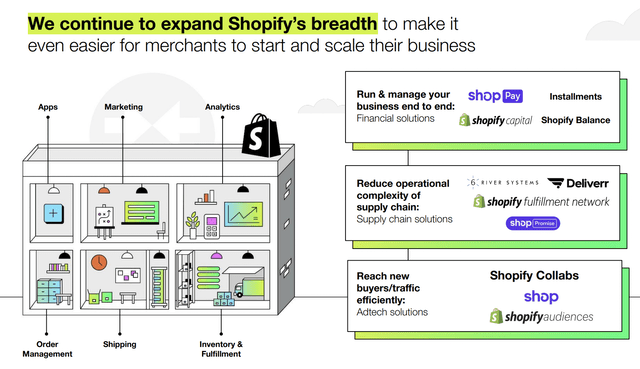

Shopify is a Canada-based commerce platform that enables anyone to start and run their business easily. Since it was founded in 2006 by Tobias Lütke, the company has grown to become one of the world's largest e-commerce companies with an annual transaction volume of $220 billion. The company has also substantially expanded its product breadth with solutions such as Shopify Fulfillment, Shop App, Commerce Components, and others. Despite such progress, I believe there are still ample opportunities for expansion as e-commerce is still in its early innings.

The popularity of e-commerce has been growing rapidly in the past decade, especially during the pandemic when everyone was forced to stay at home due to lockdowns. However, its penetration rate remains surprisingly low. According to Statista, online sales currently represent 17.3% of total sales up from 8.6% in 2017. Thanks to improving logistics and increased convenience, I believe the adoption of e-commerce will continue to rise. According to Grand View Research, the global market size of e-commerce is forecasted to grow from $15.6 trillion in 2023 to $27.2 trillion in 2027, representing a CAGR (compounded annual growth rate) of 14.7%. I believe the ongoing market expansion should continue to provide solid tailwinds for the company.

The Shift To Enterprise

Shopify has been widely known for serving SMBs (small and medium businesses). SMBs are low-hanging fruits but their growth potential is also limited due to fixed subscription fees and low transaction volume. In order to capture more opportunities, the company is now focusing more on larger brands and I believe this will be a major growth catalyst moving forward.

The company has been targeting larger brands through Shopify Plus and it recently launched Commerce Components, its enterprise retail solution. Commerce Components is a compostable stack that allows enterprises to integrate Shopify's components with their own systems through APIs. The infrastructure enables next-level customizations and vastly increases flexibility for customers with specific needs. The new solution has already onboarded notable customers such as Mattel (MAT) which owns about 400 toy brands in its portfolio. I believe this solution can attract more enterprise customers that require comprehensive commerce solutions.

As the company continues to shift to a transaction-based revenue model, the importance of larger clients magnifies further. SMBs tend to offer little value under a transaction-based model as their GMV (gross merchandising volume) is usually pretty low and volatile due to unestablished fundamentals. On the other hand, enterprise customers generally generate a lot more value over time as they have high and steady-growing GMV. I believe the shift to enterprises should be extremely accretive to financials in the long run thanks to their high CLV (customer lifetime value).

Jeff Hoffmeister, CEO on Shopify Plus Merchants:

Contribution from our plus merchants to total MRR increased year-over-year to 33% from 29% in Q4 of 2021. As larger volume brands joined the platform and thousands of additional retail locations began using point-of-sale pro.

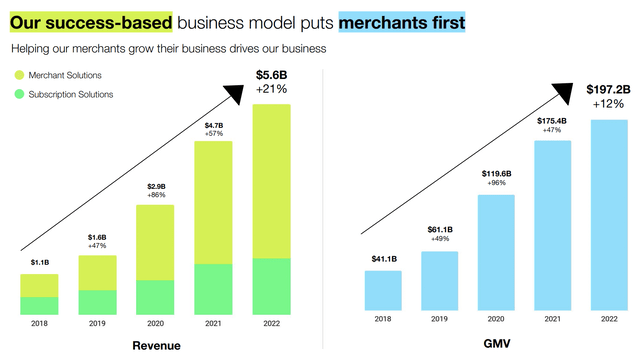

Exposure From Transaction-Based Model

Shopify has historically relied mostly on subscriptions as its major revenue stream but this has been changing as the company continues to grow. It is rapidly shifting towards a transaction-based revenue model which is much more scalable as it is able to benefit from the growth of customers. In 2018, revenue from subscription solutions accounted for roughly 50% of total revenue. The figure has been declining and now only accounts for just 23% of total revenue, as shown in the chart below. The figure should continue to decline as the penetration of Shopify Payments increases over time.

However, the rising penetration of transaction-based revenue is a double-edged sword. While it can capture much more growth, it also makes the company a lot more exposed to the economy due to the dependence on transaction volume. As the economy continues to weaken with a potential recession looming, this may become a notable concern as spending will likely drop substantially. For instance, global shipments for PCs fell 29% as demand waned, according to IDC. I believe the deteriorating economy will likely post an outsized impact on Shopify in the near term.

Elevated Valuation

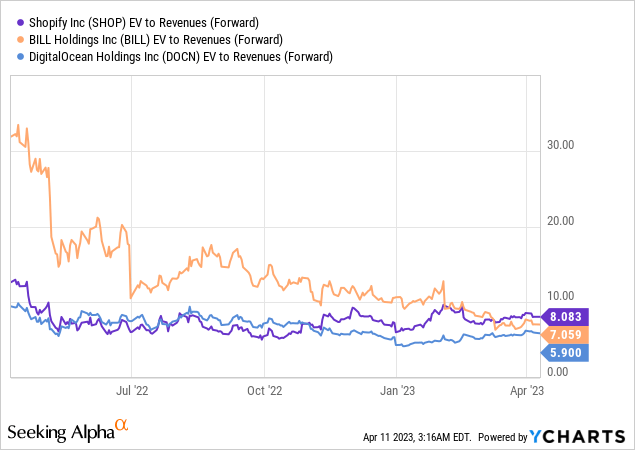

After the massive rally, Shopify's valuation looks pretty expensive in my opinion. The company is currently trading at a fwd EV/sales ratio of 9.1x, which is well above other SMB-focused SaaS companies. As shown in the chart below, BILL Holdings (BILL) and DigitalOcean (DOCN) are trading at a fwd EV/sales ratios of 7x and 5.9x, which represent a meaningful discount of 30% and 54.2% respectively. Shopify's estimated revenue growth rate for the coming fiscal year is also the lowest among peers at just 18.8% compared to Bill's 24.5% and Digital Ocean's 22.3%. I suspect the growth rate will likely come in below expectations due to the increased exposure to the weakening economy. Considering the elevated valuation and slowing growth, I believe its upside potential should be limited in the near term.

Investors Takeaway

I believe Shopify is well-positioned for the long run thanks to favorable market trends and the ongoing shift to enterprise customers, which should unlock more growth opportunities. However, the near-term concerns are making me cautious about the company. The economy has been weakening quickly due to rising rates and slowing demand should heavily impact the company's revenue due to its transaction-based model. Its elevated valuation compared to peers will also likely limit the near-term upside. Therefore I rate the company as a hold and will wait for a better entry point.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.