Elkem: A Fast-Growing Norwegian Chemicals Company

Summary

- Over the past few days, I've introduced you to or updated you on a number of chemical and basic materials companies from Norway. Today, I continue this trend.

- I'm introducing you to Norwegian company Elkem - a small, $2B player in the metal and basic materials sector, with major industrial players as customers.

- Elkem, while small, does have an upside, and in some ways is exactly the sort of company that I look for when investing. Want to know why?

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More »

Kittisak Kaewchalun

Dear readers/subscribers,

So, the company I'm going to be looking at in this article is Elkem (OTC:ELKEF). This is not the largest, nor most undervalued chemical business in Europe, or even in Norway. But I believe it to be one of the more interesting ones, based on a couple of selection criteria that I tend to use for investing in profitable ventures.

As you know, when I pick a company I tend to focus on those that perform better than average but trade at a discount. This goes hand in hand with what many "gurus" like Warren Buffet go for - quality at a below-average price, and you're not unlikely to outperform the broader market.

Elkem is a good example of a company that might offer us this.

Let me show you why that is.

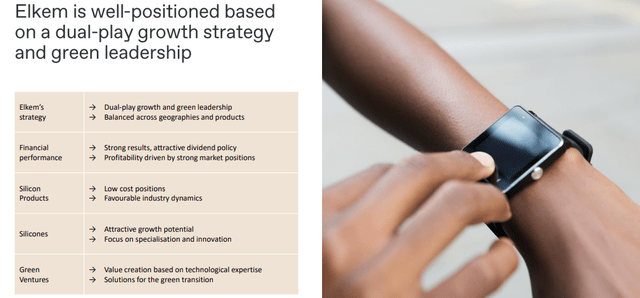

Elkem - an attractive company under any circumstances going forward

Elkem has an attractive strategy. The company produces a variety of silicones, silicon, and alloys for the foundry industry. It's also in the business of carbon, microsilica, and other materials. Despite its relatively small size on a global market, employing 7,700 people and generating revenues of around 33B NOK, the company has been around since the early 20th century. Its initial goal was the aluminum and mining sector and grew over the coming 100 years through forays into ferroalloys and steel. The company went international early and acquired Union Carbides plants in Norway and NA. Elkem was initially part of Orkla (OTCPK:ORKLY), another Norwegian company I write about, but it was sold to the China National Bluestar group at a price of $2B.

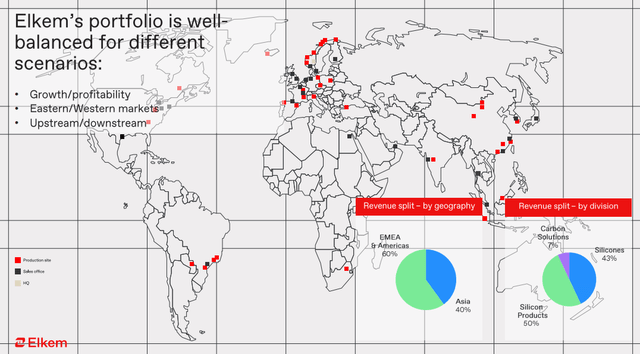

Significant Chinese influence does exist, and the company has several assets as well as customer relationships when it comes to China. It's fair to say that one of the major risks I see with Elkem, and why I'm cautious investing here, is the Asian and Chinese exposure. Calling it influence might even be a step short, because as of the current circumstances, Elkem is majority-owned by the China National Bluestar-controlled Bluestar Elkem.Co.LTD, with 52.91% of the voting power. This is very rare for a Norwegian company, which typically likes national control - but in Elkem the government only has around 5%.

Moving along and away from the China discussion, the company's assets are global. Elkem is also the world's largest producer of what's called Calcined Anthracite and electrode paste. This is a crucial component for the manufacturing process of everything from steel, aluminum, ferrosilicon and other metals. So when investing in Elkem, you are investing in a "world leader".

Elkem has a two-pronged strategy, focusing in part on the east and west - with the current growth in both areas. The West is seeing what the company calls re-industrialization, while China, despite a slowdown, remains on a growth trajectory faster than the rest of the world. The current geopolitical polarization of trade also creates an opportunity for a specialist like Elkem - and the company's revenue mix isn't at all as dependent on Asia as the ownership stake might imply.

A lot of the company's argument is related to its green strategy and emissions when in my view, the argument for investing in Elkem should be somewhat different. To go through everything the company does in Microsilica, Foundry Alloys, Ferrosilicon, and Silicon alone, not to mention the other areas, would take too long - and this is meant more as an introduction than anything else. But sufficient to say, that the company works with world leaders in every single one of its segments, and works with everything from commodity end-products and players to more premiumized, de-commoditized segments.

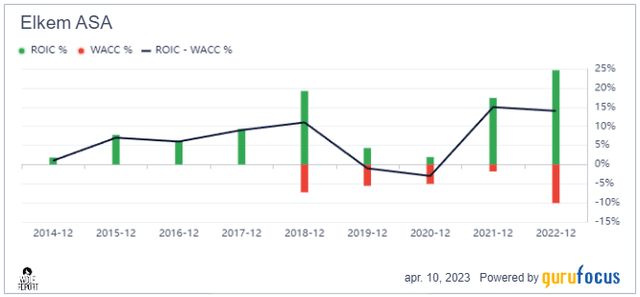

But what impresses me, and what should impress you about Elkem, is how the company does it. The company is in the 90th percentile in every single margin that matters, and in RoE, it's in the 95th percentile. The profitability the company sees from its investments and invested capital is nothing short of amazing.

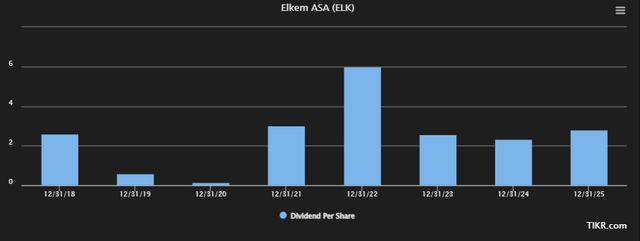

No single one such perspective is worth deciding upon by itself, but every single fundamental you can follow for Elkem shows us one and the "same" story. Elkem is growing revenues and growing earnings, as well as maintaining or growing very impressive profit margins. Its cash flows, while maintaining some of that characteristic cyclicality, are stable, and the company is consistently delivering profits as well as dividends, even if that dividend can be said to not exactly be stable in the payout.

This is a company you should invest in, not as an income investment but as a qualitative growth and long-term holding. The current yield is over 16%, but this is not indicative of anything long-term. What's more, if you compare to an over-time perspective, Elkem can be said to not exactly be "cheap" here, because the stock has at times traded below 15 NOK on the native - it now trades over 35 NOK.

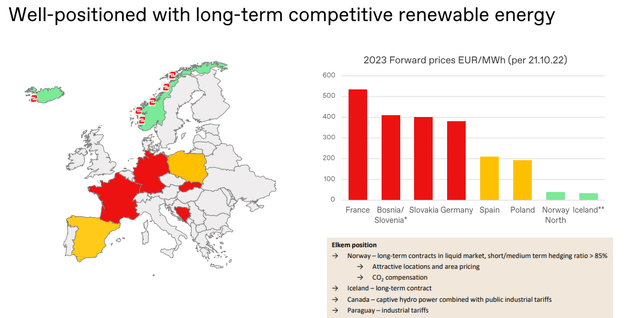

Where Elkem also "wins" as a Chemical business is that it has exposure to some of the lowest energy prices in Europe for its European assets. This is due to the massive renewable portfolio found in Norway and Iceland, next to central Europe where the mix is much less favorable in terms of pricing.

With increased focus on regionalization of production and global supply chains in these areas, among other things due to the ADDs (Anti-Dumping Duties) introduced by both Europe and America to achieve a China-balancing of the market, Elkem is once again in a good position to take a leading role in these markets. In fact, I believe that on a macro level, China's entire supply role is about to change. It initially came to the silicon market as a low-cost export producer. Under current circumstances, that is no longer tenable, because aside from ADDs, Chinese costs are actually increasing as well - over 15% in less than a year to the end of 2022. (Source: CRU Silicon Metal Market Outlook)

This international profiling together with what are future-proofed, attractively-placed production capacities make Elkem into a leader on the global scale, despite other basic material companies being far larger. Elkem is able to utilize the low production costs of its geographies with strong market positions and a goal of reducing emissions, optimizing mi, and growing both organically and inorganically.

The dividend level should indicate for you just what sort of 2022A the company had. It was a record year, despite a weak market - but Elkem's business model showed resilience, and the company managed an operating income of over 10.4B NOK, with an EBITDA margin of 17%. Elkem tries to pay out 40% of the profit on a given year, and the EPS of 15.09 in 2022, means that a 6 NOK dividend is being paid out in May of 2023. As of this article, that date is still before the ex-date, with you being entitled to that 16% dividend if you buy Elkem before the 2nd of May.

Of course, you shouldn't "BUY" Elkem just for the yield. This isn't an income investment, and as you saw above, estimates are for the company's income and dividends are to go down in 2023.

The company is seeking to expand its footprint into appealing areas, and by appealing, I mean that it focuses on areas with lower energy costs. This includes Australia, Brazil, Eastern Europe, and northern NA, while generally avoiding overexposure to central Europe and areas with rising cost structures - such as China.

Other than its production costs, Elkem is generally heavily correlated to worldwide growth and pricing structures, or a lack thereof. When markets fail, Elkem fails alongside with them as we saw with the weak silicone markets. The weakness in Silicones was weighed up for, however, by strength in Silicon Products and Carbon Solutions.

The company isn't a net-cash player, but its leverage is very low - 0.2x based on LTM EBITDA. The company doesn't have S&P Global in terms of credit but uses Scope, which has given Elkem BBB stable in 4Q22. It has a well-managed debt maturity schedule with really very little coming due or refinanced until 2027.

The outlook for early 2023 is continued problems in the silicones market, due to combined pressures from the Chinese new year and strikes in Europe, together with the overall weakening market for products, but due to significant capacity curtailment across Europe (Energy), this still manages to come to a somewhat balanced situation.

Overall, the company expects 2023 to be lower than 2022 - and this I believe is a fair assessment.

Let's look at company valuation.

Elkem - Not massively undervalued, but attractive enough

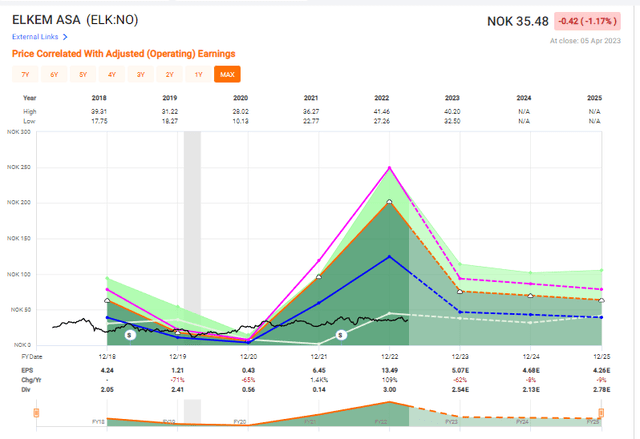

So, the reason I'm not moving firmly and deeply into Elkem as an investment is that the company, all things considered, isn't massively undervalued. It's undervalued, but most analysts who follow this company tend to be perhaps 10-15% too "premiumized" in their targets. 6 analysts following and giving the company a 37-50 NOK PT range with an average of 45, and then lowering that by 10-15% means that we're coming to just about 40 - or just under 40 NOK. At 35.48 NOK for the common, there's upside, but there are companies with greater upsides out there. Given the company's relatively limited history in its current iteration, and the volatility of its earnings, forecasting where we are going is tricky - especially given the macro correlation, no matter how attractive the company's production costs and geographies are.

Elkem Valuation/Upside (F.A.S.T graphs)

The company trades at 3.1x P/E normalized, but that includes a whole lot of 2021 and 2022, which is somewhat outside the company's norm. If we more fairly average things out, we're closer to 8-11x P/E, but it's a very tricky venture here.

Forecasting at 9-10x means a barely double-digit upside to a forecasted 2025E EPS of around 4.26 - an upside of about 10% per year. A DCF doesn't work here due to the massive volatility in earnings. The company is cheaper than its peers, peers like Dow (DOW) from a Revenue perspective, where Elkem is barely at 0.66x, as well as cheaper on Revenue, P/E, and book multiples. Sectors depend on who you ask. Some put Elkem next to gas peers, such as Linde (LIN) or Air Liquide - I'd go with the former, like Dow, maybe Sherwin-Williams (SHW). There is no shortage of quality companies in this sector, and SHW for instance, is currently modestly undervalued. Its margins and market positions relative to its fundamentals are not even close to as good as Elkem - but it is of course far larger.

In the end, I give Elkem a careful upside and forecast it at a discount of 10-15% to a double-digit P/E. Analyst forecast accuracy can't be trusted - 50% negative misses, even with a 10% margin of error. I wouldn't go above 10x P/E for this company, and that means that the highest share price I could go for when forecasting the next few years of what I expect to decline, is 41 NOK/share.

That is also my price target for Elkem, and this is my thesis for the company.

Thesis

- I consider Elkem to be a very interesting chemical play, perhaps somewhat impaired by its majority of owners from China. The upside is a very diversified production base, with favorable exposure to low-cost environments, and also being a market leader.

- The downside is the company's size, cyclicality, and limited lifespan with its current operations, making forecasting or giving the company a fair value tricky.

- Still, at this time, I give the company the equivalent of a long-term 10x P/E as a PT, which comes to 41 NOK/share. That means that there's an upside and a "BUY". I recently bought my first shares in the company.

Remember, I'm all about :1. Buying undervalued - even if that undervaluation is slight, and not mind-numbingly massive - companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn't go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

I wouldn't call Elkem cheap, but I would call it interesting on every other level, making it a "BUY".

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

The company discussed in this article is only one potential investment in the sector. Members of iREIT on Alpha get access to investment ideas with upsides that I view as significantly higher/better than this one. Consider subscribing and learning more here.

This article was written by

Mid-thirties DGI investor/senior analyst in private portfolio management for a select number of clients in Sweden. Invests in USA, Canada, Germany, Scandinavia, France, UK, BeNeLux. My aim is to only buy undervalued/fairly valued stocks and to be an authority on value investments as well as related topics.

I am a contributor for iREIT on Alpha as well as Dividend Kings here on Seeking Alpha and work as a Senior Research Analyst for Wide Moat Research LLC.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ELKEF either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment. Short-term trading, options trading/investment, and futures trading are potentially extremely risky investment styles. They generally are not appropriate for someone with limited capital, limited investment experience, or a lack of understanding of the necessary risk tolerance involved. I own the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in my articles. I own the Canadian tickers of all Canadian stocks I write about. Please note that investing in European/Non-US stocks comes with withholding tax risks specific to the company's domicile as well as your personal situation. Investors should always consult a tax professional as to the overall impact of dividend withholding taxes and ways to mitigate these.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.