2 Dividend Stocks I'm Buying: Cash Flow Is King

Summary

- For all dividend investors robust cash flows are important.

- Enterprise Products Partners and CVS Health are some of the most impressive cash cows in the market.

- Recent resurgence in dividend growth for both companies make them even more attractive.

Enes Evren

Overview

No matter which way you slice it, when it comes to dividend stocks it's undeniable that cash flow is an extremely important metric. It is the basis behind which dividend payouts can be sustained and grown. As a long term buy-and-hold dividend growth investor, I am constantly looking for companies that exhibit healthy, sustainable growth in their dividends which inevitably leads me to taking in-depth looks at balance sheets and cash flow statements.

Enterprise Products Partners (EPD) and CVS Health (CVS) are two highly intriguing options in the market today that have led me to begin a buying plan this month for both. Right off the bat, the cash flow numbers from both companies are eye-popping.

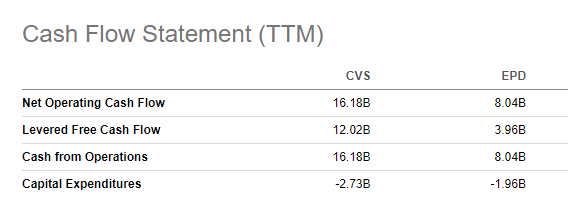

Cash Flows (TTM) (Seekingalpha.com)

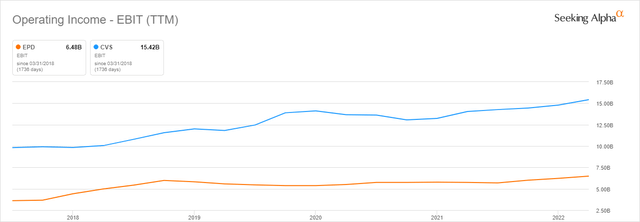

Levered free cash flows for both companies totals up to $16 billion combined! Not only that, but capital expenditures aren't overly demanding and represent less than 50% of free cash flows for both. In the past, CVS has used a large portion of operating cash flows to pay down high levels of debt accumulated from the Aetna acquisition years ago. Now that significant amounts of debt from that transaction has been paid down, CVS has a significantly expanded opportunity to increase dividend payouts and buy back stock. Since 2021 when CVS restarted growing its dividend, EPD has increased dividends at a 4.35% CAGR and CVS has grown dividends at a 10% CAGR. Even more comforting is the fact that free cash flows have been driven by long-term steady growth in operating incomes.

Operating Income Growth (Seekingalpha.com)

Because I will be investing an equal amount in both companies, I've taken a peak at the dividend metrics for what a combined 50/50 split investment looks like.

| Positions | Dividend Yield | 2-yr. DGR |

| EPD | 3.18% | 4.35% |

| CVS | 7.51% | 10.00% |

| 50/50 Split Avg. | 5.35% | 7.18% |

Based on recent dividend performance and announcements, an even split between these two companies provides an enticing combination of yield and dividend growth. While dividends are great, total returns are also extremely important especially to someone like myself in my 20's that isn't looking only for income. So let's see how these stocks have performed since the pandemic first riled the American markets and economy 3 years ago.

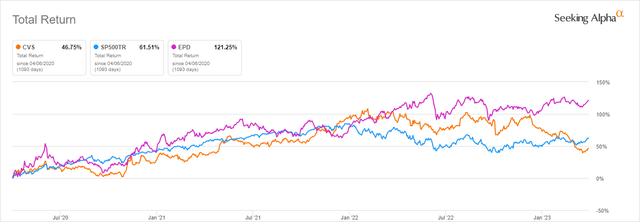

Total Returns (Seekingalpha.com)

While CVS underperformed over the time period, there was significant outperformance exhibited by EPD. A 50/50 split between the two would have delivered total returns of 84%, roughly 22.5% greater than the S&P 500. Performance in the past doesn't mean anything though if there aren't catalysts for the future, so I'll take time in the next section to discuss tailwinds.

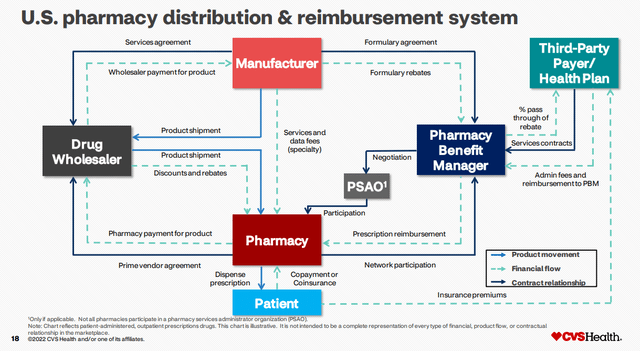

Future Growth via Pipelines

It is obvious that the midstream company EPD generates returns via its pipelines, but the returns generated by CVS are also delivered via a not-so-obvious pipeline. The pipeline that CVS Health has created is not a physical one but a metaphorical operational one. As one of the largest revenue generating companies in the world, CVS has successfully built a vertically integrated healthcare pipeline. The entire process from the writing of a prescription, the filling of a prescription, and the insurance used to fill the prescription can all be completed under one roof. By expanding its on-site health hubs and acquiring one of the largest medical insurance companies in the world, CVS has created a behemoth in health care with a market-leading value chain. I found this following graphic from the most recent CVS Investor Presentation to be extremely helpful in understanding the pharmaceutical transaction chain. CVS now owns 3 out of the 5 major components (Pharmacy, Pharmacy Benefit Manager, and Health Plan) to the chain and can provide substantial savings and convenience advantages to customers.

Pharmaceutical Transaction Chain (cvs.com)

Future tailwinds for both companies are rooted around the fact they operate with necessities that are needed in everyday life. Between energy and health care needs, virtually every person on earth requires their services or products every single day. Another potential positive for EPD is the growing global economic tension felt on every continent. It appears the United States may look to steer away from energy dependence on foreign nations and increase the energy production at home. This would be huge for Enterprise's massive pipeline network that is nearly impossible to replicate, driving the revenue per mile of pipeline higher and exponentially growing the profits.

The additional big potential tailwind for CVS stems from the fact we are witnessing an aging population. As the baby boomers retire and grow older, the demands for health services and pharmaceuticals are expected to grow rapidly. I would venture to guess that management's plan for vertical integration coming together just as this demographic shift is happening is no coincidence.

I believe in the total returns these companies will be able to return to shareholders for the next several years and to put my money where my mouth is, so as always you can follow my real-time transactions in my real money portfolio here.

Speaking of total returns, let's look at the potential bull case scenario over the next 12 months. To start, EPD is currently trading at P/FCF ratio of 7.06 vs. the 5-yr. average of 8.14. This implies a potential upside of 15.30% due to multiple expansion alone. Looking at CVS we see a current P/E of 8.70 vs. a 5-yr. average of 10.07, a potential 15.75% upside from multiple expansion. Let's combine this with the dividend yields and analyst 1 year growth expectations to paint a picture on the bull case scenario returns.

| Dividend Yield | EPS Fwd. Growth | Multiple Expansion | Total Return Potential | |

| EPD | 7.51% | 8.52% | 15.30% | 31.33% |

| CVS | 3.18% | 2.93% | 15.75% | 21.86% |

These are best case scenario returns in my view, but still provides excitement for these investments as even a 50% performance versus the bull case provides double digit returns for each over the next 12 months.

Takeaways and Risks

After combing through cash flow statements and balance sheets it is clear that both EPD and CVS can be referred to as "cash cows" that produce an abundance of free cash flow to be used at management's discretion. Understandably, investors may view CVS's management to not be so shareholder friendly in the past but it appears that trend is changing with strong growth in the dividend for the past two years.

Several potential tailwinds have been discussed that make these investments exciting, but I can't just overlook the potential risks. The major risks I see for Enterprise Products Partners is the accelerating shift to renewable and alternative energy sources and changes in legislation. As non-fossil fuel energy sources continue to grab more market share and increase their utility, this will hurt demand for EPD's gas and oil products. Additionally, changes in legislation requiring ESG disclosures and minimum ESG investment targets for pensions could lead to struggles in share price. Luckily, oil and gas products are used in a multitude of different applications other than energy such as manufacturing of clothing and consumer products that help mitigate the damage from reduced energy demand.

CVS is not without risks either, one being the dependence on Medicare and Medicaid for revenues. Reduction in Medicare ratings and loss of customers has a large impact on company earnings. Secondly, lawsuits for mishandling of certain prescriptions can create substantial losses due to the company's scale and size of its customer base. While this is a serious topic of concern and produces large scale effects, I believe the sheer size of CVS and its ability to produce 11-figure cash flows give it the safety cushion to weather these types of issues.

Summary

Massive cash flows and a growing dividend are arguably the two most important characteristics for a company to exhibit for a dividend growth investor like myself. Both EPD and CVS fit like a glove in my steady investing strategy of weekly investments and a focus on growing my dividend income. I understand the bearish stances towards each company but believe that the potential future opportunities and long company histories will propel each of them forward.

(One additional note - I know there will be comments/concerns about the K-1 tax form of EPD but in my view it is a minor obstacle for a company that I believe will help grow my portfolio)

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CVS, EPD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.