Everbridge: A Bridge Too Far For Investors Amid Financial Concerns

Summary

- Everbridge offers a comprehensive Critical Event Management platform to protect businesses and ensure continuity during emergencies.

- The company has attracted major clients across various sectors, including Fortune 50 companies, major US cities, and leading healthcare providers.

- Despite a strong product offering, Everbridge has consistently reported operating losses for the past decade.

- Everbridge's Strategic Realignment plan aims to improve profitability through cost-cutting initiatives and a focus on larger enterprise and government clients.

- Market impatience and potential economic headwinds could challenge Everbridge's ongoing transformation efforts.

I going to make a greatest artwork as I can, by my head, my hand and by my mind.

Introduction

Fear is a powerful emotion, and it’s one that we’ve all experience at some point in our lives. From terrorist attacks and pandemics to cyber-attacks and natural disasters like hurricanes, the list of potential threats seems endless. Recent global events, such as the COVID-19 pandemic, Russia's attack on Ukraine, and a rise in active shooter situations, have only heightened these fears. Such critical events and emergency situations pose a major challenge to businesses as they can threaten their workforce and paralyze operations. That’s where Everbridge (NASDAQ:EVBG) comes in.

Everbridge is a software company that's helping businesses fight back against critical events with intelligent automation technology that proactively detects, minimizes, manages, and recovers from them. Its flagship Critical Event Management (CEM) platform empowers businesses to quickly and effectively respond to critical events, ensuring the safety of their people and the continuity of their operations. The CEM features applications and systems like mass notification, public warning, IT alerting, risk control, control center, and incident management.

The company has attracted many big names in the industry, which is a testament to the strength of its product. Its financials may not look stellar right now, but there is hope for a brighter future as the company implements cost-cutting initiatives and focuses on profitability over revenue growth. However, Everbridge may face challenges from potential economic headwinds and market impatience, which can adversely impact its stock.

Standing out in the industry

One thing that stands out to me about Everbridge is their ability to thrive in a highly competitive and fragmented industry. In the world of critical event management solutions, Everbridge competes against well-known names such as BlackBerry, Crisis24, Dataminr, and PagerDuty, among others. Many companies develop their own internal mass notification and crisis management systems. Despite the rapid pace of technological advancements and the rise of new competitors in the market, Everbridge has managed to differentiate itself by offering a one-stop-shop for critical event management. Everbridge's strength lies in its ability to provide a comprehensive solution that has won over many big names across the government and private sectors.

Last year, around 68% of its revenue came from enterprise customers, 23% from government customers, and 9% from healthcare-related clients.

Everbridge's reputation in the critical event management solutions market is second to none, and the company has built a strong client base as a result. Its product offering has attracted some of the biggest names, including nearly all of the Fortune 50 companies, 22 out of the 25 largest US cities, 9 out of the 10 leading US healthcare providers, and 47 out of the 50 busiest North American airports. Everbridge's client base has grown substantially over the years, from 867 customers at the end of 2011 to more than 6,500 customers at the end of last year. That’s a testament to the strength of the company's product offering and the value it provides to its customers.

Image: EVBG Investor Presentation

Furthermore, Everbridge's net revenue retention rate of more than 110% exhibits its ability to generate repeat business. This impressive retention rate indicates that not only do clients love Everbridge's products, but the company is also able to upsell additional products and services to its existing customer base.

I also like the fact that Everbridge’s business model generates recurring revenues. This approach provides the company with a stable revenue stream, which is particularly valuable in today's turbulent times. In fact, 89% of Everbridge's total revenues over the past three years have come from subscriptions. The company typically enters into contracts that cover periods of one to three years, with an average contract length of 1.8 years last year. Additionally, Everbridge usually collects payment in advance for the full year of service. This predictable revenue model helps to ensure the long-term stability of the company.

Financial challenges

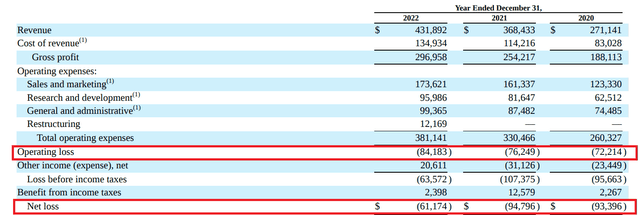

Everbridge seems to have a great product and a promising business, but there's a catch. Despite attracting many customers and generating substantial revenue, the company hasn't been able to turn its product into profits. According to Everbridge's 10-K filing, it incurred operating losses of $72 million in 2020, which increased to $84 million in 2022. Even worse, data compiled by Seeking Alpha shows that Everbridge has been reporting operating losses for the past decade. The company has reported profits on an adjusted basis in the last couple of years, with adjusted per share (loss)/profits of ($0.03), $0.21, and $0.67 for 2020, 2021, and 2022, respectively. But its GAAP earnings have consistently remained in the red.

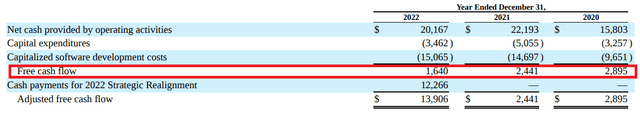

On the bright side, Everbridge has been able to keep its cash flows in check. Although it continues to lose money, the company has been living within its means and generating strong levels of free cash flows. It means that the company raises enough cash from its operations to cover all its capital expenditures and software development costs and then some. In fact, it ended last year with $1.64 million of free cash flows (unadjusted for strategic realignment payments). Still, relying on free cash flows while consistently reporting losses is not a viable long-term strategy, and it raises concerns about the company's future.

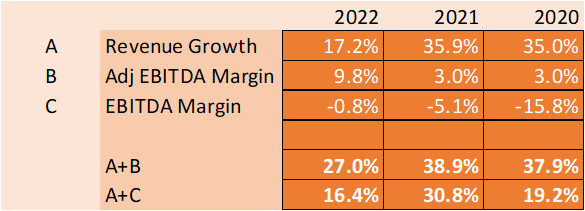

Although Everbridge has been growing, I believe it hasn't been living up to its aggressive growth strategies. I used the 'Rule of 40' to evaluate its performance, which Everbridge itself highlighted in a recent investor presentation. For those unfamiliar with the rule, it states that the sum of revenue growth rate and profit margin should be at least 40 for a healthy business. Unfortunately, even if we use adjusted earnings instead of operating losses, Everbridge's metric remains below 40.

Author

But don't count Everbridge out just yet. The company is making all-out efforts to turn things around by implementing a strategic overhaul aimed at improving its bottom-line. So, while the financials may not look stellar right now, there is hope for a brighter future.

The company has reported notable improvement in earnings, with the adjusted EBITDA climbing from $11.2 million in 2020 to $42.1 million in 2022. Its GAAP EBITDA has also improved, with losses shrinking from $42.8 million in 2020 to $3.5 million in 2022.

Path to profitability

Last year, Everbridge started working on its Strategic Realignment plan. This includes significant cost cutting initiatives such as reduction in headcount, facilities, and third-party expenditures. Additionally, Everbridge went through a major management overhaul which includes the introduction of the new CEO David Wagner in July 2022. Wagner has been building a new team, including new Chief Product and Chief Revenue Officers. The company also decided to pause all of its M&A activity and increase its focus on integrating previous acquisitions and streamline its operations. It also seeks to serve large enterprise and government customers, rather than smaller clients, with a focus on achieving $1 billion in annual recurring revenues over the long-term.

The cost-cutting initiatives should have a positive impact on the company's profits and cash flows. We are already seeing improvements in profit margins, as evidenced by the GAAP EBITDA margin shrinking to -0.8% in 2022 from -15.8% in 2020. It's clear that the company is taking significant steps to improve its financial performance, and the results so far are promising.

Everbridge is targeting 6% to 7% growth in revenues for 2023, a significant drop from previous years. But this is part of the company's Strategic Realignment plan, which prioritizes profitability over revenue growth. The company expects to see big improvements in earnings, with an increase in adjusted profits from $0.67 in 2022 to around $1.50 per share. While Everbridge still expects to report a net loss on a GAAP basis, of around $1.12 to $1.17 per share, the shift towards profitability is a positive sign for the company's future.

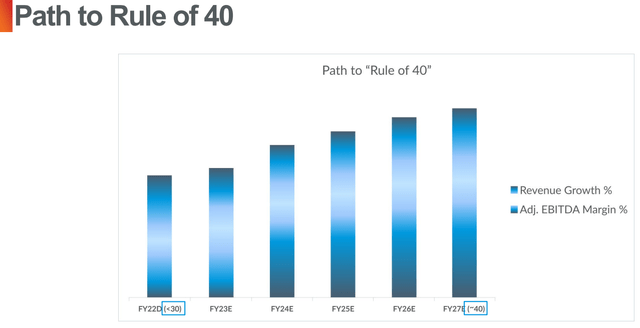

I believe Everbridge’s transformation into a higher profit and lower growth company is going to take some time. While the revenue growth will slow down immediately as it hits the pause button on M&A, the positive impact on profits may not get fully realized until the company finishes its realignment plan by the end of 2023, pulls down all of the cost cutting levers, and fully streamlines its operations. Everbridge's 'Path to Rule of 40' forecast also confirms that it may take until the end of 2027 for the company to hit the 40 mark.

Image: EVBG Investor Presentation (link provided earlier)

Everbridge's efforts to improve its bottom line through its Strategic Realignment plan should be recognized. But I believe it's important to keep in mind that the market may not be very patient, especially with a potential recession looming. Rome wasn't built in a day, and the company's transformation into a more profitable and stable business will take time. However, given the recent pressures on technology stocks, with Everbridge's shares dropping by more than 50% last year, due to the economic slowdown, high inflation, and rising interest rates, the market may not be willing to wait. The allure of future profits offered by tech companies is less valuable in tough economic climates, which puts Everbridge in a difficult spot.

Besides, the global economic slowdown could potentially harm Everbridge's business prospects. As the economy slows down and interest rates increase, organizations around the world might be less willing to invest in Everbridge's services, and existing customers might be hesitant to expand their usage of the company's platforms. This could hurt the company's ability to generate revenue and sell or up-sell its products. The company might find it difficult to maintain a healthy net revenue retention rate.

Takeaway

I believe Everbridge has a great product, but concerns remain around its financial performance. Although the company is making efforts to improve its bottom line, driven by the strategic realignment plan, the market may not be patient given the potential economic headwinds. I believe investors may want to steer clear of EVBG stock for the time being.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.