T-Mobile: Price Ignores Industry Headwinds

Summary

- In the wireless industry, decelerating growth, shareholder expectations, and the expanding value segment are converging to put downward pressure on pricing.

- T-Mobile's earnings guidance does not reflect the industry headwinds and pricing pressure likely to materialize in 2023.

- T-Mobile is overpriced as valuation ratios hit a historical high, and management guidance is overly optimistic.

Justin Sullivan

Editor's note: Seeking Alpha is proud to welcome Michael Dion as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Competition is ramping up quickly in the wireless industry, and T-Mobile's (NASDAQ:TMUS) management isn't reflecting these headwinds in their earnings guidance. While T-Mobile will likely continue its growth trajectory due to solid positioning, the current share price represents a better-than-best-case scenario. With limited upside potential and serious downside risk, now is a great time to exit TMUS stock.

Wireless Industry Facing Headwinds

The wireless industry is heating up with increased competition. Decelerating growth, shareholder expectations, and the expanding value segment are converging to put downward pressure on pricing.

During Covid, the wireless market grew at an accelerated pace allowing carriers to grow without having to compete as hard for market share. However, in 2022, wireless growth started decelerating as the world returned to normal. Industry experts expect growth to slow further heading into 2023.

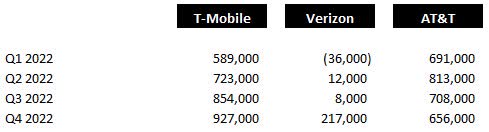

Over the past year, Verizon (NYSE: VZ) lagged behind the industry in postpaid phone net adds.

Postpaid Phone Net Adds (Chart: Mike Dion; Data: TMUS, VZ, and T Earnings Releases)

Shareholders noticed that Verizon's Consumer Group (VCG) couldn't get traction, and the stock price cratered, falling more than 25% across 2022. Management responded by replacing the CEO of VCG after just over a year and replacing the CFO. The new leader of VCG, Sowmyanarayan Sampath, is the former CEO of Verizon Business Group (VBG) and successfully grew subscribers in 2022 while VCG went backward. The change in leadership signals that Verizon is ready to compete for market share.

Across the economy, high inflation is weighing on consumers who are looking for deals. The Wireless value segment has gained traction with brands like Visible by Verizon and Mint Mobile (recently purchased by T-Mobile) offering unlimited talk, text, and data for $15 to $25 a month. Well below the entry price for the big three (Verizon, AT&T, and T-Mobile) of $60-65 a month.

Verizon finally woke up in Q4 2022 with aggressive promotions (free iPhones) and changed the competitive landscape resulting in their best postpaid phone net adds. In response, T-Mobile is offering $800 for customers who switch from AT&T (NYSE: T) or Verizon, and AT&T matches Verizon's free iPhone offer.

In addition to competing with the value segment, T-Mobile and AT&T will have to compete aggressively with Verizon to maintain market share in 2023. Verizon started competing aggressively in Q4, with T-Mobile and AT&T responding in Q1. As a result, I expect to see the impact of promotions and lower pricing in Q1 earnings.

T-Mobile's Earnings Guidance Overly Optimistic

T-Mobile's earnings guidance does not reflect the industry headwinds and pricing pressure likely to materialize in 2023. Also, T-Mobile is more exposed to pricing pressure than its competitors.

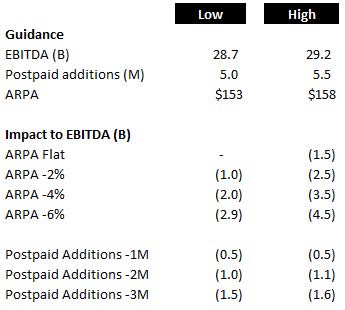

While management doesn't provide specific earnings guidance on revenue, they guide postpaid net customer additions and adjusted EBITDA growth. In the Q4 2022 earnings release, management guided postpaid net customer additions of 5 to 5.5 million and adjusted EBITDA of $28.7 to $29.2 billion, a 10% year-over-year growth.

Looking at a critical sales metric, T-Mobile has the lowest average revenue per account (ARPA) among its peers at $153/account, 13% below Verizon and 17% below AT&T. However, in the last earnings call, management stated that they expect ARPA to be stable in 2023, with potentially some upside later in the year.

A stable to growing ARPA is unrealistic in the current competitive or economic environment unless T-Mobile is willing to give up market share. However, since wireless growth is slowing, and management has guided upwards of 5 million postpaid net customer additions, T-Mobile doesn't expect to give up market share.

T-Mobile is also more exposed to pricing pressure than its competitors as it has the lowest operating margin among the big three (16% versus AT&T and Verizon at 24%). With 8ppt less margin than its competitors, a decrease in ARPA will impact T-Mobile's profitability faster. Even with the lowest margin and ARPA, T-Mobile decided to compete against itself by purchasing Mint Mobile, known for its $15/month unlimited plans. This acquisition is accounted for in the latest earnings guidance, meaning the core business would have to grow ARPA to offset the value acquisition.

The following chart shows the EBITDA impact of a miss to the guidance on customer growth or ARPA.

Impact of TMUS guidance miss on EBITDA (Chart: Mike Dion; Data: TMUS Earnings Release)

Since T-Mobile can't both grow customers and maintain or grow ARPA, the earnings guidance is overly optimistic. Therefore, the EBITDA forecast and valuation are excessively optimistic and represent a better-than-best-case scenario.

Current Price Is Better-Than-Best Case Scenario

T-Mobile is overpriced as valuation ratios hit a historical high, and management guidance is overly optimistic.

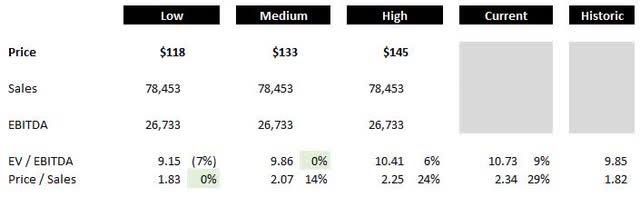

T-Mobile's EV / EBITDA ratio of 12.73 over the past 12 months is 8% above the industry and 9% above the historical 5-year average. Similarly, the Price / Sales ratio of 2.34 is 83% above the industry and 28% above the historical average. These ratios do not make sense for a business with the lowest ARPA among its competitors. Instead, they reflect the strong revenue growth that T-Mobile has seen, 14% over the last three years, while Verizon flatlined and AT&T went backward, but not the competitive changes occurring in the industry.

As shown below, normalizing the EV / EBITDA and Price / Sales ratios to align with historical performance gives a price range of $118 to $145 with a midpoint of $133.

TMUS valuation normalizing ratios to historic level (Chart: Mike Dion; Data: Seeking Alpha)

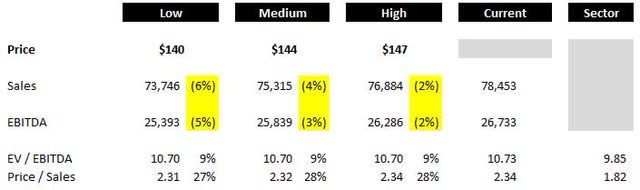

Alternatively, we can look at the impact of performance falling short of management guidance to back into a fair price using the EBITDA impacts from above. This analysis backs into what share price would be needed to maintain the current ratios (historically high) if sales fall 2%, 4%, or 6%. As shown below, holding the ratio constant with declining sales gives a price range of $140 to $147 with a midpoint of $144.

TMUS valuation adjusting for a guidance miss (Chart: Mike Dion; Data: Seeking Alpha)

For both methods, the top end of the range represents roughly the average price across Q1 2023. This indicates significant downside risk with limited upside. Remember that T-Mobile is the only one of its peers that does not pay dividends, eliminating other opportunities to drive a return.

Upside Potential

T-Mobile does have the opportunity to maintain its position and continue growing. T-Mobile leads all other Mobile Network Operators in customer service by a wide margin, according to the 2022 US Wireless Customer Care Mobile Network Operator Performance Study by JD Power. Excellent customer service is a huge deal in an industry known for strict contracts and stringent policies.

T-Mobile also has a pricing advantage compared to its peers. According to a study by MoffettNathanson, T-Mobile has the best pricing perception among major wireless carriers, and the best pricing for the service received.

Having recently won an award for the best network, T-Mobile will undoubtedly benefit from the rollout of 5G. In addition, the company has strategic advantages in customer service and pricing perception. As a result, if T-Mobile can execute its strategy and maintain pricing along with growth, it could deliver on the current share price.

That said, T-Mobile's continued strategic advantages and continued growth are included in management's most recent earnings guidance. In addition, you must recognize strong industry headwinds when valuing the stock. As a result, the current share price would be the best possible outcome without the opportunity for additional upside.

Verdict

T-Mobile's management and shareholders are not factoring in the industry's headwinds. While T-Mobile has the opportunity to continue growing, the current share price represents a better-than-best-case scenario. With limited upside potential and serious downside risk, now is a great time to exit the stock.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.