Citigroup: Too Cheap To Ignore Heading Into Earnings

Summary

- Citigroup stock is the cheapest among its leading G-SIB banking peers in the US. The recent steep decline in March dropped C's valuation into highly attractive zones.

- However, Citigroup is still in the midst of its transformation under CEO Jane Fraser. The market remains unconvinced about its ability to improve its earnings potential markedly.

- Despite that, C's valuation seems cheap enough at the current levels, despite its execution headwinds.

- Investors looking to exploit its recent valuation dislocation should consider acting with more urgency.

- I do much more than just articles at Ultimate Growth Investing: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Ceri Breeze

Investors who picked the lows in Citigroup Inc. (NYSE:C) and did not fear a further contagion in the banking sector should pat themselves on the back.

Market operators also have concurred, as C formed a formidable bear trap or false downside breakout, taking out panic sellers at C's March lows before reversing the selling momentum remarkably.

Hence, we assessed that buyers returned strongly, seeing the recent valuation dislocation in C as an opportunity to take advantage of the cheapest stock among its leading banking peers.

| Name | NTM P/E | TTM P/TBVPS |

|---|---|---|

| Citigroup | 7.91x | 0.57x |

| JPMorgan (JPM) | 10.05x | 1.77x |

| Bank of America (BAC) | 8.35x | 1.27x |

| Wells Fargo (WFC) | 7.88x | 1.09x |

C's valuation metrics Vs. peers. Data source: S&P Cap IQ

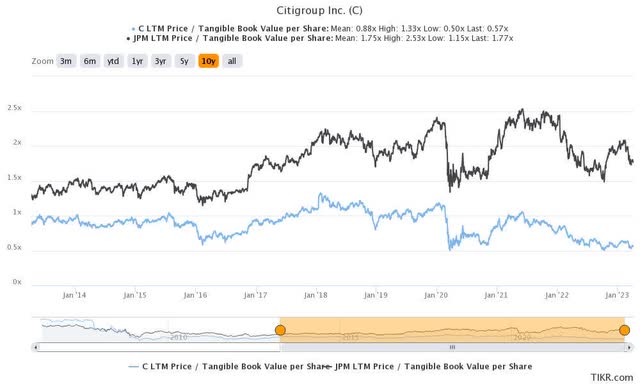

As seen above, C last traded at a TTM tangible book value per share or TBVPS multiple of just 0.57x, well below its leading G-SIB peers above. It's also below its 10Y average of 0.88x, even as Citigroup expects to progress well in its transformation efforts under CEO Jane Fraser.

However, the dislocation is not apparent from C's valuation against Wells Fargo, as seen above, as they trade at a similar NTM normalized P/E. Hence, it's clear that market operators remain skeptical about the bank's ability to improve its ROE and RoTCE significantly to justify an upward re-rating.

Morningstar also classified Citigroup without an economic moat (not even narrow), which is a clear deviation from its other three peers. Accordingly, BAC, JPM, and WFC received the highest wide moat rating, justifying their ability to defend their profitability and earnings sustainability.

However, the assessment of Citigroup's ability to drive significant earnings growth wasn't encouraging, as it added:

The bank's business mix is structurally disadvantaged compared to its money center peers, leading to limited profitability potential. The expenses associated with maintaining an international presence across many legal jurisdictions and the increase in regulatory costs further limit profitability potential. - Morningstar

C Vs. JPM TTM P/TBVPS 10Y trend (TIKR)

Does it make sense? Well, C has consistently traded at a considerable discount against leader JPMorgan over the past 10 years.

We think the market has gotten it right so far. JPM reported a ROE of 14% for FY22 and is expected to report an ROE of 13.9% this year. In contrast, C reported an ROE of 7.7% in FY22 and is projected to report an ROE of 6.05% for FY23.

As such, the transformation for Citigroup will need time for management to prove its worth, which requires investors to remain patient as the bank executes through 2026.

Investors assessing the opportunity to buy ahead of its upcoming earnings release on April 14 should consider looking beyond Q1. Why? As the market is forward looking, coupled with the possible downward earnings revision for FY23 and FY24, we believe investors have reflected these headwinds at its current valuation.

Citigroup is still expected to report a QoQ increase in its normalized EPS for Q1. Accordingly, C is estimated to post an EPS of $1.67, up 44% QoQ. Despite that, it represents a 17.4% YoY decline.

Analysts have continued downgrading banks' earnings projections through March 2023, suggesting they are modeling for worse outcomes.

However, C's TTM P/TBVPS valuation of 0.57x is close to the two standard deviation zone under its 10Y average. It indicates that the market's expectations over C remain in the highly pessimistic zone relative to its peers.

As such, we believe it should support a potential outperformance thesis if management doesn't provide a highly disappointing outlook for its upcoming release.

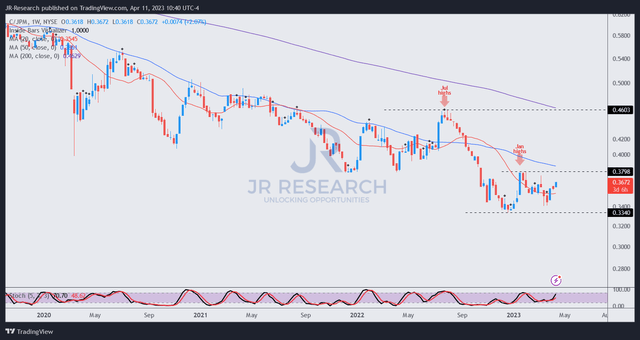

C/JPM price chart (weekly) (TradingView)

C remains in a long-term downtrend against JPM. Moreover, that trend doesn't appear to be in danger of being overturned.

Hence market operators continued to take advantage of rips in C by rotating out (such as in January) when it outperformed JPM momentarily.

Despite that, we assessed that the mean-reversion opportunity for C/JPM against its secular downtrend is still valid, as the rip has yet to occur.

However, investors must be cautious as C/JPM closes in against its January resistance zone, which saw a bull trap previously.

Hence, investors looking to exploit the dislocation in C should consider acting more urgently if they're confident that the market has priced in considerable disappointment for its upcoming earnings call.

Rating: Buy (Reiterated).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone to learn better!

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA's bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!

This article was written by

JR research was featured as one of Seeking Alpha's leading contributors in 2022. See: https://seekingalpha.com/article/4578688-seeking-alpha-contributor-community-2022-by-the-numbers

Unlock the key insights to growth investing with JR Research - led by founder and lead writer JR. Our dedicated team is focused on providing you with the clarity you need to make confident investment decisions.

Transform your investment strategy with our popular Investing Groups service.

Ultimate Growth Investing specializes in a price action-based approach to uncovering the opportunities in growth and technology stocks, backed by actionable fundamental analysis.

We believe price action is a leading indicator.

Price action analysis is a powerful and versatile toolkit for the informed investor because it can be used to analyze any publicly traded security. As such, it offers investors with invaluable insights into understanding market behavior and sentiments.

Plus, stay ahead of the game with our general stock analysis across a wide range of sectors and industries.

Improve your returns and stay ahead of the curve with our short- to medium-term stock analysis.

We not only identify long-term potential but also seize opportunities to profit from short-term market swings, using a combination of long and short set-ups.

Join us and start seeing experiencing the quality of our service today.

Lead writer JR's profile:

I was previously an Executive Director with a global financial services corporation. I led company-wide award-winning wealth management teams that were consistently ranked among the best in the company.

I graduated with an Economics Degree from National University of Singapore [NUS]. NUS is Asia's #1 university according to Quacquarelli Symonds [QS] annual higher education ranking. It also held the #11 position in QS World University Rankings 2022.

I'm also a Commissioned Officer (Reservist) with the Singapore Armed Forces. I was the Battalion Second-in-command of an Armored Regiment. I currently hold the rank of Major. I graduated as the Distinguished Honor Graduate from the Armor Officers' Advanced Course as I finished first in my cohort of Armor officers. I was also conferred the Best in Knowledge award.

My LinkedIn: www.linkedin.com/in/seekjo

Analyst’s Disclosure: I/we have a beneficial long position in the shares of C, BAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.