CCRV: Small Commodity ETF That Deserves More Attention

Summary

- Most commodity ETFs are in a downtrend.

- The (small) iShares Commodity Curve Carry Strategy ETF is an exception.

- It’s an optimized commodity ETF that focuses on commodities with the greatest degree of backwardation and the lowest degree of contango.

- This focus on roll yield is paying off: CCRV has a positive total return year-to-date.

Nastco/iStock via Getty Images

The iShares Commodity Curve Carry Strategy ETF (NYSEARCA:CCRV) is a so-called optimized commodity ETF that tries to maximize (roll) yields by systematically choosing commodities and futures contracts with the strongest backwardation or the mildest contango.

That strategy paid off last year and resulted in a hefty dividend. Also this year CCRV is one of the few commodity ETFs with a positive total return year to date.

It's notoriously difficult to find up-to-date information about CCRV. This might be an explanation for the rather low assets under management for this ETF. CCRV deserves more "public relations" attention from iShares and this might help investors to discover this hidden pearl.

Roll approach

The spot price of a commodity is the price for immediate delivery. In practice, few investors have the ability to take physical delivery of raw materials because of the significant storage and insurance costs they would incur. The closest approximation to the commodity spot market is an ETF or fund that invests in rolling front-month futures contracts. GSG is such an ETF.

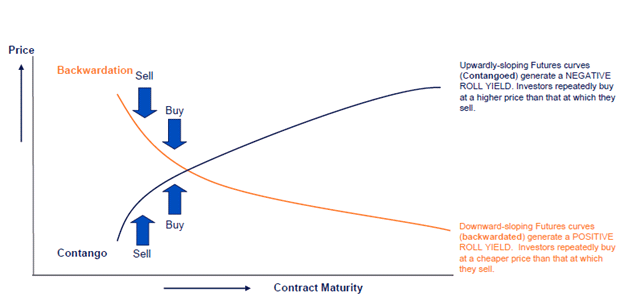

But the prices of commodity futures with longer-term expiration dates differ usually from the price of the nearest-term or front-month contract. If the price of the front-month contract is higher than the price of the next contract, you make money if you "roll" into the new contract. Selling high and buying low. Your "roll yield" is positive.

Such a futures market is said to be in backwardation. This term was coined by Keynes. Commodity producers fear that the price at harvest will be lower than today and are willing to pay a premium to hedge this risk. As a consequence, future prices will be lower than the spot price and Keynes named this condition (normal) backwardation. This implies that a futures price of a commodity is appreciating as it is getting closer to maturity.

The opposite of backwardation is contango. The price of the front-month contract is lower than the price of the next contract, and you lose money if you "roll" into the new contract. Selling low and buying high. Your "roll yield" is negative.

Figure 1: Backwardation and contango (PTMC)

Figure 2 presents the impact of contango on the WTI crude oil market by illustrating the difference in performance between the S&P GSCI Crude Oil spot return (excluding roll yield) and the S&P GSCI Crude Oil Excess Return (including roll yield) since the beginning of 2020.

Figure 2: Contango (S&P Global)

Front month or optimized?

Famous commodity indices like the S&P GSCI Index and the Bloomberg Commodity Index use a basic strategy: the front-month roll. In this case investors receive the closest exposure they can get to the spot price of a commodity, as the front-month and spot prices tend to move closely together. A possible drawback of this strategy is the negative roll yield when the market is in contango.

To circumvent this problem so-called optimized strategies were developed. Such strategies try to maximise (roll) yields by systematically choosing commodities and futures contracts with the strongest backwardation or the mildest contango.

The most important optimized ETFs that try to enhance the roll yield are:

- First Trust Global Tactical Commodity Strategy Fund (FTGC),

- United States Commodity Index Fund (USCI),

- abrdn Bloomberg All Commodity Longer Dated Strategy (BCD),

- iShares GSCI Commodity Dynamic Roll Strategy ETF (COMT),

- iShares Bloomberg Roll Select Commodity Strategy ETF (CMDY), and

- iShares Commodity Curve Carry Strategy ETF.

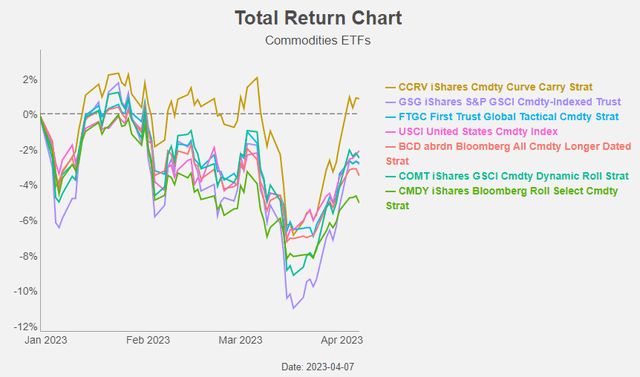

Below you can see the year to date performance of those optimized commodity ETFs and a "traditional" front-month rolling ETF; the iShares S&P GSCI Commodity-Indexed Trust (GSG).

Figure 3: Total Return Chart (Yahoo! Finance, Author)

The best performing optimized ETF is CCRV. CCRV is also the only one with a positive performance year to date. The traditional front-month rolling commodity ETFs are also posting negative year to date returns.

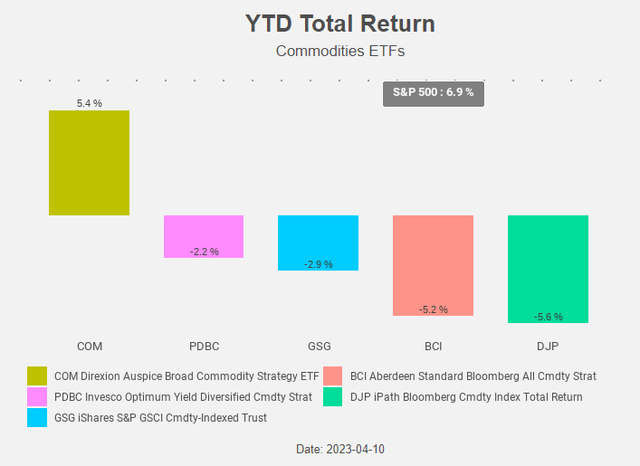

The same cannot be said of the special case commodity ETF Direxion Auspice Broad Commodity Strategy ETF (COM). We dedicated a separate article to this ETF.

Figure 4: Total Return Chart (Yahoo! Finance, Author)

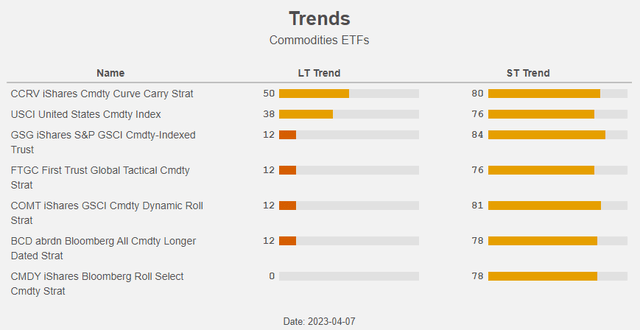

Only two optimized ETFs are not in downtrend: CCRV and USCI. The other commodity ETFs (again with the exception of COM) are in a downtrend.

Figure 5: Trends (Yahoo! Finance, Author)

So, what is so special about CCRV?

CCRV

The iShares Commodity Curve Carry Strategy ETF tracks the ICE BofA Commodity Enhanced Carry Total Return Index. This index is composed of commodities with the top ten highest ranking roll yields, on a total return basis, selected from a broad commodity universe.

CCRV is rebalanced on a monthly basis.

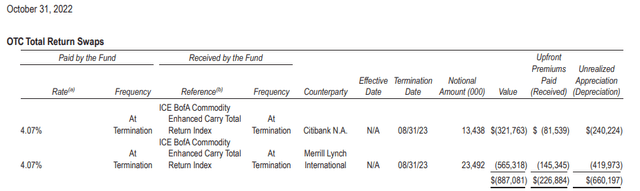

CCRV gets exposure to the index by entering into total return swaps that provide returns similar to the commodity futures contracts in the index. These total return swaps expose CCRV to counterparty risk. The counterparties mentioned in the prospectus are Citibank and Merrill Lynch.

Figure 6: Total return swaps (iShares)

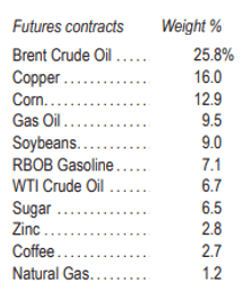

The ICE BofA Commodity Enhanced Carry Total Return Index measures the performance of the 10 commodity futures contracts (representing the underlying commodities with the largest global production value), where more weight is given to those contracts having the highest degree of backwardation or lowest degree of contango (among a universe of 22 agricultural, energy, precious metals, and industrial metals commodities).

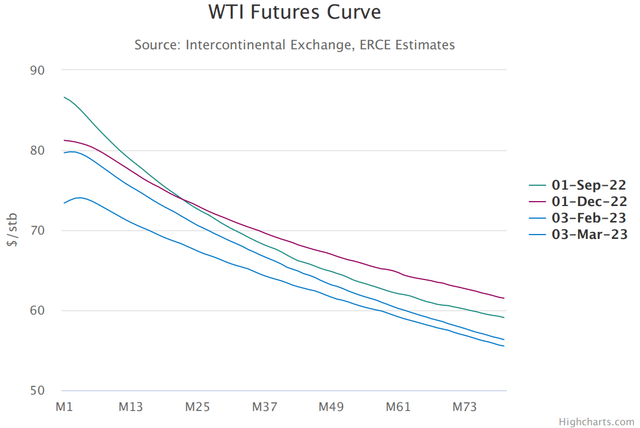

Currently, oil e.g. is still in backwardation.

Figure 7: Oil futures curve in backwardation (ECRE)

And oil is the biggest position in the portfolio. It certainly was the case at the end of October last year. It's notoriously difficult to find up-to-date information about CCRV. This might be an explanation for the rather low assets under management for this ETF.

Figure 8: Portfolio composition (iShares)

The recent jump in oil prices after the OPEC+ production cut certainly had a positive impact on CCRV.

Dividends

CCRV is exposed to the "ICE BofA Commodity Enhanced Carry Total Return Index" through total return swaps. CCRV pays a fixed rate to the counterparty and receives the total return of the index.

In the event of negative performance this total return will include a negative return (i.e., a payment from CCRV to the swap counterparty).

In the event of positive performance the opposite happens and the total return will include a positive return (i.e., a payment from the swap counterparty to CCRV). This payment is yearly paid out as a dividend.

Last year was a year with a (very) positive performance and this led to a hefty dividend of $6.673 per share. The day of the dividend payment the asset under management dropped from more than $36 million to less than $28 million due to the dividend payment.

Conclusion

Due to their inflation hedging qualities and diversification benefits commodities should remain part of your portfolio. Should you favor a traditional front-month ETF like GSG or an optimized ETF like the nicely performing CCRV?

All traditional commodity ETFs are in a downtrend. Exceptions are the special case COM and optimized ETFs like USCI and CCRV.

CCRV is the only optimized commodity ETF with a positive performance year to date. If this trend continues shareholders can expect again a nice dividend.

It's a pity CCRV remains a somewhat obscure commodity ETF. CCRV deserves more attention, from investors but certainly from iShares itself. It's very difficult to obtain recent information on the portfolio composition.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in CCRV over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.