SIL: Silver Mining Sector Breakout Coming, But The Metal Better Long-Term Bet

Summary

- The Global X Silver Miners ETF outperforms during silver bull markets as profitability rises much faster than prices, and the recent silver rally suggests a strong rally in the ETF.

- However, the long-term underperformance of SIL relative to the price of silver is likely to continue as inflation raises production costs over time and companies continue to increase shares outstanding.

- With a dividend yield of just 0.4%, there is not much benefit to owning the SIL compared with the metal itself, particularly as the latter is also less volatile.

bagi1998

The break higher in silver prices suggests that the underperformance of silver mining equities is set to reverse over the coming months. The Global X Silver Miners ETF (NYSEARCA:SIL) generally outperforms during periods of rising silver prices as profitability rises much faster than prices, suggesting a potential strong rally in the ETF. From a long-term perspective, however, the SIL is an inferior investment relative to the metal itself in my view, and should continue its long-term underperformance.

The SIL ETF

The SIL aims to track the Solactive Global Silver Miners Total Return Index, and index of global companies involved in the silver mining industry, including those engaged in silver mining and/or closely related activities such as exploration and refining. The fund is heavily weighted toward one stock in particular, Wheaton Precious Metals Corporation (WPM), which makes up 27% of the index. The SIL charges an expense fee of 0.65%, which results in a dividend yield of just 0.4%.

Silver Breakout Suggests SIL To Follow

The SIL is pushing up against its January highs, having broken above down trendline resistance from the mid-2021 highs as shown below. Silver prices have already posted new highs which is a bullish sign for the SIL. $32 is a key level for the ETF, and a close above here would suggest a move up to the gap left at $35 during the April 2022 decline.

SIL ETF and Silver Price (Bloomberg)

The strong outlook for the silver price itself suggests the SIL is also likely to perform well over the long term. As I argued in 'SLV: Bullish Breakout Could Lead To Parabolic Spike', the rise in gold prices has meant that silver remains deeply undervalued from a long-term perspective based on its correlation with gold prices and the commodity complex. The current degree of undervaluation is consistent with 10% annual returns over the next decade.

Long-Term Underperformance Relative To Silver Is Highly Likely

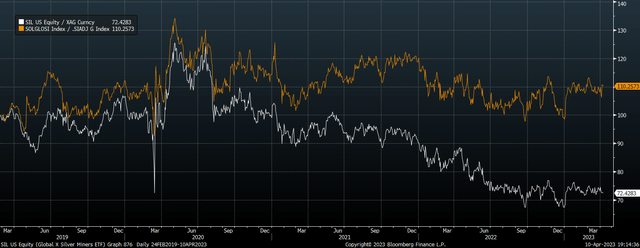

As the SIL tends to outperform silver during silver bull markets it makes sense to expect the SIL to outperform over the coming years if indeed the silver bull market continues. If we look at the ratio of the SIL over the silver price, it is near its weakest level on record, and similarly low levels in the past have resulted in significant SIL outperformance over the following years.

Silver Price, Real Silver Price, and SIL ETF (Bloomberg)

However, the long-term underperformance of SIL relative to the price of silver is likely to continue for two reasons. Firstly, inflation raises the cost of inputs for silver miners meaning that over time they tend to track the performance of the inflation-adjusted silver prices. This can be seen in the chart below, suggesting that much of the underperformance of the SIL over recent years is the result of the rise in the general prices level.

Secondly, silver mining companies, similar to gold mining companies, have a track record of issuing shares to fund capital investment. Over the past four years the Solactive Global Silver Miners index has increased net shares outstanding by almost 5% annually as shown below.

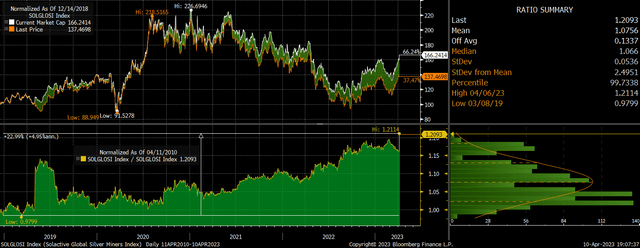

Solactive Silver Miners Market Cap Vs Price (Bloomberg)

Taken together, high inflation and share issuance fully explain why the SIL has underperformed the price of silver to such an extent over recent years. We can show the impact of these factors by looking at the real silver price relative to the market capitalization of the Solactive Global Silver Miners index. As the following chart shows, while the SIL has underperformed the silver price by 28% over the past four years, the market cap of the underlying companies has actually risen relative to the real price of silver. This suggests that miners are now overvalued relative to the metal and should continue to underperform over the long term.

SIL vs Silver Price and Market Cap of Underlying Index vs Real Silver Price (Bloomberg)

This is reflected in the valuation multiples of the index, which trades at a forward PE of 29x and a forward price to free cash flow ratio of 58x. Valuations do not matter much in the short term and I still expect to see a the SIL outperform over the coming months as has been the case during previous silver price rallies. However, with a dividend yield of just 1.1% on the Solactive Global Silver Miners index and just 0.4% on the SIL ETF, there is not much benefit to owning the SIL from a long-term perspective relative to holding silver itself. Not only should the metal continue its long-term outperformance, but it will likely do so with lower levels of volatility also.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SIL, XAGUSD:CUR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.