Raymond James: Diversified Bank Trading At A Discount

Summary

- Raymond James Financial is a diversified financial services company.

- Revenue has grown well while margins have expanded, improving shareholder returns over time.

- Banking and Wealth Management services are offsetting capital market weaknesses.

- RJF is performing in line with its peers while showing a greater level of resilience.

- Its valuation is substantially below its peers, suggesting upside at the current price.

We Are

Investment thesis

Our current investment thesis is:

- Diversified revenue should allow the business to sustain growth relative to its peers, with Banking operations driving this as rates remain high.

- Weak capital markets are a cyclical problem that the business is offsetting, although the key here is to not lose market share.

- Margins are strong and have shown a history of resilience.

- RJF's valuation is substantially below its peers, despite a comparable performance and greater resilience.

Company description

Raymond James Financial (NYSE:RJF) is a diversified financial services company that operates under the following segments:

- Private Client Group - provides investment services, portfolio management services, insurance and annuity products, and mutual funds.

- Capital markets - provides investment banking services, equity and debt underwriting, and merger and acquisition advisory services.

- Asset management - provides asset and portfolio management services to retail and institutional clients.

- Banking - provides insured deposit accounts, commercial and industrial, commercial real estate, residential mortgage, securities-based, and other loans.

- Other services - Invests in private equity funds.

Share price

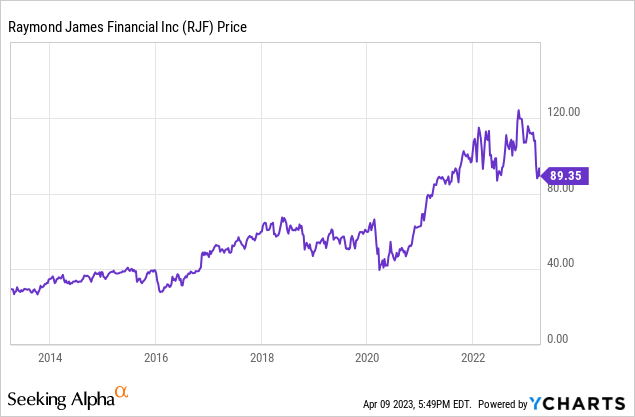

RJF's share price has grown impressively in the last decade, with returns in excess of 200%. This has been driven by improving financial performance and greater returns for shareholders.

Financial analysis

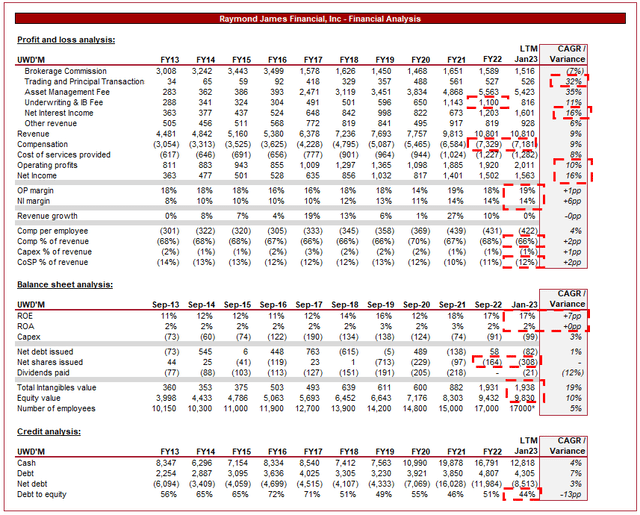

Raymond James' Financials (Tikr Terminal)

Presented above is RJF's financial performance for the last decade. The company has achieved consistent revenue growth across its revenue streams, generating improving investor returns.

Revenue

Revenue has grown at a CAGR of 9%, driven in large part by the company's asset management services, loan book, and investment banking activities.

To assess the quality of RJF's revenue, it is worth considering the current economic and market conditions we are facing. Economically, much of the West is suffering from heightened inflation and declining discretionary spending, with interest rates hiked as a response. Markets are bearish, with the S&P down 14% since the start of 2022. For a traditional investment bank, these are problematic factors as they lead to reduced activity in markets, constraining the services that can be provided.

For the reasons above, it is key for a modern investment bank to diversify its revenue streams, which will help to reduce the cyclical impacts of markets changing. Our view is that RJF has done a good job of this, with no single revenue stream over 51%. Many of RJF's peers experienced a decline in revenue during FY22, primarily due to a reduction in advisory fees. RJF experienced the same, with a 26% reduction yet still saw revenues up, driven by its banking activities. This is why diversification is key.

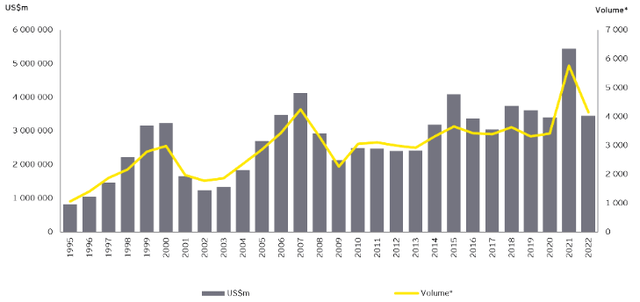

Expanding further on advisory services, the market has softened considerably since its peak in FY22. As the following graph from EY shows, the market peaked in FY21, with things reverting rapidly in FY22.

The reason for this in our view is the rising cost of capital, which is making accessing debt markets difficult while also reducing the valuation of businesses. With this occurring, buyers are more hesitant with purchases, looking to price aggressively, while sellers remain stubborn with pricing to the extent that they are willing to wait for rates to come down. This widens the valuation gap between buyer and seller, contributing to a decline in M&A activity.

KPMG surveyed many in the space, coming to a similar conclusion.

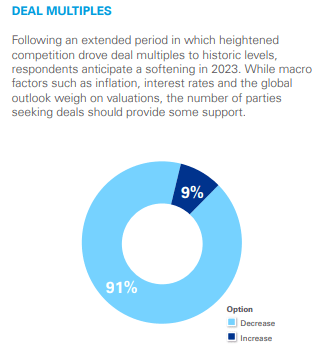

Deal multiples are expected to decline in 2023, with investors demanding a rerating following the change to the cost of capital.

Deal multiple (KPMG)

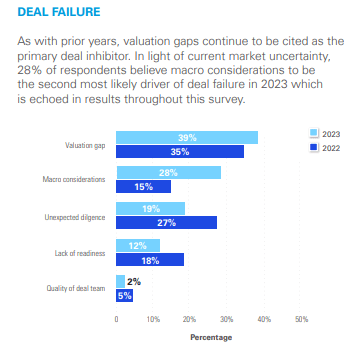

This is why the valuation gap is considered to be the key reason for deals falling over, with investors far more inclined to pull the plug during current economic conditions than previous ones.

Deal failure (KPMG)

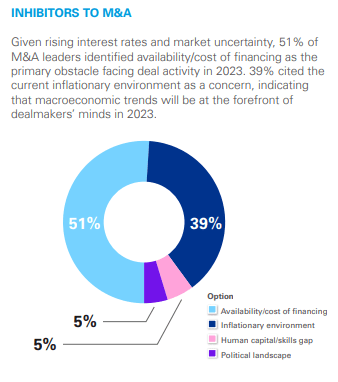

With the valuation gap driven in large part by the cost of capital, the availability of capital must be considered alongside this. It is considered the largest inhibitor of M&A transactions, as investors are now forced to fund less of a transaction through debt to get it over the line.

Inhibitors to M&A (KPMG)

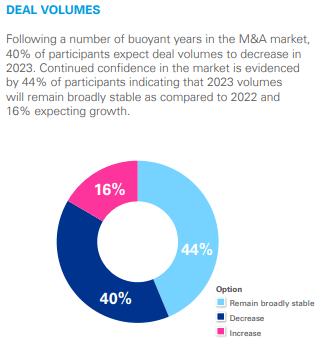

The net impact of these factors is that respondents are broadly of the belief that deal volumes will remain flat if not decline in the coming year, a bearish view.

Deal volume expectations (KPMG)

Based on this, we would expect continued softening in RJF's investment banking operations, likely dragging on revenue growth. We have focused heavily on the IB division despite it only contributing 10% of revenue as the sentiment around the market translates into all facets of the company's operations.

PCG/Asset management services have remained relatively resilient, experiencing a decline of only 2.5%. During bear markets, AUM declines and investors are far more likely to redeem their investments and limit new relationships. This usually contributes to a reduction in fees and a slowdown in AUM growth, but RJF has done a good job of retaining fees.

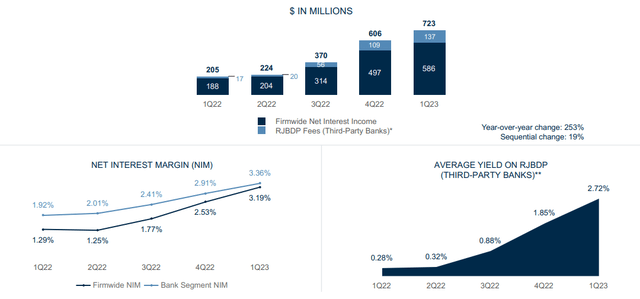

The real driver in the near term will be traditional banking activities in our view. With heightened interest rates, loans are generating a substantially higher return, contributing to rapidly growing revenues. As the following graph illustrates, RJF's NIM has increased by almost 200bps in the last 4 quarters.

Our view is that rates will likely need to remain elevated for another 6-12 months before beginning to decline, with inflation being extremely stubborn. This should allow RJF ample time to increase its loan book and the yield on its debt, hedging the total revenue performance against the weakening market activity.

Margins

RJF's margins have trended up in the last decade, primarily on a NI basis.

Management has done a good job of keeping compensation under control, with the current ratio at 66%. Our view is that anything under 65% would be fantastic but the current level is good.

Other costs have grown in line with revenue, which is not an ideal performance but the size of these costs means that margins will still trend up if this continues.

Revenue per employee has increased in line with compensation per employee, which is a passable performance but ideally, we would see some accretive value for shareholders.

Overall, an OPM >17% and NIM >13% is a good performance in our view, making the business attractive on an absolute basis.

Distributions

RJF has seen inconsistent share buybacks and dividends, with variability based on historical transactions and macro factors. Our view is that a healthy level of distributions should be sustainable based on the earnings potential of the business.

Q1-23 download

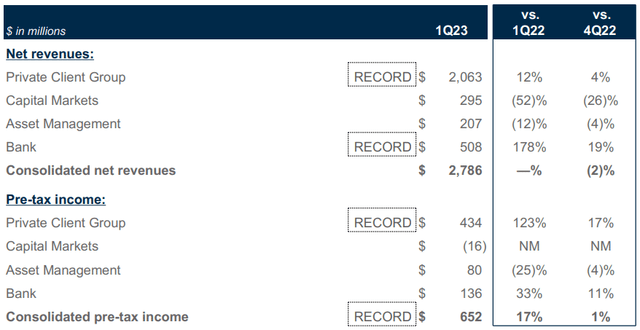

Q1-23 performance by segment (RJF)

RJF recently released its Q1 results, with revenues down 2% compared to the prior quarter but pre-tax income up against both Q1-22 and Q4-22.

The key area for us is that Banking continues to grow rapidly, generating increased alpha Q/Q. This aligns with our view on how things should progress, allowing the business to maintain growth despite the weakening conditions.

Interestingly, the PCG segment continues to grow, showing the resilience of its wealth management despite the weakness in asset management. Clients remain confident in RJF's ability to weather the coming bear market and the subsequent uptick in activity.

The key area of weakness is the continued decline in Capital Markets activity, which has experienced an almost unrelenting decline since FY22. It is difficult to see where this will stop but the company is facing a significant drag on growth if this continues to decline.

Outlook

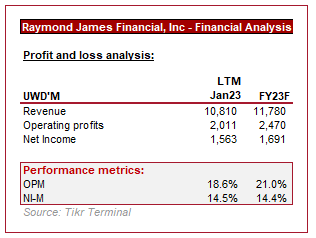

Outlook (Tikr Terminal)

Presented above is Wall Street's consensus view on the coming year for RJF. Given the nature of the business, the figures are not the most useful, however, directionally can provide some useful guidance as analysts speak regularly with Management and other IBs.

Revenue is expected to grow compared to FY22, suggesting the Banking division will be successful in offsetting any weakness in capital markets. Further, this likely suggests continued resilience from the PCG segment.

Margins are expected to remain flat on the bottom line, which looks reasonable during weaker market conditions.

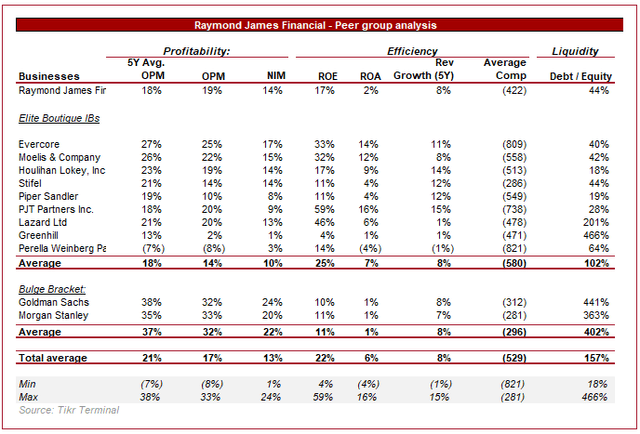

Peer comparison

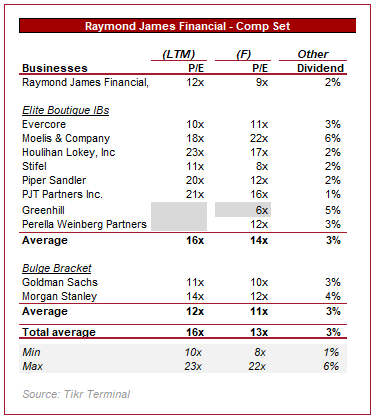

Presented above is a comparison of RJF on a financial basis to a cohort of other investment banks.

The company performs extremely well in our view, generating a similar OPM while outperforming the average on a NIM basis. Interestingly, the business has not seen OPM dilution in the most recent period which the majority of its peers have.

Growth looks to be lagging the pack when excluding the poor performers, suggesting RJF is trading stability for growth.

Overall, RJF is attractive relative to its peers, although is unlikely to demand a premium valuation given its lack of growth relative to its profitability.

Valuation

IB Valuation (TIkr Terminal)

RJF stock is currently trading at a noticeable discount to its peers, both on an LTM and Forward basis. From a financial basis, the most comparable companies in our view are Moelis (MC), Houlihan Lokey (HLI), Stifel (SF), and Piper Sandler (PIPR). The average of these 4 is still substantially higher than RJF's current valuation.

If we look at the company's historical trading range, the average LTM multiple is 16x and the average forward multiple is 13x, again suggesting the business is undervalued.

Finally, Wall Street's consensus valuation suggests an upside of 37.2%, which is an implied multiple of 12x.

Final thoughts

RJF is a strong financial institution in our view, the business is growing well and has diversified revenue. The lack of margin dilution and growth in FY22 suggests a level of resilience that is not observed by many of its peers but equally could mean weaker growth during a bull market.

The key risk we see with the business is a continued decline in capital markets activity, which could mean a loss of market share which is not easily taken back. Further, with markets uncertain, it is difficult to rely wholly on wealth/asset management services to continue growth.

Based on RJF's valuation, investor risk is compensated for in our view, giving ample upside potential.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.