Guild Holdings: A Compounder In The Making, Below Book Value At Present

Summary

- Guild Mortgages was founded in 1960 and has operated as a mortgage originator and servicer through many cycles.

- The company is run by CEO Mary Ann McGarry, only their second CEO, since 2007 where she has overseen massive growth and an annual average ROE of 35.7%.

- Shares IPO'd in October 2020 and trade currently at $10.84 with a P/B of 0.53x. Earnings per share were $5.35 and $4.67 in 2022 and 2021, respectively.

- Since December 2022, Guild has purchased three mortgage companies as part of their roll-up strategy.

- We'll take a look at all of these things and try to contextualize Guild's history with some current valuations.

- This idea was discussed in more depth with members of my private investing community, Microcap Review. Learn More »

Steady organic growth and strategic acquisitions set this company up for continued growth.

gopixa

This article was originally published exclusively for the Microcap Review on March 20th, 2023.

Guild Mortgage Overview

Guild Holdings (NYSE:GHLD) is a top-30 residential mortgage originator and servicer that IPO’d in October 2020. The company has a history dating back to 1960 during which they’ve had only two CEOs. Mary Ann McGarry is the current CEO since 2007 and she joined the company originally in 1984. She also recently announced retirement and will be replaced by Terry Schmidt in July.

During her tenure McGarry has grown origination volume 1279%, their servicing portfolio balance by 3056%, and has managed an average annual return on equity of 35.7% over fifteen years. Despite these results the company currently trades at the lowest valuation multiples compared to its peers. Particularly the company trades at a P/B multiple of 0.53x with GHLD stock price at $10.84. Earnings per share were $5.35 in 2022 and $4.67 in 2021.

Management owns 32.5% of the company and anticipated the current downturn by saving up cash. In recent months, the company has purchased three different mortgage businesses as it pursues a roll-up strategy which should continue to build out Guild’s scale and presence as a national player.

I have a base case two year price target of $14.15, representing 30% potential upside.

Guild Mortgage History: Sixty Three Years in the Making

Guild Mortgage Company has been underwriting home loans since 1960 when it was founded by Martin Gleich. Mr. Gleich led this company for forty-seven years during which Guild became some of the first experts in government backed FHA loans, developed their own in-house IT system as early as the 1970s, making them one of the first mortgage companies to do so, and started automating underwriting in the 1990s.

Besides the mortgage company, Mr. Gleich ran a homebuilder called American Housing Guild which built over 20,000 homes in the Western US during the 1960s. Later in the 1980s Guild attempted to run both a lending and real estate sales operation under the same roof with the acquisition of Red Carpet Realty. Guild ultimately determined that it was “an unprofitable combination” and sold the unit.

Around 1985 the company expanded into the wholesale mortgage business which generated a growth cycle for the company. Mary Ann McGarry, the current CEO, has been with the company since around this time (1984 to be exact) when she started as an internal audit supervisor.

In the 2000s the company avoided the sub-prime market and has seen immense growth since 2007.

($ in billions) | December 31, 2007 | December 31, 2022 | % Change |

Origination Volume | $1.4 | $19.3 | 1279% |

MSR UPB | $2.5 | $78.9 | 3056% |

That year was a major pivot point for the company as founder Mr. Gleich retired and Mary Ann McGarry became CEO. During her journey through the company Mary previously held the President, CFO, and COO positions. Since 1985 McGarry has worked alongside Terry Schmidt whom she hired as the internal audit department that year. Ms. Schmidt is the current President where she oversees the company’s finance, human resources, capital markets, and compliance departments.

Company Website: Headshots of McGarry and Schmidt.

Both of these women worked their way to the helm of this company for nearly twenty years. The numbers above reflect what they have done since coming to control. When Ms. McGarry became CEO she also negotiated a management-led buyout of the company from Mr. Gleich in partnership with McCarthy Capital. For the past sixteen years McCarthy Capital and management have been working on a growth strategy to expand the company’s footprint from the West to the entire country.

As part of this the company filed for an IPO in October 2020 which saw management cashing out somewhat on their ownership stake in order to bring the company to market. Guild the company did not receive any proceeds from this. Notably, the McCarthy folks did not sell any of their shares through this transaction.

IPO Prospectus: Selling Shareholders.

In total we can see that selling stockholders sold 40.1% of their ownership interests. And in no case above did a shareholder liquidate their entire stake, meaning all retained some interest.

Despite originally pricing the offering at $19.00 a share, ultimately the shares were sold at $15.00 each. Pro forma net tangible book value per share at the time was $6.67 meaning the shares were sold for 2.24x book value versus being offered at 2.85x book.

One likely culprit for the decline in price was that just before the offering (allegedly hours before) Guild settled a federal lawsuit for $25 million. The lawsuit was brought by the Department of Justice in 2016 and alleged that Guild knowingly violated FHA program requirements in their underwriting and origination.

A whistleblower was involved here, Kevin Dougherty, who received $4.98 million of the $24.9 million settlement (20%). Dougherty was formerly head of quality control at Guild. Through the settlement Guild did not admit to any wrongdoing.

Fast Forward to Today

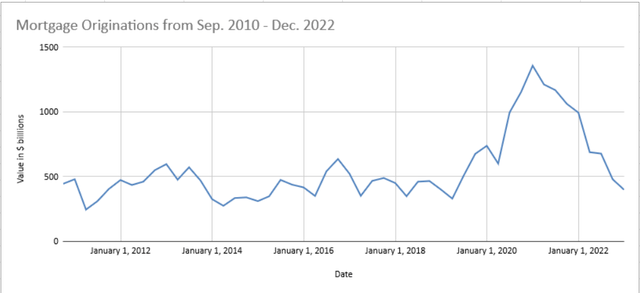

Mortgage origination volume hit a quarterly peak following the IPO in December 2020 at $1,357 billion in originations. The free-fall since then has been in part due to the unprecedented rise in interest rates.

Mortgage Bankers Association: Quarterly Mortgage Originations.

The quarter ended December 31, 2022 saw just $398 billion in originations; the quarter before that originations were $480 billion. Average volume during the above time period is $554 billion with the standard deviation being $264 million – that means we are still within one-sigma of the normal range. Statistically that suggests we are not seeing anything abnormal here.

What’s really reflected as abnormal is the volume during the period between June 2020 and December 2021 which saw average quarterly volume jump to $1,135 billion. This was an above two-sigma event.

Origination volume clearly is retreating from these peaks and coming back down into the channel from the last ten years or so. The impact on valuations of these companies has been clear this past year with peers all trading below book value and at depressed P/E multiples.

| Peers | P/B | P/E | P/FCF | P/S |

| GHLD | 0.53 | 2.01 | 1.9 | 0.66 |

| PFSI | 0.86 | 7.09 | 5.83 | 1.28 |

| COOP | 0.72 | 3.46 | 3.08 | 1.2 |

| HMPT | 0.5 | -- | -- | 0.65 |

| Average | 0.65 | 4.19 | 3.60 | 0.95 |

| Std. Dev. | 0.17 | 2.62 | 2.02 | 0.34 |

Data pulled from TD Ameritrade on 4.11.2023.

All four of these companies are both originators and servicers of single family mortgages. An interesting comparison here can be made with Home Point Capital (HMPT) more specifically as they went public three months after Guild in January 2021. Originally pricing shares in the $19 - $21 range, the pricing settled at $13.00 per share.

Let’s look at some data comparing the two since the IPO.

| GHLD | Book Value Per Share | Price Sold | P/B Ratio |

| IPO in October 2020 | $6.67 | $15.00 | 2.25 |

| April 2023 | $20.51 | $10.84 | 0.53 |

| % Change | 207.50% | -27.73% | -76.50% |

| HMPT | Book Value Per Share | Price Sold | P/B Ratio |

| IPO in January 2021 | $5.27 | $13.00 | 2.47 |

| April 2023 | $4.38 | $2.12 | 0.48 |

| % Change | -16.89% | -83.69% | -80.38% |

Both companies have seen a commensurate amount wiped from their P/B ratio to the tune of 76-80% reflecting some of the sector wide negative sentiment. And yet compared to the underlying performance there seems to be some potential inefficiency with GHLD given they have grown book value 208% since IPO whereas HMPT has actually lost equity value.

Despite this dramatic growth and that Guild is profitable and Home Point is not, they trade at around the same multiple P/B multiple. If we refer back to the table above about peer multiples we can observe that GHLD trades at the second lowest P/B amongst the peer group. A simple reversion to the peer group average excluding GHLD (0.69x) would imply 41% upside from current levels.

If we look at some comparative balance sheet data amongst the peer group it also seems as if Guild is in the best shape to weather a credit crisis storm.

| Ticker | Cash | Debt | Equity | Net Debt/Equity | Cash / Equity % |

$138 | $1,490 | $1,206 | 1.12 | 11.44% | |

$97 | $1,525 | $604 | 2.36 | 16.06% | |

$1,329 | $7,011 | $3,471 | 1.64 | 38.29% | |

$0 | $7,423 | $4,057 | 1.83 | 0.00% |

Part of why I think this mispricing is at play is because Guild IPO’d during a peak and the markets have been haywire since the beginning of 2022. With either a recession impending or already upon us mortgage originators are expected to see revenues and profits drop as the origination cycle finds a bottom. The rise in interest rates combined with the recession has caused less buyers in the market and nearly eliminated refinancing.

Companies like Guild attempt to build counter-cyclicality into their business model through a mortgage servicing rights or MSR portfolio. When Guild originates a loan they actually sell it to the market immediately typically seeing a 4.03% average gain on sale margin since 2008. That’s the origination portion of their business.

($ in billions) | 2018 | 2019 | 2020 | 2021 | 2022 | % Change Total | Annual Average |

Total Origination | $16.41 | $21.71 | $35.19 | $36.81 | $19.12 | 16.53% | $25.85 |

Gain on Sale Margins | 3.78% | 3.76% | 5.00% | 4.02% | 3.68% | -2.65% | 4.05% |

UPB | $49.33 | $49.33 | $59.97 | $70.94 | $78.89 | 59.94% | $61.69 |

MSR Multiple | 2.9 | 3.9 | 2.7 | 3.3 | 4.9 | 68.97% | 3.54 |

Yet even as they sell the loan, they retain the right to service the mortgage. This means the company is tasked with gathering payments and interfacing with the customer if troubles come up with the loan. Originators which retain MSR like Guild maintain their front-facing relationships with clients even as the loan itself is being paid back to some other party. This typically is beneficial for both Guild and whoever purchases their loans as Guild remains committed to the loans as well.

For service of these loans Guild and similar companies are paid a percentage on their unpaid principal balance or UPB – for Guild the weighted average servicing fee is around 0.30%. Essentially this is a percentage of money that the company is paid to manage the relationship with the homeowner and ensure cash flows smoothly to the owner of the loan. It’s a structure that Guild leverages by focusing their business model at the relational level with homeowners. See this explanation of the business model for reference from their original prospectus.

“Our business model is centered on providing a personalized mortgage-borrowing experience that is delivered by our knowledgeable loan officers and supported by our diverse product offerings. Throughout these individualized interactions, we work to earn our clients’ trust and confidence as a financial partner that can help them find their way through life’s changes and build for the future.”

I think this is an underappreciated part of the strategy Guild’s developed. Their focus is on the homeowner whom they make contact with through originations. When they sell the loan they’ve originated they maintain the relationship through their MSR and these are customers they can offer further things to down the line like refinancing or perhaps a new home loan.

Guild’s M&A Spree

Management at Guild anticipated the down-cycle and intentionally built up cash in order to pursue strategic acquisitions when it occurred. According to a recent article from HousingWire only 25% of independent mortgage banks were profitable in q4’22 and saw an average loss per origination of $2,812. It’s been the third consecutive quarter of losses on originations and the steepest. Operators with scale like Guild are better positioned to weather a downturn – but they can be even more opportunistic by rolling-up the failing businesses.

This is an expected trend over the next year. Another article from HousingWire quoted a managing director from Sterling Point Advisers noting that, “Up to 30% of the 1,000 largest independent mortgage banks are projected to disappear by the end of 2023 via sales, mergers or failures.”

That article is in reference to Guild’s first of three acquisitions since December 2022. It started with the acquisition of troubled Inlanta Mortgage which had already announced layoffs and intentions to close. Instead they were purchased by Guild for $4 million and are now branded as Guild Mortgage Inlanta. Five-year average annual origination volume for Inlanta was $1.183 billion.

This first deal looks to be a steal. It expands Guild’s penetration and presence in the Midwest and allows them to start retaining servicing rights on this purchase volume. They also picked up 35 new Inlanta branches and 72 registered mortgage loan officers. Imagine the recruiting costs it would take to hire 72 new loan officers alone and acquire 35 branch locations -- the compare that with the$4 million purchase price here.

The next acquisition was the February 2023 purchase of Legacy Mortgage. Legacy was an independent New Mexico-based lender with thirteen branches across Arizona, Colorado, New Mexico, and Texas. Guild funded this acquisition with $2.9 million in cash on hand. The company maintained a five-year average origination volume of $328 million.

Lastly, we have the most recent and likely largest purchase of Cherry Creek Mortgage announced on March 13th, 2023. With this purchase came 68 branches across 45 states, 299 mortgage loan officers, and it’s expected to become its own division of Guild headed by the co-founder of Cherry Creek, Jeff May. Of particular note with this acquisition is that it brings reverse mortgage expertise in house which Guild is looking to expand further into.

Terms for the deal were not disclosed in the press release, similarly to all of the acquisitions. But I expect in subsequent filings the price point for Cherry Creek will be revealed just as they have for Inlanta and Legacy. For now though, here’s my nearly complete table of data regarding the acquisitions so far.

Acquisition Target | Date | 5-Year Average ($ in millions) | Purchase Price | Number of Branches | # of States | Mortgage Loan Officers |

Cherry Creek Mortgage | March 2023 | $5,760.40 | -- | 68 | 45 | 299 |

Legacy Mortgage | February 2023 | $328.44 | $2.90 | 13 | 4 | 39 |

Inlanta Mortgage | December 2022 | $1,182.74 | $4.00 | 35 | 27 | 72 |

Total | $7,271.57 | $6.90 | 116 | 410 |

Origination data (source) merged with HousingWire article data.

With acquisitions the company expands its physical presence, staff and leadership as they typically retain them, products and expertise like reverse mortgage, and access to more loan originations to roll into their servicing portfolio. Prior to these acquisitions Guild maintained 250 branches and 1,823 loan officers. According to the numbers I’ve gathered, that would leave Guild now with 366 branches (46.4%) and 2,233 loan officers (22.5%).

There’s a significant amount of physical growth and talent acquisition here which will benefit the organization over the long term. And the ~$7.3 billion in potential new originations could increase their MSR unpaid principal balance of $78.9 billion by 9.3% in a year.

It’s not the first time that Guild has used M&A to build scale. President Terry Schmidt gave an interesting data point on their q4’20 earnings call noting that “companies that we have acquired increased by nearly 40% on average in the third-year following acquisition, as businesses increasingly leveraged our scale-enabled platform to accelerate growth and realize operating efficiencies.”

While I would not bank on originations increasing that much in the current environment, the scale that Guild is building here is undeniably valuable. For each company they just bought they can reduce duplication of corporate functions (meaning expenses) while optimizing the origination funnel and retain even more servicing rights on the loans written.

During the origination trough we are expected to see in 2023, Guild management can focus internally on consolidating these acquisitions into their operations. And there may still be more acquisitions to come given they had ~$135 million in cash post-the Legacy acquisition.

A Compounder in the Making

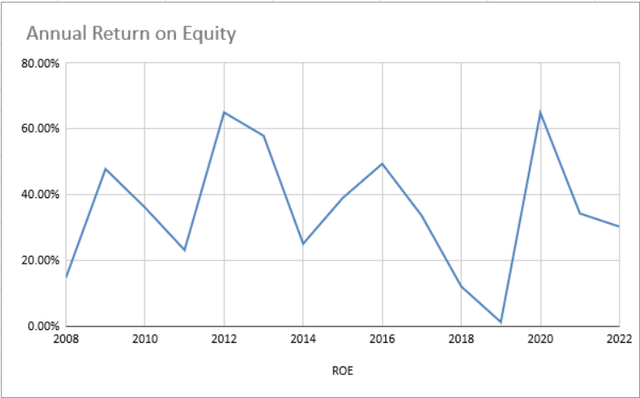

Over the years since CEO McGarry took over the average annual return on equity was 35.7%. It’s been a bit lumpy though jumping around the 20-40% range.

Author's Calculations: Annual Return on Equity.

Through their focus on building a retail mortgage originator and servicer with the homeowner as their long-term prospective client they’ve built a track record of impressive operating and M&A integration results. Retained earnings reported in their 2022 10-K is $1.206 billion and nearly equal to total stockholders’ equity of $1.249 billion.

Equity has grown from $25 million in 2007 to the current $1.249 billion. That’s 4,896% growth in fifteen years. Management still retains significant ownership interest here (32.5%) as well as their private partner McCarthy Partners which should help to align interest moving forward.

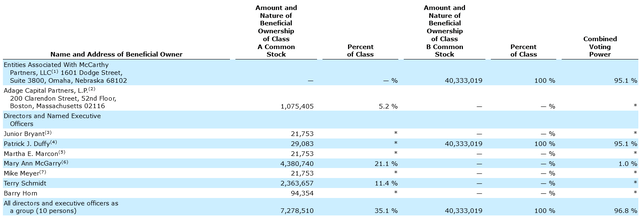

GHLD 2022 Proxy. Insider Ownership Table.

One of the ways we can observe management unlocking value as well is through the use of share repurchases. The plan was originally announced in May 2022 for up to $20 million in repurchases. Here's a table with data of the subsequent repurchases.

Period | Total Number of Shares Purchased | Average Price Paid Per Share | Dollar Value Left for Share Repurchases in thousands |

May 2022 | 48,623 | 9.88 | 19,519 |

June 2022 | 93,329 | 10.41 | 18,554 |

July 2022 | 66,625 | 11.52 | 17,807 |

August 2022 | 27,763 | 11.07 | 17,496 |

September 2022 | 44,574 | 10.77 | 17,032 |

October 2022 | 144,727 | 9.68 | 15,613 |

November 2022 | 79,555 | 9.69 | 14,864 |

December 2022 | 38,668 | 11.41 | 14,418 |

The company has spent $5.58 million buying shares back at an average price of $10.55 since May 2022. With over $14 million in repurchase capacity remaining this continues to be a lever that management can pull in the near term to help drive value. It also reflects management’s confidence in the business at these prices.

High Level Valuation Remarks

Earlier I gave a valuation based on P/B reversion to the peer group multiple of 0.69x which suggested 41% upside. If we do the same exercise from the perspective of P/E we see an average P/E multiple of 5.2x trailing twelve-month earnings. If we apply that to Guild’s 2022 earnings per share of $5.35, we get a price target of $27.82, or 156% implied upside.

If management is able to maintain profitability through the upcoming year, then there's a possibility to see Guild recover to 1x P/B at the least. If management continues their return of equity track record above 30% while the stock trades at such a depressed P/B multiple then book value growth will force a change in the multiple here -- and could potentially generate a significant compounder for owners.

When we compare the five-year average annual return on equity across the peer companies it reinforces the notion that there is undervaluation of Guild at play.

Ticker | 5-year Annual Average ROE | P/B |

29.86% | 0.86 | |

29.48% | 0.53 | |

20.13% | 0.72 | |

14.83% | 0.50 |

Despite being nearly tied for the top ROE it trades with the lowest valuations. I note particularly that despite having over double the average ROE then Home Point it trades at around the same valuation.

Finally here’s a table with all of these different valuation methods pulled together.

| Price Calculations | Current Price | Price Target | Implied % Change |

| Reversion to Lowest Rated Peer P/B of 0.5x [BEAR CASE] | $10.85 | $10.26 | -5.48% |

| Reversion to Peer Group Average P/B of 0.69x [BASE CASE] | $10.85 | $14.15 | 30.43% |

| Reversion to 1x P/B [BULL CASE] | $10.85 | $20.51 | 89.07% |

| Reversion to Peer Group Average P/E of 5.2x | $10.85 | $27.82 | 156.41% |

| Average of price targets | $10.85 | $18.19 | 67.61% |

Risks

Origination volume is expected to be markedly lower in 2023. The Mortgage Bankers Association or MBA predicts lenders will originate $1.98 trillion in 2023 down 12% from 2022. This will have a negative impact on their origination earnings.

The company maintains a dual class structure with Class A and Class B shares. Class A shares are the ones publicly traded; the Class B shares are the ones held by McCarthy entities. Class B shares receive 10 votes for every one vote of Class A shares translating to 95% voting power for McCarthy. It makes this a controlled company.

Two Critical Audit Matters were included in the most recent 10-k. The first is regarding the fair value of their MSR as these are fairly subjective. The other matter is related to their goodwill related to the originations reporting unit which was reported at $176.8 million. The company determined there was no impairment here and the auditors agreed – but they did flag it under the critical audit matter heading.

In their 2021 10-k they were dinged by the auditor opinion on their internal control over financial reporting. They noted “The Company did not have a sufficient complement of personnel with requisite experience in the design and operation of controls and did not perform an effective risk assessment, including risk of fraud.” While this issue was technically resolved with the 2022 10-k stating they had effective internal controls, it is a risk that I would pay attention to moving forward.

---

Microcap Review is a service offering multiple microcap stock picks a month.

We subscribe to the first rule of investing, "Do not lose money," by seeking a discernible margin of safety in investments.

I believe small and microcap stocks, as well as special situations, are the best place to look for value in the markets, as most people overlook these companies, making them more likely to be mis-priced.

Join now to get exclusive research!

This article was written by

Always open to questions and dialogue as I believe it only serves to improve us all.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GHLD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.