Axos: A Digital Banking Leader Poised For Growth

Summary

- Axos has a strong online banking presence with no physical branches and very low overhead, making it an efficient and low-cost option for consumers.

- The upcoming earnings season for banks could bring increased volatility to the market, but Axos' strong fundamentals and low valuation make it an attractive long-term investment option.

- Axos shares are trading at 7 times forward earnings and 1.25 times book value, the stock is currently undervalued.

wildpixel

After the bank crisis, bank runs, and sell-offs in the sector, I am searching for bargains. One bank that caught my attention is Axos Financial, Inc. (NYSE:AX). Its share price has dropped 30% in the past two months. Is this a favorable opportunity to open a position in the bank? Let's explore. Axos Financial's management has been executing a long-term strategy effectively, providing excellent prospects. The bank's competitive advantage lies in its lack of physical brick-and-mortar premises, which positions it favorably in terms of key metrics when compared to its peers. Additionally, the bank is trading at a low price-to-forward-earnings ratio due to the bank crisis, making it an attractive investment option at current prices. I am interested in purchasing Axos Financial as I see a significant potential upside from here.

Exploring Axos' Competitive Advantages

Axos Financial stands out as an online-only bank, which allows it to operate with a lower cost structure compared to traditional brick-and-mortar banks. This provides Axos with several competitive advantages, particularly in their ability to offer full-service banking that is exclusively online.

One of Axos' unique features is that 95% of its loans are asset-backed, meaning that almost everything they lend is backed by a first-lien position on a tangible asset. This makes their lending portfolio relatively low-risk compared to other banks that offer riskier types of loans that are not backed by any specific asset.

Axos' focus on the high-end market, particularly in jumbo loans, has helped the bank maintain a net interest margin of around 4%, which is higher than the banking average of 2% to 3%. The bank's loan book is safe, targeting single and multi-family mortgages with an average mortgage loan-to-value ratio below 57% and 53%, respectively.

Although larger banks have responded to the online banking threat, Axos' competitive advantage lies in its efficiency and profitability. While other banks have maintained the cost structure of maintaining physical branches, Axos has thrived as an online-only bank. However, the trend toward fewer banking centers over time has slightly diminished Axos' competitive advantage in terms of growth.

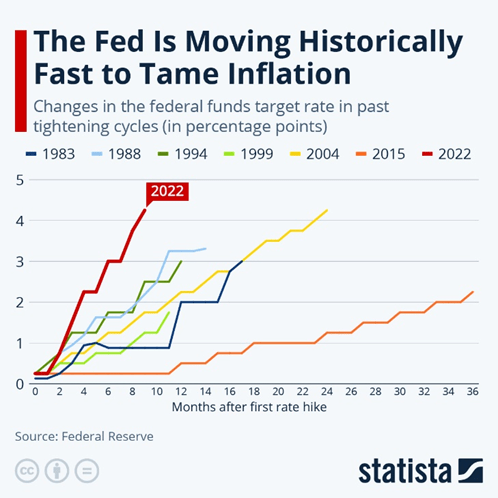

Fed Rate Hike Pace (Statista)

It is worth noting that after a year of interest hikes, the fastest in the history of the USA, and with the possibility that we have not reached the peak yet, it is essential to analyze the asset sensitivity of the bank. Axos remain slightly asset sensitive, with 43% of its loans comprising five-year hybrid single-family jumbo mortgages and multifamily term loans, and 48% of Axos' loans comprising primarily of floating rate C&I loans.

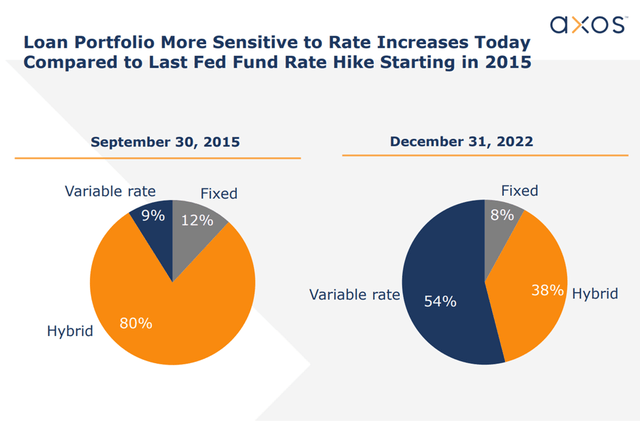

From the last Fed rate hike cycle in 2015, Axos adapted its portfolio to prepare for a new rate hike cycle, which has since occurred. It is pleasing to see that its portfolio has changed dramatically for the better.

Loan Portfolio Sensitivity (Axos Investor Presentation January 2023)

The variable rate has increased from 9% to 54% from 2015 to 2022, putting Axos in a much better position now. Its fixed rate has decreased slightly to 8%. Therefore, Axos was able to increase its net interest margin as its portfolio was prepared for this. I believe that the net interest margin has room to grow even higher in the future, locking in some deals at higher rates. Additionally, I foresee its portfolio slowly changing now, increasing its weight in fixed rates to benefit from these hikes, as we are reaching the peak of the cycle. The market is pricing in a 25bps hike next meeting in May and cuts in the second half of the year, which I don't see as an outcome at this point.

Axos sees Cash Reserve Ratio rise

Axos will report third-quarter 2023 earnings on April 27 but it posted a company release to announce some of the third-quarter 2023 results earlier this month and the results are stellar.

The total cash, cash equivalents, and cash segregated increased by $550 million from December 31, 2022, to $2.5 billion at March 31, 2023. Additionally, the total deposits increased by 25% annualized, or approximately $1.0 billion to $16.7 billion, leading to an increase in the reserve ratio to 15% from 12.5% in the previous quarter.

Also, 90% of Axos' deposits are insured by the Federal Deposit Insurance Corp. (FDIC), providing a high level of protection against potential bank runs. Furthermore, Axos' net interest income after its provision for credit losses grew by $84 million for the quarter ending Dec. 31, representing a 30% increase from the same period in 2022. These figures demonstrate Axos' strong financial position and ability to generate solid returns for its shareholders.

Best Online Banks

There is no better proof that a company is on the right path than receiving recognition from its customers. Axos has been recognized multiple times for its excellent service, and in 2022, it was awarded honors such as "Bank Honor Roll 2022", "1st Place - Top 10 Digital Banks for 2022", and "Best Online Banks 2022". In fact, Axos has been among the top online banks for four years in a row and remains a top contender in 2023.

Additionally, Axos is working on launching the next version of its consumer app in the summer of 2023. This new version will include a planning tab offering financial planning journeys, investment content, enhanced personal and management features, and better system and data integration with third-party service providers. With these enhancements, Axos is expanding its optionality and moving away from a banking-centric focus to a more integrated set of financial products, including improvements to its self-directed trading and automated model-based investment platform.

However, in my opinion, Axos will need to increase its marketing budget to attract customers on the investment side, as it faces many competitors in this field, such as TD Ameritrade, Webull, and Robin Hood. While Axos will focus more on the advisors and brokers side, it remains a very competitive market, and I believe that Axos will need to spend more to grow this side of the business. It may take a few years for this move to become profitable and could potentially drag down the company's share price. This is a development that I will keep a close eye on to see how it pays off.

Risk

The first-quarter earnings season begins in the second week of April, led by banking giants JPMorgan Chase (JPM), Wells Fargo (WFC), and Citigroup (C). This will be the first time banks report earnings after the bank crisis, so I expect a very volatile season for the sector. Axos will report earnings on April 27th. As a long-term investor, I do not base my investment decisions solely on quarterly earnings, but I use earnings season to understand if my thesis is still valid. However, given the current market volatility, I am anticipating more turbulence in the sector than usual, which could lead to a sell-off in the market, impacting Axos shares. Nevertheless, this would be a correlation issue rather than a problem with Axos itself.

A long-term risk I will be monitoring is how Axos’ loan portfolio sensitivity changes throughout the quarters and how the company can benefit from high-interest rates. Lastly, I will be watching to see if the new version of Axos' consumer app can engage and retain customers, and ultimately generate more revenue.

The Bank is a Buy

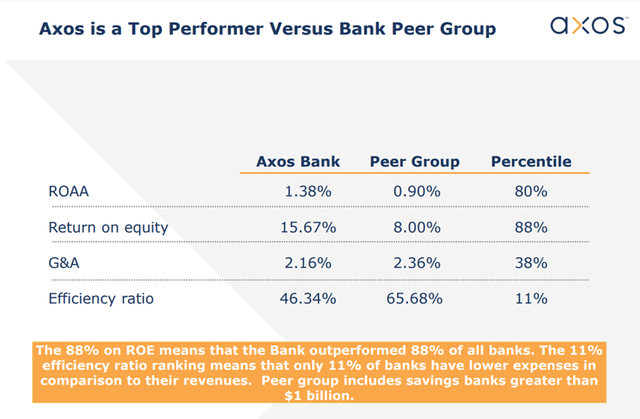

One of Axos' biggest strengths is its impressive metrics compared to its peers. During the period, the bank posted a return on average assets of 1.38%, compared to 0.90% for its peers. It also posted a return on equity of 15.67%, compared to 8% for its peers, where an ROE above 10% is generally considered good. Additionally, the bank's efficiency ratio was 46.34%, which is excellent compared to the peer average of 65.68%. This metric measures the percentage of the bank's revenues that go towards operating costs, and a lower efficiency ratio is a sign of an efficient bank. As Axos has no physical branches and very low overhead, it has dominated this metric since its early days as the Bank of Internet USA.

Axos versus Bank Peer Group (Axos Investor Presentation January 2023)

Despite a 20% decline in share prices since the FDIC took over SVB, Axos has given back all of the gains from January and February, putting it at 7 times forward earnings and 1.25 times book value. However, paying these prices anytime in the past decade has worked out really well for investors. Not only is Axos relatively safe, but it's also very cheap. Therefore, as a long-term investor, I see Axos as a buy opportunity.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AX over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.