Pierre-Olivier Gourinchas, the IMF's chief economist, has warned that the fog around the global economic outlook has thickened.

The International Monetary Fund's (IMF) top economist has called for policymakers to have a "steady hand" and communicate clearly so that quick adjustments can be made to new developments.

"More than ever, policymakers need a steady hand and clear communication," Pierre-Olivier Gourinchas, the multilateral agency's chief economist, said on the release of the IMF's World Economic Outlook report on April 11.

"With financial instability contained, monetary policy should remain focused on bringing inflation down, but stand ready to quickly adjust to financial developments," Gourinchas added.

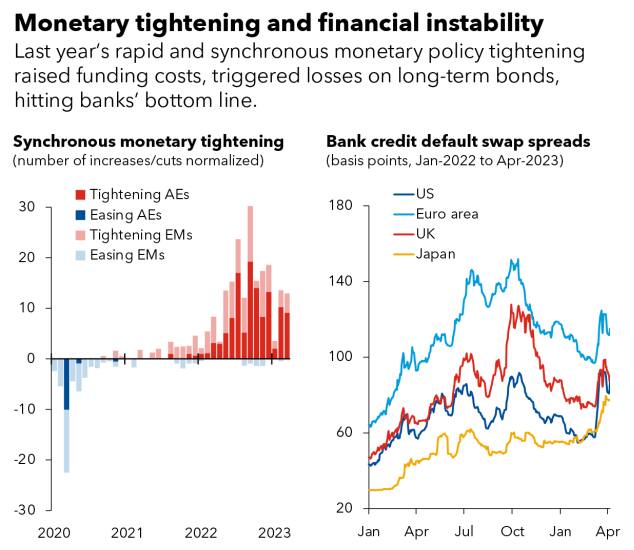

According to Gourinchas, the banking disturbances seen recently in the US and Europe will help slow down activity as lenders cut down on lending. While this should partially reduce the need for further monetary tightening, central banks could not let expectations of premature surrender of the inflation fight form.

"We are therefore entering a tricky phase during which economic growth remains lackluster by historical standards, financial risks have risen, yet inflation has not yet decisively turned the corner," Gourinchas said.

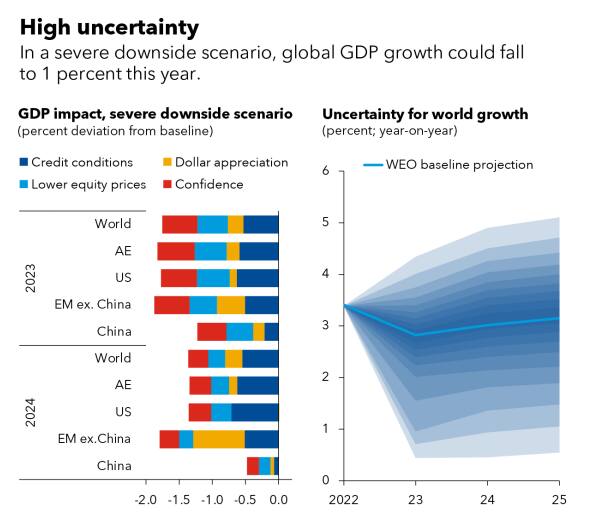

The IMF, on April 11, cut its global growth forecast for 2023 and 2024 by 10 basis points each to 2.8 percent and 3 percent, respectively.

One basis point is one-hundredth of a percentage point.

Downside risks dominate

The IMF's latest outlook report comes weeks after the global financial system was rocked by the collapse of regional banks in the US and the takeover of Credit Suisse by UBS in Europe. And Gourinchas said the banking sector's instability was a reminder that the "situation remains fragile", with the "fog" around the world economic outlook thickening as downside risks dominate.

Source: International Monetary Fund

Source: International Monetary Fund

The IMF's chief economist also said that although risks from sticky inflation – especially core inflation – remain, the impact of rapid tightening of monetary policy over the last year on the financial sector was "more worrisome".

"Following a prolonged period of muted inflation and low interest rates, the financial sector had become too complacent about maturity and liquidity mismatches," Gourinchas said in a nod to the US' banking sector issues.

According to him, the global financial system could be tested "even more".

"Nervous investors often look for the next weakest link, as they did with Credit Suisse," he said.

"Financial institutions with excess leverage, credit risk or interest rate exposure, too much dependence on short-term funding, or located in jurisdictions with limited fiscal space could become the next target. So could countries with weaker perceived fundamentals," he added.

Source: International Monetary Fund

Source: International Monetary Fund

As such, Gourinchas sees a 15 percent chance of global growth crashing to just 1 percent in 2023 if global financial conditions tighten sharply – or a 'risk off' event.