HYG: 3 High-Yield Bond Trends

Summary

- High yield bonds offer investors strong yields with low interest rate risk.

- With market conditions in flux, thought to have a close look at how these securities have evolved and fared these past few months.

- Three trends stand out.

- This idea was discussed in more depth with members of my private investing community, CEF/ETF Income Laboratory. Learn More »

RapidEye

Author's note: This article was released to CEF/ETF Income Laboratory members on April 9th.

With market conditions in flux, thought to have a look as to where high-yield corporate bonds stand today. I'll be using the iShares iBoxx $ High Yield Corporate Bond ETF (NYSEARCA:HYG), the largest ETF in this space, as an industry benchmark. Still, everything here should apply to all high-yield bond funds in roughly equal measure.

High-yield bond spreads are currently slightly below their historical averages, on bullish investor sentiment.

High-yield bond default rates are slightly below their historical averages too, due to strong economic conditions. Conditions are somewhat deteriorating, with most analysts expecting a shallow recession, and average default rates moving forward.

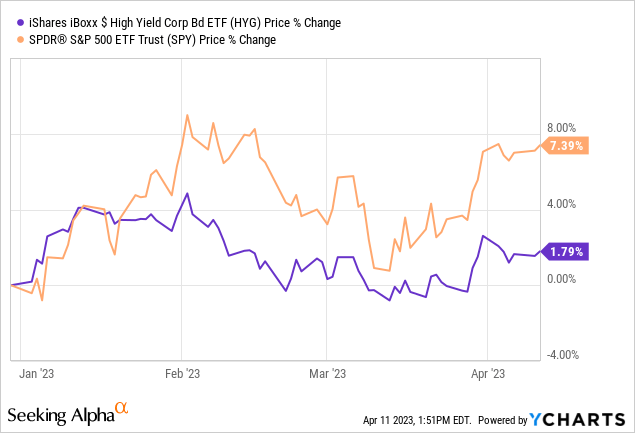

High-yield bonds have below-average interest rate risk and duration. This has been a negative YTD, as long-term rates have started to soften, but a positive these since early 2022, in which rates have increased. In my opinion, lower interest rate risk is a net positive, recent performance notwithstanding.

In general terms, high-yield bonds seem to offer sensible yields, broadly in-line with prevailing economic conditions. Expectations are bullish, so these securities might not make investment sense for more bearish investors. HYG is the largest ETF in this niche, and so has these same characteristics.

High-Yield Corporate Bonds

Spread Analysis

High-yield corporate bonds effectively always trade with a spread over safer assets, including treasuries, due to their greater risk, volatility, and probability of default. Spreads do vary, based on economic conditions and investor sentiment, amongst other factors.

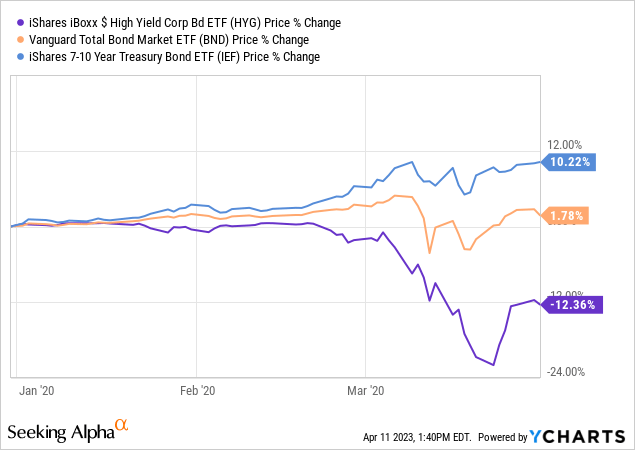

When economic conditions are tough there is lower demand for risky assets, higher demand for safer assets, and so spreads are wide. One can see this scenario play out during most recessions, including during 1Q2020, the onset of the coronavirus pandemic. HYG was down while treasuries were up.

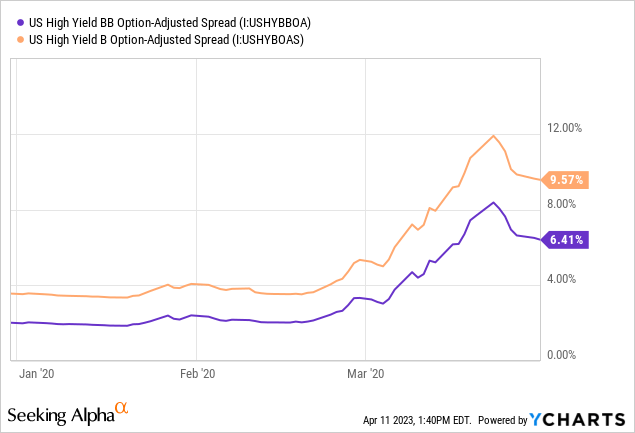

So spreads widened.

When economic conditions are strong investor demand for riskier assets increases, leading to tighter spreads.

Investor sentiment and expectations matter too. Spreads should widen if sentiment worsens, and if investors come to expect economic conditions to worsen.

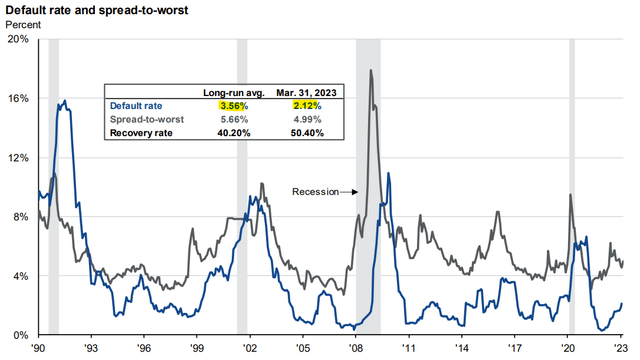

Right now, spreads seem to be around 0.7% below their historical averages, although these do vary widely.

JPMorgan Guide to the Markets

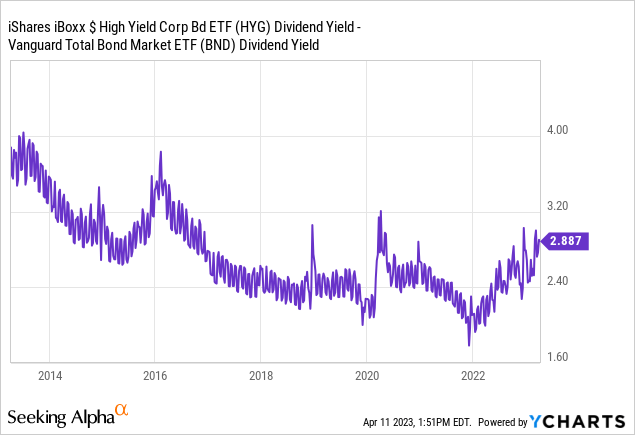

HYG itself trades with a 2.9% spread over the Vanguard Total Bond Market ETF (BND), which tracks the broader bond industry. Spreads are quite clearly above their recent historical averages, but much lower than in the prior decade.

In my opinion, and considering the above, it would be accurate to say that high-yield bond spreads are currently slightly below their historical averages. One could argue spreads are higher, solely based on spreads from the past few years, but a longer term view is more appropriate, in my opinion.

Spreads are broadly consistent with current economic conditions, as economic and job growth both remain strong. Sentiment and expectations both seem broadly bullish, as riskier assets have seen strong performance YTD, and as spreads wouldn't be this tight otherwise.

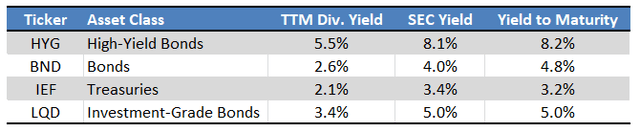

As a final point, a quick table with relevant yield metrics for HYG and some other broad-based bond funds.

Fund Filings - Chart by Author

Default Rate Analysis

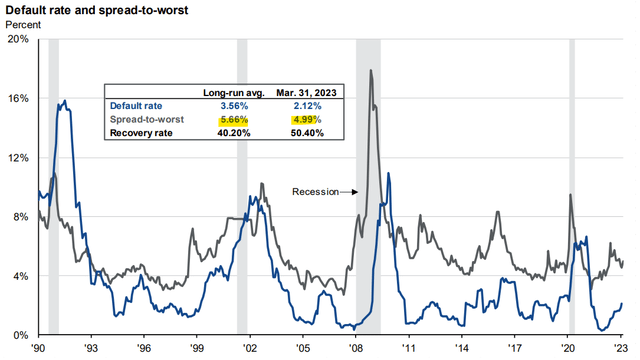

High-yield corporate bonds tend to sport above-average default rates, although these are almost always low on an absolute basis. Default rates are almost entirely dependent on underlying economic conditions, which tend to vary. Default rates currently stand at 2.1%, quite a bit below their 3.6% historical average.

JPMorgan Guide to the Markets

On a more negative note, default rates are rapidly increasing, as higher Federal Reserve intervention rates lead to tighter financial conditions across the board, and a (marginally) worse economy. Heavily indebted corporations are at particular risk right now. Best-case scenario, these companies rollover their debt at unfavorable rates, leading to declining earnings. Worst-case scenarios, these corporations are unable to rollover or service their debt, leading to bankruptcy and default.

In my opinion, and in the opinion of most market analysts, default rates should continue to trend upwards, but settle on very manageable levels. S&P forecasts a 4.0% default rate by late 2023, a significant increase from current levels, but still below the company's 4.1% historical average (JPMorgan has a slightly different average). Moody's expects a 4.4% default rate by the end of the year, Fitch expects a lower rate, in the 3.0% - 3.5% range. Expectations seem to be for default rates to climb to roughly average levels, not above-average.

Spreads are a bit tighter than expected, given prevailing default rate expectations. Average default rates should lead to average spreads, while spreads are currently slightly below average. In my opinion, the disconnect between expected default rates and spreads is small enough so as to not make an important difference to investors.

Investors whose expectations differ from those of the market should assess the situation closely. Very bearish investors should consider avoiding HYG and similar funds, as these trade with somewhat bullish expectations, and would almost certainly see sizable losses if the recession proved deep or long-lasting. Although this is almost always the case, sometimes spreads and yields are much more enticing, which might change the investment calculus.

Duration Analysis

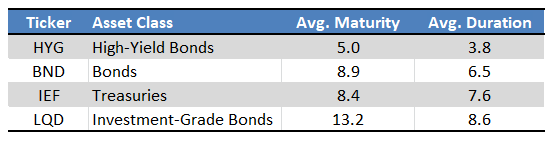

High-yield corporate bonds tend to sport below-average maturities, as investors are loathe to extend long-term credit to riskier borrowers. At the same time, investors are much more willing to extend long-term loans to safer borrowers, so there is a clear, significant difference in average duration between type of bond / credit rating.

HYG itself currently sports a weighted average duration of 3.8 years, significantly lower than the bond average, and less than half the treasury / investment-grade bond average.

Fund Filings - Chart by Author

Do bear in mind, the funds above invest in different types of bonds, so their interest rate exposure is different too. HYG is impacted by high-yield bond rates, while the iShares 7-10 Year Treasury Bond ETF (IEF) would be impacted by medium-term treasury rates. Federal Reserve rates, and expectations thereof, have an indirect effect on all funds. Still, rates are generally somewhat correlated, and have been correlated this entire hiking cycle.

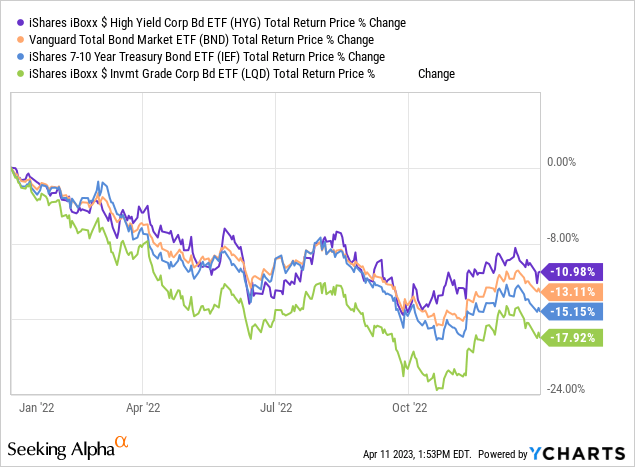

HYG's comparatively low duration reduces losses when interest rates rise, as was the case in 2022.

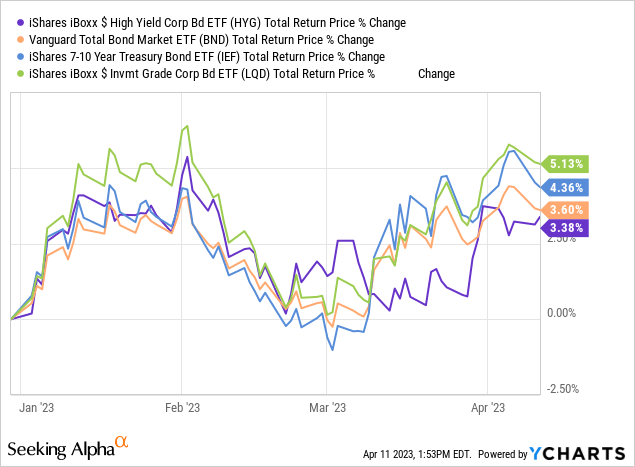

On the flipside, low duration leads to lower gains when relevant rates go down, as has been the case YTD.

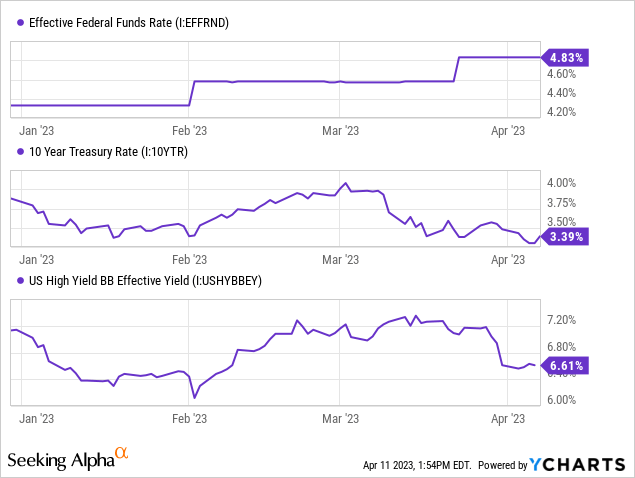

To expand a bit on the above, although Fed rates have increased these past few months, longer-term rates have increased. The funds above are benchmarked to these longer-term rates, so have seen declining rates.

HYG's low duration reduces interest rate risk and portfolio volatility, two important positives for the fund and its shareholders. HYG's low duration would almost certainly continue to lead to underperformance if rates soften more than expected, an important negative. In my opinion, HYG's low duration is a net positive, although some investors, especially those who believe the Fed will pivot in the coming months, might disagree.

Conclusion

Economic and market conditions are in flux. Three high-yield bond characteristics investors need to consider.

Spreads are currently very slightly below their historical averages.

Default rates are slightly below their historical averages.

Duration and interest rate risk remain below-average.

In general terms, high-yield bonds and bond funds look reasonably priced, including HYG.

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

This article was written by

Juan has previously worked as a fixed income trader, financial analyst, operations analyst, and economics professor in Canada and Colombia. He has hands-on experience analyzing, trading, and negotiating fixed-income securities, including bonds, money markets, and interbank trade financing, across markets and currencies. He focuses on dividend, bond, and income funds, with a strong focus on ETFs, and enjoys researching strategies for income investors to increase their returns while lowering risk.

---------------------------------------------------------------------------------------------------------------

I provide my work regularly to CEF/ETF Income Laboratory with articles that have an exclusivity period, this is noted in such articles. CEF/ETF Income Laboratory is a Marketplace Service provided by Stanford Chemist, right here on Seeking Alpha.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.