Shopify: It's Time To Buy The Dip

Summary

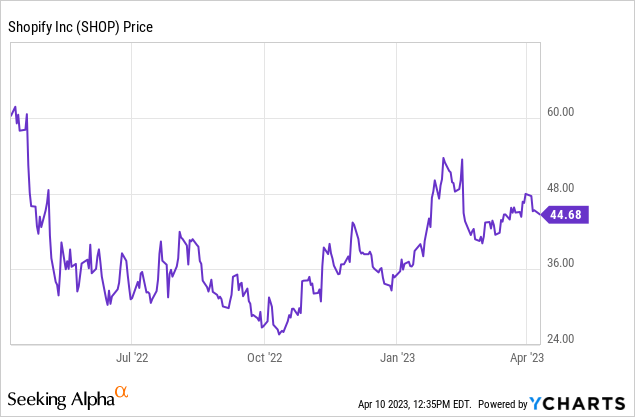

- Shares of Shopify have crumbled after the company reported Q4 results and issued guidance for 2023.

- Though up ~25% year to date, SHOP stock is still trading at a fraction of its pandemic-era highs.

- Despite its ~$7 billion annualized revenue scale, the fact that Shopify is still managing to grow revenue at a >20% y/y pace is impressive.

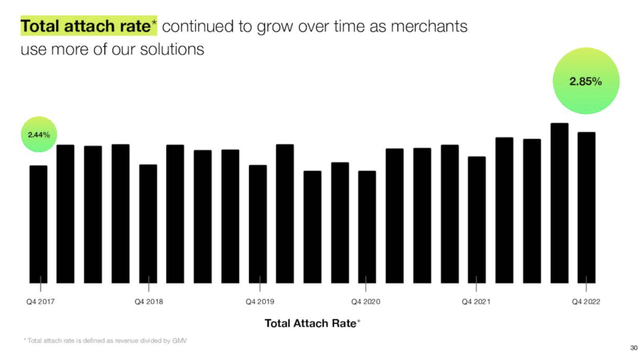

- The company is successful at increasing its attach rate through expanding its merchant services.

Sean Gallup

Understandably, sentiment for the e-commerce space is weak right now. The underlying business faces challenges from an expected pullback in consumer spending, driven by layoffs and high interest rates; while valuations are also under pressure as investors shift toward higher-yielding cash and bonds.

This turmoil has impacted Shopify (NYSE:SHOP), one of the most recognizable e-commerce software platforms. Though up ~25% year to date, Shopify's gains lag behind the rebounds seen in many other software companies, and the stock is also down sharply since reporting Q4 earnings in mid-February. And relative to 2021 peaks above $160, Shopify is still trading at a fraction of its former worth.

It's a good opportunity, in my view, to re-assess the bullish thesis for Shopify. My view on the stock is at a buy - though I agree that Spotify isn't exactly a value play, I think expectations are low for this company and even the slightest whiff of a beat can send the stock into an upward spiral.

The one-stop shop platform: attach rates have improved materially

Shopify, for investors who are not aware, is one of the largest merchant platforms in e-commerce. The company services both mom-and-pop casual sellers as well as large global brands.

The total GMV (gross merchandise sales, or the total dollar volume of goods that transact on the Shopify platform) stands at a massive ~$200 billion annually (for sizing purposes: that's roughly a third of Walmart's (WMT) annual revenue.

Of course, Shopify's slice of revenue of that total is much smaller - but it's growing.

Shopify attach rate (Shopify Q4 earnings deck)

As shown in the chart above, Shopify's attach rate (calculated as revenue over total GMV) has expanded to 2.85%. Though small, this represents a substantial lift (17%) over 2.44% over the past five years. We can't ignore the fact that GMV itself is also growing double-digits while Shopify's take-rate on this GMV is also expanding.

The slide below showcases all the new features and products that Shopify launched in 2022, on top of deepening its efforts to expand globally:

Shopify product expansion (Shopify Q4 earnings deck)

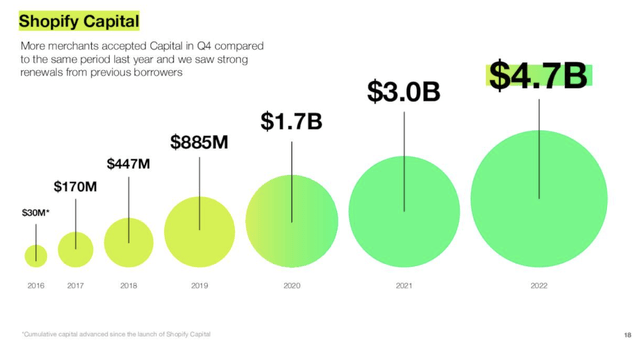

Zooming into Shopify Capital, which is Shopify's lending program for its merchants - this effort has grown by more than 50% y/y to $4.7 billion in 2022 as shown in the chart below:

Shopify Capital (Shopify Q4 earnings deck)

Shopify Payments, meanwhile, has expanded availability into 22 countries (adding five countries in 2022, including France and Switzerland), and GMV processed through the platform grew to $11 billion.

It's important to note that Shopify is capturing brick and mortar sales through its payments platform as well through the rollout of its new POS system, which is incredibly important as we move into the post-pandemic world and retail sales reclaim share. Per President Harley Finkelstein's remarks on the Q4 earnings call:

We rolled out both Shop Pay and installments to point-of-sale in limited beta. So in-store buyers at the point-of-sale can now benefit from the same payment options and payment flexibility that we offer online. Driving greater integration of Shop Pay and point-of-sale remains a big opportunity for us, and we are excited to scale this more broadly in 2023 and beyond.

Point-of-Sale Go, our first-in-class mobile hardware device, takes the merchant and customer experience to the next level by offering buyers of super smooth and quick checkout. Point-of-Sale Go, which launched in September is an all-in-one fully integrated point-of-sale system, barcode scanner and card reader that accepts tap chip and swipe payments.

A key selling point of Point-of-Sale Go is its proprietary operating system, which allows Shopify to control the end-to-end experience on the device from app updates, to permissioning, to point-of-sale onboarding. At $399 per device, Point-of-Sale Go brings incredible value to larger, more complex retailers who are buying these devices in multiples.

The initial response to this cornerstone product has been exceptionally strong, and we are excited to drive even greater adoption in 2023."

The bull case for Shopify

Here is my updated long-term bull thesis for Shopify:

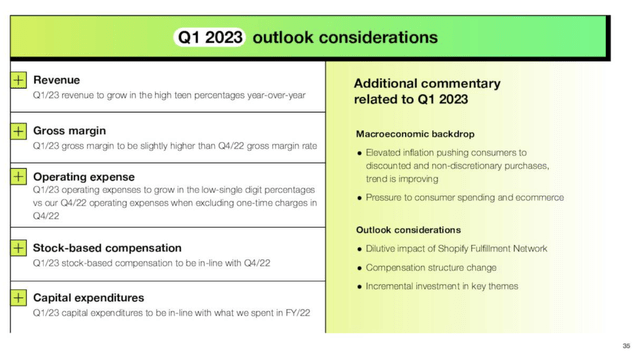

- Growth at scale. Shopify's GMV has hit a ~$200 billion annualized scale, and it's still growing in the double digits. Revenue, in turn, has hit a >$6 billion annualized scale, and it's still currently growing north of >20% y/y and projected to grow in the high-teens in 2023. This is indicative of the fact that Shopify is still pursuing a large and greenfield market.

- Higher attach rates driven by a wide product flywheel; capturing brick and mortar spend. Shopify's attach rates (revenue as a percentage of GMV) has steadily ticked up over time, as the company continues to roll out more merchant solutions including POS, lending, sales tax management, and other services. It is also expanding these services into other countries. In addition, the company's new Point of Sale Go product brings Shopify Payments into brick and mortar retail sales, expanding Shopify's reach far beyond e-commerce.

- Blue chip brands. Shopify's clientele ranges from smaller independent storefronts to some of the world's most recognizable brands. Large companies that operate Shopify storefronts include Samsonite, Allbirds, Staples, and Heinz are all Shopify clients.

- Capital-light business with growing gross margins. Shopify operates a pure software platform that collects fees from merchants. The company is growing its subscription revenue base through Shopify Plus, and as attach rates on add-on services improves, the company will continue to expand its profitability.

Valuation check

Of course, all of Shopify's strengths are priced into the stock. At current share prices near $45, Shopify trades at a market cap of $56.06 billion. After we net off the $5.05 billion of cash and $913.3 million of debt on Shopify's most recent balance sheet, the company's resulting enterprise value is $51.92 billion.

Meanwhile, for the current fiscal year FY23, Wall Street analysts have a consensus revenue target of $6.65 billion for the company, representing 19% y/y growth (data from Yahoo Finance). This ties loosely to the company's outlook for high-teens growth in Q1:

Shopify outlook (Shopify Q4 earnings deck)

Taking consensus at face value, Shopify trades at 7.8x EV/FY23 revenue. In my view, Shopify has enough fundamental firepower to flex up to a 9x forward revenue multiple, implying a $52 price target and 17% upside from current levels.

Key takeaways

There's a lot to like about Shopify as the company continues to add adjacent services. I especially admire the company's push into the brick-and-mortar retail space with the launch of its new POS system. Stay long here and buy the recent dip.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SHOP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.