Robinhood: 70% Net Cash And Cancellation Of $500 Million RSUs

Summary

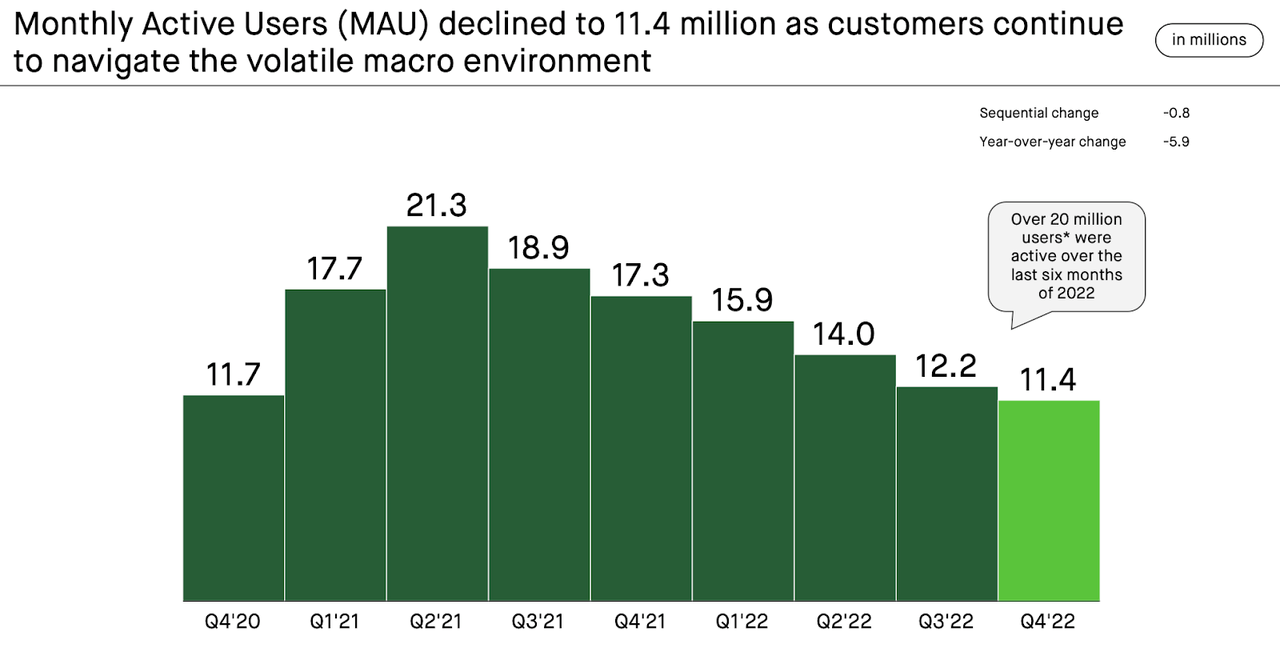

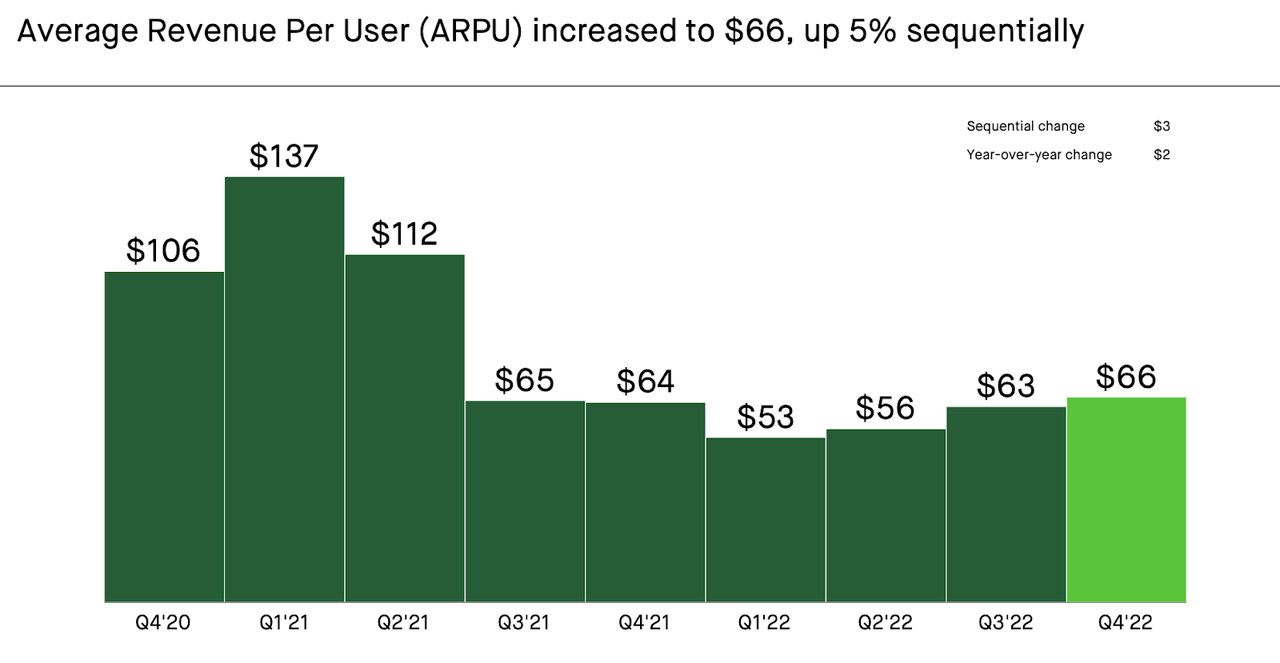

- Robinhood continues to bleed MAUs but ARPU is rising.

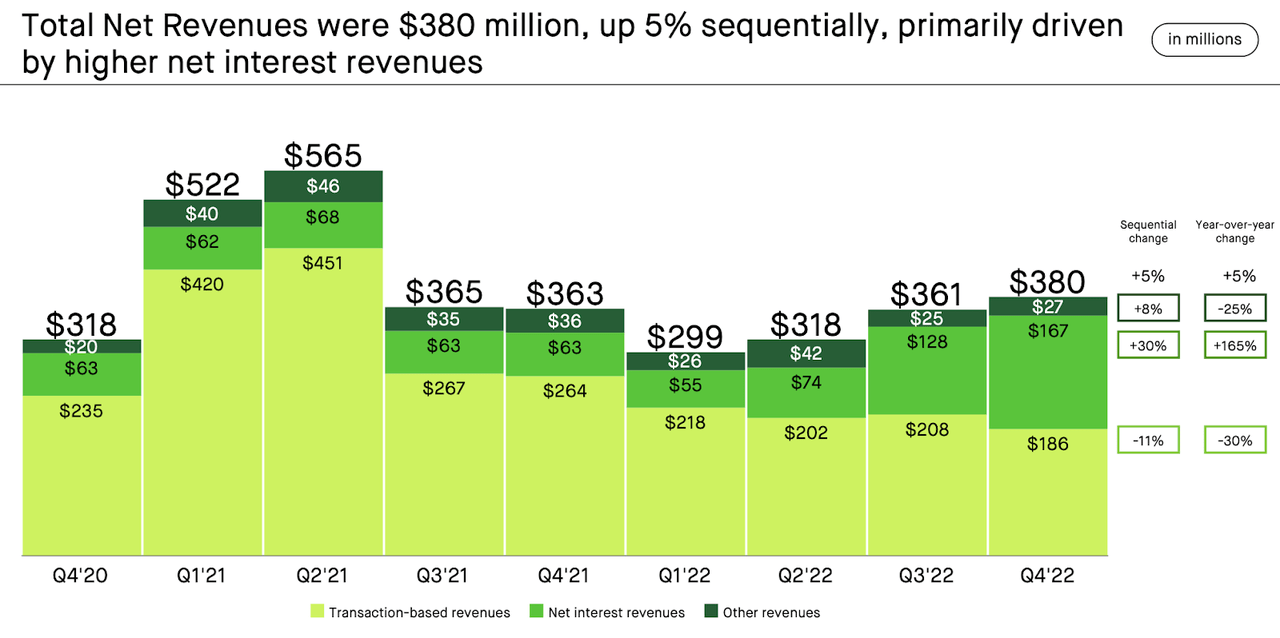

- The rising interest rate environment has boosted revenues and helped to offset declines in transaction revenue.

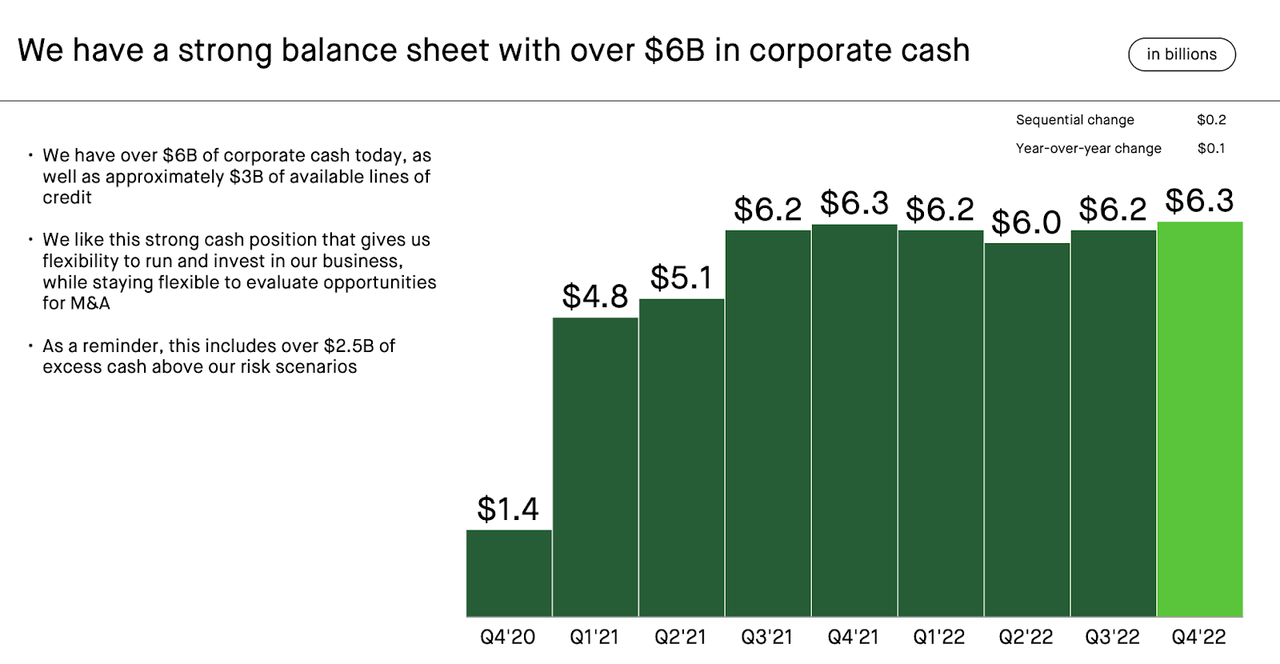

- Net cash stands at $6.3 billion or 70% of the market cap.

- I discuss management's decision to cancel $500 million of restricted stock units.

- Looking for a portfolio of ideas like this one? Members of Best Of Breed Growth Stocks get exclusive access to our subscriber-only portfolios. Learn More »

Spencer Platt

Things may finally be starting to look up for the stock brokerage firm Robinhood (NASDAQ:HOOD). While monthly active users continue to decline, the company has made substantial progress on improving profitability, bolstered in part by the rising interest rate environment. With management promising further improvements in margin this year, investors might begin to focus on the large cash hoard. HOOD intends to repurchase the 55 million shares owned by Sam Bankman-Fried's Emergent Fidelity Technologies, something that may only accelerate that focus. While HOOD is not quite out of the woods just yet, the stock still looks too cheap here.

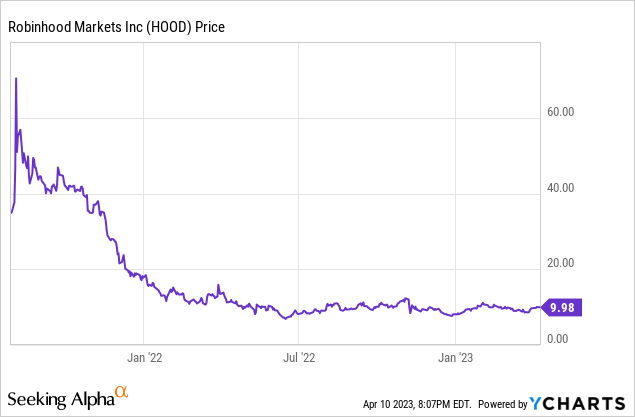

HOOD Stock Price

HOOD continues to trade as a shell of its former self, but that makes sense considering that growth - and profits - had suddenly disappeared in mid-2021.

I last covered HOOD in November where I discussed why the stock was a buy after the collapse in FTX. With HOOD preparing to repurchase the shares owned by Bankman-Fried's Emergent Fidelity Technologies, this is a good time for an update.

HOOD Stock Key Metrics

In its most recent quarter, HOOD saw MAUs decline sequentially yet again, though the pace of the decline continues to improve.

2022 Q4 Presentation

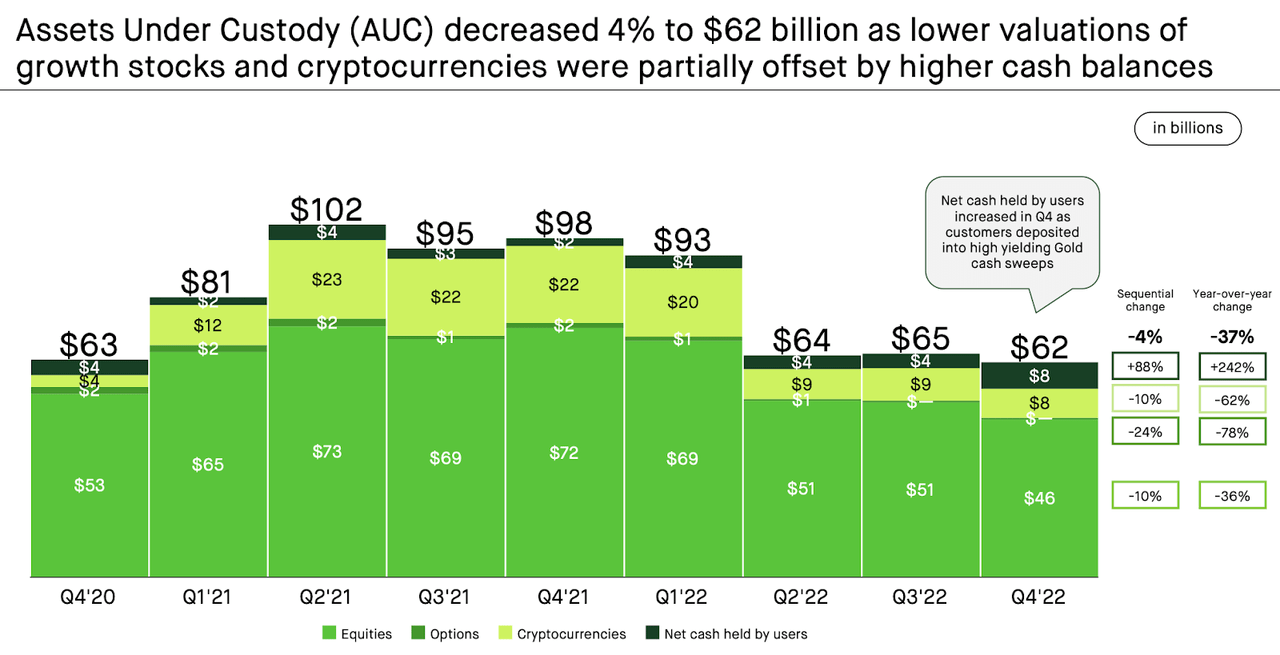

Meanwhile, assets under custody declined 4% sequentially, as weakness in equities and cryptocurrencies was offset by an increase in cash balances.

2022 Q4 Presentation

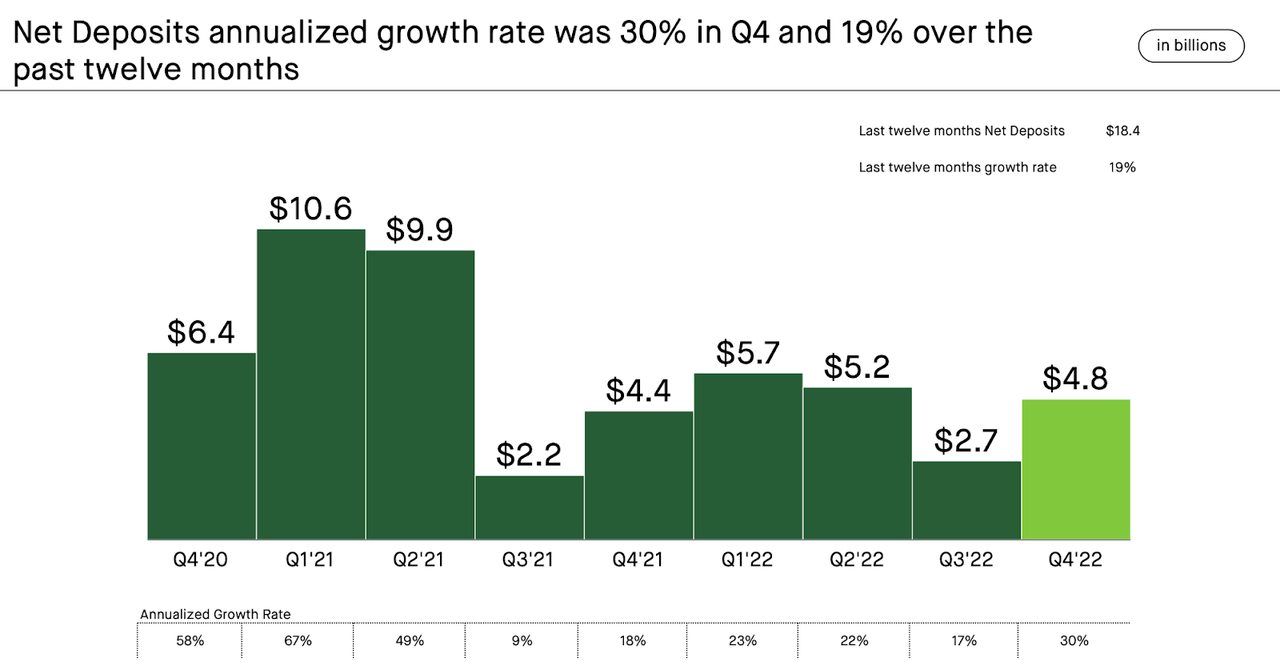

HOOD has been quite aggressive in gaining new deposits, with net deposits growing 30% YOY, likely helped by the company's generous interest rates.

2022 Q4 Presentation

While HOOD is still looking for a stop to the decline in MAUs, average revenue per user ('ARPU') increased sequentially for the third straight quarter. The strength in ARPU increases hopes that HOOD is turning the corner as its current user base reflects "loyal" long term users.

2022 Q4 Presentation

HOOD generated its first quarter with YOY net revenue growth in a year, with higher net interest revenues helping to offset lower transaction revenues.

2022 Q4 Presentation

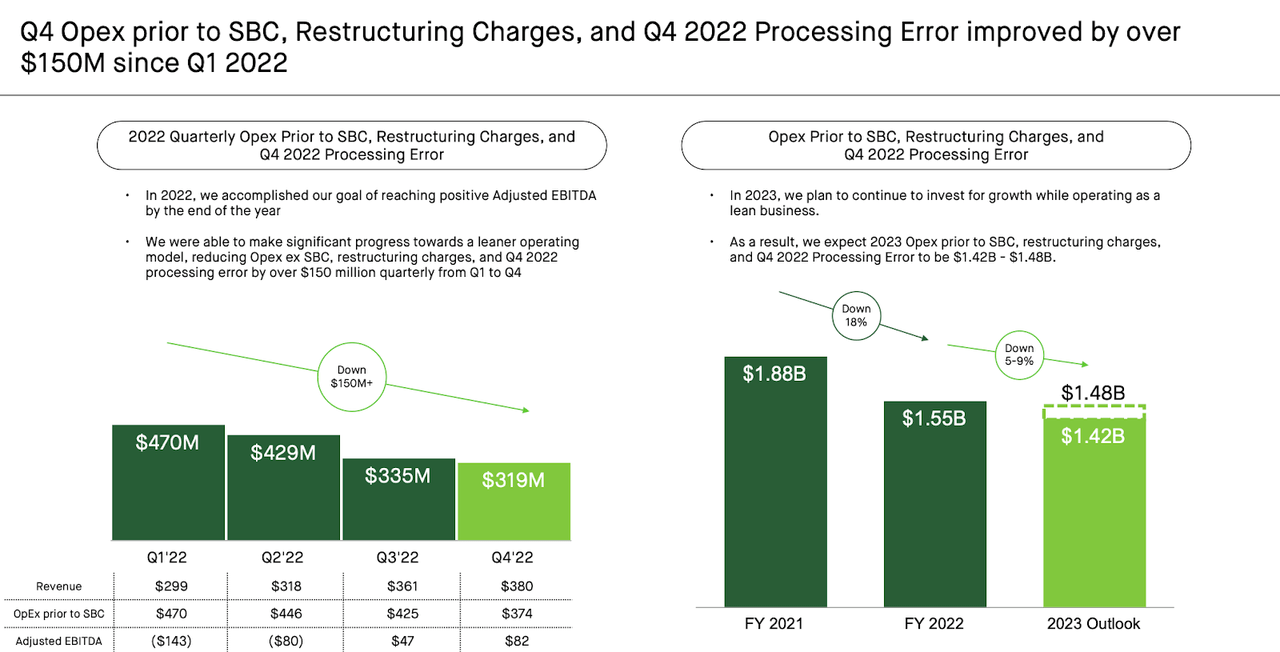

HOOD continued to exercise cost discipline, with OpEx declining sequentially yet again with 2023 expected to see further improvement.

2022 Q4 Presentation

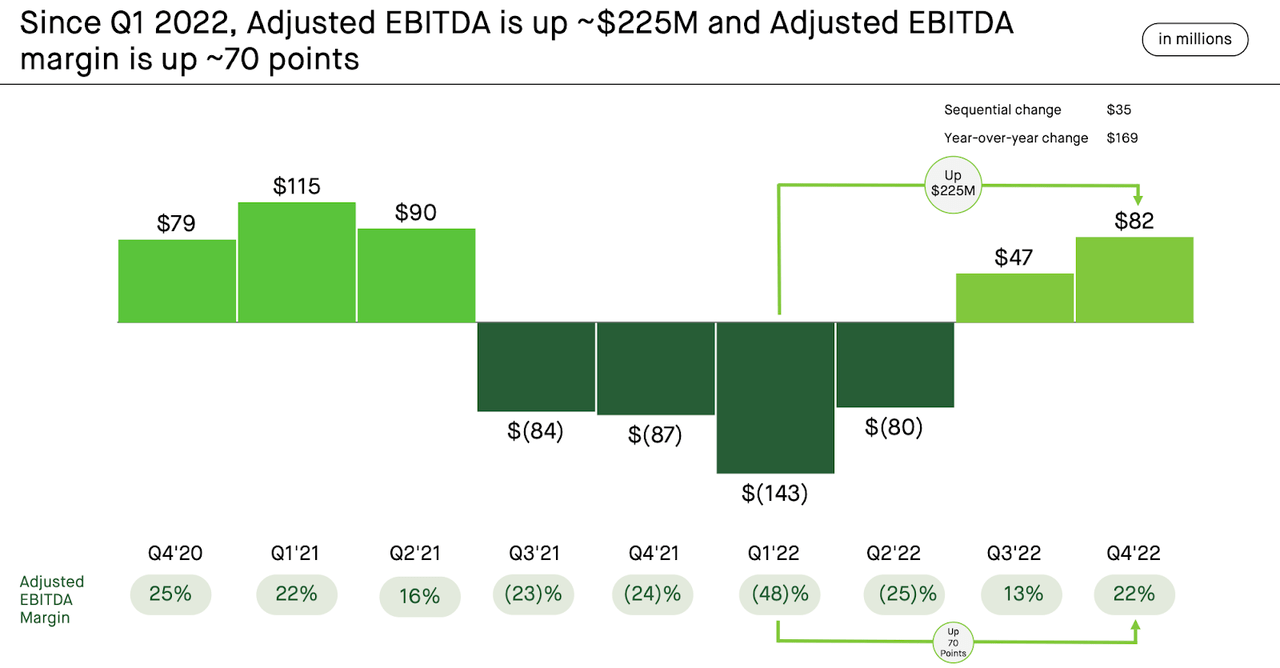

Management deserves credit for the cost improvements, as HOOD was able to generate its second consecutive quarter of positive adjusted EBITDA after four straight quarters of adjusted EBITDA losses.

2022 Q4 Presentation

HOOD ended the quarter with $6.3 billion in net cash, or $2.5 billion of excess cash above their "risk scenarios."

2022 Q4 Presentation

On the conference call, management guided for a $30 million sequential increase in revenues and outlined plans to reduce full-year OpEx by another 7%. The board of directors authorized a share repurchase program focused on buying back the 55 million shares owned by Sam Bankman-Fried's Emergent Fidelity Technologies, which recently filed for bankruptcy. With adjusted EBITDA finally positive and corporate cash comfortably above risk scenarios, such a move makes some sense - though I admittedly wonder why the company would not instead consider simply buying the stock in the open market at presumably lower prices.

Is HOOD Stock A Buy, Sell, or Hold?

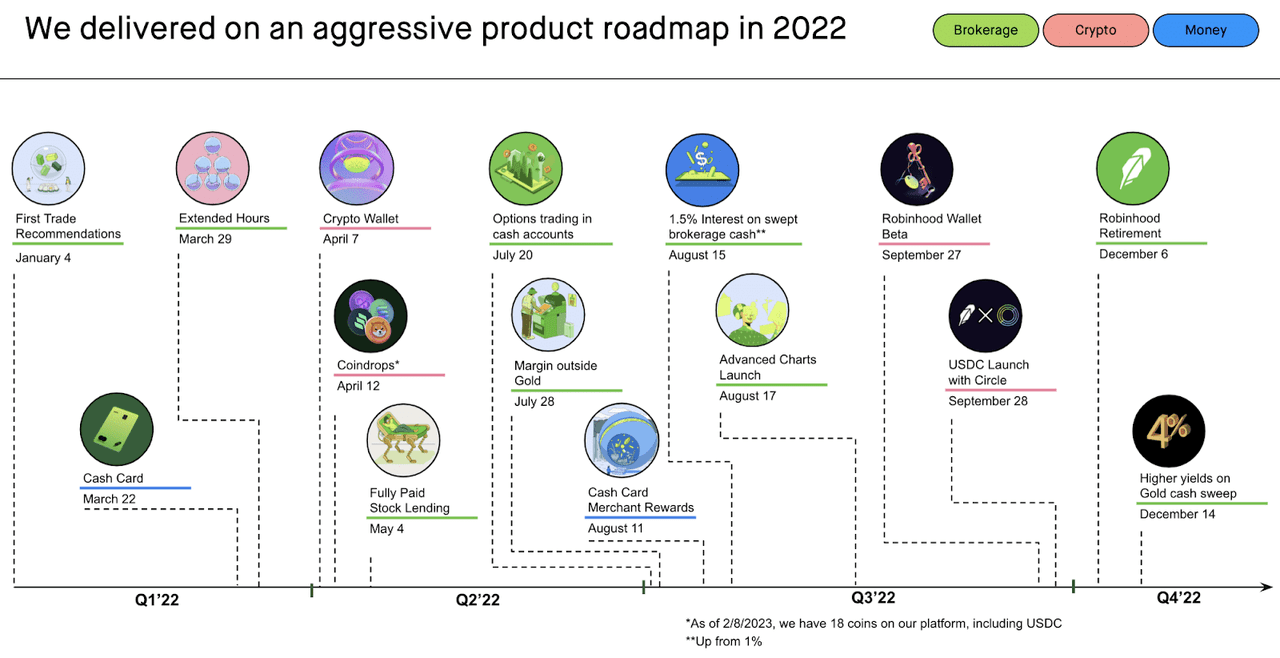

HOOD's stock price screams distress and in many ways that isn't too inaccurate considering the persistent declines in MAUs. But we mustn't forget that HOOD was once a fast-growing brokerage firm that was resonating with younger investors. HOOD has been delivering on innovative new features including the following roadmap in 2022.

2022 Q4 Presentation

Looking ahead, HOOD aims to focus on increasing net deposits, an understandable goal considering the higher interest rate environment.

2022 Q4 Presentation

As of recent prices, HOOD was trading at just around 5x sales in spite of an anticipated acceleration in revenue growth this year.

Seeking Alpha

I note that the 5x sales multiple is not giving credit to the $6.3 billion in net cash making up 73% of the market cap. Based on 30% long term net margins, a return to 20% growth rates and a 1.5x price to earnings growth ratio ('PEG ratio'), I could see HOOD trading at 9x sales, implying around triple-digit upside. I note, however, that this valuation depends on a turnaround of the company's fundamental picture including a return to MAU growth. The large net cash position helps to buy the company time to achieve such a turnaround.

What are the key risks? The most obvious risk is if the company can not turn things around. It is possible that HOOD has permanently impaired its brand and will never return to MAU growth. While I find such a scenario unlikely considering how big banks are typically able to bounce back from scandals over time, HOOD admittedly does not have the long history or legacy of the big banks. HOOD does not charge commission fees as its transaction revenues mainly come from payment for order flow ('PFOF'). Whether or not PFOF is ethically sound is not important - politicians and the general public have in the past shunned the practice, though the SEC is not yet ready for a full ban.

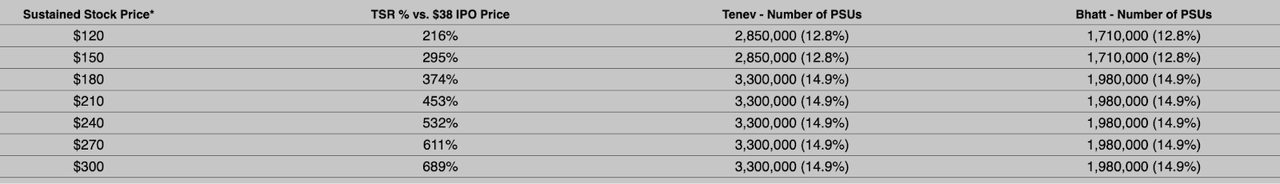

I also should note the curious announcement that they "would cancel nearly $500 million of our combined share-based compensation." On the surface that sounds very shareholder friendly, but it is not so simple. As stated in the press release:

The Cancellation Agreement provides for the cancellation of the 22,200,000 and 13,320,000 market-based restricted stock units granted to Mr. Tenev and Mr. Bhatt, respectively.

These RSUs refer to the 2021 grant with stock price hurdles as seen below:

2022 DEF14A

These RSUs would not have vested unless HOOD sustained a stock price of at least $120 per share at the lowest tranche - representing 10x upside from here. From the shareholder's point of view, one may have hoped for these RSUs to remain in play or at the very least that management still believed in these hurdle prices. That hope has been dashed.

Nonetheless, HOOD stock remains cheap here and is priced for strong upside in the event of a successful turnaround. I continue to view a basket of undervalued tech stocks as being an optimal way to position ahead of a recovery in tech stocks. HOOD fits in such a basket on the basis of its cheap valuation and large net cash position.

Sign Up For My Premium Service "Best of Breed Growth Stocks"

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 6-8 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!

This article was written by

Julian Lin is a top ranked financial analyst. Julian Lin runs Best Of Breed Growth Stocks, a research service uncovering high conviction ideas in the winners of tomorrow.

Get access to his highest conviction ideas here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HOOD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.