Kosmos Energy: Nearly A Triple, Pack It In Or Stick Around?

Summary

- Kosmos is growing production in 2023, and will be getting a major boost from GTA startup in early 2024.

- It has a number of HIW prospects that could add hundreds of millions to their already growing reserves base.

- Investors with a moderate risk profile may find the company attractive at a slight discount to current prices.

- Looking for more investing ideas like this one? Get them exclusively at The Daily Drilling Report. Learn More »

satori13/iStock via Getty Images

Note: This company was discussed in more detail in the Daily Drilling Report on April 4th, 2023.

Introduction

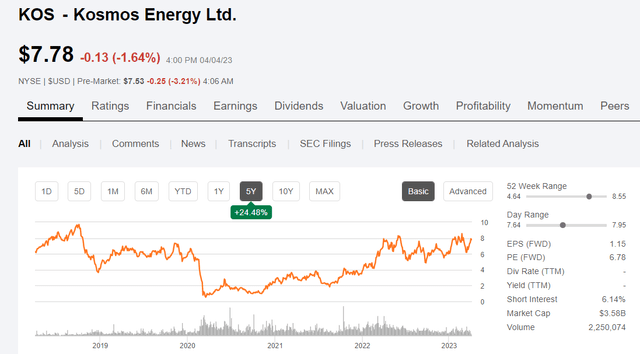

It's hard to believe it's been a year and a quarter since we discussed Kosmos Energy (NYSE:KOS). We picked it as a strong buy in the low $3s in early January of 2022, and the intervening year or so has justified the confidence we felt with the stock breaching the mid-$8s as recently as the end of February. It hovers near that level still.

KOS Price Chart (Seeking Alpha)

The stock has traded sideways for much the year so far if you ignore a recent dip down into the low $6s, at the peak of the bank panic. Now trading in the upper $7s the perennial question posed by the Clash in the early 1980s arises, "Should I stay, or should I go." (Little did the British punk rockers know they were serving up a line that would be repeated endlessly in articles like this one.)

In this article, we review KOS's progress to this point and decide if we are going to hang around, or not.

The thesis for KOS

A few years back, there were two companies trading at about the same price with what I thought were strong prospects as future LNG suppliers. One was a company headed up by ex-Cheniere Energy CEO, Charif Souki, Tellurian Inc. (TELL), and Kosmos Energy. Kosmos' story was more compelling to me, and I presented it to readers in my first article on the company. Since 2020 I've written several articles on the company, all with buy ratings. I think I went the right way, as TELL is currently trading at around a buck, and KOS has nearly tripled. Since I bring them - TELL, up it should be noted there is wide divergence of opinion - ranging from Strong Buy to Sell, about TELL, and I would refer you to these articles for an in-depth look at them.

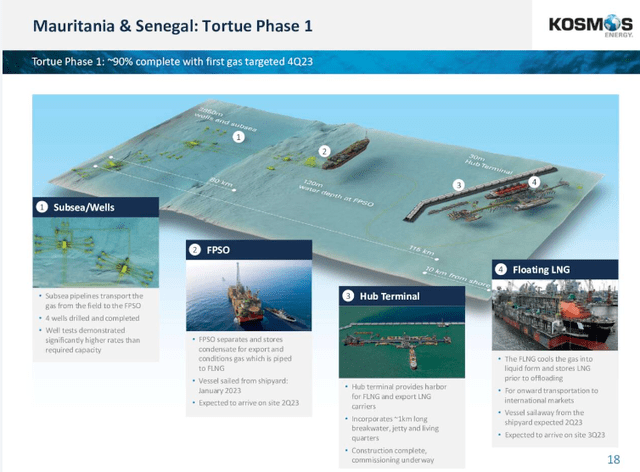

This project is what convinced me about KOS. It's a compelling story that involves the sale of half the stake to BP (BP) for their construction acumen and gas marketing expertise, a ready market for the gas in the host countries, Mauritania and Senegal, and a straight shot to Europe for exposure to the TTF gas prices, and the long term future of LNG as a coal or wood pellet substitution fuel. Greater Tortue Ahmeyim (GTA) is nearly complete with first loadings planned for Q-4, of this year. We received a note of encouragement in the Q-4 CC from Andy Inglis, CEO, on the quality of the GTA reservoir-

On drilling, four wells have been drilled and completed. Flowback of the wells has demonstrated ranked significantly higher than required for Phase 1 liquefaction.

Early next year, holders of KOS's stock should start seeing the benefit of LNG loadings hit the balance sheet. Thus far the stock doesn't reflect any of that coming cash flow potential.

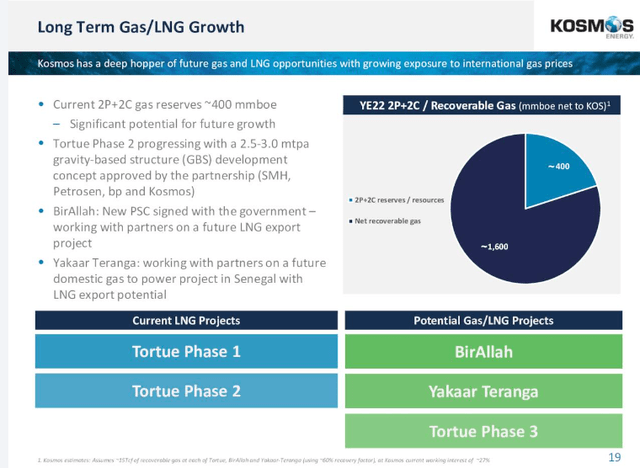

It should also be mentioned, GTA has massive future development potential, and recently passed a critical hurdle on its way to Phase II FID, with the approval of the Phase II development concept. Bir Allah, Yakaar Teranga, and GTA-Phase III give a long arc for future development offshore in West Africa.

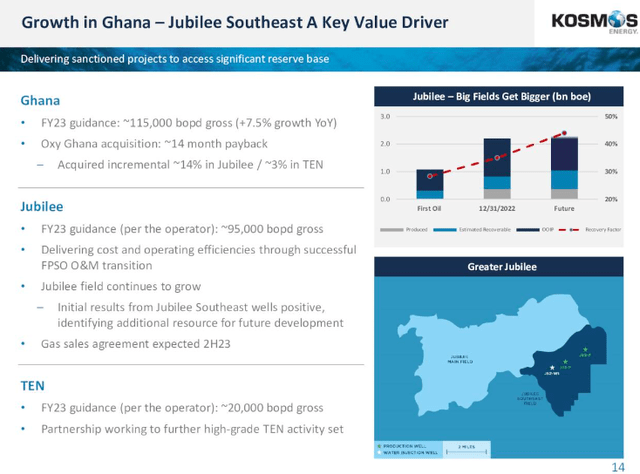

KOS also has current production at several mature fields offshore Ghana, and Equatorial Guinea.

In Ghana, the primary resource is the Jubilee field. With over 2-bn bbls in place on first production, Jubilee is now producing ~75K BOEPD, and KOS expects to raise it to 95K later this year with the start up of Jubilee SE field. About 1-bn of recoverable oil remains. The company notes 30 future drilling locations in Jubilee field, and pointing to the results from Jubilee SE completions. Andy Inglis discusses the future of Jubilee-

Recent drilling programs have been excellent with three Jubilee Southeast wells drilled, all of which have come in ahead of expectations. The results have been encouraging from two dimensions. Firstly, the wells are located reserves in more oil horizons than expected, and secondly, the primary horizons have indicated connectivity to the main Jubilee field. We look forward to providing further updates on this important project over the coming months.

TEN booked an impairment due to deferral of exploitation drilling and a decision to focus capex on the clear cut opportunities on Jubilee. Production on TEN is forecast to remain at ~20K BOEPD for 2023.

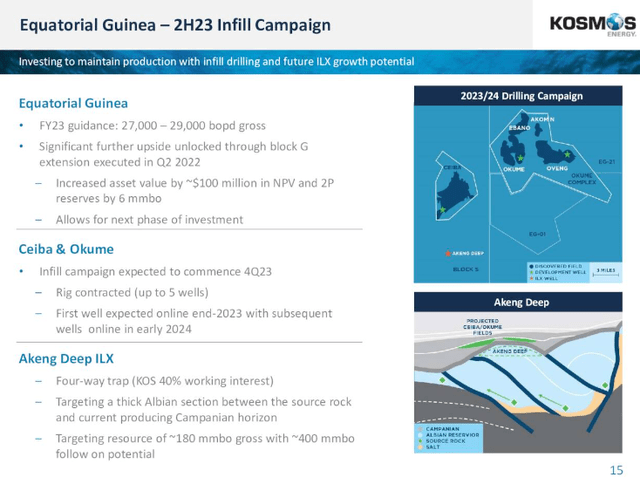

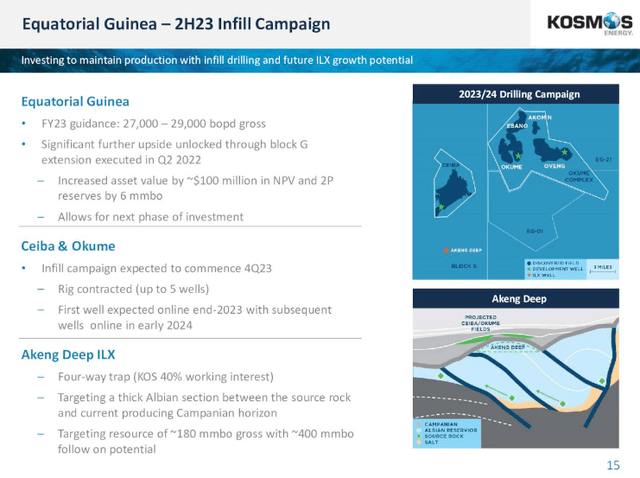

E.G. is very prospective for 2023 with a number of infill wells planned as the slide below discusses. Infill wells are among the least risky as they connect parts of a proven reservoir to areas skipped or not understood during the original development phase. E.G. is producing ~30K BOEPD at present, with a boost from the infill drilling toward the end of the year.

Akeng Deep scheduled for 2024 will test a stratigraphic trap with a potential of 180 mm bbls of untapped resource.

E.G. In-Fill Campaign 2023 (KOS)

The last major area of emphasis for KOS is the Gulf of Mexico-GoM. The Kodiak-ST3 well under-performed upon completion and workover is scheduled for the back half of the year. "Skin damage" was mentioned as a driver for the workover. Positive skin is a measure of mechanical damage to the reservoir preventing full production from the affected zone. Skin can result from a number of factors-cement, mud invasion primarily. It can also result from incompatible connate and completion fluids. Fixes can involve pumping solvents or other chemicals to restore water-wetting in the near well bore, or if heavy mud damage is involved a full frac pack is probably called for. The length of time they took planning this intervention makes me think that a frac pack is in the offing. Hopefully they don't botch that, it is the Side Track #3 after all.

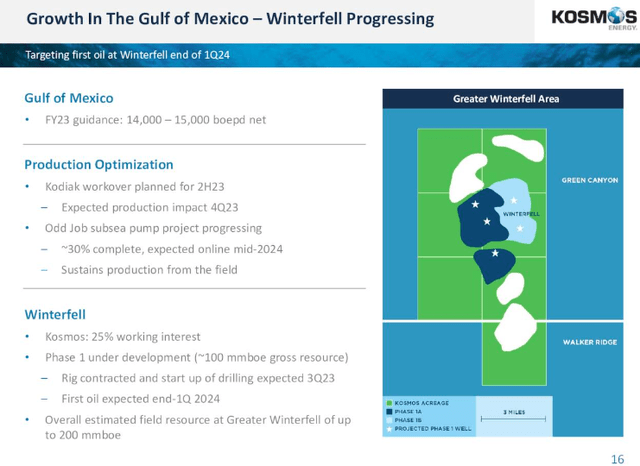

The Winterfell resource was FID'd last year and drilling will commence in Q-3 of this year. KOS is a 25% equity partner in this Beacon Offshore (private equity) managed project. Winterfell targets a resource of ~200 mm BOIP and is programmed to deliver 100K BOEPD by the middle of 2024.

A possible catalyst for KOS

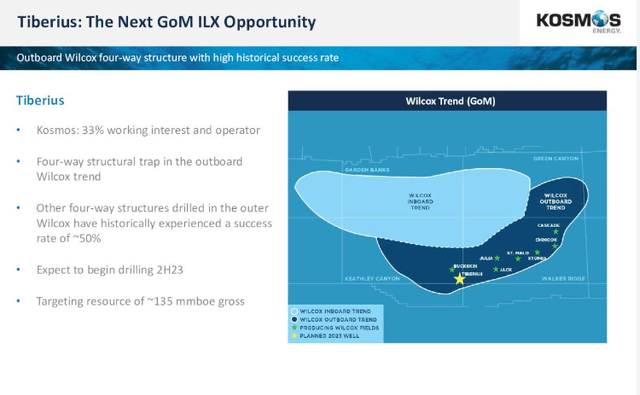

We spend a lot of time talking about GTA as we should, but KOS has numerous HIW prospects closer to home. KOS also has an ILX High Impact Well-HIW on the exploration schedule for this year. Tiberius will be drilled in the Outboard Wilcox trend in Keathley Canyon, near the OXY Lucius host. If successful about 135 mm bbl could be added to reserves and 60 to 80K BOEPD from several subsea wells can be expected.

KOS Tiberius ILX prospect (KOS)

If the Winterfell and Tiberius, and Akeng wells prove out, KOS could add ~40K BOEPD net to their GoM production, and up to 100K BOEPD in West Africa. These are in areas that has produced a lot of oil over the last decade, so expectations are pretty highs. Success in these wells could add significant EBITDA to KOS in 2024.

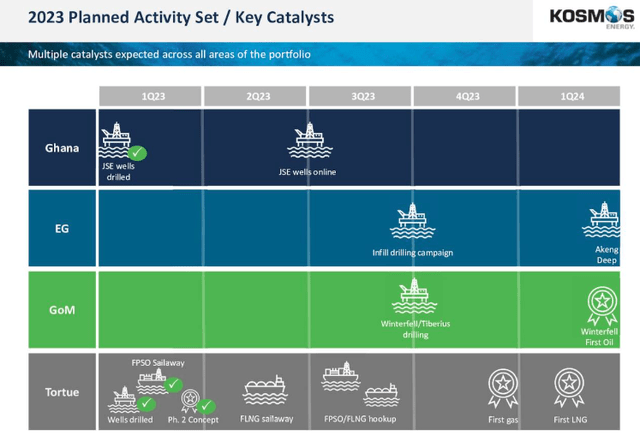

KOS summarizes their near term opportunity set in the slide below.

KOS Planned Activities 23/24 (KOS)

Capital allocation priorities 2023

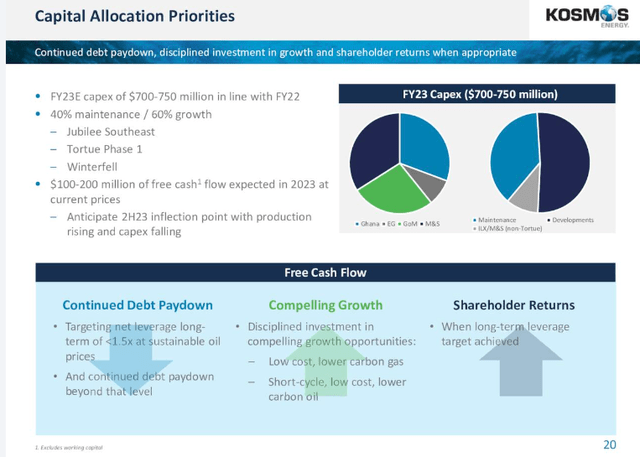

On TTM basis, KOS generated $1.3 bn in EBITDA as of Q-4, and are very near to generating positive cash flow at current pricing, as noted in the slide below. Also as noted in this slide free cash will benefit from falling capex requirements for GTA. This also could be a catalyst for the shares.

KOS Capital Allocation Priorities (KOS)

With $2.1 bn in LT debt, the company rightly notes paydown is a top priority. This is evident in the debt reduction for this year, ~$400 mm. So good faith progress is being made. They allude to shareholder returns when the debt to EBITDA range hits 1.5X. That looks to be at least a couple of years off, so we aren't holding our breath on this one. Just as an observation, KOS is never going to be a high dividend value stock. Their very nature tends to minimize this likelihood. Investors interested in KOS should be expecting growth in the share prices and not a lot more.

Your takeaway

I am pretty satisfied with the progress KOS has made since I first invested in 2020. Fortune has favored us undoubtedly with the higher oil price regime that's set in over the last couple of years now. That said, the work of the past few years appears to about to come to fruition and cash flow will be on the increase.

The analyst community which currently rates the company as Overweight, with a median price of $9.80 and a high price of $14. I think the analysts are a little timid, and KOS will outperform the upper end of this range, possibly reaching the upper teens.

I am sticking with KOS for future growth and would probably add sub-$6.00 depending on other investing opportunities.

This article was written by

I am an oilfield veteran of 38+ years. Retired from Schlumberger since 2015. My background is drilling and completion fluids. I have authored a number of technical papers on completion topics. I have worked around the world- Brazil, Russia, Scotland, and the Far East. I still maintain a training and consulting practice and am always willing to help people who want to learn.

New- The Daily Drilling Report is Live!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of KOS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is not advice to buy or sell this stock or ETF in spite of the particular rating I am forced to select in the SA template. I am not an accountant or CPA or CFA. This article is intended to provide information to interested parties and is in no way a recommendation to buy or sell the securities mentioned. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to do their own due diligence before investing their hard-earned cash.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.