The Future For Gold Is Bearish, So Is iShares Gold Trust Micro ETF

Summary

- Gold's prospects are bleak, so the price per ounce may not stay at these highs much longer.

- Its role as a hedge against rising inflation will diminish and the ounce may be overvalued relative to the inflation outlook, which is affected by tightening monetary policy.

- iShares Gold Trust Micro, a fund that invests in physical gold but whose shares trade on the U.S. exchange, and gold futures perform very similarly, investors should trim.

- There is a risk that gold will continue to rise significantly instead of falling, but it is not high.

MATJAZ SLANIC

Gold Is Still Hovering Around the High Price of $2,000 an Ounce but with an Unfavorable Outlook

According to this analyst, investors should consider an outlook that predicts a downtrend for gold over the year and act accordingly by reducing positions in assets that track the yellow metal's price action, such as iShares Gold Trust Micro (NYSEARCA:IAUM).

Psychological factors have undoubtedly given gold prices a strong tailwind over the past month, and these factors have proved sufficiently compelling to propel the precious metal's price up to around $2,000 an ounce.

Markets fear the broader financial crisis following regional bank failures and the economic recession following the US Federal Reserve's rate hikes to combat high inflation.

However, there are reasons to seriously doubt that these fears are justified. No other banking crisis has occurred a month after the collapse of Silicon Valley Bank and Signature Bank (OTC:SBNY) and this, combined with extensive reassurances from prominent insiders about the stability of the banking system, means that fears of a deeper crisis should be dismissed as overblown.

As for the risk of an economic recession, there are some signs of a slight slowdown in economic activity, which is not surprising given that the cost of borrowing, which does not bode well for consumption and investment, has been rising for more than a year so far. But to say from here that the economy is shrinking significantly goes a long way.

The job market, the stated target of the Federal Reserve's policy tightening, should show some signs of slowing down but instead continues to add jobs while the unemployment rates are uncharacteristic of a slowing economy.

Since the labor market appears to be very robust despite the damage caused by high inflation and the Fed's anti-inflationary policy, further interest rate hikes beyond the 0.25% expected from the May 3rd decision cannot be completely ruled out. And if they occurred, they wouldn't favor gold, which doesn't bring income, but fixed income assets.

Analysts Forecast on the Price of Gold

Roughly for the reasons above, analysts expect gold prices to fall from the current $2,006 per troy ounce negotiated through Gold Futures – June 23 (GCM3) to reach an estimated target price of $1,779.15 before the end of 2023, determining an 11.3% drop.

US Stock Market Investors Should Consider Reducing their Position in iShares Gold Trust Micro

With the current bullish gold market inevitably coming to an end, investors should consider reducing their positions in the securities that follow the precious metal.

Investors should sell some shares in iShares Gold Trust Micro as this fund, in an attempt to mimic the performance of gold, exposes shareholders to significant downside risk from current levels. If gold is expected to decline from current levels, shares of iShares Gold Trust Micro will also fall given the strong positive correlation between the two assets.

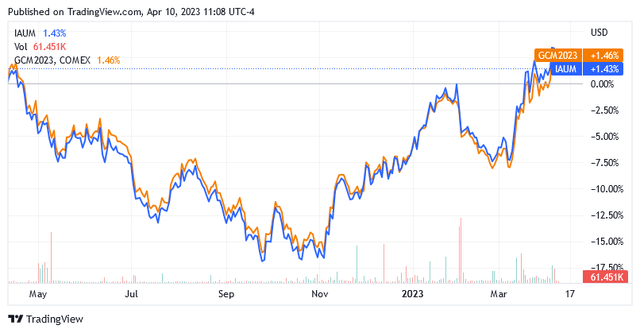

iShares Gold Trust Micro and Gold Futures – June 23 (GCM3) is the same practice in terms of performance as shown in the chart below.

So predicting an 11.3% fall in the price of gold is equivalent to predicting an identical fall in the price of the iShares Gold Trust Micro in the coming months of 2023.

About iShares Gold Trust Micro and Its Inflation Hedging Feature

Investing in physical gold requires investors to go through a number of complex and certainly not the most economical procedures, such as agreements about the dosage, transport, storage of the physical gold and taking out expensive insurance contracts.

iShares Gold Trust Micro represents a way to participate in changes in the price of gold, making an investment similar to investing in gold but in a much simpler and, most important, cheaper way.

Owning iShares Gold Trust Micro shares is not exactly like investing in gold, but it allows the investor to participate in the gold market, not directly but through the US stock market as the fund is listed on the NYSE Arca.

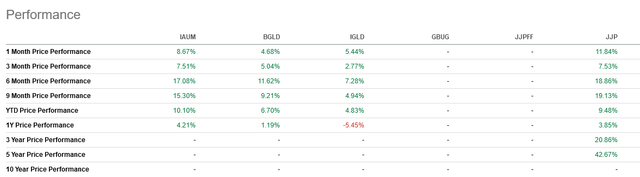

iShares Gold Trust Micro implies an expense ratio of 0.09%, suggesting that this investment vehicle is by far the cheapest of its peers.

As stated on the fund's website, the iShares Gold Trust Micro is a valuable tool for achieving portfolio diversification and raising an inflation barrier.

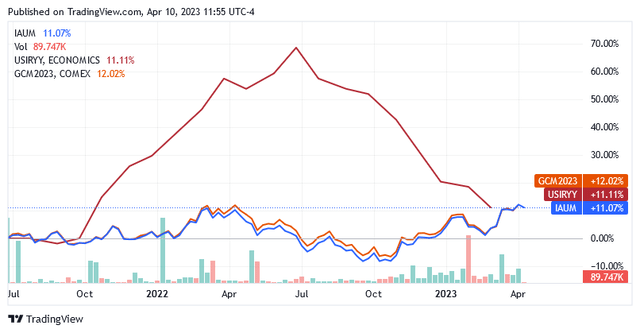

However, as the latter falls from the current annual rate of 6% to the target of 2%, the function of IAUM as a hedging tool against the rapid rise in the prices of goods and services should gradually become less useful. The chart below from Seeking Alpha shows a red line representing the US annual inflation rate curve.

While gold's March 2022 valuation of around $1,955 an ounce was considered reasonable given the prospect of hedging against the historic peak of inflation in June 2022, current valuations, which are higher than a year ago, may not reflect the ongoing disinflation process and are therefore likely to be inappropriate.

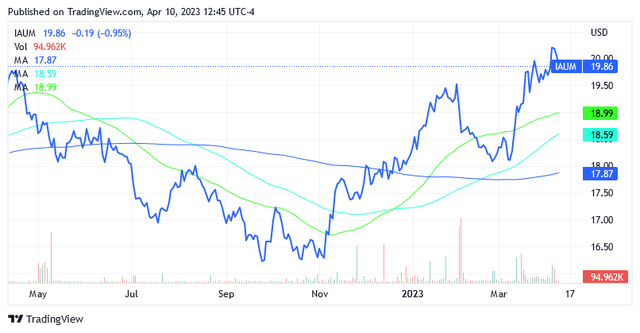

This creates an overvaluation risk for iShares Gold Trust Micro shares, which are currently trading as per below chart.

The Stock Valuation

Shares were trading at $19.86 as of this writing, well above the 200-day simple moving average of $17.87, the 100-day simple moving average of $18.59 and the 50-day simple moving average of $18.99.

Shares are also above the middle point of $18.23 of the 52-week range of $16.17 to $20.29.

The trust trades on the NYSE Arca with 49,350,000 publicly traded shares outstanding, representing 492,870.29 ounces of gold.

The fund's net assets as of April 6, 2023 were $986,665,836 or $19.99 per share, which means that the shares are trading at a discount of 0.65%.

iShares Gold Trust Micro was launched on June 15, 2021, and the chart of Seeking Alpha below shows its performance compared to some peers over various sub-periods.

Risk of Selling iShares Gold Trust Micro

The risk of selling iShares Gold Trust Micro now is that the stock could shoot to much higher levels than current ones and miss an opportunity to make a better profit in the future than today.

What could lead to another bull market for gold is the risk of a recession. This event could result in investors flocking to the yellow metal to hedge against the negative impact of the adverse economic cycle on any investment portfolio's return prospects.

From today's perspective, there is a risk of recession, but with a medium to low probability rate of occurrence. The Fed - if only the market were less impulsive and relied a little more on our monetary authorities - is beginning to achieve what its governor has been hoping for since the beginning of the battle against runaway inflation: the drop in inflation and a soft landing rather than a recession for the economy.

Inflation is effectively returning to target, and this coupled with continued US wage growth bodes well for the consumption outlook and the US economy as 70% of US GDP comes from consumption. Wage growth in the United States, at 7.28% in February 2023, remains well above the historical average of 6.21% over the period 1960-2023.

The new look that the cycle will take after monetary tightening should not appear as a dramatic contraction in economic activity, but rather a mild slowdown as long as the US economy's workforce remains resilient. The latter is really the economic macro indicator that investors should definitely follow closely.

Conclusion

As bullion prices are expected to reverse the current bullish trend and trade significantly lower, US-traded iShares Gold Trust Micro shares, which represent holdings of physical gold, are on track to perform negatively from current levels.

Investors may want to free up some cash and invest in assets to take advantage of a favorable yield environment fueled by higher interest rates.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.