3 A-Rated 6+% Yielding Blue-Chips With Buffett-Like Return Potential

Summary

- While the banking crisis appears to be calming down, a recession is still likely in the 2nd half of 2023.

- A-rated blue-chips are the safest way to survive and thrive through any recession, and profit from the bull market that invariably follows.

- These A-rated 6+% yielding blue-chips are the best choices for anyone worried about the economy but who wants to lock in the best ultra-yield on Wall Street.

- They are 17% to 30% undervalued and offer Buffett-like 19% to 26% annual return potential through 2025.

- Each is growing fast enough to deliver market-beating returns over the long term, making these A-rated blue-chips ideal choices for retirees today.

- Looking for more investing ideas like this one? Get them exclusively at The Dividend Kings. Learn More »

peshkov

This article was published on Dividend Kings on Monday, April 10th.

---------------------------------------------------------------------------------------

Recession is top of mind for investors these days thanks to the fastest Fed rate hiking cycle in 43 years.

9 of the last 12 recessions were caused by the Fed hiking until they broke something.

Most financial crises caused by the Fed are nothing like the collapse we saw in 2008. However, in the short term, things like the Mexican debt default of 1994, or the Asian currency crisis of 1997, or Long-Term Capital Management's (LTCM) 1998 collapse can cause plenty of market volatility.

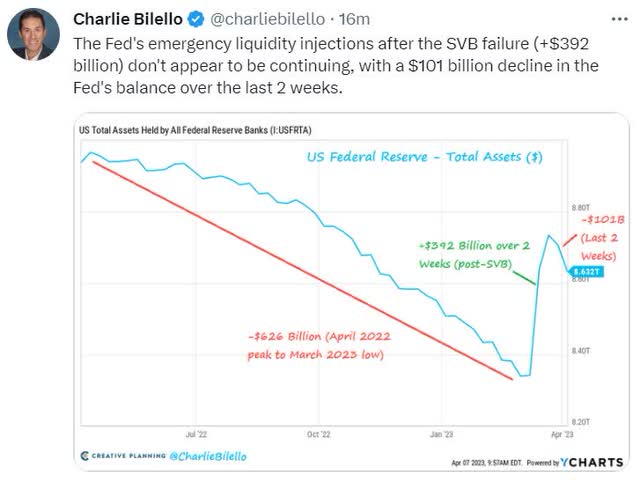

The banking crisis of 2023 is calming down for now, with $6 billion in deposits moving back into regional banks last week.

The amount of emergency borrowing by banks from the Fed is also starting to fall, declining by $101 billion in the last two weeks.

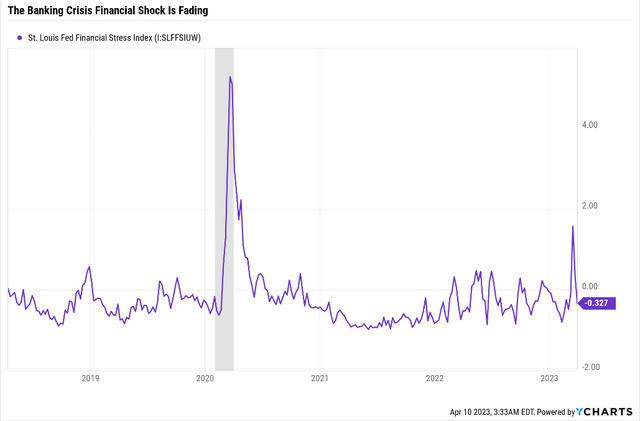

The big spike in financial stress from the banking crisis has now largely reversed, but that doesn't mean the economy is out of the woods.

At the end of 2021, banks were already tightening lending standards for almost every kind of loan. The regional banking crisis is expected to tighten conditions further and decrease U.S. GDP by 0.3% and 1% in 2023.

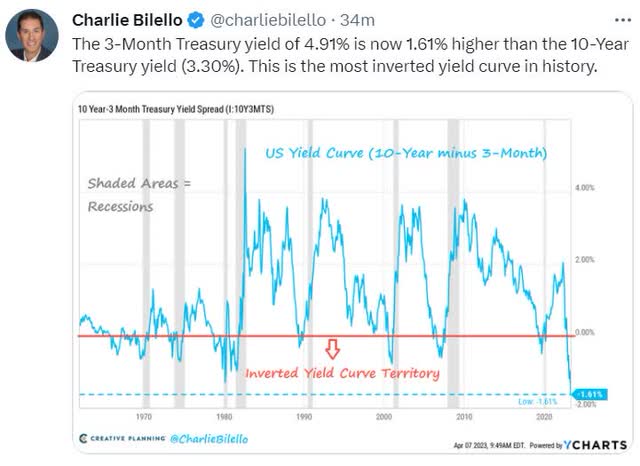

The bond market's most accurate recession forecasting tool in history, the yield curve, is now the most inverted it's ever been.

That means the bond market is 100% certain that a recession is coming no later than October 2024.

- most likely by July of 2024

- economic data confirms a second-half mild recession is likely.

The bad news is that tough times are likely ahead for companies with weak balance sheets, and management teams used to surviving on an ocean of free money.

The good news? Strong companies like what I recommend are likely to survive and thrive as they have always done.

In fact, the best A-rated high-yield blue-chips offer ultra-yield today, with Buffett-like return potential over the coming years. Let me show you how.

A-Rated Blue-Chips: Your High-Yield Port In The Storm In Uncertain Economic Times

Credit ratings are a useful proxy for understanding a company's balance sheet and fundamental risk.

- The risk of a company going bankrupt and the stock to zero.

| Credit Rating | 30-Year Bankruptcy Probability |

| AAA | 0.07% |

| AA+ | 0.29% |

| AA | 0.51% |

| AA- | 0.55% |

| A+ | 0.60% |

| A | 0.66% |

| A- | 2.5% |

| BBB+ | 5% |

| BBB | 7.5% |

| BBB- | 11% |

| BB+ | 14% |

| BB | 17% |

| BB- | 21% |

| B+ | 25% |

| B | 37% |

| B- | 45% |

| CCC+ | 52% |

| CCC | 59% |

| CCC- | 65% |

| CC | 70% |

| C | 80% |

| D | 100% |

(Source: S&P.)

An A-credit rating means an approximate 2.5% or less risk of a company going bankrupt in the next 30 years.

How low is that? For context, Goldman Sachs estimates the risk of nuclear war with Russia is approximately 2.5%.

In other words, if you buy A-rated companies, your risk of losing money from the company failing is about as high as the risk of losing all your money to the apocalypse.

A-rated companies have strong balance sheets, stable cash flows, very safe debt and interest coverage ratios, sound payout ratios, and usually good to very good risk management.

In other words, the kinds of companies you want to own in uncertain economic times, but especially during a recession.

How To Find The Best A-Rated High-Yield SWANs For These Troubled Times

Let me show you how to screen the Dividend Kings Zen Research Terminal, which runs off the DK 500 Master List, to find the best A-rated high-yield SWANs for the coming recession.

The Dividend Kings 500 Master List includes some of the world's best companies, including:

- Every dividend champion (25+ year dividend growth streaks, including foreign aristocrats)

- Every dividend aristocrat

- Every dividend king (50+ year dividend growth streaks)

- Every Ultra SWAN (as close to perfect quality companies as exist)

- The 20% highest quality REITs, according to iREIT

- 40 of the world's best growth blue-chips.

| Step | Screening Criteria | Companies Remaining | % Of Master List |

| 1 | Reasonable Buy Or Better | 361 | 72.2% |

| 2 | Non- Speculative | 300 | 60.0% |

| 3 | 10+ quality (Blue-Chip Or Better) | 288 | 57.6% |

| 4 | A credit rating or better | 107 | 21.4% |

| 5 | 10+% long-term return potential | 75 | 15.0% |

| 6 | 4+% Yield | 13 | 2.6% |

| Total Time | 2 Minutes |

(Source: Dividend Kings Zen Research Terminal.)

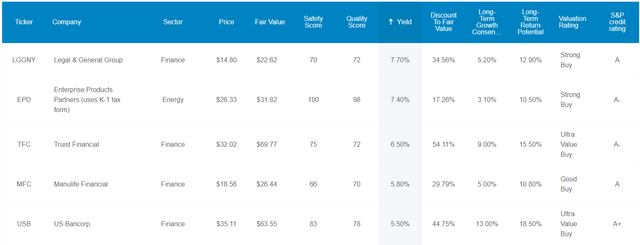

The Best A-Rated High-Yield SWANs For Today

Dividend Kings Zen Research Terminal

Here are the five highest-yielding A-rated blue-chips you can safely buy today.

- safety has nothing to do with short-term price volatility just fundamental safety.

Let me quickly summarize the case for three of my favorites right now.

3 A-Rated 6+% Yielding Blue Chips Perfect For What's Coming Next

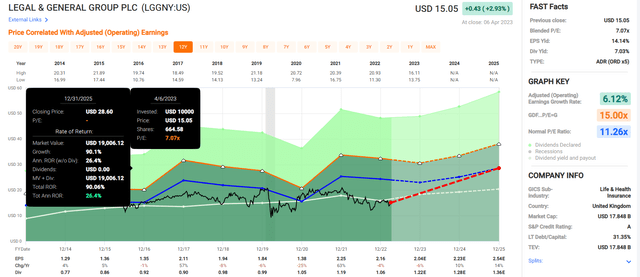

Legal & General Group Plc (OTCPK:LGGNY): The Highest Yielding A-rated blue-chip on Wall Street

Further Reading

- An Update On Legal & General: It's Still Attractive

- Legal & General Group: A Safe 9.2% Yield That Could Change Your Life.

Invest Thesis Summary

Legal & General is a UK-based asset manager founded in 1836 and just hiked its dividend 5%, per management's long-term policy of hiking 5+% each year.

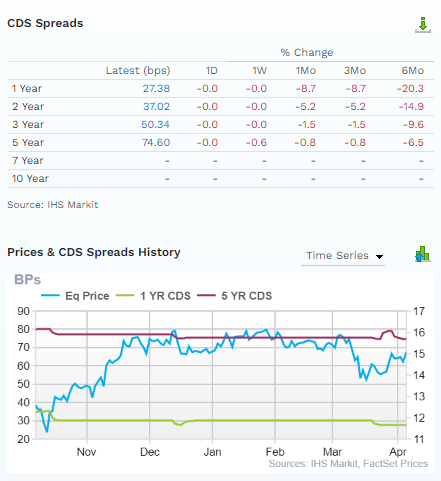

The bond market agrees with rating agencies that LGGNY's balance sheet is a fortress, despite all the recent financial chaos we saw in the U.S. and Europe.

FactSet Research Terminal

Credit default swaps are insurance policies bond investors take out against default and provide real-time fundamental risk-assessments when news breaks.

LGGNY's fundamental risk has been falling throughout the banking crisis, including the turmoil in Europe created by Credit Suisse.

Summary Facts

- DK quality rating: 72% low risk 10/13 blue-chip quality asset manager

- Fair value: $22.64

- Current price: $15.25

- Historical discount: 33%

- DK rating: potential strong buy

- Yield: 7.7%

- Long-term growth consensus: 5.2%

- Long-term total return potential: 12.9%.

LGGNY is trading at 7X earnings and pricing in -3% growth, while growth is expected to be 10% to 14% in 2024 and 2025 coming out of the recession.

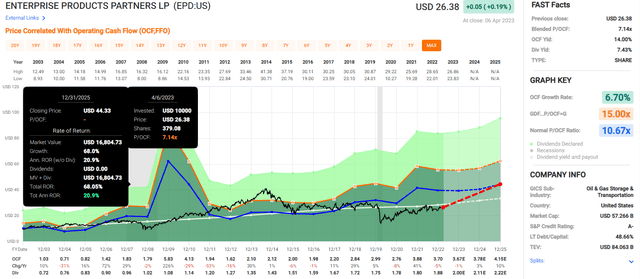

Enterprise Products Partners L.P. (EPD): The First A-Rated Midstream In History

Further Reading

Invest Thesis Summary

Enterprise is a dominant pipeline MLP in the U.S. (uses K1 tax form) and the first A-rated midstream in history.

Management has a new policy of 3X debt/EBITDA and that's why S&P just upgraded them to the first A-rating in industry history.

It becomes a dividend champion (25-year streak) in 2023 and management has a solid plan for delivering steady growth for decades to come.

The bond market is so confident in EPD's long-term green energy transition plan they are willing to buy its bonds maturing in 2078, 55 years from now.

In other words, the smart money on Wall Street is betting EPD will survive and thrive for at least the next 55 years.

Summary Facts

- DK quality rating: 98% low risk 13/13 Ultra SWAN midstream dividend champion (in 2023)

- Fair value: $31.83

- Current price: $26.38

- Historical discount: 17%

- DK rating: potential strong buy

- Yield: 7.4%

- Long-term growth consensus: 3.1%

- Long-term total return potential: 10.5%.

EPD offers a 21% Buffett-like annual return potential through 2025 if it grows as expected and returns to historical fair value.

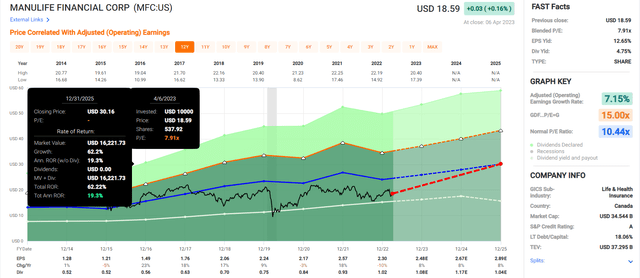

Manulife Financial Corporation (MFC): One Of The Best Insurance Companies You've Never Heard Of

Further Reading

- Manulife: A 5.2% Yielding Blue Chip Too Cheap To Ignore

- Manulife: I Keep Putting Capital To Work At A Great Yield.

Invest Thesis Summary

Manulife is undergoing a margin expansion program that management thinks can deliver double-digit growth for years to come. It's not just focused on cost-cutting but also smart expansion into Asia.

MFC Credit Ratings: Very Little Fundamental Risk

Rating Agency | Credit Rating | 30-Year Default/Bankruptcy Risk | Chance of Losing 100% Of Your Investment 1 In |

S&P | A stable | 0.66% | 151.5 |

Fitch | A stable | 0.66% | 151.5 |

DBRS | A+ stable | 0.60% | 166.7 |

AmBest | A- | 2.50% | 40.0 |

Consensus | A stable | 1.11% | 90.5 |

(Source: S&P, Fitch, DBRS, AMBest.)

But MFC isn't pursuing industry-leading growth by taking on excessive risk. Four rating agencies estimate its fundamental risk is 1.1% or half that of nuclear war with Russia.

Summary Facts

- DK quality rating: 70% very-low risk 10/13 blue-chip quality insurance company

- Fair value: $26.47

- Current price: $18.59

- Historical discount: 30%

- DK rating: potential strong buy

- Yield: 5.8%

- Long-term growth consensus: 5.0%

- Long-term total return potential: 10.8%.

Bottom Line: 3 A-Rated 6+% Yielding Blue Chips Perfect For What's Coming Next

Let me be clear: I'm NOT calling the bottom in LGGNY, EPD, or MFC (I'm not a market-timer).

Even Ultra SWANs can fall hard and fast in a bear market.

Fundamentals are all that determine safety and quality, and my recommendations.

- over 30+ years, 97% of stock returns are a function of pure fundamentals, not luck

- in the short term; luck is 25X as powerful as fundamentals

- in the long term, fundamentals are 33X as powerful as luck.

While I can't predict the market in the short term, here's what I can tell you about these A-rated high-yield blue-chips.

These are some of the strongest and safest high-yield blue-chips you can buy going into a recession.

Each is led by skilled management teams with good to very good risk management according to S&P.

Each has a safe dividend of 6+% and is attractively to very attractively valued.

Each offers Buffett-like 19% to 26% annual return potential through 2025 for any investor willing to look beyond the recession of 2023.

If you're looking for maximum safe income, LGGNY, EPD, and MFC are three of the best choices you can make in these uncertain economic times.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

----------------------------------------------------------------------------------------

Dividend Kings helps you determine the best safe dividend stocks to buy via our Automated Investment Decision Tool, Zen Research Terminal, Correction Planning Tool, and Daily Blue-Chip Deal Videos.

Membership also includes

Access to our 13 model portfolios (all of which are beating the market in this correction)

my correction watchlist

- my $2.3 million family hedge fund

50% discount to iREIT (our REIT-focused sister service)

real-time chatroom support

real-time email notifications of all my retirement portfolio buys

numerous valuable investing tools

Click here for a two-week free trial, so we can help you achieve better long-term total returns and your financial dreams.

This article was written by

Adam Galas is a co-founder of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 5,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) The Intelligent REIT Investor (newsletter), (2) The Intelligent Dividend Investor (newsletter), (3) iREIT on Alpha (Seeking Alpha), and (4) The Dividend Kings (Seeking Alpha).

I'm a proud Army veteran and have seven years of experience as an analyst/investment writer for Dividend Kings, iREIT, The Intelligent Dividend Investor, The Motley Fool, Simply Safe Dividends, Seeking Alpha, and the Adam Mesh Trading Group. I'm proud to be one of the founders of The Dividend Kings, joining forces with Brad Thomas, Chuck Carnevale, and other leading income writers to offer the best premium service on Seeking Alpha's Market Place.

My goal is to help all people learn how to harness the awesome power of dividend growth investing to achieve their financial dreams and enrich their lives.

With 24 years of investing experience, I've learned what works and more importantly, what doesn't, when it comes to building long-term wealth and safe and dependable income streams in all economic and market conditions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

DK owns LGGNY, EPD, and MFC in our portfolios.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.