Albemarle: Another Bargain-Basement Buy

Summary

- ALB has crashed 40% in a few months due to lithium prices coming down and concerns about an upcoming acquisition.

- ALB expects long-term lithium prices to average at least 2X pre-pandemic levels and is tripling its production capacity within five years.

- ALB has $10 billion in borrowing capacity without risking its credit rating, is free cash flow positive, and free cash flow is expected to triple by 2026.

- ALB is the world's low-cost lithium leader and is a dividend aristocrat whose management is guiding for 20% to 30% growth for the next five years.

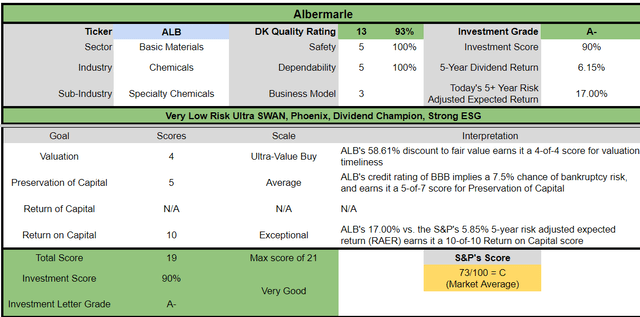

- ALB is trading at 7X trough earnings, and 5.5X cash-adjusted earnings, a PEG ratio of 0.25. It's 59% undervalued, and has 142% upside to fair value and could potentially deliver 340% returns in the next six years, or 25% annual returns.

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More »

Just_Super

This article was coproduced with Dividend Sensei.

During bear markets, the world's best blue chips can be bought for a song. I'm not just talking about a good deal, or a great deal.

I'm talking about life-changing blue-chip bargains, what Buffett calls "fat pitches."

“Wait for a fat pitch and then swing for the fences." - Warren Buffett

These are table-pounding low-risk opportunities that smart long-term investors can buy with margins of safety so high that it's impossible to lose money as long as the company doesn't go bankrupt and you don't panic sell.

I just recommended Albemarle (NYSE:ALB) as just such a company for Dividend Kings members.

Let me show you the three reasons why this hyper-growth dividend aristocrat is crazy, stupid cheap and a classic Buffett-style fat pitch with a possible 340% return potential in the next few years.

Reason One: The World's Low-Cost Lithium Leader

ALB is down 40% off its late 2022 highs, including a 33% crash in the last two months. There are two main reasons for this.

Bank of America just cut its price target on ALB to $195 (where it trades today) due to concerns about falling lithium prices.

Chinese August futures are $23,000 per ton, down from the recent $33,400

This is not at all surprising given that the big lithium price surge created by car makers locking in supplies was never expected to be permanent.

In 2020 ALB's average selling price was $12,000 per ton of lithium, and in 2022 it had soared to $41,000, and that's expected to peak at nearly $56,000 in 2023.

Spot lithium prices peaked at $70,000 per ton, up almost 400% from 2020 levels

By 2025 it's expected to normalize at just over $27,000, which is still more than double 2020 levels.

Management thinks lithium prices will average well over $20,000 per ton over the long term, 2X the pre-pandemic level.

ALB's growth thesis is only partially based on higher lithium prices in the future. The key growth driver is lithium demand, specifically from EV adoption.

Europe is talking about requiring 100% EVs by 2035, and the EPA is potentially going to impose new regulations requiring 66% EVs by 2032.

The chances that these regulations actually go into effect is small, given the logistical challenges involved with such rapid EV ramp-ups.

But the point is that demand for lithium is expected to soar in the coming decades as the race for "white gold" heats up.

For example, in 2022, global EV sales were up 64%; by 2030, global lithium demand is expected to soar 400% to 3.7 million tons per year.

ALB has a solid plan that it believes can deliver 20% to 30% volume growth over the next five years.

Another reason for the potential decline in ALB's price is that Liontown (OTCPK:LINRF) has rejected ALB's unsolicited $3.7 billion acquisition offer.

“Liontown is in the construction phase of its first lithium hard rock resource, named Kathleen Valley. The project plans to produce 3 million metric tons of lithium concentrate, which we estimate could be converted to roughly 375,000 metric tonnes per year of lithium chemicals on a lithium carbonate equivalent basis. Based on the project's development study, it is estimated to be the fifth largest hard rock resource in Western Australia, behind Albemarle's two current resources, Greenbushes and Wodgina, with an above-average lithium concentration." - Morningstar

Liontown owns great low-cost assets that ALB wants in order to cash in on the EV adoption mega-trend. And that's possibly why Wall Street is worried.

“With Liontown's board rejecting the offer, Albemarle will likely have to raise its bid to complete the deal. Liontown reported Albemarle's most recent bid was its third offer since October to acquire Liontown. Should Albemarle substantially raise its bid, the company risks overpaying for Liontown." - Morningstar

This was the third offer ALB made that Liontown rejected, and analysts think that ALB won't stop until they buy these prime assets. However, given its crashed stock price, such a deal would likely have to be debt funded in a higher-rate world.

ALB has the balance sheet to handle taking on $4 to $5 billion in debt, but it would represent a major acquisition with lots of execution risk.

For context, by 2026, analysts expect, even with lower lithium prices, ALB's EBITDA to be $4.6 billion.

3X leverage is considered safe for this industry

giving ALB debt capacity of $13.8 billion

ALB could take on as much as $10 billion in debt without putting its credit rating at significant risk

But that doesn't mean that ALB can bid $10 billion for Liontown or anything close to it.

ALB is aggressively ramping up growth spending, tripling from $1.3 billion in 2022 to almost $3.5 billion by 2027.

the dividend costs $189 million per year

its free cash flow was $646 million in 2022, and it's expected to almost triple to $1.6 billion in 2027

Why is ALB pulling out all the stops to pursue the most aggressive growth in its history?

Albemarle: The World's Low-Cost Lithium Leader

Albemarle was founded in 1993 in Charlotte, North Carolina, and has built up a vertically-integrated lithium empire.

ALB sells to 70 countries but operates in a few primary lithium and bromine-rich areas.

US

Chile

Argentina

Australia

China

planning on EU facilities for processing

“Albemarle is one of the world's largest lithium producers, generating most of the total profits. It produces lithium through its own salt brine assets in Chile and the United States and two joint venture interests in Australian mines, Talison and Wodgina. The Chilean operation is among the world's lowest-cost sources of lithium. Talison is one of the best spodumene resources in the world, which allows Albemarle to be one of the lowest-cost lithium hydroxide producers, as spodumene can be converted directly into hydroxide." - Morningstar

On average, it takes 16 years for a new lithium mine to come online due to environmental regulations. Thus whoever controls the lowest-cost production sites now is in a strong position to benefit from the boom in EVs and lithium demand.

ALB produced 200,000 tons of lithium in 2022 and plans to increase that to 500,000 to 600,000 tons annually by 2027.

In other words, from 40,000 tons in 2015, ALB plans to increase capacity by 1275% in just 12 years.

Most of that expansion is at existing sites since new facilities take a long time and a lot of money to bring online (it does plan a new facility in the US).

ALB also is a world leader in bromine, an important industrial chemical.

“Albemarle is the world's second-largest producer of bromine, a chemical used primarily in flame retardants for electronics. Bromine prices have begun to rise as increased demand for use in servers and automobile electronics is offset by a decline in demand from TVs, desktops, and laptops as well as lower demand for bromine used in oilfield completion fluids. Over the long term, we expect Albemarle to generate healthy bromine profits due to its low-cost position in the Dead Sea."

- Morningstar

About 70% of its sales are from lithium, 20% from bromine, and 10% from catalysts used in the petrochemical industry. This last part of the business might be sold off or spun out since it's the least profitable part of its empire.

ALB's cost advantage stems from very well-placed lithium mining sites, such as the Atacama desert of Chile, where it has contracts with the government to produce 80,000 tons of lithium through 2043.

40% of its current supply

The Atacama desert is one of the driest places on earth, making extracting lithium from the brine pools here extremely cheap.

Those brine pools also have the highest concentration of lithium on earth

To expand its production, ALB is focusing on Australia, also a low-cost leader in lithium, as well as Nevada, where costs are in the bottom half of the cost curve.

“The Dead Sea is the lowest-cost bromine source, with concentrations of 10,000 parts per million, while Arkansas has concentrations of 5,000 parts per million. These assets have 2.5-5.0 times the concentration of the next-best reserves in India and 25-50 times the concentration of producers in China." - Morningstar

ALB's cost advantage in bromine is due to its production sites in the Dead Sea and Arkansas, where bromine concentrations are almost 4X more than the next highest concentration reserves in the world.

ALB estimates its Arkansas bromine reserves will last 70 years. The Dead Sea reserves are an "inexhaustible asset, given its enormous reserves compared with production volume."

"ALB's management team brings over 210 years of industry experience to its quest to dominate the future of "white gold." CEO Kent Masters brings engineering and specialty chemical leadership experience to Albemarle. Previously, he was CEO of Foster Wheeler, a global engineering and construction contractor, and a member of the executive board of Linde, a global industrial gas provider." - Morningstar

Management's capital allocation priorities are on maximizing profitable production, including through smart acquisitions. They expect to raise the dividend in 2023 for the 29th consecutive year, though it's not expected to be a particularly large hike (4% and 4% the year after).

ALB's investment strategy calls for investing in projects it believes can deliver returns on capital equal to 2X their cost of capital over the entire lithium cycle and 1X cost of capital at trough prices, a very prudent and disciplined approach to investing in a cyclical market.

Bottom line, if you want to cash in on the EV gold rush in a low-risk way, then buying shares of the world's low-cost lithium leader and a hyper-growth dividend aristocrat is a potentially great way to do that.

Reason Two: Fantastic Growth Prospects

Given the 40% crash in price, you might think that ALB's growth outlook has collapsed. It hasn't.

Metric | 2022 Growth | 2023 Growth Consensus | 2024 Growth Consensus | 2025 Growth Consensus |

Sales | 118% | 62% | 2% | -3% |

Dividend | 3% | 1% | 4% | 4% |

Earnings | 444% | 32% | 1% | -9% |

Cash Flow | 448% | 32% | 31% | -13% |

EBITDA | 252% | 67% | 2% | -12% |

EBIT | 365% | 49% | 2% | 1% |

(Source: FAST Graphs, FactSet)

ALB has seen its sales, earnings, and cash flow explode higher in recent years, and even with falling lithium prices in the coming years, its growth isn't expected to fall off a cliff.

Long-Term Growth Outlook

Analysts think ALB will be able to grow earnings at 22.2% for the foreseeable future, and that's not outlandish given the volume growth guidance of 20% to 30%.

ALB's long-term growth earnings growth rate has been 16% to 20% for the last 20 years, indicating that our 16.3% growth forecast is reasonable.

16.3% is the historical growth rate, including the consensus forecast through 2025, which includes falling lithium prices.

Long-Term Consensus Total Return Potential

Investment Strategy | Yield | LT Consensus Growth | LT Consensus Total Return Potential | Long-Term Risk-Adjusted Expected Return |

Albemarle (Analyst Consensus) | 0.8% | 22.2% | 23.0% | 16.1% |

Albemarle (My Estimate) | 0.8% | 16.3% | 17.1% | 12.0% |

Vanguard Dividend Appreciation ETF | 2.0% | 11.3% | 13.3% | 9.3% |

Nasdaq | 0.8% | 11.2% | 12.0% | 8.4% |

Schwab US Dividend Equity ETF | 3.8% | 7.6% | 11.4% | 8.0% |

REITs | 3.9% | 7.0% | 10.9% | 7.6% |

Dividend Aristocrats | 1.9% | 8.5% | 10.4% | 7.3% |

S&P 500 | 1.7% | 8.5% | 10.2% | 7.1% |

60/40 Retirement Portfolio | 2.1% | 5.1% | 7.2% | 5.0% |

(Sources: DK Research Terminal, FactSet, Morningstar)

ALB offers incredible long-term return potential far more than almost any other investment strategy, including the S&P, aristocrats, and Nasdaq.

Historical Returns Since 1994

ALB has delivered 14% annual returns vs. 9.7% for the S&P since 1994, a 47X return that's more than tripled the market's wealth compounding.

Its average 12-month return over the last 29 years was 20.7%, literally Buffett-like returns.

From bear market lows, its returns are truly staggering.

Albemarle's Best Bear Market Recovery Rallies Since 1994

178% in one year

378% in three years (68% annually)

280% in five years (31% annually)

562% in seven years (31% annually)

655% in 10 years (22% annually)

1268% in 15 years (19% annually)

Today, ALB is an ultra-value buy, after its 40% crash, meaning potentially awe-inspiring short-term return potential.

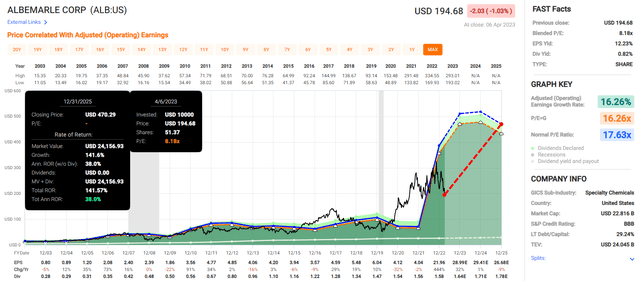

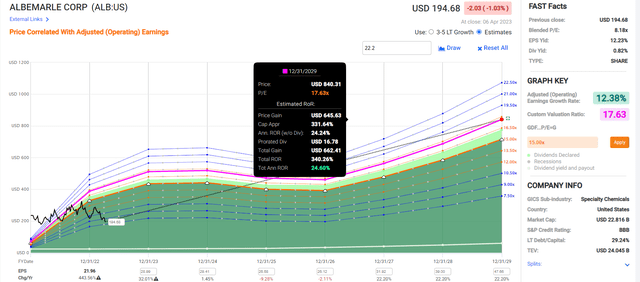

Albemarle 2025 Consensus Total Return Potential

FAST Graphs, FactSet

Albemarle 2029 Consensus Total Return Potential

FAST Graphs, FactSet

ALB's five-year consensus total return potential range is 22% to 32% CAGR.

It could potentially deliver 340% total returns in the next six years, more than quadrupling your money. That's because ALB is a screaming bargain right now.

Reason Three: A Wonderful Company At An Unspeakably Wonderful Price

For 20 years, millions of income growth investors have paid 17 to 21.5X earnings for ALB.

91% statistical probability that fair value is within this range

Metric | Historical Fair Value Multiples (all Years) | 2022 | 2023 | 2024 | 2025 | 12-Month Forward Fair Value |

PE | 17.63 | $387.15 | $470.37 | $470.37 | $470.37 | |

Average | $387.15 | $470.37 | $470.37 | $470.37 | $470.37 | |

Current Price | $194.68 | |||||

Discount To Fair Value | 49.72% | 58.61% | 58.61% | 58.61% | 58.61% | |

Upside To Fair Value (including dividend) | 98.87% | 141.61% | 141.61% | 141.61% | 142.43% | |

2023 EPS | 2024 EPS | 2023 Weighted FFO | 2024 Weighted FFO | 12-Month Forward PE | Historical Average Fair Value Forward PE | Current Forward PE |

$26.68 | $26.68 | $18.98 | $7.70 | $26.68 | 17.6 | 7.3 |

Today ALB trades at about 7X TROUGH earnings, not 2023 consensus but 2025 consensus.

Even if earnings forecasts fall by 50%, you're not overpaying

ALB's cash-adjusted PE is 5.5, meaning its trading at a PEG ratio of 0.25.

hyper-growth aristocrat quality at an absurdly great price

ALB is so undervalued it has a 142% upside to fair value.

Rating | Margin Of Safety For Very Low-Risk 13/13 Ultra SWAN | 2023 Fair Value Price | 2024 Fair Value Price | 12-Month Forward Fair Value |

Potentially Reasonable Buy | 0% | $470.37 | $470.37 | $470.37 |

Potentially Good Buy | 5% | $446.85 | $446.85 | $446.85 |

Potentially Strong Buy | 15% | $399.81 | $399.81 | $399.81 |

Potentially Very Strong Buy | 25% | $335.14 | $352.78 | $352.78 |

Potentially Ultra-Value Buy | 35% | $305.74 | $305.74 | $305.74 |

Currently | $194.68 | 58.61% | 58.61% | 58.61% |

Upside To Fair Value (Including Dividends) | 142.43% | 142.43% | 142.43% |

For anyone comfortable with its risk profile, ALB is a potential Buffett-style "fat pitch" table-pounding Ultra Value buy.

Risk Profile: Why Albemarle Isn't Right For Everyone

There are no risk-free companies, and no company is right for everyone. You have to be comfortable with the fundamental risk profile.

Albemarle Bancorp Risk Summary

“We assign Albemarle a High Morningstar Uncertainty Rating. The biggest risk for Albemarle is lithium prices. Lithium prices could decline if electric vehicle demand grows more slowly than expected or if new supply comes online too quickly. EV demand could undershoot expectations if fuel cells or other technologies overtake lithium as the preferred powertrain for zero-emission vehicles.

Lithium production could ramp up faster than demand warrants if producers bring too much supply. Further, new lithium production technologies could alter the cost curve in carbonate and hydroxide. Albemarle also faces execution risk in ramping up its lithium production, which includes production delays and cost overruns. Albemarle is also subject to political risk in Chile as a new constitution or left-wing president Gabriel Boric's government could create laws that affect the company's operations.

The largest ESG risks come from potential new regulations. Regulations that limit emissions in the bromine business could hurt profit margins as Albemarle's profits come from its cost advantage rather than pricing power, and it may not be able to pass along the cost increases. We see this as having a moderate probability and materiality. Another risk is that Albemarle may have its products banned due to the environmental impact, which has occurred before in the bromine business. We see a moderate probability but low materiality as Albemarle doesn't rely on a single product and could likely modify its products to meet new regulations, similar to what occurred when products were banned. Lithium customers may require Albemarle to reduce its emissions. While we see this as having a moderate probability to occur, we see low materiality as all lithium producers would be subject to the same requirements, so the company could likely pass along these costs. Albemarle could also serve these customers from its already reduced-emission lithium from Chile." - Morningstar

ALB's Risk Profile Includes

commodity price risk (lithium prices can be extremely volatile)

regulatory risk (EU and US primarily affecting EV adoption rates)

secular EV adoption risk: how long will the transition take (likely 100% EVs by 2035 in the EU are not actually possible)

disruption risk: alternative sources of lithium (from seawater) or solid-state batteries

Political risks (Chile's government could nationalize their assets)

M&A execution risk (ALB historically buys top-quality assets, risking overpaying)

worker retention risk (tightest job market in 54 years)

currency risk: 88% of revenue from outside the US

How do we quantify, monitor, and track such a complex risk profile? By doing what big institutions do.

Long-Term Risk Management Analysis: How Large Institutions Measure Total Risk Management

We use S&P Global's global long-term risk-management ratings for our risk rating. S&P has spent over 20 years perfecting their risk model, which is based on over 30 major risk categories, over 130 subcategories, and 1,000 individual metrics.

50% of metrics are industry specific

this risk rating has been included in every credit rating for decades

The DK risk rating is based on the global percentile of a company's risk management compared to 8,000 S&P-rated companies covering 90% of the world's market cap.

ALB Scores 80th Percentile On Global Long-Term Risk Management

S&P's risk management scores factor in things like:

supply chain management

crisis management

cyber-security

privacy protection

efficiency

R&D efficiency

innovation management

labor relations

talent retention

worker training/skills improvement

customer relationship management

climate strategy adaptation

corporate governance

brand management

ALB's Long-Term Risk Management Is The 145th Best In The Master List (71st Percentile In The Master List)

Classification | S&P LT Risk-Management Global Percentile | Risk-Management Interpretation | Risk-Management Rating |

BTI, ILMN, SIEGY, SPGI, WM, CI, CSCO, WMB, SAP, CL | 100 | Exceptional (Top 80 companies in the world) | Very Low Risk |

Strong ESG Stocks | 86 | Very Good | Very Low Risk |

Albemarle | 80 | Very Good | Very Low Risk |

Foreign Dividend Stocks | 77 | Good, Bordering On Very Good | Low Risk |

Ultra SWANs | 74 | Good | Low Risk |

Dividend Aristocrats | 67 | Above-Average (Bordering On Good) | Low Risk |

Low Volatility Stocks | 65 | Above-Average | Low Risk |

Master List average | 61 | Above-Average | Low Risk |

Dividend Kings | 60 | Above-Average | Low Risk |

Hyper-Growth stocks | 59 | Average, Bordering On Above-Average | Medium Risk |

Dividend Champions | 55 | Average | Medium Risk |

Monthly Dividend Stocks | 41 | Average | Medium Risk |

(Source: DK Research Terminal)

ALB's risk-management consensus is in the top 29% of the world's highest quality companies and similar to that of such other blue-chips as

Target (TGT): Ultra SWAN dividend king

Walmart (WMT): Ultra SWAN dividend aristocrat

T. Rowe Price (TROW): Ultra SWAN dividend aristocrat

Mastercard (MA): Ultra SWAN

Visa (V): Ultra SWAN

The bottom line is that all companies have risks, and ALB is very good at managing theirs, according to S&P.

How We Monitor ALB's Risk Profile

28 analysts

three credit rating agencies

31 experts who collectively know this business better than anyone other than management

“When the facts change, I change my mind. What do you do, sir?"

- John Maynard Keynes

There are no sacred cows at iREIT or Dividend Kings. Wherever the fundamentals lead, we always follow. That's the essence of disciplined financial science, the math behind retiring rich and staying rich in retirement.

Bottom Line: Albemarle Is A Buffett-Style Hyper-Growth Aristocrat Table-Pounding Great Buy

Dividend Kings Automated Investment Tool

Let me be clear: I'm not calling the bottom in ALB (I'm not a market-timer). Even Ultra SWANs can fall hard and fast in a bear market. Fundamentals are all that determine safety and quality, and my recommendations.

over 30+ years, 97% of stock returns are a function of pure fundamentals, not luck

in the short term; luck is 25X as powerful as fundamentals

in the long term, fundamentals are 33X as powerful as luck

While I can't predict the market in the short term, here's what I can tell you about ALB.

- the world's low-cost lithium leader

- a hyper-growth dividend aristocrat (28-year streak)

- BBB credit rating (7.5% 30-year bankruptcy risk)

- very safe 0.8% yield that will eventually grow at over 20% per year

- 17% to 23% long-term return potential, almost 2X that of the S&P

- historically 59% undervalued

- 7.3X earnings vs 17X to 21.5 historical

340% consensus return potential over the next six years, 25% annually, 6X more than the S&P 500

3X better risk-adjusted expected returns than the S&P 500 over the next five years

If you want to bend it like Buffett and buy a world-beater blue chip at an unspeakably great price, consider ALB.

If you want a 17% to 22% growing dividend aristocrat with potentially decades of amazing growth ahead, ALB is what you're looking for.

If you want to buy an anti-bubble blue chip priced for -6% growth but that's growing almost as fast as Mastercard (MA), ALB is a bargain you don't want to pass up.

If you want to profit from one of the greatest megatrend opportunities in history while minimizing your risk, then Albemarle is one of the best Wall Street bargains you can buy today.

Author's note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Subscribe to Get the Sweet 16 REIT Report

When you subscribe to iREIT on Alpha you will get a free copy of our Sweet 16 REIT report in addition to access to all of our tools and resources.

Also, every new member will get a free copy of my new book, REITs For Dummies (summer 2023). Take the 2-week FREE trial and I can assure you that you will enjoy being part of the iREIT family.

This article was written by

Brad Thomas is the CEO of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 100,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) iREIT on Alpha (Seeking Alpha), and (2) The Dividend Kings (Seeking Alpha), and (3) Wide Moat Research. He is also the editor of The Forbes Real Estate Investor.

Thomas has also been featured in Barron's, Forbes Magazine, Kiplinger’s, US News & World Report, Money, NPR, Institutional Investor, GlobeStreet, CNN, Newsmax, and Fox.

He is the #1 contributing analyst on Seeking Alpha in 2014, 2015, 2016, 2017, 2018, 2019, 2020, 2021, and 2022 (based on page views) and has over 108,000 followers (on Seeking Alpha). Thomas is also the author of The Intelligent REIT Investor Guide (Wiley) and is writing a new book, REITs For Dummies.

Thomas received a Bachelor of Science degree in Business/Economics from Presbyterian College and he is married with 5 wonderful kids. He has over 30 years of real estate investing experience and is one of the most prolific writers on Seeking Alpha. To learn more about Brad visit HERE.Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.