Monro Expects Gross Margin Enhancement, And Appears Quite Undervalued

Summary

- Monro is a national tire retailer and auto repair parts sales company in the United States.

- I believe that recent divestitures and expected M&A activity in 2023 could bring beneficial inorganic growth and some balance sheet improvements, which may increase future stock demand.

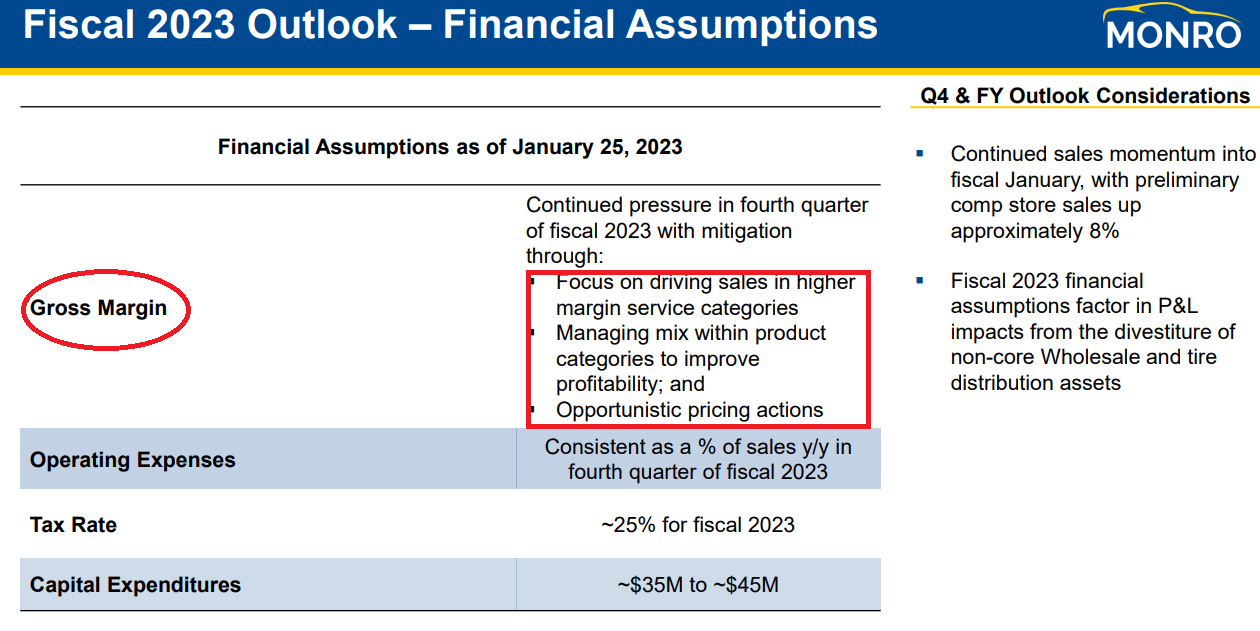

- It is also worth noting that the guidance recently delivered includes gross margin appreciation thanks to opportunistic pricing actions and successful management of the product mix.

Nature

Monro, Inc. (NASDAQ:MNRO) recently announced incoming gross margin improvements from opportunistic pricing actions and successful management of the product mix. Besides, management announced potential new M&A opportunities for 2023. I also believe that we could see further divestitures to reshape the balance sheet. Even taking into account potential risks from supply chain issues, increase in the price of imports, or changing regulations, I think that MNRO stock remains significantly undervalued.

Monro Reports A Significant Number Of Brands, And Signed Agreements To Sell Some Divisions And Acquire New Targets

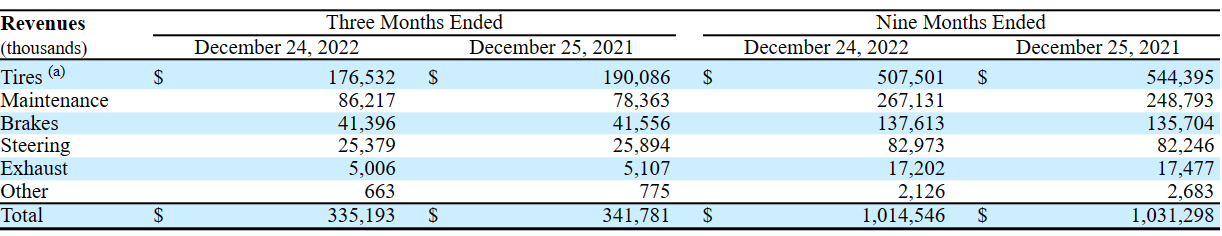

Monro is a national tire retailer and auto repair parts sales company in the United States. Services, in addition to the sale of tires and repair devices, include routine maintenance and technical inspections of vehicles, mainly passenger cars, vans, and light cars. Products include specialty products for hydraulic and brake systems as well as wheel alignment.

Source: Quarterly Report

During the year 2022, the company worked with more than 5 million vehicles, through just over 1,300 retail stores distributed throughout the country. These retail stores are generally less than 20 miles from product storage centers, which ensures a permanent stock available to their customers. These stores are distributed among wholesale stores, retail stores, some of which include repair shops, and exclusive stores to serve commercial customers.

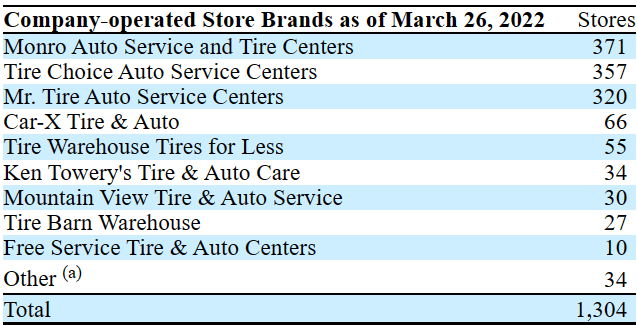

All of the company's operations are organized under a single operating segment, which includes all of the brands through which Monro is presented. They include Monro Auto Service and Tire Centers, which is the largest brand, Tire Choice Auto Service Centers, Mr. Tire Auto Service Centers, Car-X Tire & Auto, Tire Warehouse Tires for Less, Ken Towery's Tire & Auto Care, Mountain View Tire & Auto Service, Tire Barn Warehouse, and Free Service Tire & Auto Centers.

I appreciate that the company reports different brands. As a result, I believe that management obtains beneficial diversification. If one brand has issues, the other stores or brands will likely not suffer reputational damage.

Source: Quarterly Report

Monro states that much of its operating value comes from the great relationships built with dealers, primarily American Tire Distributors, with whom it transacts to sell its products. In this sense, it is important to highlight that the 10 main sellers for Monro mean 83% of its stock, and only one of these sellers represents 25% of it. I believe that there are some risks from these relationships. I would appreciate it if management works with more dealers.

It is also worth noting that Monro signed several agreements to reshape its balance sheet, which certain investors may appreciate. The company signed an agreement with American Tire Distributors to sell assets under a payment of $105 million dollars. In my view, investors need to take into account that Monro may receive an earnout of close to $40 million in the coming years, which may enhance future income statements.

On June 17, 2022, we completed the divestiture of assets relating to our wholesale tire operations (seven locations) and internal tire distribution operations to American Tire Distributors, Inc. (“ATD”).

The remaining $40 million (“Earnout”) of the total consideration of $102 million will be paid quarterly over approximately two years based on our tire purchases from or through ATD pursuant to a distribution and fulfillment agreement with ATD. Source: Quarterly Report

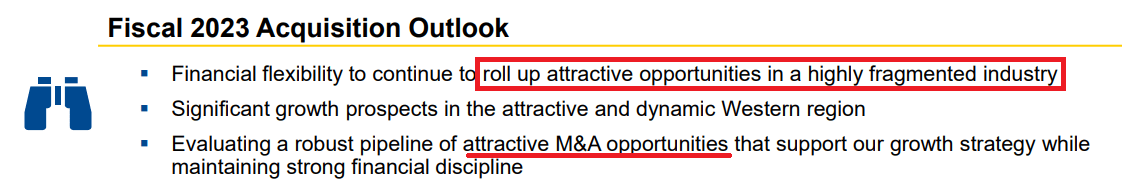

Besides, I consider it very positive that Monro intends to acquire new targets in 2023, which will most likely accelerate growth and FCF generation. The company made the following comments in a recent quarterly release report.

Source: Presentation To Investors

Finally, it is also worth noting that the guidance recently delivered includes gross margin appreciation thanks to opportunistic pricing actions and successful management of the product mix. Besides, 2023 capital expenditures are not expected to increase significantly, which would bring future FCF growth.

Source: Presentation To Investors

Balance Sheet

In my view, Monro reports a solid balance sheet with some cash in hand, but a lot of accounts payable. The company appears to receive financing from providers, which help the company finance inventories. As a result, Monro does not need a lot of cash in hand, and the total amount of debt does not seem substantial.

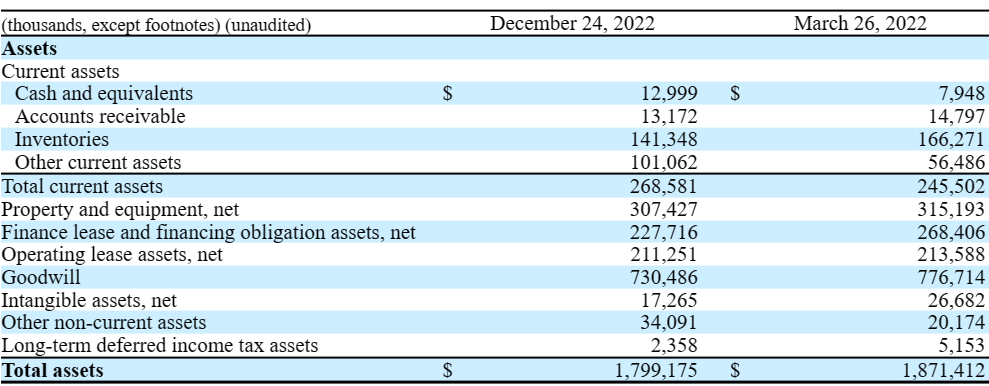

As of December 24, 2022, Monro reports cash of $12 million, accounts receivable close to $13 million, inventories of $141 million, and total current assets close to $268 million. Total current assets are less significant than the total amount of current liabilities, however I would not be worried about any liquidity crisis. Current amount of assets is small because the company does not need to hold cash in hand to run the business model.

Monro also reported property and equipment close to $307 million with finance lease and financing obligation assets of $227 million, operating lease assets of $211 million, and goodwill close to $730 million. Finally, total assets are equal to $1.799 billion. The asset/liability ratio is close to 1.7x, so I believe that the balance sheet is stable.

Source: Quarterly Report

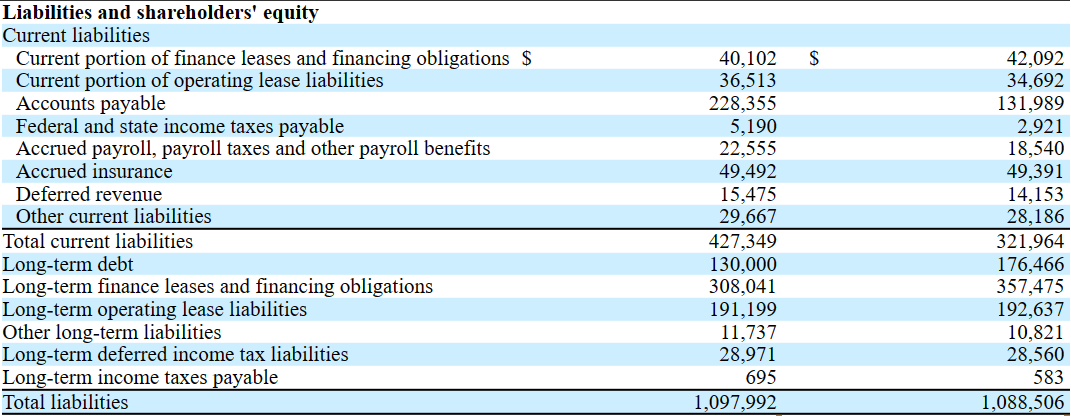

I believe that the total amount of finance lease liabilities and debt is not small, but could be justified taking into account the cash flow from operations and FCF reported. The list of liabilities include current portion of finance leases and financing obligations close to $40 million, current portion of operating lease liabilities of $36 million, accounts payable of $228 million, and total current liabilities of $427 million.

Long-term debt stood at $130 million with long-term finance leases and financing obligations of $308 million. Total liabilities were equal to $1.097 billion.

Source: Quarterly Report

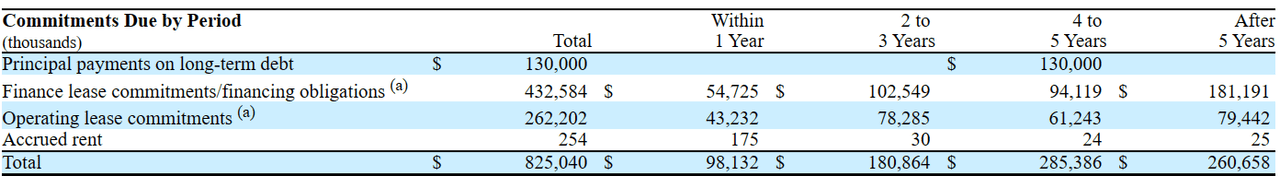

In the last quarterly reports, Monro reported the expected future debt payments. In two to three years, the company will have to pay $180 million, and $285 million in four to five years. In my view, considering the current cash flow from operations, I believe that Monro will likely be able to renegotiate its debt agreements, or find new debt investors.

Source: Quarterly Report

My Assumptions Include Sufficient Investments In Customer Experience, New Small Acquisitions, New Divestitures, And Further Stock Repurchase Agreements

Under my DCF model, I assumed that Monro would successfully invest in the customer experience of its stores, and build a community of professionals thanks to its software, cloud storage development, and work through Monro University. Besides, I would be expecting that operational excellence and more personnel will lead to economies of scale, which could successfully push the FCF north.

Besides, considering the previous 17 acquisitions, I believe that Monro has sufficient expertise of integrating new M&A targets. I assumed successful integration and a few new small acquisitions as soon as the company can lower its level of debt sufficiently. New acquisitions will likely enhance revenue growth and cash flow from operations in the coming years.

Given the agreement to some part of the business to wholesale tire operations, in my view, management may accept other deals in the near future. As a result, the company may reshape its balance sheet, and may receive some cash in return. If investors appreciate the change in the financials, in my opinion, the EV/FCF could increase, and the WACC may decrease, which may bring stock price appreciation.

I also believe that the recently announced stock repurchase program will likely increase the demand for the stock. We are talking about a program of close to $150 million, which could, in my view, have a beneficial effect on the stock price.

On May 19, 2022, our Board of Directors authorized a share repurchase program for the repurchase of up to $150 million of shares of our common stock. The Board of Directors did not specify a date upon which the authorization will expire. Source: Quarterly Report

DCF Model

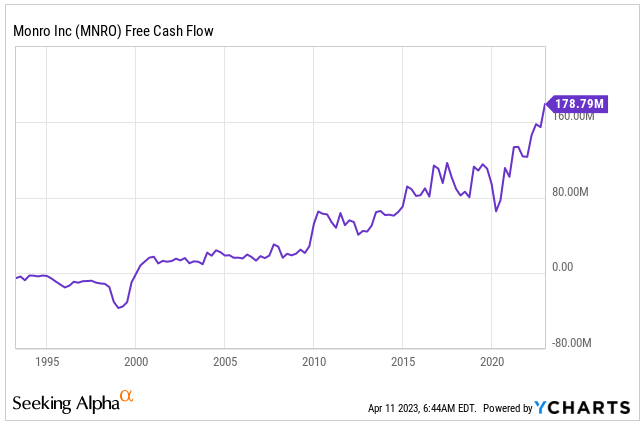

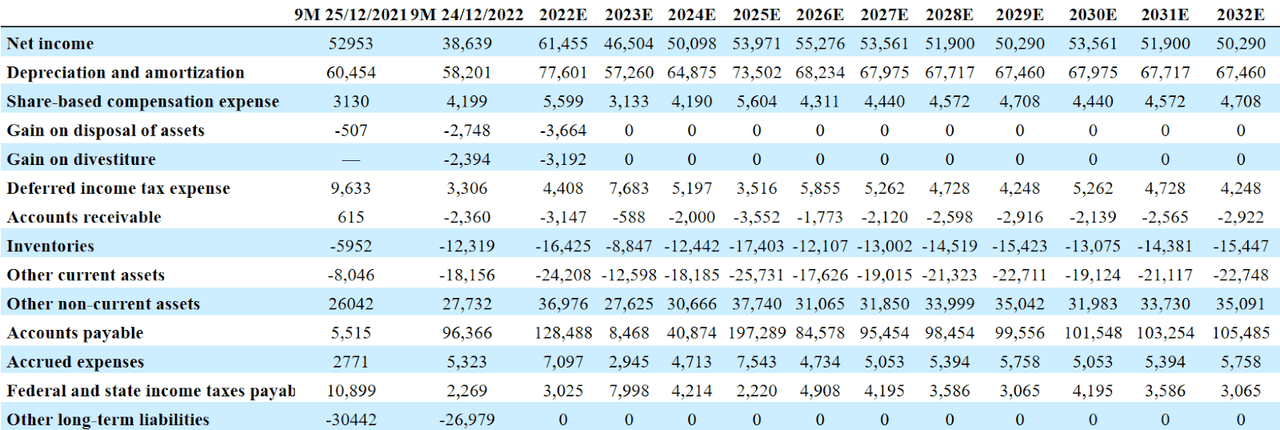

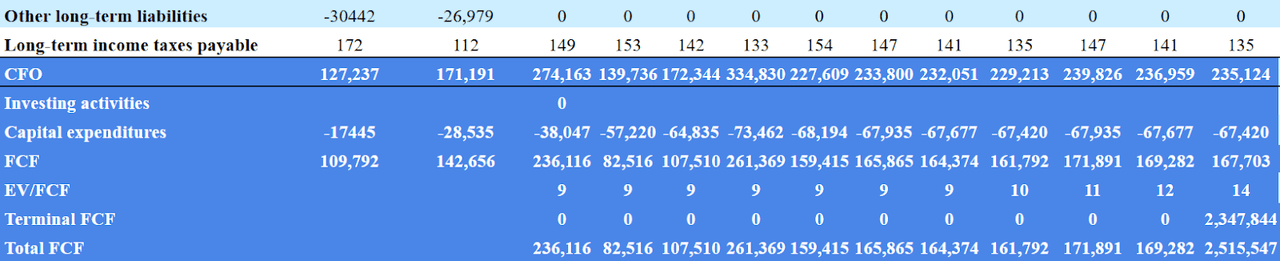

My cash flow model included net income growth, D&A growth, increases in inventory, and no gain on disposals or properties. I obtained growing CFO and FCF growth, not very different from what shareholders enjoyed in the last 19 years.

Source: YCharts

My assumptions included 2032 net income close to $50 million, depreciation and amortization of $67 million, and share-based compensation expenses of around $4 million. Also, with changes in accounts receivable of -$3 million, changes in inventories of -$16 million, and accounts payable worth $105 million, I obtained 2032 CFO close to $235 million.

Source: My DCF Model

Source: My DCF Model

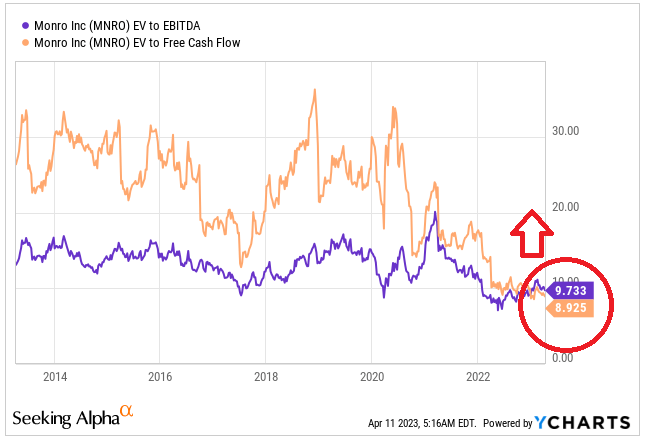

Besides, with 2032 capital expenditures of -$68 million, I obtained FCF of around $167 million, and with an EV/FCF multiple of 14x and a WACC of 6.7%, the enterprise value would be close to $2.429 billion.

If we add cash of $12 million, and subtract the current portion of finance leases and financing obligations of $40 million, long-term debt $130 million, and long-term finance leases and financing obligations of $308 million, the equity would stand at $1.964 billion. Finally, the implied price would be $59, and the IRR would stand at close to 3%.

Source: My DCF Model

Note that I am using an EV/FCF multiple that is significantly lower than what we saw in the past. The company traded at more than 30x EBITDA and around 20x FCF.

Source: YCharts

Competitors And Risks

Competition in this market is highly fragmented. Nationally, Monro competes with certain companies that offer services similar to that of Monro, including parts sales and repair services. In regional terms, competition is provided by a large number of small independent workshops as well as retail auto parts stores. To a lesser extent, service stations and some online sellers also provide competition for Monro. Some of the companies that stand out in the competition at the national level are TBC Corporation, Firestone Complete Auto Care service stores, The Pep Boys, Moe, & Jack service stores, Meineke, and Mavis Discount Tire.

From a broad perspective, Monro is exposed to risks in the economy in general, in terms of the company's operations and the operation of its storage and distribution centers. I also think that innovation and technological development in the auto industry also means a potential risk for the company, in the sale of parts and the repair services. If drivers prefer to buy new innovative cars, I believe that the auto parts may suffer from obsolescence risks.

The risk factors also relate to supply chains, lack of diversification of dealers and sellers as well as future changes in the regulations for trade in the United States, mainly with regard to the prices of tariffs for imports.

Ultimately, the inability to carry out its acquisition and growth strategy in the future is a potential risk factor to consider, especially with regard to the integration of acquisitions into its current operation. Considering the size of the goodwill in the balance sheet, I believe that we can expect goodwill impairments, which may lower the book value per share.

My Takeaway

Monro delivered expectations about gross margin appreciation thanks to opportunistic pricing actions and successful management of the product mix. I believe that recent divestitures and expected M&A activity in 2023 could bring beneficial inorganic growth and some balance sheet improvements, which may increase future stock demand. Even considering potential risks from supply chain issues, increase in import taxes, or radical changes in drivers’ behaviors, I believe that the company is quite undervalued.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MNRO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.