New Mountain Finance: 7% Discount To NAV, Raised Dividend, Buy The Dip

Summary

- New Mountain Finance covered its dividend with NII in 4Q-22.

- The BDC paid its first raised dividend of $0.32 per share in the fourth quarter.

- I think New Mountain Finance is an attractive addition to a passive income portfolio.

Galeanu Mihai

New Mountain Finance (NASDAQ:NMFC) is currently trading at a 7% discount to net asset value, despite the fact that the business development company has consistently covered its quarterly dividend pay-out with net investment income in 2022.

While New Mountain Finance's credit quality isn't the best, with a non-accrual ratio of 1.8%, it remained stable in the fourth quarter.

New Mountain Finance currently has a dividend yield of 10.6% after increasing its payout to $0.32 per share, and the stock is a buy on the dip.

Get A 10% Yield From A Well-Diversified Portfolio

The portfolio of New Mountain Finance is geared toward anti-cyclical and high quality First Lien investments that have a high chance of performing well even in difficult economic times. The fair value of New Mountain Finance's investment portfolio was $3.2 billion at the end of 2022, up slightly (1.4%) from the previous year due to new loan originations.

In 2022, New Mountain Finance saw net originations of $208.7 million, with originations slowing noticeably in the second half of the year due to the central bank's aggressive stance on rate hikes. Higher interest rates make borrowing money from capital providers like New Mountain Finance more expensive for borrowers, which explains the drop in originations in the final six months of 2022.

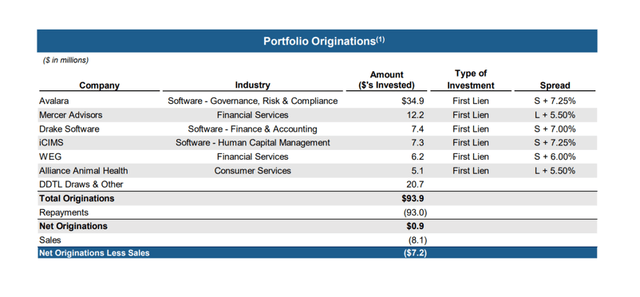

New Mountain Finance originated only $0.9 million in net originations in the fourth quarter. In 4Q-22, however, new originations were solely comprised of high quality First Liens.

Portfolio Originations (New Mountain Finance Corp)

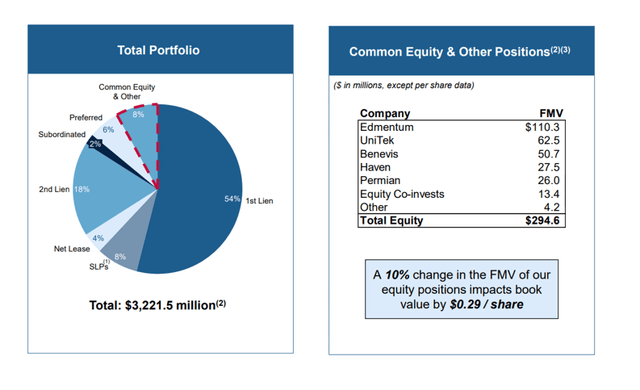

At the end of 2022, New Mountain Finance's portfolio remained overweight First Liens, implying that the company had more than half of its assets invested in the safest forms of available debt, First Liens (54%).

Second Liens (18%), Subordinated Debt (2%), Equity (14%), and other investments (12%) are among the other investments.

The company has $294.6 million in equity investments, which provides NMFC with valuation upside if one of its portfolio companies hits a home run.

Overweight 1st Liens (New Mountain Finance Corp)

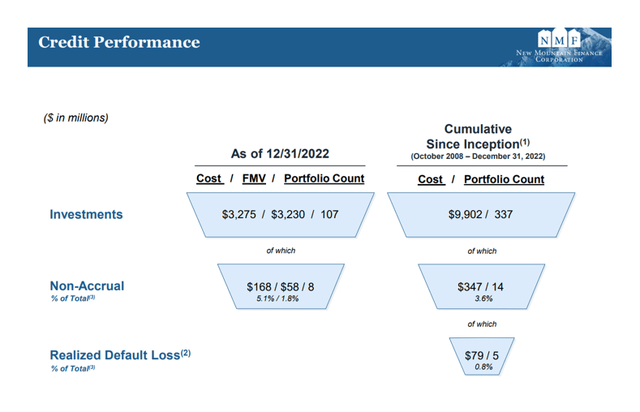

The credit quality of New Mountain Finance remained stable in the fourth quarter, and the business development firm ended the year with a non-accrual ratio of 1.8%. The investment is worth $58 million (based on fair value).

As of September 30, 2022, New Mountain Finance's non-accrual ratio was 1.8%, indicating that the BDC's credit quality did not deteriorate or improve.

For passive income investors concerned about the credit quality of the BDC, I would recommend Oaktree Specialty Lending Corporation (OCSL), an experienced, disciplined credit manager with perfect credit quality.

Credit Performance (New Mountain Finance Corp)

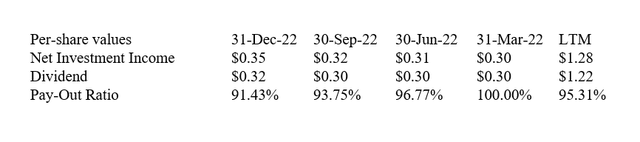

Dividend Coverage

In 2022, New Mountain Finance earned $1.28 per share in net investment income and paid out a total dividend of $1.22, resulting in an updated pay-out ratio of 95%. Having said that, the pay-out ratio improved throughout 2022 as a result of higher net interest income in the second half of the year as a result of the central bank raising rates.

Because New Mountain Finance is well-positioned to profit from rising interest rates (89% of the BDC's assets are floating rate), it was also able to increase its dividend payout by 7% in the fourth quarter to $0.32 per share.

Dividend (Author Created Table Using BDC Information)

New Mountain Finance Is Still Available At A Discount NAV Valuation

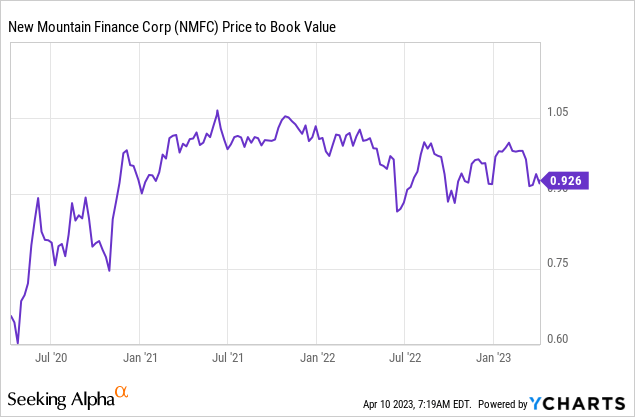

New Mountain Finance is currently trading at a 7% discount to net asset value, which makes the stock appealing from a margin of safety standpoint, in my opinion.

In the last year, New Mountain Finance has traded at both a premium and a discount to net asset value, which is why I believe the current price drop represents an opportunity for passive income investors to purchase the stock on the cheap.

Why NMFC Could See A Lower Valuation

New Mountain Finance has prepared its investment portfolio for an increase in interest rates. If the central bank continues to raise interest rates in 2023, the business development company will benefit from its floating rate exposure.

Alternatively, a change in the central bank's interest rate policy would likely undermine the arguments made in this article, and New Mountain Finance could see weaker dividend coverage in a falling-rate environment.

My Conclusion

I believe New Mountain Finance is an appealing business development company to add on the dip: the dividend is covered by net investment income and was raised in 4Q-22, and the company continued to initiate new investments throughout the year.

Furthermore, if the central bank continues to push for higher rates in 2023, I believe the pay-out metrics will improve.

Because the stock is also trading at a discount to NAV, indicating a high margin of safety, I believe NMFC is still a compelling dividend/yield play for passive income investors.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NMFC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.