GM Buyout Attracts 5,000, Cuts Costs To Boost Inconsistent Earnings

Summary

- GM's voluntary separation plan will result in a $1 billion charge against Q1 earnings and $1 billion of cost savings or half of $2 billion target.

- With 2023 net income projected to fall for a second straight year, GM seeks to shrink salaried workforce, reduce vehicle complexity and lower corporate overhead.

- CFO Jacobson said separation numbers "came in about in line with our expectations."

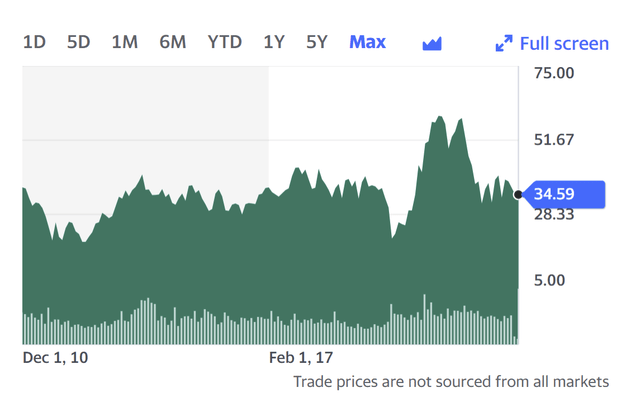

- Shares remain mired close to 2010 initial public offering price, reflecting investor skepticism of company’s prospects.

- Because GM hasn't proven it can grow profit consistently since its reorganization, the next few years will be risky for investors due to outsize investments in battery-electrification technology.

2022 GMC Hummer EV on a dirt road Wirestock/iStock Editorial via Getty Images

General Motors' (NYSE:GM) Mary Barra has received much laudatory coverage since taking over as the automaker's CEO in 2014. Yet nine years on, the price of GM stock remains the same as when her tenure began. In fact, they're roughly at the same price as they were at the time of 2010 initial public offering, a year following the company's bankruptcy.

A post-bankruptcy consensus among Wall Street analysts held that newly-reorganized GM would not prove to be a worthwhile investment until the automaker established a strong financial position that could withstand the automotive industry's periodic downturns. At a matter of fact, GM has maintained a fairly solid financial footing - but the context has changed, notably the global pandemic and the onset of an entirely new propulsion technology: battery electrification.

GM stock price 2010-2023 (Yahoo finance)

Consistent earnings?

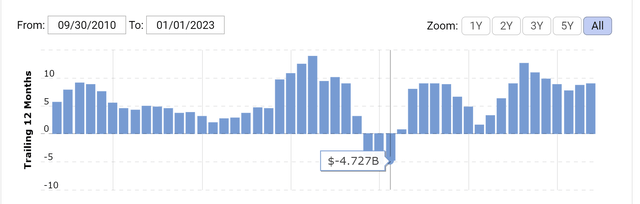

Much of GM's share price stagnation over more than a decade might be blamed on the difficulty of posting consistently growing earnings, which - after all - most stock pundits would insist is the bedrock of a growing share price. The global automotive industry remains viciously competitive. Although the pandemic tended to moderate the industry's chronic over-production of vehicles and improve profits, investors may legitimately suspect that automakers, including GM, are poised to raise output and are headed to toward large inventories that will depress pricing.

GM net profit since 2010 reorganization (Macrotrends.net)

General Motors annual/quarterly net income history and growth rate from 2010 to 2022. Net income can be defined as company's net profit or loss after all revenues, income items, and expenses have been accounted for.

- General Motors net income for the quarter ending December 31, 2022 was $1.984B, a 16.98% increase year-over-year.

- General Motors net income for the twelve months ending December 31, 2022 was $8.915B, a 9.37% decline year-over-year.

- General Motors annual net income for 2022 was $8.915B, a 9.37% decline from 2021.

- General Motors annual net income for 2021 was $9.837B, a 57.47% increase from 2020.

- General Motors annual net income for 2020 was $6.247B, a 5.08% decline from 2019.

As if competition to sell internal combustion models such as the Chevrolet Silverado wasn't hard enough on profit, GM now is embarked on roughly $35 billion worth of investments in battery production and new battery-electric vehicle (BEV) models. GM has bravely projected profitability for its BEVs by 2025, boosted by federal subsidies. Obviously, the outcome still hinges on consumer acceptance of BEVs, not to mention the potential erosion of subsidies if political climate change engulfs Washington.

Against that backdrop, Barra in late January raised a signal flare that buyouts were likely with the announcement of $2 billion in cost cuts through the end of 2024, achieved in part by reducing the size of the work force. Clearly, the prospect of a global recession and the decline in used-car prices was influencing GM's planning.

Mary Barra, CEO, at CES in January 2023 (GM)

Slimming down

In late February, GM said it was eliminating about 500 executive and managerial level jobs worldwide for "performance related" reasons. Those employees began leaving the company immediately. Globally, GM employed about 88,000 salaried personnel, about 58,000 in the U.S., according to its latest filings.

The February personnel reduction wasn't large enough to be material, keeping analysts and investors on the lookout for the next step. It came on March 10, with the announcement that all salaried personnel with more than five years of service were being offered a buyout.

On April 4, Paul Jacobson, GM's chief financial officer, announced the number of employees accepting the buyout offer was in line with GM's expectation and would be reflected in a $1 billion charge against earnings. Additional layoffs wouldn't be necessary, he said. First quarter financial results are scheduled for release on April 25 at 6:30 a.m.

The offer was one month's salary for every year of service, up to 12 months, paid as a lump sum.

Additionally, some money would be paid to those covered under the company's group health plan, a pro-rated portion of the latest bonus, outplacement assistance, and the right to keep using a company car for some period of time, depending on the employee's last day of work. All those accepting the offer will be leaving the company by June.

New talent

Although the workforce reduction will lighten GM's cost burden, the company no doubt will lose a significant amount of experience and skill that could cause hardships in engineering, financial and marketing organizations. Because of the migration toward BEV models, GM has been hiring aggressively in recent years to build up its expertise and talent in software, battery engineering, digital connectivity and related fields.

At the end of January GM said that it expects its core auto operations to perform at a consistently strong level in 2023, with full-year net income attributable to stockholders of $8.7 billion-$10.1 billion, EBIT-adjusted of $10.5 billion-$12.5 billion, and EPS-diluted and EPS-diluted-adjusted of $6.00-$7.00.

Additionally, Barra asserted that 2023 will also be "a breakout year" for the Ultium Platform, the company's latest battery technology used for its newest EV models such as the Cadillac Lyriq and the Chevrolet Silverado EV. The BrightDrop Zevo 600 delivery van is aimed at commercial customers. Clearly, she's banking on robust acceptance of GM's new BEV models.

EV future

So far, GM's BEVs consist of models like the GMC Hummer EV and Lyriq, which are priced for affluent consumers. Popularly priced Chevrolet Bolt and Bolt EUV BEVs have achieved record sales, though their battery technology is becoming outdated; later this year GM will introduce Chevrolet Silverado EV, Blazer EV and Equinox EV. The automaker's goal is to build and sell 400,000 BEVs through the first half of 2023 - which would be an impressive achievement.

GM's Cruise subsidiary is expanding robotaxi operations in San Francisco and poised to enter Austin and Phoenix markets - significant revenue, not to mention profit, appear to be years in the future.

The jury is still out on electrification - specifically, the amount of time needed before mainstream buyers are willing to switch from conventional propulsion technology (internal combustion engines) to battery electrics. This uncertainty hits GM especially hard since the regulations and incentives in the U.S., GM's most important market, are the least binding, compared to China and the European Union.

In other words, if consumer uptake of BEVs takes longer than projected then GM shareholders will have to wait longer for a payoff from the tens of billions invested in new battery plants and BEV models. Although the growth rate of BEV sales sounds impressive, the absolute number remains rather small compared to sales of conventional models. Additional government investment and regulatory action could accelerate BEV sales -- though that's a shaky premise on which to hang an investment.

Wall Street analysts tend to be sanguine. The consensus assigns a "Buy" rating to GM shares, with several assessing GM as a "Strong Buy." I tend to be more persuaded by SeekingAlpha's Quant Rating of "Hold," which appears to be influenced by the D- grade given for growth of revenue and earnings.

GM's long-term potential is great. Reviewers give its models strong marks. Yet in the face of global competition, economic headwinds, massive and costly electrification costs, GM has still to prove it can make money on a consistent and growing basis. Investors who have hung on to positions in GM may wish to wait a bit longer to see if mainstream consumers will flock to the automaker's new BEV lineup - and are willing to pay premium prices, which will be reflected in growing earnings.

Without more proof in hand, adding shares to one's portfolio looks risky. Thus, GM remains a hold.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.