Lithium Royalty Corp.: Buying Royalties At The Top Of The Market

Summary

- Absolutely and entirely nothing wrong at all with a mineral royalty company.

- However, long-term success does depend upon the prices paid in which part of the cycle.

- What worries me here is that lithium is coming off the top - so are they buying at the top of the market?

- Looking for more investing ideas like this one? Get them exclusively at Forsaken Value and Yield. Learn More »

jroballo

What's The Projection For The Lithium Market?

At one level there's absolutely nothing wrong with Lithium Royalty Corp (OTCPK:LITRF), the recently IPO'd lithium, um, royalty company. OK, so its main listing is in Canada, which might give South Park fans some thought. But other than that? It's a standard industry technique, they've just raised money to expand, gained that listing. They're in a hot market, so, what's not to like?

Well, really, the only thing is whether that market is going to stay hot.

With minor metals there's a time to sell, a time to buy

As I've pointed out several times here there are cycles to minor metals markets. Some new use for one of them - whichever it is - arrived and so it looks as if there will be a shortage judging by current extraction capacity. The short term price rises and many seem to think that's going to continue.

But this misses that there's simply no shortage out there of anything we might want to use. OK, some of the short lived radioactives maybe. But other than that, well, Earth is a big place. So, the price rises, junior miners kick into action and look for, find, start mining this new more desirable element.

As it happens more start than is really quite necessary, some smaller number manage to actually produce but again, more than perhaps is entirely and wholly necessary. My favourite number for this comes from Jack Lifton back after China restricted rare earth exports in 2010. He said that at one point there were 420 rare earth plays all looking for finance. Only two major ones got into production, Molycorp and Lynas and that was enough to crash RE prices back below what they were at the start. Molycorp eventually went bust (the mine is open again as MP Materials) and Lynas required a near total recapitalisation. As I've pointed out around here Altura went bust running a perfectly good lithium mine (it's now the basis of those vast profits at Piedmont). Altura went bust because we had a lithium price rise and exploration boom back in 2013, but by the time Altura came to market so had others and the price was well back down again. Until the next boom of course.

The point is - in economic terms - that sure demand is flexible. But so also is supply. There is no shortage of any particular element. There's just a shortage of people extracting it. OK, that's not wholly, exactly and entirely true but it's a very good working thesis.

Tesla's Master Plan

We have an interesting confirmation of this in Tesla's (TSLA) Master Plan 3 just released. The bits for us start on page 31 here. They've calculated just how much of everything is going to be needed to electrify everything (although they agree with me about Rolls Royce and jet fuels - see, they must be right, as with everyone else those who agree with me are, by definition, correct). Now, OK, such grand planning tends not to work out very well - if the planning is about how we do this and detailing who does it and so on. The Soviets didn't have a good time with that idea. But as a calculation of what is needed well, why not?

The answer is that we're going to need 20% of lithium resources.

No, that's all, 20%.

Resources are not what there is

Here we need a bit of techspeak. Reserves are, largely enough, the stock at already extant or about to open mines. Resources is a wider number. But it's still vital to grasp what the definition is. It's - here, lithium resources - the element in rocks that we know about, that we know how to process. So, this is brines, clays and hard rock (spodumene) resources. What's not included here is all the other possible extraction methods. Some claim they can extract from desalination plant wastes and that makes sense to me. There's lots of work being done on geothermal waters. A couple of guys insist they can extract economically from the Red Sea. None of these are included in resources as yet. Resources are things we know about, even if we've not really proven it - proved become reserves.

Resources don't include the known unknowns, nor the unknown unknowns. We're really pretty sure we know the total amount of lithium in the lithosphere. To within a few hundred billion tonnes at least, good enough accuracy with numbers this large. And resources just aren't that, not at all. It's much, much, closer to deposits of rock we know how to process that we know about to some level of knowledge but not to a level of proof.

That is, resources just aren't "everything available". It's a much narrower definition than that, by comparison in terms of tonnes it's tiny.

As Tesla also points out all that's really required to turn resources into reserves and then usable material is investment and effort. That's implicit in the definition we're using at the start.

But here's Tesla saying we need only 20% of what we already know about to achieve the plan. At which point there's still that room for investment and effort to get well ahead of demand, isn't there? The implication for the price there is the same as it has been in so many other minor metals cycles - it drops like a stone.

So, how much effort is going into lithium?

This is one of those times when a Seeking Alpha subscription is so valuable. A piece on lithium juniors news for February this year. Now just look at the listing of companies there. We're all absolutely certain that lithium production is going to continue to lag behind demand, are we? That the lithium price is going to stay elevated?

I'm not.

You don't have to agree with me about whether that lithium supply will catch up with demand and the implications for the price. I just insist that that's the basic question in this sector. More specifically, it's important to Lithium Royalty.

What does a royalty company do?

Well, obviously, it collects royalties, D'Oh. Rather more importantly, it's really a Venture Capital company for mining companies. For those royalties are bought by paying some of the early stage exploration expenses of the mining company. Some of these come good, some go bad. Some exploration finds something and is able to take it all the way through to production - at which point royalties get paid. But there are obviously exploration companies which manage to find nothing and fold their tents and steal away into the night (sorry, go bust) making the potential royalty worth nothing.

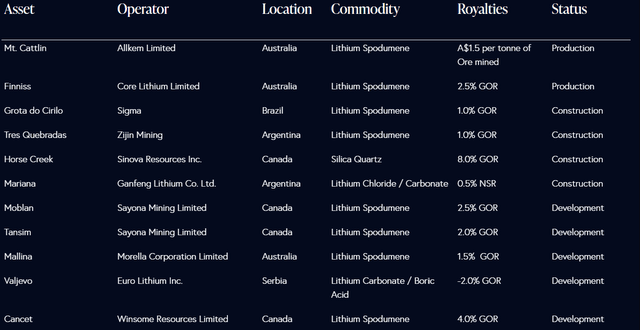

This is a risk business. Lithium Royalty's current listing from their site:

Lithium portfolio (Lithium Royalty) Lithium portfolio (Lithium Royalty) Lithium portfolio (Lithium Royalty)

Now, there's absolutely nothing wrong with any of that. At least that I or anyone else knows about. But it is important to note that it's in order of development and therefore risk. That first company, Allkem is producing and delivering about $700k in payments. OK. That last, Avro, at least as far as I can find out (which could be a product of my Google Fu) is at present little more than a shell company that's going to do something real soon now. Larvotto is at the stage of reporting interesting drill results. Which is a long, long, way away from actually producing anything.

This is how mining royalties are acquired. By providing the very early stage risk capital - possibly even more like Angel Investors than VCs - to get folk scouting the countryside for interesting rock.

Nothing wrong with that at all, someone's got to finance this. As with Angel or VC investing it's necessary to have a portfolio, some will be duds, the occasional one will be a glorious 50 to 100 bagger and that's how the business works.

Please note, I am not arguing with the business style, the sector or the manner of business being done. I'm fine with the sector, the essential point and purpose of how this works and so on. Given that this is a very recent IPO and the portfolio is - well, let's be polite here - less than mature we also can't really judge the picking skills of the management.

There's a useful sector of the Canadian stock exchange (which is why this IPO was in Canada at a guess) which contains a number of companies which were very successful at this in the past.

So, here's my worry

Lithium Royalty is currently investing further in that exploration. That's what the proceeds of the IPO - that $100 million and change - are for. They're also very early in the maturity stages of that portfolio.

But I think that the lithium market is going to go into oversupply soon enough. So, they're buying at the top of the market and the revenues are going to come through later - when I think they're going to be considerably depressed from current levels.

Yes, we can think that the price of those early stage investments is low because of course the risk means that it always is low. But early stage investments in a hot market like lithium right now are obviously more expensive than in something like, well, boring like gallium, just to give an example. Or germanium. On the basis that other people also want to invest in lithium right now therefore there's competition.

It's also true that if the lithium price falls - note the if - then some to many of these investigations aren't going to end up being producing mines. This is a different risk from not finding any lithium, this is price risk not geological. After all, when prices change entirely viable deposits at higher prices become unviable. Or, more to the point, uninvestable into production.

My view

As I say, I've not a problem at all with the base idea, the construction of the market idea. Royalty companies are, when looked at properly, VC companies for exploration stage mining companies. VC - royalty purchases by finding exploration work - works across a portfolio, it's a high risk business. Some few monster mines pay for all the failures.

But the trick of the business is to be paying the right, risk adjusted price, at that entry stage into the investments. I just think that the lithium market is so elevated that investments at this stage aren't going to pay out. So I'd suggest Lithium Royalties is one to sit out.

Why I might be wrong

Well, if everything I think I know about mining and price cycles is wrong then obviously it's possible that the lithium price is going to stay elevated. Perhaps climb to new heights for years, decades even. If it does then I'm wrong.

Don't think I am but then even my ego won't support the idea that I'm never wrong.

The investor view

I just think that Lithium Royalty is an entirely fine business structure which is putting money into lithium at the wrong point of the price cycle. Therefore there are other and better places to put our money.

Desiring to play on the lithium price is also fine. There are perhaps other, better opportunities to do that. Currently producing mines perhaps.

My thinking is simply that Lithium Royalty is doing a perfectly sensible thing but just at the wrong point of the price cycle.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Another look at a corner of the lithium market

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.