CLOA: 6% Yield From This AAA Fund

Summary

- CLOA is a new fund from BlackRock.

- The vehicle focuses on AAA CLO paper.

- The fund has a 30-day SEC yield in excess of 6% and an ultra-safe collateral pool.

- The underlying collateral is floating rate, meaning it will re-set higher as the Fed increases rates.

Joe Raedle/Getty Images News

Thesis

The BlackRock AAA CLO ETF (NASDAQ:CLOA) is a new entrant in the CLO debt space. BlackRock chose the exchange traded fund format for this wrapper, meaning there is no leverage on the underlying CLO portfolio. The fund is new, having IPO-ed in January of this year.

CLOA, just like JAAA which we covered here, focuses on AAA CLO paper:

Collateralized loan obligations are securities that are backed by a pool of corporate loans. In other words, CLOs are repackaged loans that are sold to investors. They are similar to a collateralized mortgage obligation (CMO), except that the underlying instruments are loans instead of mortgages.

The risk is tranched in a CLO, and this fund only focuses on the highest piece of the debt stack:

Risk Tranching (CorporateFinanceInstitute)

The CLO asset class is a true tried and tested one, having been around for over 30 years now. There are few surprises to be had here, and we find it interesting that it took so long for an ETF wrapper to come out for this piece of debt.

Default Risk for AAA CLOs

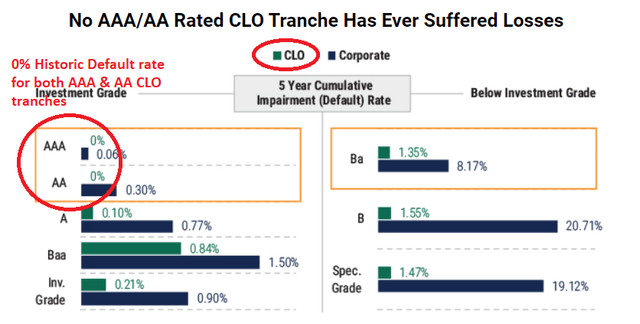

The default risk for this asset class is almost inexistent:

AAA CLO Default Risk (Pinebridge)

We can see from the above table, courtesy of Pinebridge, the historic loss occurrence for the asset class. It just never happened. This is mainly due to the deep subordination at the AAA level (usually around 30%), the low default rate for leveraged loans, and high recovery rate for the asset class. The takeaway here is that AAA CLOs are true tried and tested AAA bonds. The credit risk is minute to non-existent here. A savvy reader would have also noted that AA CLOs also never defaulted in the entire history of the asset class.

We feel exchange traded funds like CLOA and Janus Henderson AAA CLO (JAAA) will bring this institutional investor asset class more in the focus of retail investors. This sector of the securitization market is actually a nice fit for retail since it generally focuses on corporate credit via senior secured structures (i.e. leveraged loans). Investors can already buy into leveraged loan CEFs and ETFs, and a CLO ETF is just another expression of the same risk appetite. We are surprised it took so long for this sector to develop, and we would expect some sort of AAA/AA CLO tranche CEF at some point in time as well.

Holdings

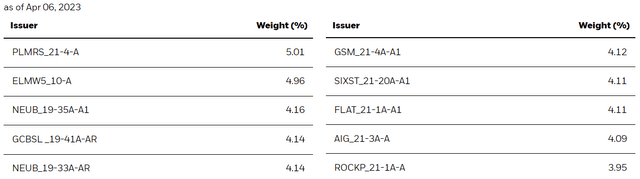

The fund holds only 26 names, which will grow as the fund gathers more AUM:

The collateral weighting is higher than what you see in floating rate funds, but this is normal due to the diversified nature of the CLO asset class:

In a nicely diversified leveraged loan fund you do not see issuer concentration above 2%. However, here the actual names are composed of hundreds of loans, thus we are not concerned by any exposure up to 10% of the fund. We expect this 5% threshold to be kept for the future as well.

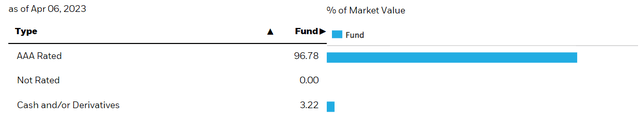

All of the bonds in the portfolio are currently rated AAA:

We do not see much of a migration down in credit from AAA to AA or single A, unless the collateral manager for a CLO is really bad at his/her job. Due to its deep subordination and cash waterfall that diverts interest when O/C ratios are breached, CLO structures tend to maintain their integrity in time. We think this will be the case here as well.

Is this a good cash parking vehicle?

While the fund is AAA and the yield is high at over 6% this name is not an ideal cash parking vehicle. Why? Because the collateral is not really 100% liquid. Yes you are able to freely trade AAA CLOs, but if the fund gets bigger and needs to redeem a lot of shares in a day, it might experience price slippage. Let us explain - CLOs are not exchange traded, and usually they trade in sizes up to 10x10 for certain names (this means 10mil for bid and offer). If the structure would want to redeem say 20 mil of a certain CLO tranche it might obtain a bid lower than what it is valuing the collateral at.

At the end of the day, true cash parking vehicles are the ones where the collateral is ultra liquid, no matter the size. CLOA is more of a yield enhancing vehicle composed of ultra safe collateral. An investor needs to have a 6 months plus time horizon here.

Conclusion

CLOA is a new fund from BlackRock . The manager packages AAA CLOs in the ETF wrapper for a low 20 bps fee. AAA CLOs are ultra safe assets that have never defaulted. The debt is floating rate, meaning it will re-set higher as the Fed increases rates. The fund sports currently a 30-day SEC yield in excess of 6%. The offering is new in the market, and represents a competitor to the more established Janus Henderson AAA CLO fund which we covered here. We are happy to see this asset class get more coverage via exchange traded funds, and feel a CEF based on AA/AAA paper is not too far off. Given liquidity issues with the underlying collateral and its small size, CLOA is not a cash parking vehicle, but more of a yield enhancing instrument. The credit risk here is inexistent, so a savvy investor looking to capitalize on higher risk free rates would need to hold CLOA for 6 months or more.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.