Bed Bath & Beyond: Reverse Split Or Bankruptcy

Summary

- Company proposes a reverse split of common stock.

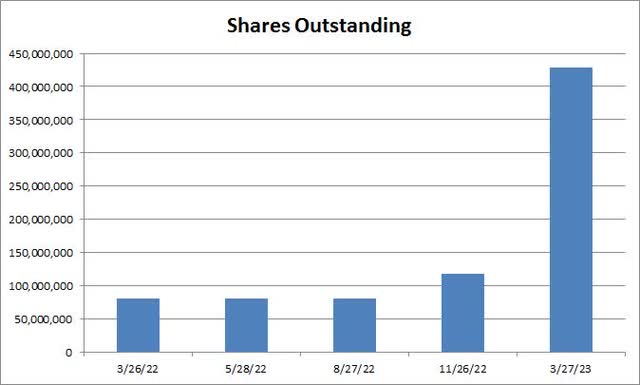

- Significant dilution continues to pile up.

- Sales estimates have fallen to new lows.

Bruce Bennett

Back in February, I discussed a very troubling equity offering announced by struggling retailer Bed Bath & Beyond (NASDAQ:BBBY). With heavily pressured sales trends leading to significant cash burn, the company was doing everything it could to stay afloat. Just a few months later, another major move is on the horizon as management looks to avoid bankruptcy.

Last week, the company filed a proxy statement inviting shareholders to attend a special meeting on May 9th. The main reason for the meeting is to vote on a reverse split proposal for the company's common stock. Should the board receive approval, it will decide on a ratio between 1:10 and 1:20. Given how much shares have fallen in recent months, I'm guessing that we'll see the upper end of that range if the vote goes through.

The primary reason to enact the split is to give the company adequate access to raise desperately needed capital. On March 30th, Bed Bath & Beyond entered into a sales agreement with B Riley to sell up to $300 million worth of shares. However, with the stock only trading around 30 cents currently, selling just a portion of that would mean brushing up against the maximum amount of shares outstanding that the company can have.

At the end of the November fiscal period, the company reported just $153 million of cash on its balance sheet, along with a little more than $21 million in long term investments. However, there was also over $900 million of debt due within 12 months, with another billion plus of long term debt. Since then, there have been numerous transactions like this one to raise fresh capital, resulting in a massive amount of dilution.

BBBY Shares Outstanding (Company Filings)

We should get an update on the company's financial situation rather soon, as fiscal Q4 results in the past have usually been announced in the middle of April. Unfortunately, management did pre-announce that revenues would be about $1.2 billion, which was well below the average street estimate of $1.4 billion. It doesn't help that the company continues to close stores, but also that preliminary Q4 comparable sales were projected to decline 40%-50%.

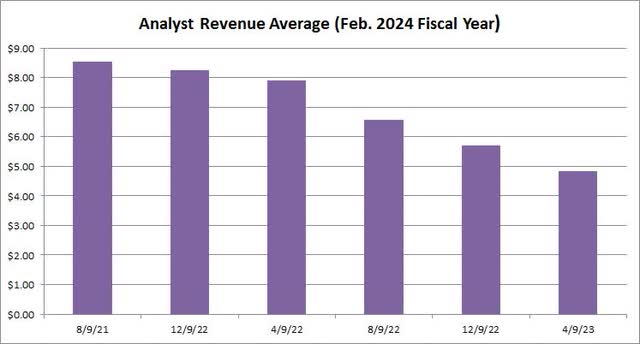

Beyond closing non-core brands in recent years as well as Harmon stores recently, management has worked on reducing expenses as much as possible. However, the company really has to lay out a plan to get the top line moving again. Consumers may be hesitant to shop at a retailer that could be going out of business, and the company has had trouble getting inventory at times with suppliers worrying about getting paid. As the chart below shows, the average street revenue estimate for the current fiscal year has nearly halved since the summer of 2021.

BBBY Revenue Estimate Average (Seeking Alpha)

Analysts don't expect the sales pressures to stop anytime soon, so all eyes will be on management to hear how the latest cost cutting efforts have worked. With cash burn likely continuing, equity sales will continue once the reverse split goes through. It's hard to estimate how many shares will need to be sold to raise the latest $300 million that was announced. That's because we don't know when the reverse split will go through if approved, and whether any sales will take place before then anyway.

In the end, Bed Bath & Beyond is looking at a reverse split as a way to avoid bankruptcy. The company is looking to raise hundreds of millions in fresh capital, but with the stock price so low, it can't do so without hitting its authorized share count limit. With revenue expectations continuing to drop, investors are looking for a key update on the financial situation and cash flow. While the stock is near a multi-year low currently, there still could be plenty of downside on a percentage basis from here as investors face significant dilution.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.