Gannett Is Misunderstood, Grossly Undervalued, And Back On Track

Summary

- After a surge in input costs that wiped out 2022 net income and free cash flow, Gannett Co., Inc. is back on track.

- Additional cost cuts, lower commodity prices, and new affiliate deals are a triple tailwind for 2023.

- Patient investors will be rewarded with a stock that is valued as though bankruptcy is imminent when it is progressing rapidly into the digital age.

- This idea was discussed in more depth with members of my private investing community, The Portfolio Architect. Learn More »

Mark Wilson

It has been more than three years since Gannett Co., Inc. (NYSE:GCI) started its transformation from a traditional print media operation into a digitally focused media and marketing solutions company. The road has not been a smooth one. Management had to navigate the pandemic coming out of the gates in 2020, which was followed by an increase in inflation not seen in 40 years that severely impacted results in 2022. Regardless, CEO Mike Reed has worked tirelessly to strengthen the balance sheet by paying down debt and lowering interest expenses, reducing operational costs, and increasing the percentage of overall revenues dedicated to its digital future.

Now Gannett Co., Inc. is in the early stages of monetizing its vast library of content and the 179 million unique visitors to its countless digital properties in the U.S. and United Kingdom. This company continues to be extremely misunderstood, while its stock remains grossly undervalued, but it is back on track to deliver for astute investors who are paying attention.

The Progress Continues

Over the past three years the company has consistently improved on all key metrics. I may sound like a broken record, but every quarter management pays down more debt, reduces operational costs, and grows digital revenues. The print business continues to shrink each year, as expected, due to the combination of an aging customer base and the natural progression to digital platforms. Still, that can be viewed as a long-term positive from the standpoint that it increases the percentage of overall revenues coming from digital and moves the company towards a more variable cost structure.

After achieving $325 million in cost synergies in 2020 and 2021 from the merger of New Media Investment Group and Gannett, management anticipates an additional $220 million in savings in 2023 from initiatives taken last year to address the surge in inflation.

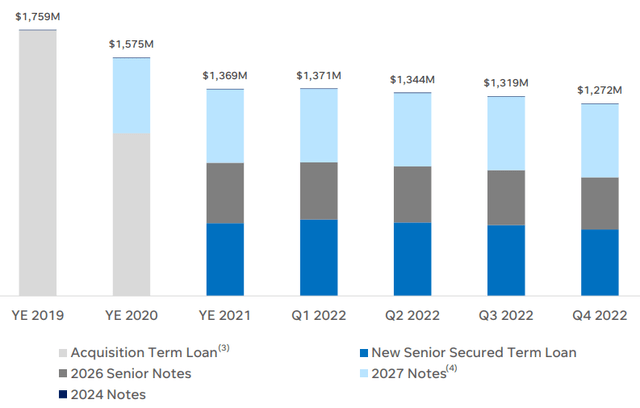

Gannett finished 2022 with $1.27 billion in debt, which translates into a reduction of $487 million from the post-merger total of $1.76 billion at the end of 2019. The cost to carry that debt has risen modestly from 5.8% to 7.1% due to the variable rate on the $438 million remaining on its senior secured term loan, but this is still down significantly from the 11.5% it was paying at the end of 2019. The company finished the year with $94 million in cash and expects to realize asset sales of $65-75 million that will contribute at least another $120 million in debt reduction this year. Once asset sales near completion, we should see significant free cash flow generation serve as the fuel for what will eventually be a debt-free balance sheet.

The company increased digital revenues as a percentage of overall revenue to 35.3% last year, exceeding the milestone of $1 billion, which is meaningful progress from what was 25% three years ago. It finished the year with strong momentum, as digital revenues were 36.8% of total revenue in the fourth quarter of last year.

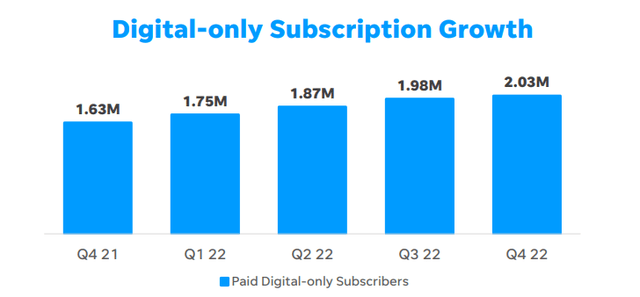

In that effort, another milestone was hit when Gannett surpassed two million digital subscribers, which is more than double the number it had three years ago and now exceeds the number of print subscribers. Digital circulation revenue of $35.5 million was also a new high, resulting in annualized growth of 32% in 2022. Most importantly, the company is now realizing overall growth when combining its digital and print subscription base. This is a major step toward returning to the key inflection point of overall revenue growth for the entire enterprise, which should begin next year.

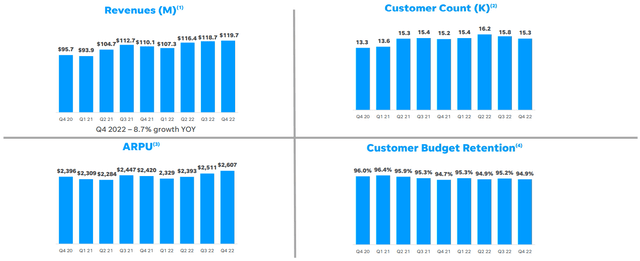

Nearly half of the company’s digital revenues are coming from its Digital Marketing Solutions (DMS) business, which finished 2022 with a record $469 million in revenue and $58 million in adjusted EBITDA. DMS is a cloud-based platform of products serving more than 15,000 small-to-medium size businesses to help them build their online presence, and it operates under a software-as-a-service model (SaaS). Revenues grew nearly 9% year-over-year in the fourth quarter, while adjusted EBITDA growth was 15%. The most important aspect of this business is that it has shown very little cyclicality, as we typically see in the advertising space. Therefore, it deserves a premium valuation. Similar businesses on a stand-alone basis are valued at 3-5 times sales, which means that the value of DMS is nearly non-existent under the Gannett umbrella.

Early last year, shares of Gannett were trading near their post-pandemic high of $7, as the company was firing on all cylinders after emerging from the pandemic. Management was forecasting $50-70 million in net income for the year and approximately $170 million in free cash flow. What happened?

The Detour

A surge in inflation not seen in 40 years, which began in 2021 and did not relent until the summer of 2022, presented unique challenges for Gannett from an input cost standpoint. The company incurred an approximate $100 million increase in operational costs, which were predominantly due to higher paper and ink prices associated with the print business. That wiped out the forecasted net income and free cash flow growth. It also wiped out the stock. This is why management took such aggressive steps late last year to reduce expenses by an additional $220 million.

Yet now those input prices are falling, consistent with what we have seen in Producer Price Index reports over the past several months, which means that what was a massive headwind in 2022 should be a decent tailwind in 2023.

What’s Misunderstood

I continue to be amazed by the millions of dollars individuals with no particular talent earn each year on social media platforms simply because they have followers. These walking billboards are called “influencers” who earn money from brands for posting sponsored content. One million followers can translate into a seven-figure income for some.

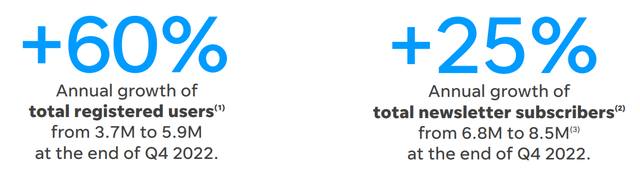

In that same vein, what are Gannett’s followers worth? Consider that its digital platforms had an average of 179 million unique visitors per month during the fourth quarter. In addition, it has 5.9 million registered users who have opened a free account to access additional content, as well as emails from another 8.5 million who have subscribed to newsletters. The growth rates for both are tremendous.

This makes Gannett one the largest “influencers” there is today, and CEO Mike Reed is just starting to monetize its followers. His partnership deal with Tipico Group in late 2021 never bore fruit, aside from the $20 million guarantee in advertising revenue, because Germany’s leading online sportsbook was unable to scale as hoped. That deal has been replaced with two new affiliations so far this year, and more are expected to come.

Gannett will be providing its followers with additional sports content from Gambling.com Group Limited (GAMB), through which it will earn fees when visitors to its platform open new online gambling accounts. It has established a similar affiliation with Forbes Marketplace. Gannett will share in the revenue earned by Forbes Marketplace when its followers purchase products or services that they learn about from content provided by Forbes Marketplace on Gannett’s digital platform. It is easy to see how the number of affiliate deals could mushroom when Gannett incurs no costs, while the affiliate benefits from an audience of nearly 200 million.

The Guidance

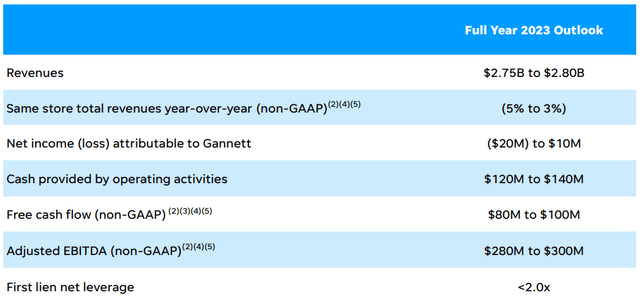

The guidance provided by Gannett Co., Inc. management for this year was underwhelming to say the least, but understandable considering what has transpired over the past three years. It appears that under-promising and over-delivering will be the strategy moving forward. According to comments made by the CFO on February’s earnings conference call, there is no accounting in the guidance for a decline in input costs from 2022 levels. Yet we know that input prices are coming down significantly, and I suspect that could lower operating costs by $50 million or more during 2023. The weaker dollar should also be a tailwind in 2023, as it negatively impacted revenue derived from the U.K. operations last year. Finally, the new affiliate deals are obviously not a part of this year’s forecast, both of which should provide a meaningful contribution to net income and cash flow as the year progresses.

Grossly Undervalued

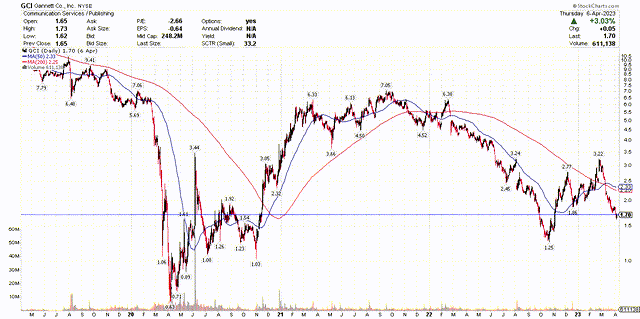

The greatest impediment to Gannett Co., Inc.’s stock performance is the stock price itself. No one wants to own a stock under $2/share that has no momentum and loses it within days or weeks of regaining some. It trades horribly, largely due to the fact that the volume equates to just a few million dollars per day. The shareholder base needs to broaden significantly to improve the liquidity in the stock. That takes coverage, but there is virtually no Wall Street coverage other than a couple of analysts who have been assigned the name with seemingly very little interest in understanding its potential. It has only traded at a lower price during the height of the pandemic and the bear market low of last October. That seems ludicrous given the progress on debt reduction and cost cuts, as well as the steady growth in the digital businesses. Gannett Co., Inc. may be back on track, but the business remains misunderstood, and the stock is grossly undervalued.

Therefore, Gannett Co., Inc. management needs to start producing results that are ahead of its own projections, as well as the consensus estimate, on a consistent basis. I think guidance was provided with that goal in mind. The first test will come at month’s end with results for the first quarter. Assuming Gannett can restore free cash flow and net income growth this year, which I think it can, it should start to trade in line with its peers in the industry.

In previous reports, I have used multiples of projected cash flow to show how this stock could trade as high as $20-25 over the coming 3-5 year period, but let me focus on a more real-time valuation model based on enterprise value (EV) in relationship to EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization).

Enterprise value is calculated by adding the market capitalization of the company (stock price x outstanding shares) to the total debt outstanding, minus the cash on the balance sheet.

Investopedia

Gannett finished 2022 with $1.272 billion in debt outstanding and $94 million in cash on the balance sheet for net debt of $1.178 billion. The current market cap of $239 million equates to an enterprise value of $1.417 billion. If we assume $300 million in EBITDA this year, the multiple is just 4.7 times. That compares to EV/EBITDA multiples of 18 times for The New York Times (NYT) and more than 11 times for News Corporation (NWS). The median for the sector is 10 times. If Gannett executes this year, given its unique engines for growth and continued debt reduction, there is no reason it should trade at such a steep discount to its peers. Let us look at the potential.

Assuming Gannett Co., Inc. pays down an additional $120 million in debt this year, the net debt would fall to $1.058 billion. If they simply meet their forecast for EBITDA of $300 million in 2023, and we see multiple expansion to a still discounted EV/EBITDA multiple of 8 times, it will equate to $2.4 billion. If the net debt is down to $1.058 billion, then the market cap would be $1.342 billion. Based on a share count of 140 million, the stock would be priced at $9.50. This may be a herculean return from $1.70, but it still values the company at a meaningful discount to its peer group.

The only way to earn outsized gains in the stock market is to identify a high quality and extremely undervalued name well before anyone else does. It then requires the patience to allow everyone else time to figure it out. Gannett Co., Inc. is such a name, and I am convinced that patience will be rewarded.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

This article was written by

Lawrence is the publisher of The Portfolio Architect. He has more than 25 years of experience managing portfolios for individual investors. He began his career as a Financial Consultant in 1993 with Merrill Lynch and worked in the same capacity for several other Wall Street firms before realizing his long-term goal of complete independence when he founded Fuller Asset Management. He graduated from the University of North Carolina at Chapel Hill with a B.A. in Political Science in 1992.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GCI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Lawrence Fuller is the Principal of Fuller Asset Management (FAM), a state registered investment adviser. Information presented is for educational purposes only intended for a broad audience. The information does not intend to make an offer or solicitation for the sale of purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. FAM has reasonable belief that this marketing does not include any false or material misleading statements or omissions of facts regarding services, investment, or client experience. FAM has reasonable belief that the content as a whole will not cause an untrue or misleading implication regarding the adviser’s services, investments, or client experiences. Past performance of specific investment advice should not be relied upon without knowledge of certain circumstances or market events, nature and timing of investments and relevant constraints of the investment. FAM has presented information in a fair and balanced manner. FAM is not giving tax, legal, or accounting advice. Mr. Fuller may discuss and display charts, graphs, formulas, and stock picks which are not intended to be used by themselves to determine which securities to buy or sell, or when to buy or sell them. Such charts and graphs offer limited information and should not be used on their own to make investment decisions. Consultation with a licensed financial professional is strongly suggested. The opinions expressed herein are those of the firm and are subject to change without notice. The opinions referenced are as of the date of publication and are subject to change due to changes in market or economic conditions and may not necessarily come to pass.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.