Why Westlake Chemical Partners Is A Bond-Like Investment

Summary

- An ethylene sale agreement with WLK limits WLKP's opportunities until 2027 and gives the stock bond-like qualities.

- The company will benefit from its WLK contract in 2023 as ethylene margins fall below 10 cents.

- Renegotiating its WLK contract adds optionality in the future.

teppakorn tongboonto/iStock via Getty Images

With no real path to growth until 2027 and generally steady operating results, Westlake Chemical Partners (NYSE:WLKP) is more akin to a high-yield bond at this point.

Company Profile

WLKP owns a 22.8% interest in an operating company that has three ethylene production facilities, which primarily convert ethane into ethylene. The Opco also owns a 200-mile ethylene pipeline. Westlake Corporation (WLK) owns the remaining stake in the operating company.

The facilities produce approximately 3.7 billion pounds of ethylene, which is used to further produce chemicals such as polyethylene (PE) and polyvinyl chloride (PVC). It also sells co-products of ethylene production, including propylene, crude butadiene, pyrolysis gasoline and hydrogen.

Two of the facilities, Petro 1 and Petro 2, are located at WLK’s Lake Charles site and produce nearly 3 billion pounds of ethylene combined. The ethylene from these facilities are used at WLK’s Lake Charles facilities or transferred to its Geismar facility or its Longview facility. The company also has a smaller facility at Calvert City that process about 720 million pounds of ethylene.

In addition to owning 77.2% of the underlying operating company, WLK also owns 40.1% of WLKP and its IDRs. While most MLPs have eliminated their IDRs, WLKP still has them. However, it has them more technically speaking, as in 2019 it reset the IDRs at no cost to WLKP to a pretty unattainable level. The first 15% split would not kick until WLPK paid a quarterly distribution of $1.2938, a far cry from the 47.1-cent quarterly distribution it is currently paying. The dreaded high-splits would kick in with a quarterly distribution above $1.6875.

Opportunities and Risks

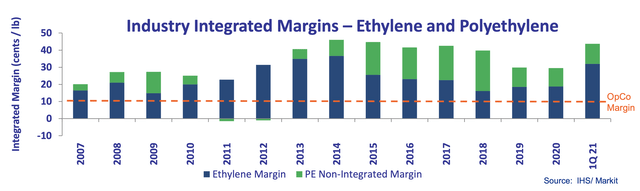

WLKP has a 12-year ethylene sales agreement with WLK to sell 95% of the facilities’ production at a fixed 10-cent margin. In addition to feedstock costs, WLK also covers operating costs, maintenance capital expenditures, and other turnaround expenditures, less net proceeds from co-products sales. The remaining ethylene and any co-products are sold to third parties. WLK supplies the ethane feedstock to WLKP.

The 10-cent margin WLKP charges its parent is below where ethylene margins typically fall. However, the contract is a take-or-pay and is not reduced for a force majeure event lasting fewer than 45 consecutive days. This has come in handy when hurricanes have hit the facilities in the past. The contract runs through the end of 2026.

As such, WLKP's biggest growth opportunity is to renegotiate the deal and get a better margin. The 10-cent margin is typically below where third-party margins have been, so while WLKP may not be able to get historical market averages, it does have the opportunity to get an increase.

In the meantime, results tend to fluctuate mostly based on the 5% of production that isn’t tied to the WLK agreement. Third-party margins started to feel pressure in 2022 and likely will continue to be challenged in 2023. The company is actually predicting that 2023 third-part ethylene margins could fall below the fixed 10-cents it get with WLK.

On its Q4 call, CEO Mark Bender said:

"So third-party margins were depressed in the quarter simply because of lack of demand of ethylene derivatives in the marketplace. We're selling ethylene into that market. And so there was a pullback as you've seen in the macroeconomic environment for ethylene-related derivatives. And so therefore, margins were below that historical threshold of what we've seen historically. So therefore, margins were under pressure. As we look forward, we'll look to see where we can optimize ethylene margins. The market is volatile in terms of ethylene margins, and we certainly look to maximize those third-party sales when we can optimize margin to exceed the targeted $0.10. In 2023, the consultants are looking to forecast margins could be below that $0.10 threshold currently."

Argus has also predicted that ethylene margins will be at historically low levels in 2023. Margins were 19.75 cents in Q1 2022, but fell throughout the year.

Last Quarter

For Q4, WLKP reported EBITDA of $125.6M, down from $166.8 million a year ago. Distributable cash flow (DCF) came in at $20.3 million, good for a coverage ratio of 1.2x. That was up from $15.3 million a year ago.

The declines in EBITDA were due to lower third-party margins as well as a lower buyer deficiency fee of $10 million. DCF rose due to lower maintenance CapEx. The company continues to receive a 10-cent margin on the 95% of its business from WLK.

A turnaround for its smaller Calvert City ethylene facility is currently planned for the first half of 2023. The turnaround will start in May and last 30 days.

On the call, CEO Albert Chao said:

“We are pleased with the Partnership's financial and operational performance through the fourth quarter and the year as a whole. The stability of our business model and associated cash flows demonstrate the benefit of our ethylene sales agreement and its protective provisions provide the Partnership through predictable long-term earnings and cash flows despite both planned and unplanned production outages.

"While recent economic weakness has negatively impacted demand for ethylene derivatives, the nature of our ethylene sales agreement provides for the recovery of all costs related to sales to Westlake. Thus, we are very well positioned to navigate these markets. Our ethylene sales agreement which provides a predictable fee-based cash flow structure from our take-or-pay contract with Westlake for 95% of OpCo's production will continue to deliver stable and predictable cash flows."

Valuation

When looking at WLKP’s valuation, it is important to make adjustments based on the company’s 22.8% ownership of the Opco.

Thus, when looking at the 2023 consensus of $445.3 million, when valuing the company I prefer use $101.5 million, which is the EBITDA attributable to the WLK. WLKP's debt and cash should also be adjusted to get an EV of $834 million. I feel that is more accurate than just adjusting using the minority interest.

On that basis, the stock trades at around 8.2x EV/EBITDA multiple. That seems about right for a growth company that is defensive and throws off good cash.

Conclusion

The original vision when WLKP was created by WLK has been a bust, and the idea of a drop-down MLP is generally no longer considered attractive. In the current environment, it just does not make sense for WLKP to buy more of the Opco in my view.

As such, I believe WLKP has really been turned more into a bond-like instrument. It will have some cash flow variations from things like changes to third-party margins, maintenance CapEx, and interest rates, but overall results will be steady with no real growth opportunities over the next few years.

The big opportunity for the company will be in 2027 if it can renegotiate a higher margin from WLK. For now, though, the company will actually see a rare benefit to its contract with WLK given that ethylene margins have fallen well below historic norms and under 10 cents.

Until then it’s more of a high yield bond with about an 8.8% yield. Theoretically, the stock should become more or less attractive depending on where Treasury yields head.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.