PubMatic Feels The Brunt Of Display Ad Slowdown

Summary

- PubMatic went public in December 2020, raising $118 million in gross proceeds for the company and selling shareholders.

- The firm provides a sell-side programmatic advertising platform for publishers and advertisers worldwide.

- PUBM has seen display advertising drop markedly since Q4 2022 and is cutting expenditures and has reorganized its go-to-market efforts in response.

- I'm on Hold for PUBM in the near term.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

NicoElNino

A Quick Take On PubMatic

PubMatic (NASDAQ:PUBM) went public in December 2020, raising approximately $118 million in gross proceeds for the company and selling shareholders in an IPO that was priced at $20.00 per share.

The company provides a sell-side programmatic advertising platform for publishers and app developers.

PUBM has borne the brunt of a significant valuation compression over the past year, so my near-term outlook is on Hold pending further information about demand for its platform services.

PubMatic Overview

Redwood City, California-based PubMatic was founded to enable real-time programmatic advertising transactions via its specialized purpose-built advertising database and delivery infrastructure.

The system exists to help publishers and application developers monetize their advertising placement inventory efficiently and reliably across different devices and platforms.

Management is headed by co-founder and CEO Rajeev Goel, who was previously product marketing director at SAP AG (SAP).

The firm provides a sell-side advertising infrastructure platform within the digital advertising ecosystem.

In addition, PubMatic has integrated its system with demand-side platforms such as The Trade Desk (TTD) and Google DV360 (GOOG).

PubMatic’s Market & Competition

According to a 2022 market research report by Verified Market Research, the global market for programmatic advertising platform revenue was valued at an estimated $4.9 billion in 2020 and is expected to reach $38.7 billion by 2028.

This represents a forecasted very high CAGR (Compound Annual Growth Rate) of 29.71% from 2021 to 2028.

The main drivers for this expected growth are the use of real-time bidding, global automated guaranteed auction environments and strong demand from the mobile advertising industry.

Also, by region, China will show the greatest growth potential as part of the larger Asia-Pacific region, reaching a forecast of $5.7 billion in spending by 2027.

Major competitive or other industry participants include:

Magnite (MGNI)

Google

Adobe (ADBE)

Xandr (Microsoft) (MSFT)

MediaMath

Yahoo!

The Trade Desk

Connexity (Taboola)

PubMatic’s Recent Financial Trends

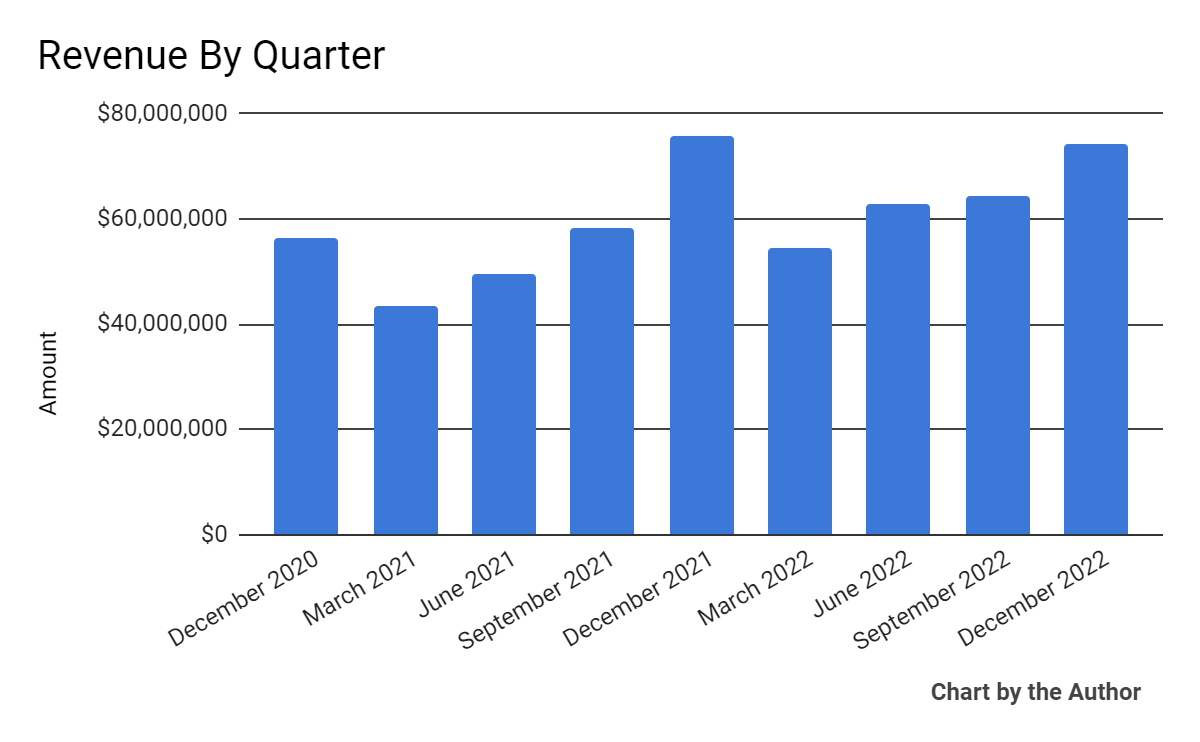

Total revenue by quarter has shown recent stagnation, which is largely due to a recent drop in display advertising activity:

Total Revenue (Seeking Alpha)

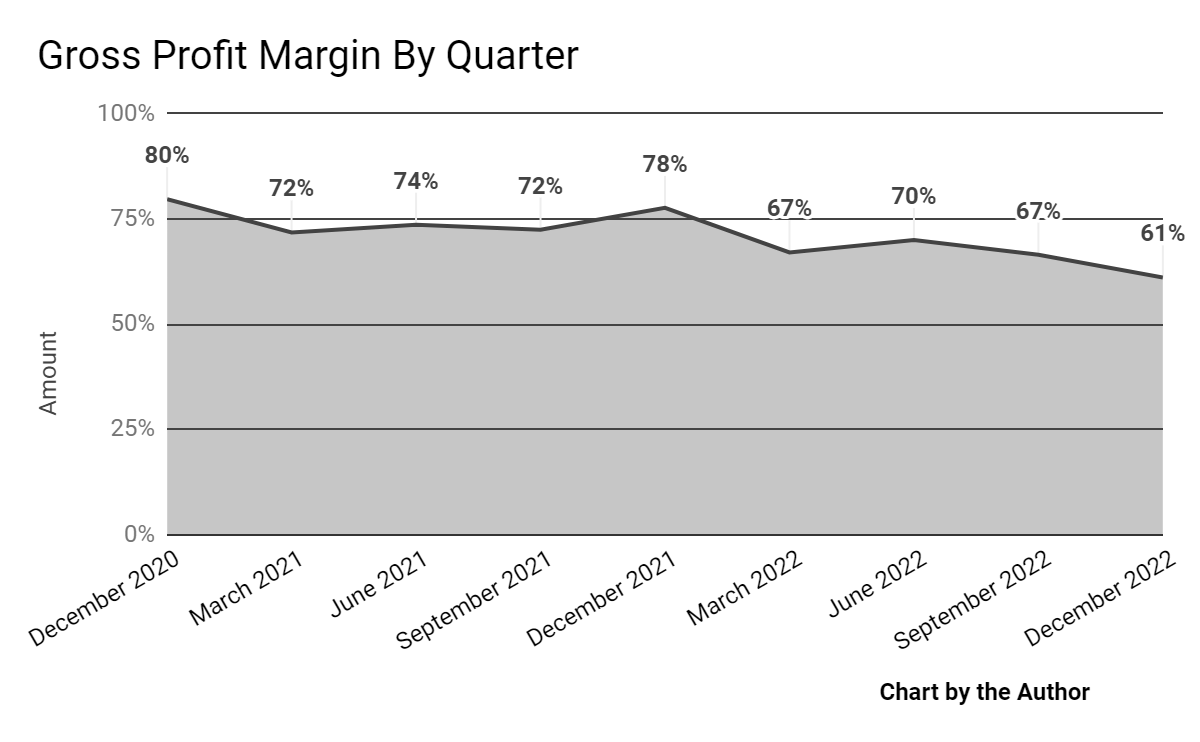

Gross profit margin by quarter has trended downward in recent quarters, and management has said it expects a ‘challenging next couple of quarters’, but says it is ‘laying the groundwork for margin expansion later this year and into 2024 along a variety of parameters:

Gross Profit Margin (Seeking Alpha)

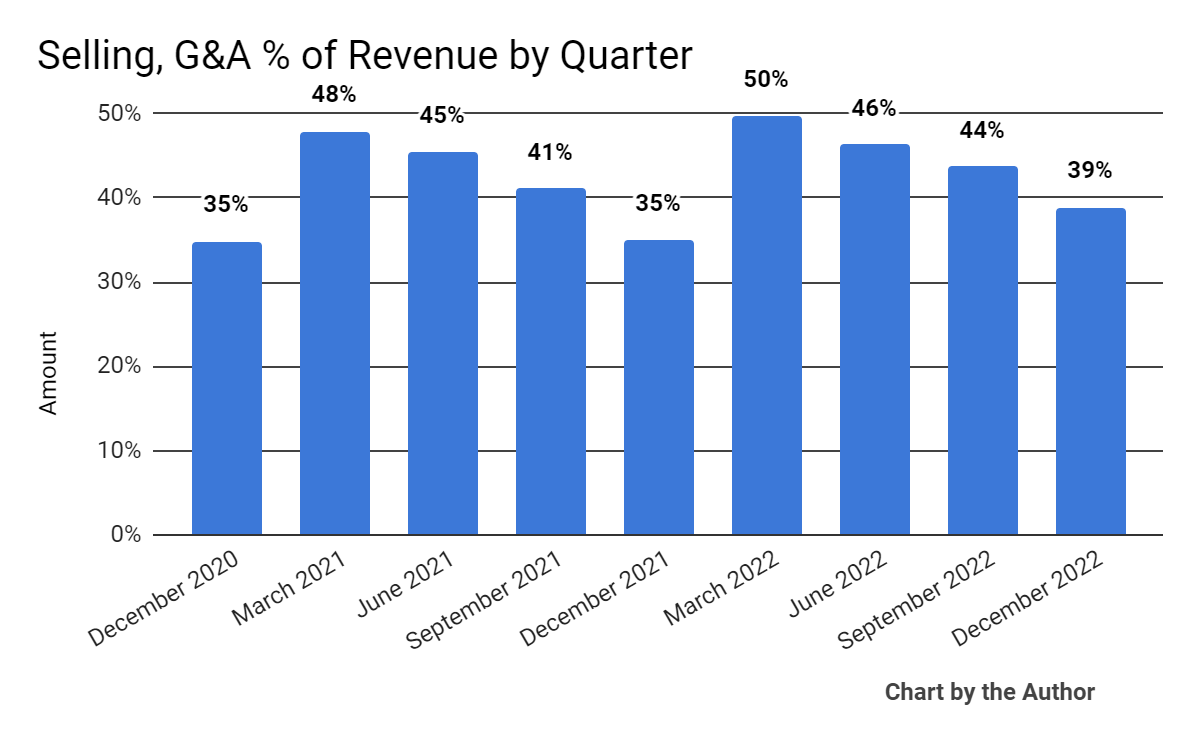

Selling, G&A expenses as a percentage of total revenue by quarter have trended higher more recently after a few years of increased hiring. Management has already reduced the pace of hiring and expects to focus on only a ‘very select number of high priority roles’:

Selling, G&A % Of Revenue (Seeking Alpha)

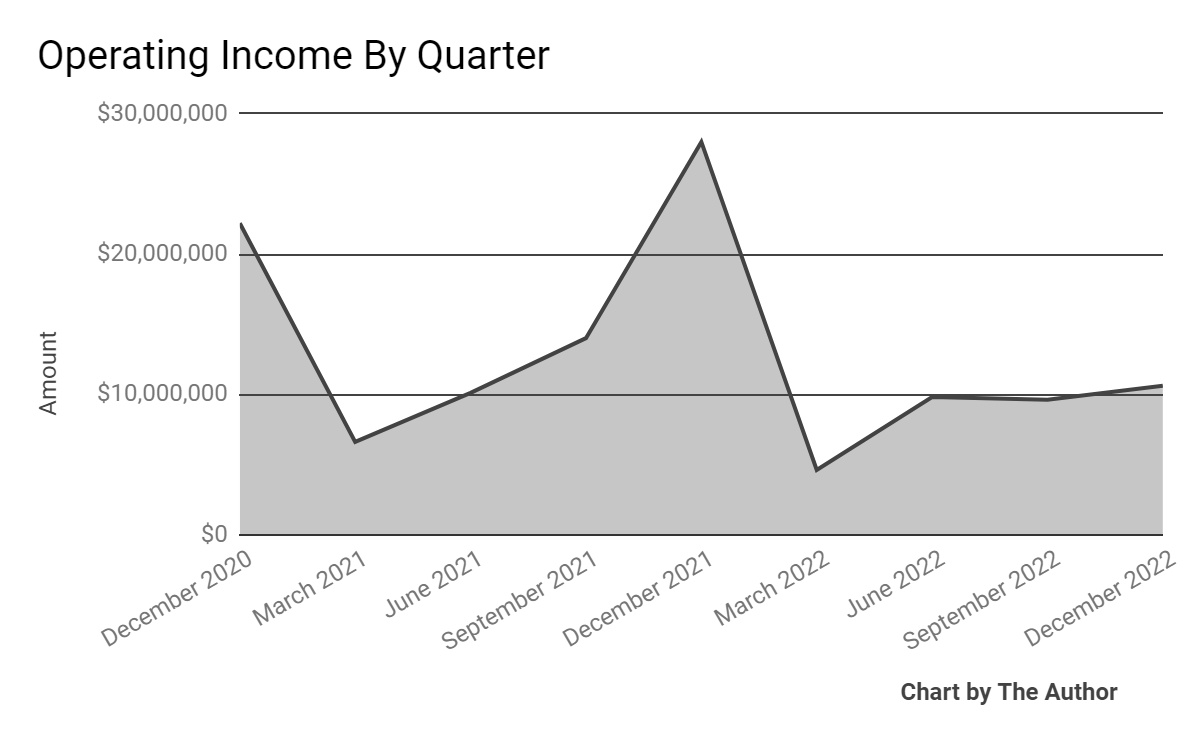

Operating income by quarter has trended lower in recent quarters as expenses have trended higher, including stock-based compensation:

Operating Income (Seeking Alpha)

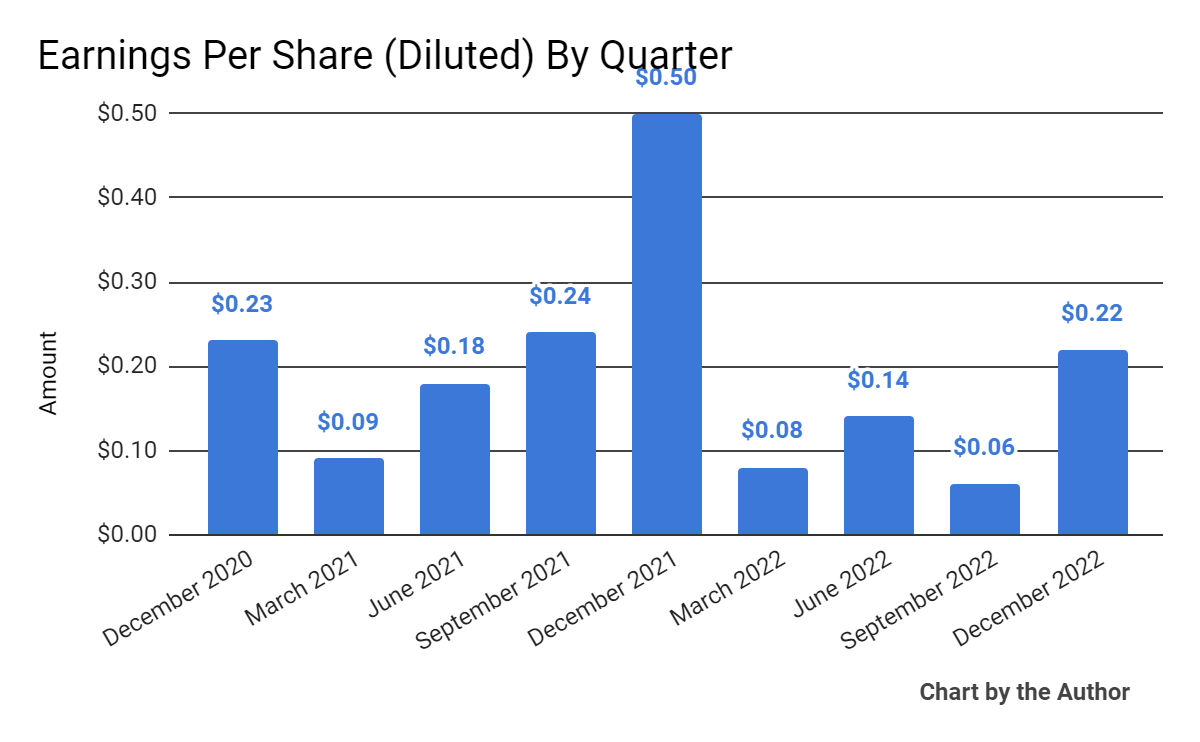

Earnings per share (Diluted) have dropped in recent quarters:

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

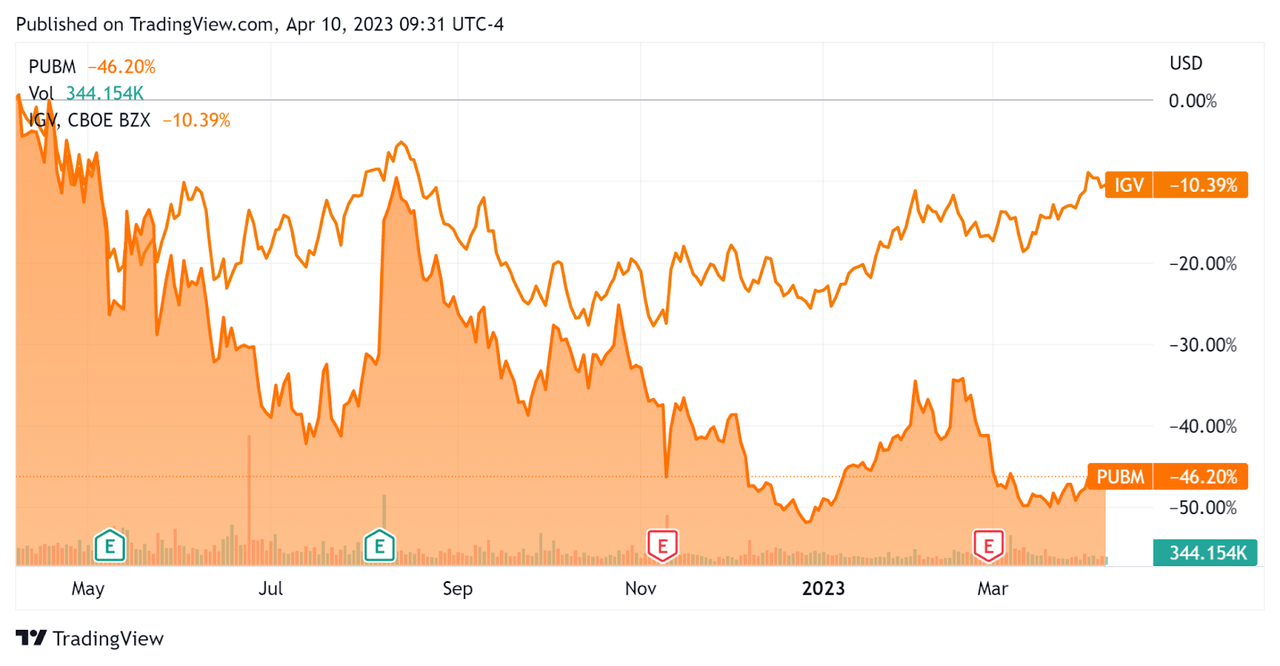

In the past 12 months, PUBM’s stock price has fallen 46.2% vs. that of the iShares Expanded Tech-Software ETF’s (IGV) drop of 10.4%, as the chart indicates below:

52-Week Stock Price Comparison (Seeking Alpha)

The company’s net dollar retention rate in 2022 was 108%, indicating reasonably good product/market fit and sales & marketing efficiency.

For the balance sheet, the firm ended the quarter with $174.4 million in cash, equivalents and short-term investments.

Over the trailing twelve months, free cash generated was $51.3 million, of which capital expenditures accounted for $35.9 million. The company paid a meaningful $20.6 million in stock-based compensation in the last four quarters.

Valuation And Other Metrics For PubMatic

Below is a table of relevant capitalization and valuation figures for the company:

Measure [TTM] | Amount |

Enterprise Value / Sales | 2.3 |

Enterprise Value / EBITDA | 10.0 |

Price / Sales | 2.8 |

Revenue Growth Rate | 13.0% |

Net Income Margin | 11.2% |

GAAP EBITDA % | 22.9% |

Market Capitalization | $733,250,000 |

Enterprise Value | $586,060,000 |

Operating Cash Flow | $87,210,000 |

Earnings Per Share (Fully Diluted) | $0.50 |

(Source - Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

PUBM’s most recent GAAP Rule of 40 calculation was 35.9% as of Q4 2022’s results, so the firm has performed reasonably well in this regard, per the table below:

Rule of 40 - GAAP | Calculation |

Recent Rev. Growth % | 13.0% |

GAAP EBITDA % | 22.9% |

Total | 35.9% |

(Source - Seeking Alpha)

Future Prospects For PubMatic

In its last earnings call (Source - Seeking Alpha), covering Q4 2022’s results, management highlighted the challenges the firm faced as the year ended.

Display advertising is roughly two-thirds of PubMatic’s business, so the factors negatively impacting that business will have an outsize effect on PUBM’s top-line revenue growth trajectory.

Management noted that it expects further consolidation in the sell-side platform market, ‘consolidating down to fewer bigger platforms’ and see PUBM as a ‘winner in that process.’

The firm owns and operates its own infrastructure, which leadership believes gives it greater operational control and operating leverage.

However, it has experienced a severe downturn in its display business due to industry cut-backs which began in December 2022.

The company's financial position is reasonably solid, as the company has significant cash resources, no debt and is generating free cash flow.

Regarding valuation, the market is valuing PUBM at an EV/Sales multiple of around 2.3x.

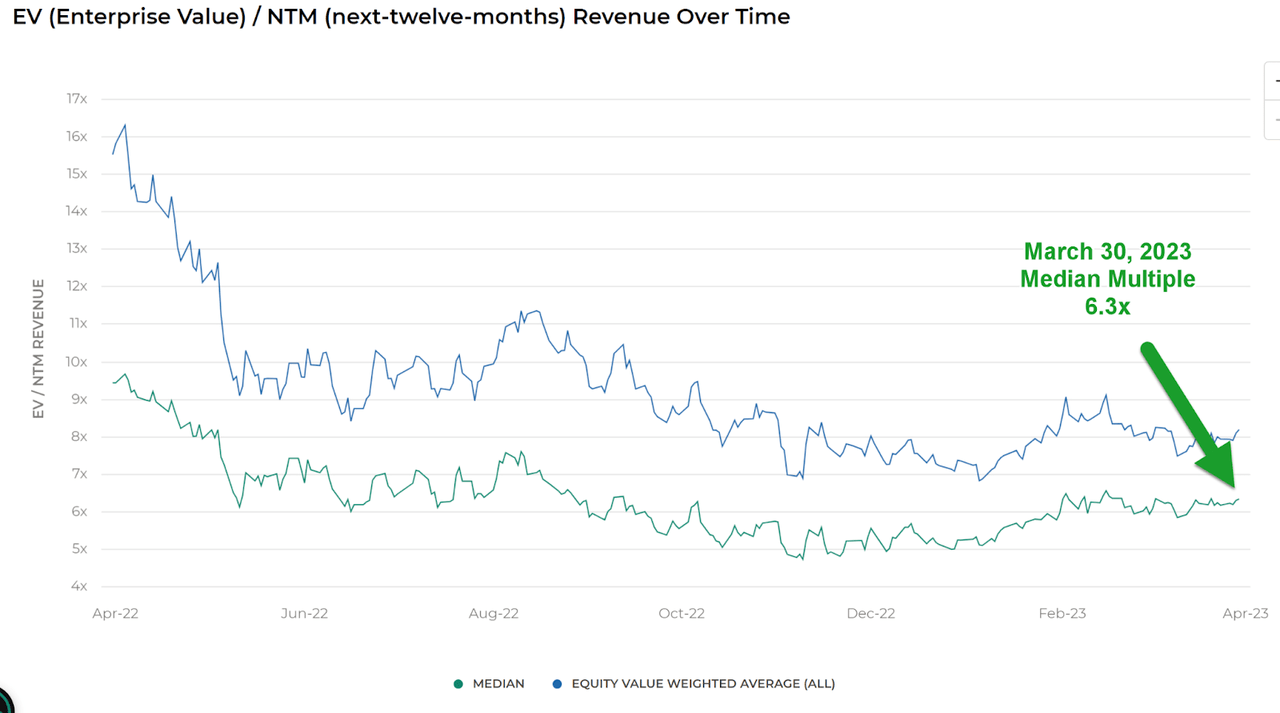

The Meritech Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 6.3x on March 30, 2023, as the chart shows here:

EV / Next 12 Months SaaS Index Multiple (Meritech Capital)

While the company is not a pure SaaS business, by comparison, PUBM is currently valued by the market at a significant discount to the broader Meritech Capital SaaS Index, at least as of March 30, 2023.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown or recession, which is already producing slower sales cycles, cutting ad spending, thereby reducing its revenue growth trajectory.

Looking ahead, management said it has limited visibility into 2023, so it did not provide guidance beyond Q1 due to challenging macroeconomic conditions.

In response, the firm will be cutting its 2023 CapEx by 50%, reducing its discretionary spending and has reorganized its technology and go-to-market teams to focus on the fastest growth opportunities it sees, which are:

Video

Supply path optimization

Retail media

A potential upside catalyst to the stock could include a pause in interest rate hikes, reducing downward pressure on its multiple, which has dropped sharply from around 5x to 2.3x in the past 12 months, as the chart shows below:

Enterprise Value / Sales Multiple History (Seeking Alpha)

Given my base case of a further slowing economy, as a ‘credit crunch’ from U.S. banks forces business retrenchment, I’m not optimistic for PUBM.

However, the stock has borne the brunt of a significant valuation compression over the past year, so my near-term outlook is on Hold pending further information about demand for its platform services in a down display advertising market.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.