Casella Waste Systems Doesn't Scream Buy At These Prices

Summary

- Casella Waste Systems, Inc. might have seen a 22% increase in revenues YoY but that still leaves the company far away from growing into its valuation.

- The company has a history of diluting shares and doesn't distribute a dividend either, leaving little value left for shareholders.

- I think that paying 69x earnings is far too much and will hold a sell rating for the company.

taseffski/E+ via Getty Images

Investment Summary

Casella Waste Systems, Inc. (NASDAQ:CWST) is a company that helps manage waste for a range of customers, including households, businesses, and local governments, throughout the United States. They're one of the top companies in this industry and are known for providing comprehensive waste management services.

They've been growing steadily, thanks to the increase in demand for these services and their own efforts to expand and improve their offerings. Casella Waste Systems, Inc. continues to generate a higher top line while also strengthening its position in the market through various acquisitions.

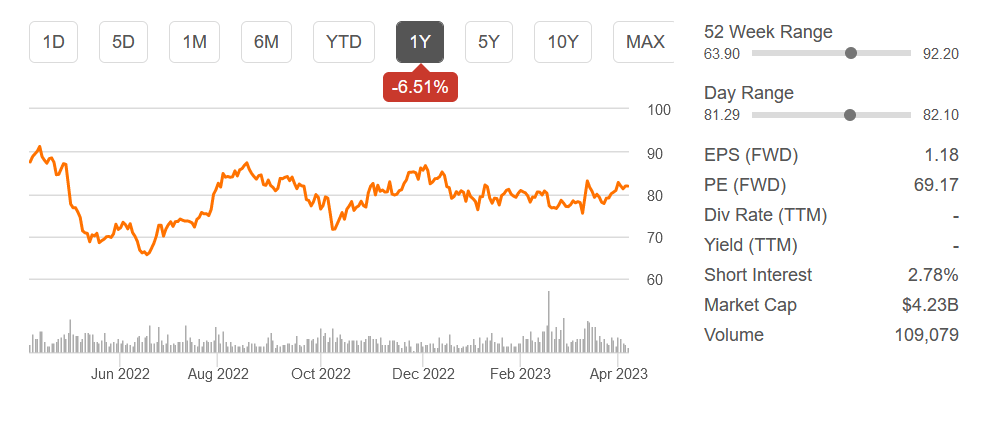

Stock Price (Seeking Alpha)

During the last 5 years, the company managed to achieve a 13% CAGR but it seems the growth is not really there to justify the high valuation in my opinion (trading around 69x earnings on estimated future earnings). This doesn't scream undervalued, nowhere near it. Pair this with a history of diluting shares and I think there is more risk than reward here and so I will issue a sell rating for the company. I don't see the growth story and the current valuation is at a high risk of compressing to a level more in line with the broader sector.

Guidance

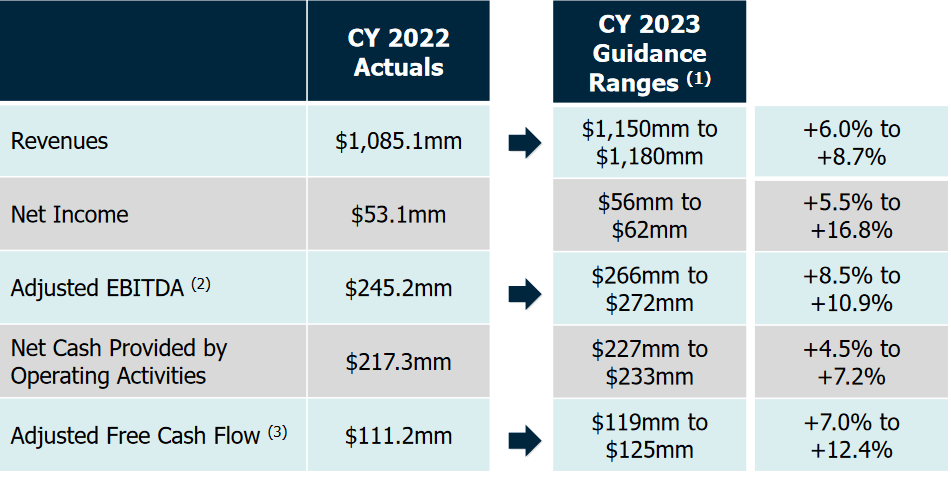

Looking ahead the company is projected to grow faster than the industry according to a presentation the company released in March. It showcases a pretty broad range for net income which makes me believe the management is a little uncertain about what the company's expenses will look like and what the impact of volatile recycling commodities might be.

Company Guidance (Investor Presentation)

Looking at a report from fortunebusinessinsights about the solid waste management industry they project the CAGR between 2019 and 2027 to be 3.3%. It is a good sign that CWST is able to grow faster than this, but when the industry they are in isn't exactly poised for growth it's often difficult for companies within it to be able to achieve that.

In the earnings report, the company itself says they maintain this outlook as they "assume a stable economic environment for the remainder of 2023". What makes me worried is that if that is not the case, which very much might be the case, then the outlook is at a high risk of being revised downwards in my opinion. Then the forward p/e rises and the company continues staying incredibly overvalued.

Risks

Looking at some of the risks regarding the company, there aren't exactly any glaring ones when just looking at how the company operates. They have a solid framework they can build out from and generate stable revenues for years to come I think. Instead, I think the risk lies with the investors as they might be holding shares in a company with a very rich valuation. Compression in the valuation might not be caused by any actions of the company, but instead, just the market letting go and giving it an arguably fairer multiple.

This is enough in my opinion to not rate it a buy and instead a sell. As a reference, if the company was to trade at around 19 p/e then the EPS would need to be around $4.3 with the current share price or around $80. In 2022 the EPS was $1.08, meaning it would need to rise almost 300% to make the current price make sense. I just don't see a situation where this is possible.

Besides perhaps the valuation of the company being very high and placing the risk on the side of the investor, the last report also showcased the cost of operations increasing by 24% YoY which was faster than the 22% rate the revenues increased. This makes me think margins might actually decrease over the next few years.

Financials

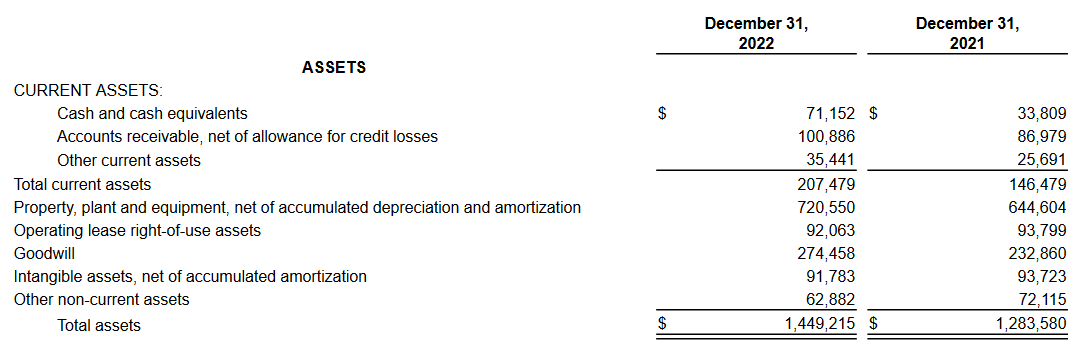

Looking at Casella Waste Systems, Inc.'s balance sheet as of December 31, 2022, there are some key figures and changes to take note of. The company's total assets have grown from $1.28 billion in 2021 to $1.45 billion in 2022, which is a positive sign in my opinion. The cash position has seen a more than 100% increase YoY which I think is fantastic as it makes it so much easier for the company to tackle short-term headwinds. But it's of course coming at the cost of some share dilution too over the last few years.

Company Assets (Earnings Report)

The company's long-term debt has also gone up from $542.5 million in 2021 to $585.0 million in 2022. I am not too worried about debt becoming an issue in the future. The company has managed to increase its cash flows at a good rate over the last several years, from $8.9 million in 2019 to $65 million in the last 12 months. This should be sufficient to handle and short-term the company has to pay down some debt and also leave some to build up their cash position.

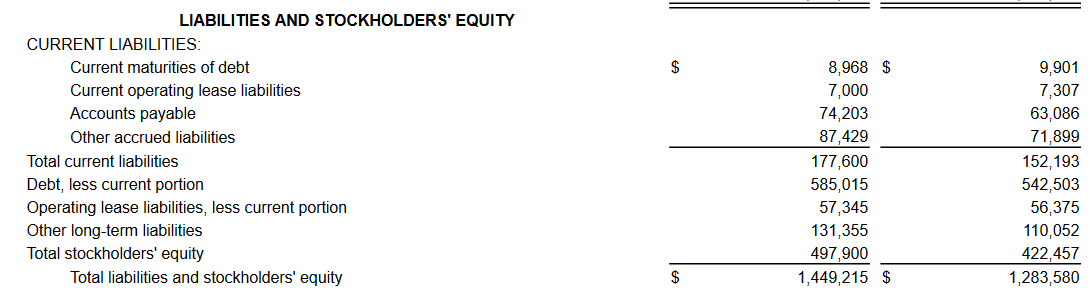

Company Liabilities (Earnings Report)

To summarize the balance sheet a little bit, I think they are in a relatively strong and stable position right now. They seem to have been able to handle themselves quite well despite the last few years and the challenges it has placed on companies all across the industry. I think it will be important to watch how the likely margin compression for the company might impact its cash flows and whether share dilution will pick up or not because of it.

Valuation & Wrap Up

It has been said throughout this article that the valuation of CWST is too high. Trading at 69 forward earnings and not generating that impressive revenue doesn't justify the valuation in my opinion.

I think there is a lot of potential downside for the company if there is any sign of weakness from the company. A potential catalyst for that might be a downward revised outlook because of there not being a "stable economic environment", on which the company bases its guidance on.

I wouldn't want to pay more the around 22x earnings with the type of growth the company has. That would put the share price around $23 which is far below the current price. All in all, I think there is far more risk than reward right now and with that I rate the company as a sell.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.