DHY: High Yield CEF Surviving The Credit Suisse Association

Summary

- Credit Suisse High Yield Bond is a fixed-income closed-end fund.

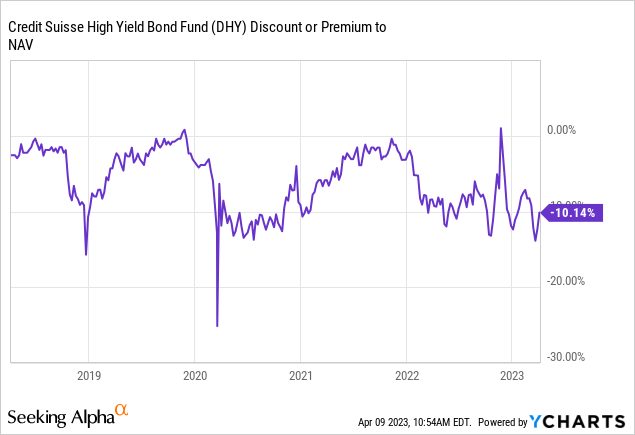

- The CEF has a moderate 33% leverage ratio and a very large discount to NAV of -11%.

- The fund's collateral is managed by the Credit Suisse asset management team but has no other association with the bank, its assets, or the estate.

- The CEF has seen its discount to NAV widen significantly when the Credit Suisse scandal started.

- The fund does not take extreme credit risk via a high CCC bucket but has a moderate BB/B allocation.

Torsten Asmus

Thesis

Credit Suisse High Yield Bond (NYSE:DHY) is a fixed income closed end fund. The vehicle has the misfortune to be associated with Credit Suisse, although outside the investment advisory function it has little to do with the actual bank. It is true that its outperformance throughout time is due to the portfolio managers from the CS asset management business, but with UBS set to take-over we feel the CEF advisory business will not be affected much.

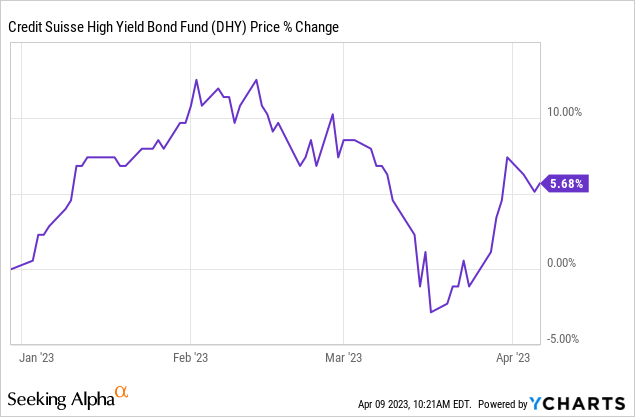

The fund closely tracked risk-on markets in 2023, up to the Credit Suisse implosion, when DHY tanked:

We can see in the above chart how the fund lost over 12% in a matter of days. Since the Credit Suisse rescue the CEF has re-bounded.

DHY is only subject to Credit Suisse risk as far as the portfolio management goes:

A savvy investor needs to realize a CEF is a separate legal entity, a company on its own, that has independent accountants and a separate custodian in place. There is no securities co-mingling here or any other association with Credit Suisse outside the Investment Adviser agreement.

With the UBS take-over starting, we feel the asset management business is a prized possession that will largely be kept intact. The current set-up and portfolio managers should not change much going forward in our opinion. We agree there will be a period of turmoil and uncertainty, but we feel the CS investment banking business is going to be the one to suffer most cuts going forward. That was the division responsible for the recent blow-ups, and that is the division running the highest RWA and consuming most of the capital versus the profit it generates (in this case the loss it generates).

Analytics

- AUM: $0.2 billion.

- Sharpe Ratio: 0.8 (3Y).

- Std. Deviation: 11 (3Y).

- Yield: 10%

- Premium/Discount to NAV: -11%

- Z-Stat: -0.4

- Leverage Ratio: 33%

Performance

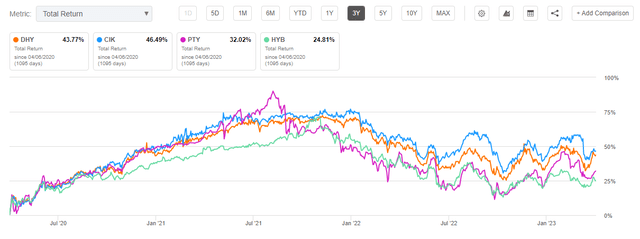

Similarly to its sister fund Credit Suisse Asset Management Income Fund (CIK), DHY has a strong historic performance:

We can see from the above graph that the two Credit Suisse funds outperform a HY CEF cohort on a 3-year lookback period.

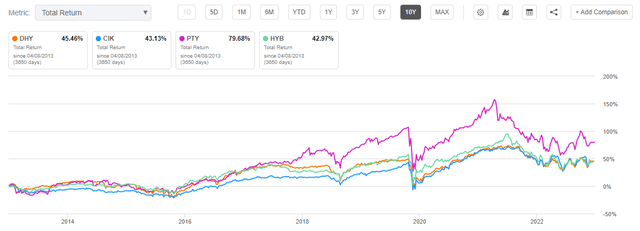

On a 10-year time-frame we see a very similar performance with the cohort, outside of PTY which is the outperformer here:

An informed reader needs to keep in mind that PTY has an outstanding historic performance also due to its large premium to NAV. During the past decade the investor community realized the value inherent in this CEF and bid it up. It has now traded for years with very large premiums to NAV. Normalized for those premiums the fund would otherwise be much closer to the overall cohort performance.

Holdings

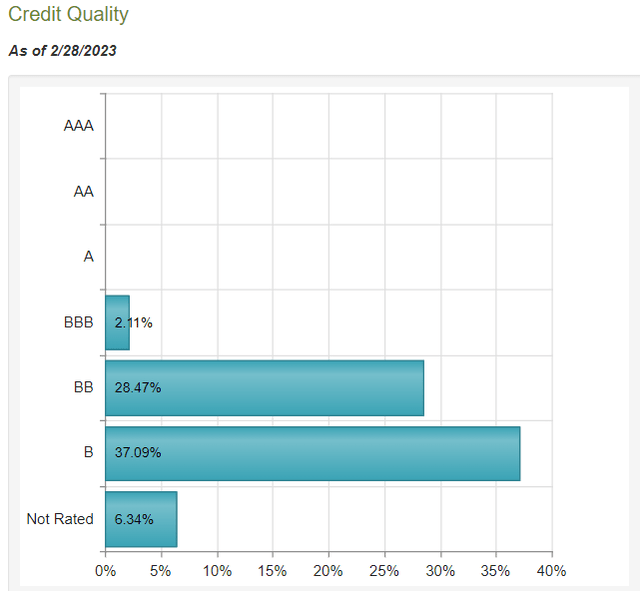

The fund has an average build for a HY CEF:

The fund does not take extreme credit risk via high CCC buckets, but has a moderate BB/B allocation.

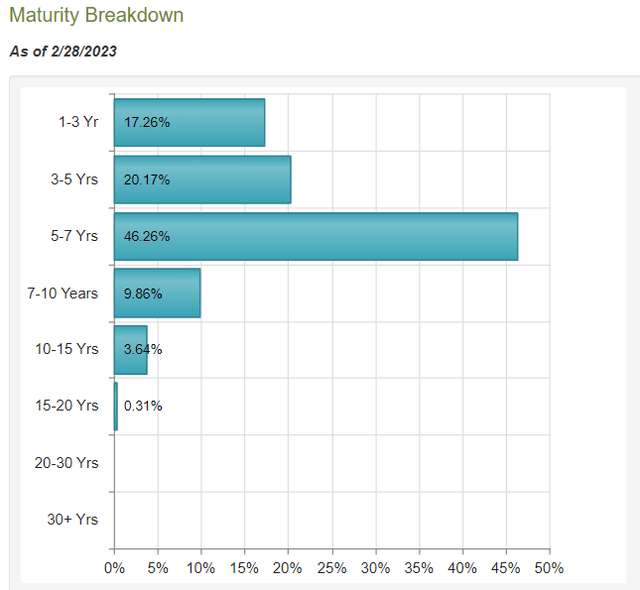

Similarly, it has an average duration bucketing profile:

Maturity of Collateral (CEFConnect)

Nothing sticks out in the portfolio here, with the holdings being very granular as well, with single name issuers under 2%.

Premium/Discount to NAV

The fund has been severely punished for its association with Credit Suisse:

Outside periods of stress, this CEF trades close to flat to NAV. We can see that post the CS melt-down the fund moved to a -10% discount to NAV. We think this is going to normalize in 2024, but 2023 will be rough.

Conclusion

DHY is a fixed income CEF. The fund invests in U.S. high yield debt and has the misfortune to be associated with Credit Suisse via its naming convention and its investment manager. That is where the link ends. The CEF is a separate legal entity, with a separate custodian and its own accountants. If the fund decides to terminate its investment advisory agreement and choose a new one, it can do so. That being said, its robust historic performance has been driven by the CS asset management team that has chosen credits for its portfolio. With the UBS takeover we expect the portfolio management team to stay in place with no changes. We feel the CS division that will be impacted the most from the takeover is constituted by the investment banking arm. We expect significant changes there. DHY is now trading at a substantial discount to NAV of almost -11%, although its collateral is within the normal, granular allocation for HY CEFs. The fund has rebounded in the last few weeks as the CS situation has been clarified, but in our mind will move higher as 2023 progresses. There might be a name change in the future as well for this fund.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.