Why I Sold Broadcom Stock: Mismatch Between Expectations And Reality

Summary

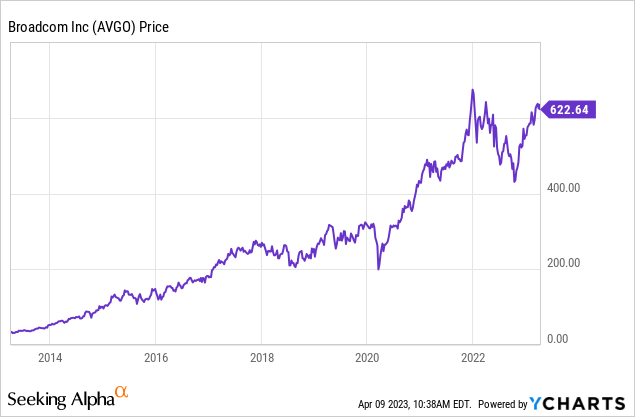

- Broadcom is one of the few tech stocks still trading near all-time highs.

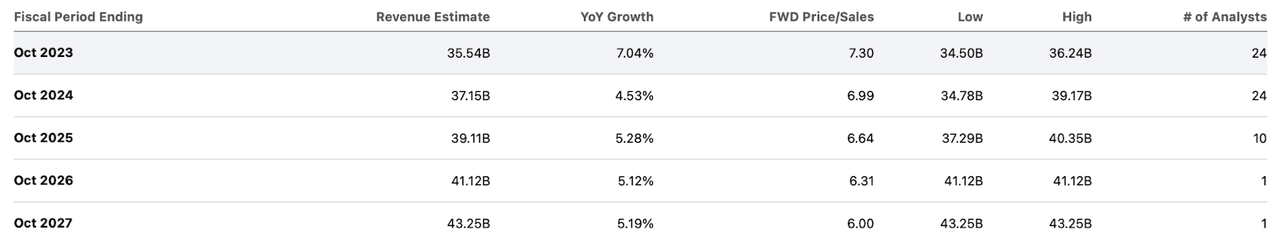

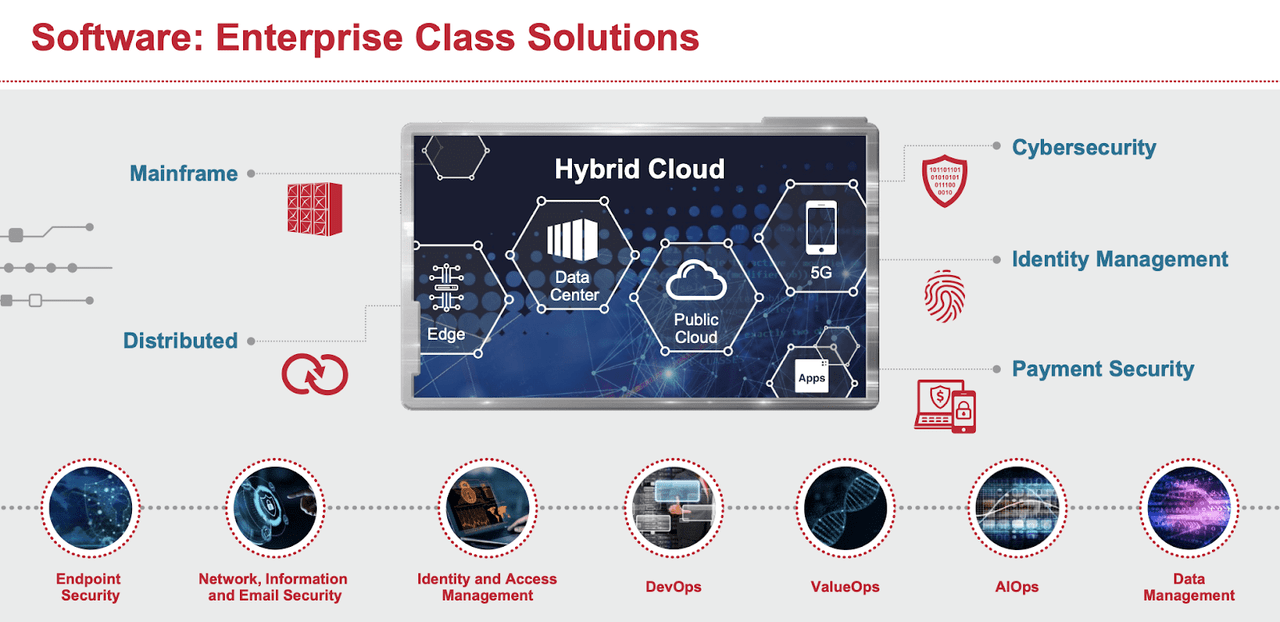

- The stock is a favorite among retail investors due to its history of rapidly growing earnings and dividends.

- Consensus estimates tell a different story, with mere single-digit projected revenue growth ahead.

- I explain why I have sold my stock and moved on.

- Looking for a portfolio of ideas like this one? Members of Best Of Breed Growth Stocks get exclusive access to our subscriber-only portfolios. Learn More »

Justin Sullivan/Getty Images News

Broadcom (NASDAQ:AVGO) has been a surprisingly strong performer over the past half year. The company is still working on completing its acquisition of VMware (VMW) but in the meantime remains profitable while returning cash to shareholders through dividends and share repurchases. Yet I make the case that AVGO is in its mature stage of its company lifecycle and the current valuations are not presenting enough upside. Given that I find it difficult for AVGO to generate the growth necessary to justify its multiple, I have sold out of my position and rate the stock a hold.

AVGO Stock Price

AVGO is one of the few tech stocks still trading at all time highs. As I'll discuss in this report, I find that distinction to be misplaced.

I last covered AVGO in September where I rated the stock a buy on account of the reasonable valuation. Two quarters later, the stock has returned more than 20%, wildly surpassing even my most bullish expectations.

AVGO Stock Key Metrics

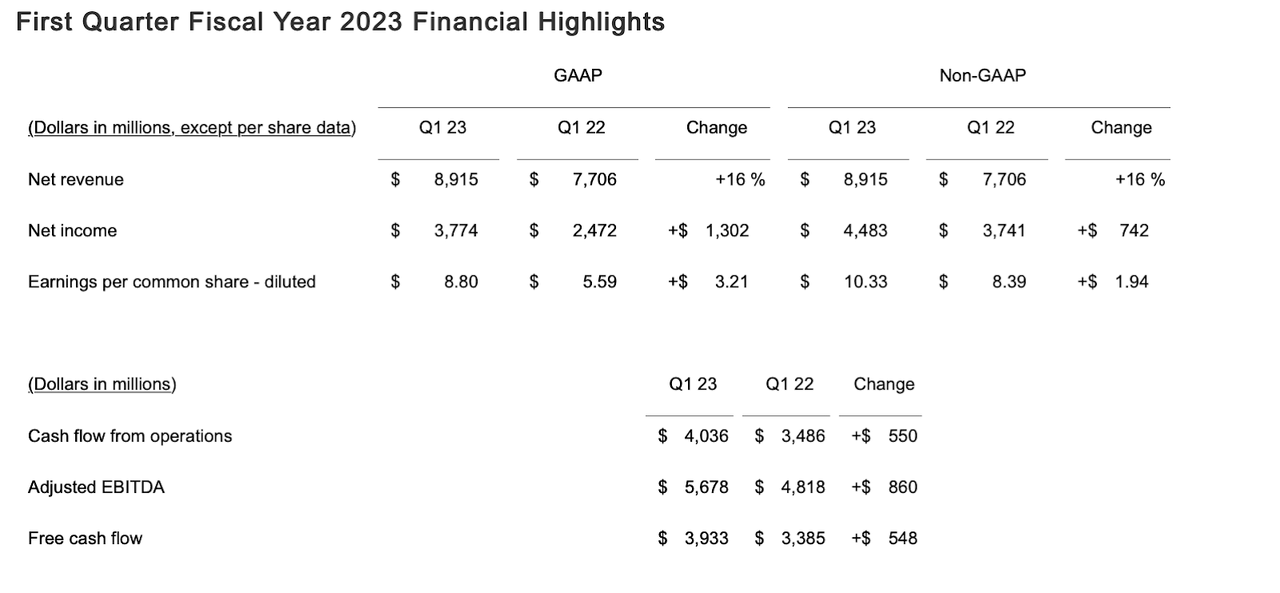

In its most recent quarter, AVGO delivered yet another quarter of stunning growth, with revenues growing 18% YOY and earnings per share growing by a similar amount.

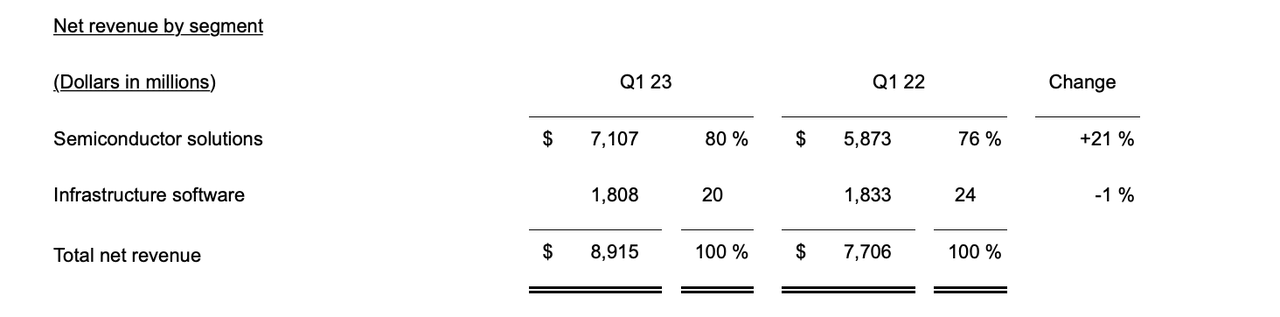

As has been the case for many quarters, those strong growth rates were driven by semiconductor revenues as the software revenues actually declined by 1% YOY.

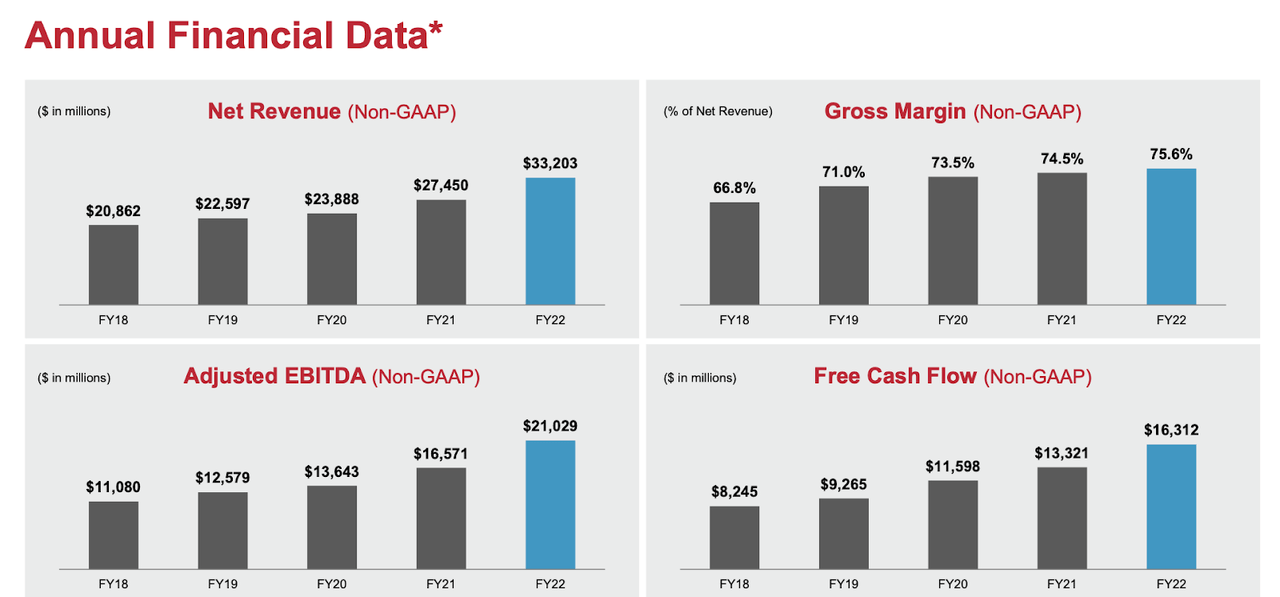

These strong numbers come after a 2022 year in which AVGO delivered the typical double-digit top and bottom line growth that investors have come to expect.

AVGO ended the quarter with $39.3 billion of debt versus $12.6 billion of debt. The company repurchased $1.2 billion of stock and has grown its dividend over the past decade.

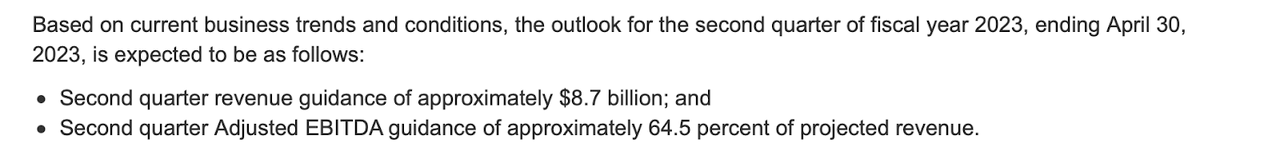

Looking ahead, management has guided for the second quarter to see around $8.7 billion in revenue, representing 7.4% YOY growth.

It is precisely that deceleration in growth rates that I believe will take investors by surprise as they may have come to expect AVGO's history of double-digit growth to be more sustainable than it really is.

Is AVGO Stock A Buy, Sell, or Hold?

At first glance, AVGO appears to be greatly underpriced. How often do you get to buy the stock of a double-digit grower paying growing dividends and buying back stock at 15x forward earnings?

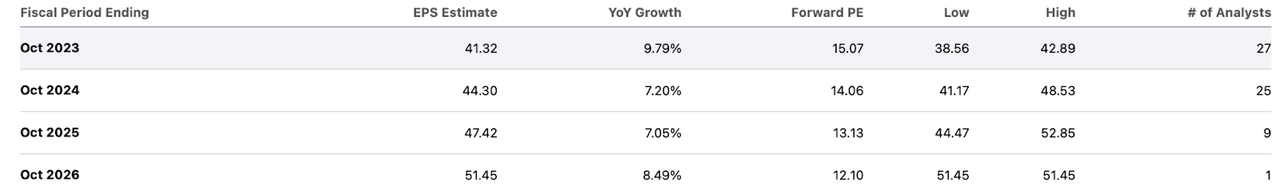

But that valuation multiple becomes more understandable when one factors in consensus estimates for low single-digit revenue growth over the coming years.

Those consensus estimates may surprise some readers, as AVGO has a history of growing its dividend at very rapid rates.

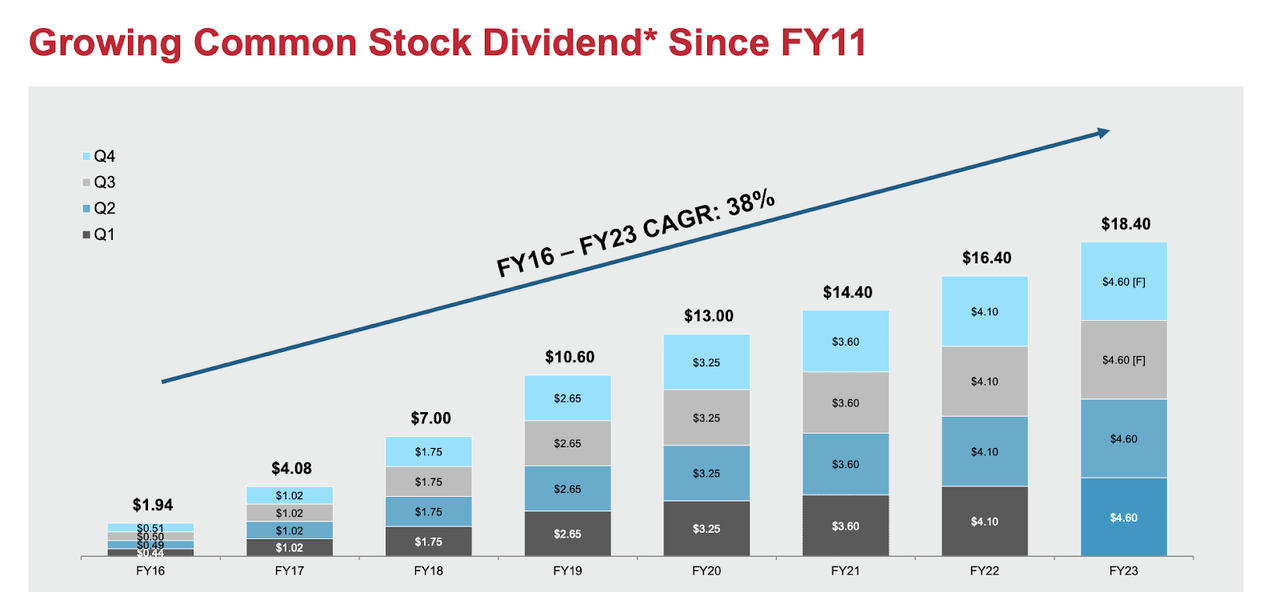

Here's the problem: despite appearing on the surface to being a cross between a hardware and software company, AVGO remains primarily a semiconductor business subject to the typical cyclicality of that sector. Meanwhile, its software business is nothing to write home about as evidenced by the poor growth rates. AVGO often touts having a wide product portfolio with a focus on cybersecurity.

But as a tech analyst covering competitive firms, I cannot help but point out that their endpoint security offering in Symantec, which AVGO acquired in 2019, is widely known as an incumbent being disrupted by the likes by more modern competitors in CrowdStrike (CRWD) and SentinelOne (S). Not all tech is equal, and it is very difficult to make the argument that AVGO is on the right side of that coin.

What's more, AVGO represents what I like to call a "fully-milked cow." I have mentioned that AVGO has accelerated its growth rates over the past several years through acquisitions. Pro-forma for the VMware acquisition, AVGO would see debt to EBITDA jump to 3.1x, a rather high ratio in the tech sector. Whereas many other tech companies have many catalysts ahead of them in terms of juicing margins and ramping up leverage, AVGO has arguably already moved past such catalysts. After all, its adjusted EBITDA margin is already around 63% - how much more cost optimization can really occur here? "It doesn't get better than this" might be an appropriate saying.

This brings me back to the valuation. Slow-grower stocks like AVGO aren't unbuyable but the bulk of the upside typically comes from multiple expansion. At the time of my previous report, AVGO was trading at 13x 2023e earnings. Now, AVGO is trading at 15x 2023 earnings and those estimates have gone up by 3%. For a name projected to grow by a mid-single-digit rate moving forward, 15x earnings does not look so cheap, especially considering the valuation reset that has occurred in the broader tech sector. Risks have emerged regarding the company's ability to close its acquisition of VMware, and AVGO needs this acquisition to help bolster its forward growth rates (it is also arguable that VMware represents yet another slow-growing mature company). I am concerned that many investors might be owning AVGO thinking that it is a rapidly growing secular growth company, holding that belief due to the company's growth rates over recent years. But the reality is that AVGO is a mature company with a leveraged balance sheet and low projected forward growth. Given that outlook, 15x earnings is presenting a price to earnings growth ratio ('PEG ratio') in the 2.5x range, but I am finding many tech stocks with PEG ratios in the 1.2x range and even lower (a silver lining of a brutal period for tech investors). This means that AVGO is trading at the upper end of its fair value range, offering little hope for upside from multiple expansion with the bulk of its returns to come from its 6.7% earnings yield. In light of the poor risk-reward proposition, I have sold out of my position and rate the stock a hold.

Sign Up For My Premium Service "Best of Breed Growth Stocks"

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best 6-8 investment reports monthly.

- My top picks in the beaten down tech sector.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!

This article was written by

Julian Lin is a top ranked financial analyst. Julian Lin runs Best Of Breed Growth Stocks, a research service uncovering high conviction ideas in the winners of tomorrow.

Get access to his highest conviction ideas here.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of S, CRWD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.