The Market Timer's Hall Of Fame Is An Empty Room

Summary

- The stock market is a place where you can make untold riches. You just have to know what you’re doing… without getting cocky.

- Don’t think you can beat it day in and day out.

- As Jane Bryant Quinn said, "The market timer's Hall of Fame is an empty room."

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More »

akinbostanci/E+ via Getty Images

Maybe I'm feeling nostalgic or something, but I seem to be working with decade-old material this month.

On Monday, April 3, I published "Buy the 5% CD or These 4 Monthly-Paying REITs." While it addressed an issue a reader recently raised - that of avoiding the stock market altogether and just buying up CDs - I ended up referencing an article from all the way back in 2012.

It's not an article I wrote, admittedly, but it's by a Seeking Alpha legend well worth quoting. This oldie-but-goodie is titled "Dividends Provide a Return Bonus," and the author is none other than Chuck Carnevale.

Today, I'm turning to the same solid stock picker, just from one year later: "Trying to Beat the Market Is a Fool's Errand." Because it's just as worth pointing out, particularly when my topic today is how retirees shouldn't try to be too cute.

Forgive my bluntness here, but market timing just isn't worth it after you've hit a certain age. Market timing is almost never worth it, mind you. But when you're young, footloose and fancy free, you at least have more room to mess up and recover.

That's just not the case when you're nearing retirement or actually in retirement.

The money you have is much harder to replace. So treat it with a lot more wisdom than your 20-something-self may have.

The "Hassle" Is Worth It, Retiree

For the record, going back to that 5% article, I don't advise buying up CDs over stocks. Especially not when we're talking about dividend stocks.

Especially-especially not when we're talking about dividend stocks that are real estate investment trusts.

And especially-especially-especially not when we're talking about dividend stocks that are REITs that yield what the four I recommended are yielding with the kind of share price appreciation they're promising.

The stock market is a place where you can make untold riches. You just have to know what you're doing… without getting cocky.

Don't think you can beat it day in and day out. Aim to beat it long-term through careful research, an understanding of your own investment situation - temperament included - and a healthy focus on dividend stocks that can light your sustainable returns on fire.

That was the precise point of Chuck's "Fool's Errand" article, despite how he approached that conclusion with a different thesis. His goal was to steer investors - especially retirees - away from index investing.

That may seem like "the best investment strategy" out there, he wrote. "… the vast majority of professionally managed portfolios (mutual funds, separately managed accounts, hedge funds, ETFs, etc.)" do "fail to outperform the S&P 500," after all.

So it's understandable that some people conclude it isn't worth trying at all. Why try to beat the experts… the markets… the fates… or whatever it is that keep this unflattering fact a fact?

Just invest in an index like the S&P 500 and leave all the hassle behind! Right?

Chuck makes a very sound case for why the "hassle" can be very well worth it when you choose individual high-yielding income stocks. And, again, his conclusion works just as well for my purposes as his.

Some Wise Words From Chuck

They say imitation is the most sincere form of flattery. And while I have some personal experience that contradicts that belief to some degree, it's definitely true in this case.

I'm more than happy to give Chuck credit where credit is due for the following paragraphs:

"… trying to build a portfolio based on the idea of outperforming the market is not necessarily the appropriate course of action. Although total return is certainly a consideration worthy of investor attention, it should not necessarily be the driving force behind constructing an appropriate portfolio. Considerations for the amount of risk investors are willing to take should also be part of the thought process.

"Moreover, total return does not necessarily represent the final answer. The amount of income a portfolio is capable of generating may take precedence over capital appreciation. This would be especially true for the prudent retiree desirous of creating a portfolio capable of meeting their long-term needs for income."

In other words, retirees want to largely keep their portfolios as-is. They don't want to be selling shares to cover their costs of living. That strategy will only last so long.

Instead, they want to live off the dividends those shares provide - which keep coming quarter after quarter after quarter (or month after month after month).

It's easy to get caught up in trying to beat the markets though. It certainly seems the way to go in order to get rich, stay rich, or get richer still.

But that way of thinking can be a trap, driving investors to focus on instant gratification over sustainability… sometimes in the form of market timing.

Another Charles Agrees: Market Timing Ain't Where It's At

The desire to jump in and out of stocks based on day-to-day price movement - or even month to month or year to year - is a tempting one. But that doesn't make it wise, as another Charles (Charles Schwab) so aptly puts it:

Imagine for a moment that you've just received a year-end bonus or income tax refund. You're not sure whether to invest now or wait. After all, the market recently hit an all-time high. Now imagine that you face this kind of decision every year - sometimes in up markets, other times in downturns. Is there a good rule of thumb to follow?

Our research shows that the cost of waiting for the perfect moment to invest typically exceeds the benefit of even perfect timing. And because timing the market perfectly is nearly impossible, the best strategy for most of us is not to try to market-time at all. Instead, make a plan and invest as soon as possible.

That's why I'm going to repeat something I said back in the opening segment:

"Forgive my bluntness here, but market timing just isn't worth it after you've hit a certain age. Market timing is almost never worth it, mind you. Period. But when you're young, footloose and fancy free, you have more room to mess up and recover.

"That's just not the case when you're nearing retirement or actually in retirement.

"The money you have is much harder to replace. So treat it with a lot more wisdom than your 20-something-self may have."

With that in mind, here are some REITs worth buying and holding onto…

3 of the Best REITs Out There

Prologis (PLD)

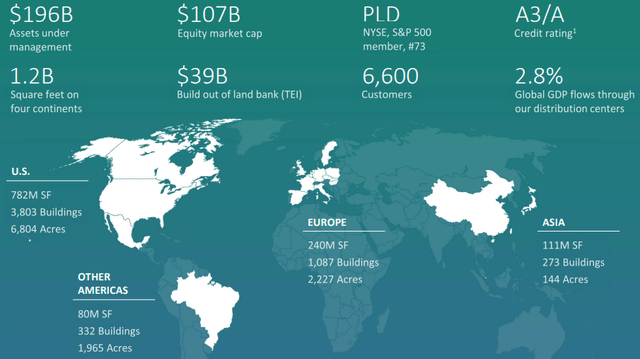

As the largest industrial real estate investment trust ("REIT"), Prologis owns, manages, and develops logistics real estate across 19 countries that serve 6,600 customers. They have a total of 1.2 billion square feet of real estate and $39 billion invested in land banks for future expansion.

PLD's industrial properties are critical to global trade as 2.8% of global GDP passes through their distribution centers. They have a strong international presence with industrial properties located on 4 continents: North America, South America, Europe, and Asia.

PLD has a strong tenant list with some of the names in their top twenty including Home Depot, Amazon, Walmart, Pepsi, UPS, FedEx, and BMW to name a few. They are well diversified with 19% of their net effective rent coming from their top 20 tenants. They have no issues with occupancy, in their latest earnings call the CFO, Timothy Arndt said that as of the fourth quarter occupancy increased to 98.2% and that their portfolio was 98.6% leased.

Industrial real estate is arguably one of the best, if not the best, REIT sectors currently as e-commerce is only expected to grow. This growth will increase the need for distribution and fulfillment centers which should provide continued demand for years to come.

PLD is in a strong position to capitalize on this trend, having superior size and scale with properties all around the globe and established relationships with some of the world's largest companies. Along with the strength of their properties and tenants, Prologis has a fortress balance sheet and excellent debt metrics which will give them flexibility to expand through future investment.

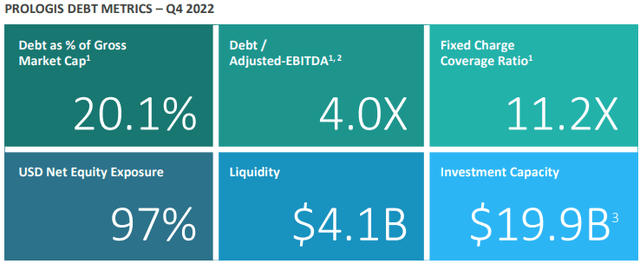

Prologis is investment grade rated with a credit rating of A from S&P. They have a debt to adjusted EBITDA of 4.0x and fixed charge coverage ratio of 11.2x. PLD's weighted average to maturity on their consolidated debt is 9 years and their weighted average interest rate is 2.5%. Through refinancing they have substantially addressed their debt maturities until 2026 and had $4.1 in total liquidity as of December 31, 2022.

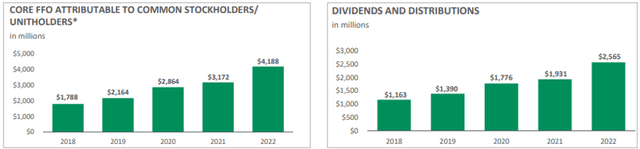

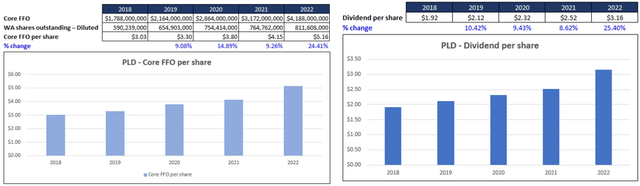

In the aggregate PLD's core funds from operations ("Core FFO") increased from $1.8 billion in 2018 to $4.2 billion in 2022.

In terms of percentage growth, the year-over-year growth rates are as follows: 2018-2019 (21.03%), 2019-2020 (32.35%), 2020-2021 (10.75%), 2021-2022 (32.03%). Similarly, the aggregate distribution has more than doubled since 2018.

On a per share basis, PLD increased its Core FFO from $3.03 in 2018 to $5.16 in 2022. The Core FFO year-over-year growth rate on a per share basis is as follows: 2018-2019 (9.08%), 2019-2020 (14.89%), 2020-2021 (9.26%), 2021-2022 (24.41%).

On a per share basis the dividend was increased 10.42% in 2019, 9.43% in 2020, 8.62% in 2021, and 25.40% in 2022. Overall, since 2018 the average dividend growth rate comes in at 12.59%. PLD's current dividend yield of 2.85% is very secure with an AFFO payout ratio of 68.27% in 2022.

PLD - Form 10-K (compiled by iREiT)

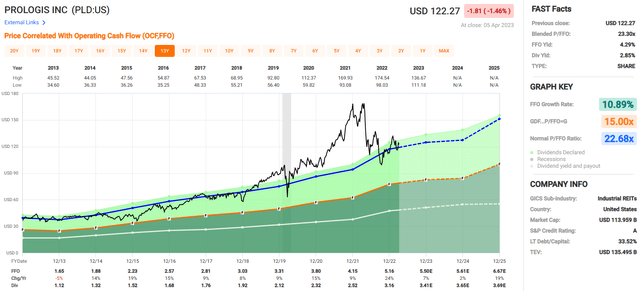

Right now, Prologis is trading at a P/FFO of 23.30x which is right in line with their normal P/FFO of 22.68x. They pay a 2.85% dividend yield that is very safe and have exhibited strong growth over the past decade.

Since 2013 PLD has averaged an FFO growth rate of 10.89% and analysts expect 7% growth in 2022, 2% growth in 2024, and 19% growth in 2025. This is one of the highest quality REITs you can own and I think there is a lot of potential over the long term. At iREIT, we rate Prologis stock a BUY.

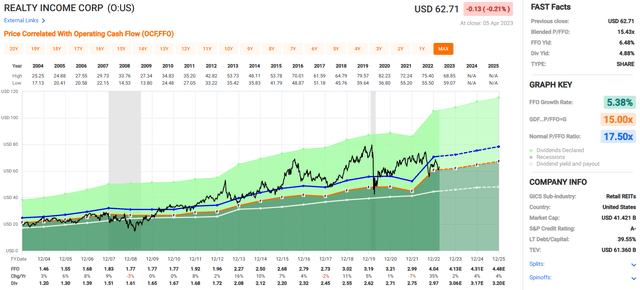

Realty Income (O)

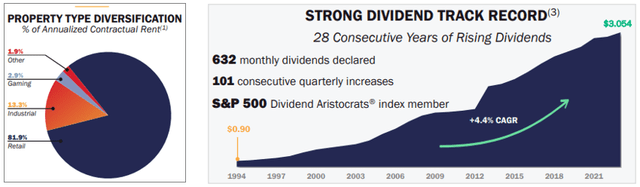

This one probably needs no introduction, but Realty Income, the monthly dividend company, is a triple-net lease REIT with 12,237 properties covering approximately 236.8 million square feet of leasable space with properties located in all 50 states and international properties in the UK, Spain, and Italy. Realty Income has 1,240 clients within 84 industries and has multiple property types including retail, industrial, and gaming.

As a percentage of their rental income, retail contributes 81.9%, Industrial contributes 13.3%, while gaming contributes 2.9%. They have been around since 1969, went public in 1994, and are a dividend aristocrat, having increased their dividend for the past 28 consecutive years.

In all they have declared 632 monthly dividends and have 101 consecutive quarterly increases. Since 1994 their dividend has increased at a compound annual growth rate of 4.4%.

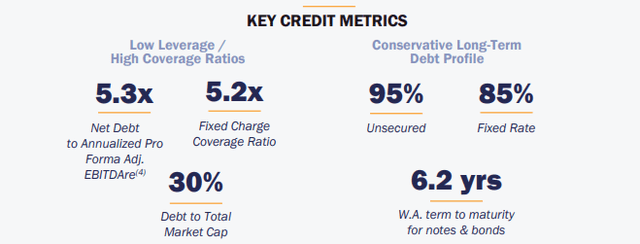

Realty Income has a strong balance sheet with an A- credit rating and $1.7 billion of liquidity as of the end of 2022. They have a net debt to pro forma adjusted EBITDA of 5.3x and a 5.2x fixed charge coverage ratio. They have a weighted term to maturity of 6.2 years and 85% of their debt is fixed rate while 95% is unsecured.

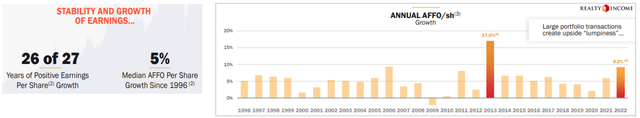

Realty Income has delivered strong and consistent earnings growth since going public with 26 out of 27 years of positive earnings growth. The only year in which their adjusted funds from operations ("AFFO") did not increase was 2009.

Even during the pandemic they were able to increase their AFFO per share. The consistency and reliability in which Realty Income operates and distributes profits is one of the factors that makes this a favorite REIT among many investors.

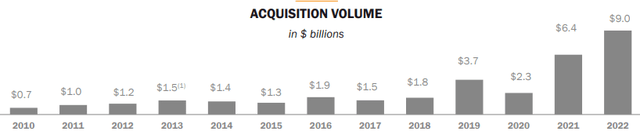

Realty Income shows no signs of slowing down with record acquisition volume in 2022. In 2021 Realty Income merged with VEREIT in an all-stock transaction which significantly increased their size and scale.

In 2022 they acquired the Encore Boston Harbor Resort and Casino for $1.7 billion under a long-term net lease agreement with Wynn Resorts and in December they agreed to acquire a portfolio of approximately 185 single-tenant retail and industrial properties from CIM Real Estate Finance Trust.

In March of 2023, Realty Income announced that its entered into an agreement to acquire up to 415 convenience store properties from EG Group. The portfolio of convenience stores is estimated to be acquired at a cap rate of roughly 6.9% with a 20-year weighted average initial lease term.

In their 2023 guidance, Realty Income guided for over $5.0 billion in acquisitions for the year. I think $5.0 billion is a conservative projection, but even if acquisition volume comes in at that amount, while less than the previous 2 years, it would still more than double the acquisition volume in 2018.

Realty Income pays a 4.88% dividend yield that is well covered with an AFFO payout ratio of 75.69%. They currently trade at a P/FFO of 15.43x which is a discount to their normal P/FFO of 17.50x. Realty Income is the largest triple-net lease REIT and has maintained consistent growth regardless of the size of their portfolio.

In other words, as they add more real estate they are not seeing diminishing returns as their investments have been accretive. They have been consistent through varies economic cycles, interest rate and inflationary environments, recessions, wars, and so on. Throughout all the varieties of turmoil over the last 29 years, they have maintained steady earnings and distributions since going public in 1994. At iREIT, we rate Realty Income stock a BUY.

Camden Property Trust (CPT)

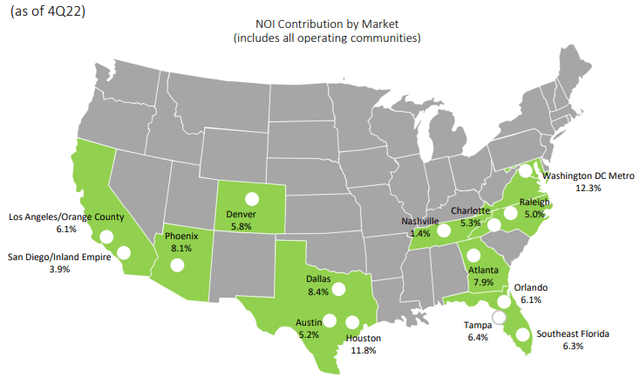

Camden Property is a multifamily REIT that owns, manages, develops, and acquires multifamily apartment complexes. CPT owns and operates 172 properties containing 58,702 apartment units that are diversified geographically with properties across the U.S. The average age of their properties is 14 years and they have a 96% occupancy rate.

Their target markets have strong economic growth and employment characteristics and a high quality of life. The majority of their net operating income ("NOI") is derived from States in the Sunbelt region of the country with properties in Tampa, Orlando, Dallas, and Houston to name a few. Measured by NOI, their largest market is Washington DC at 12.3%, followed by Houston at 11.8%. By State, CPT receives its largest NOI contribution from Texas, with their 3 markets in Texas contributing 25.4% of CPT's net operating income.

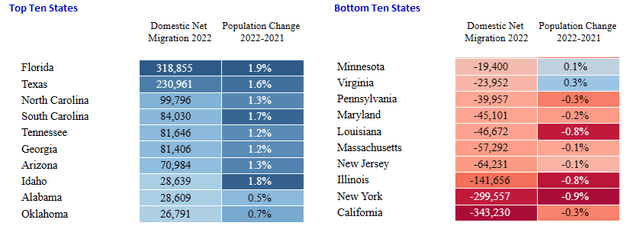

Camden's concentration in the Sunbelt should serve them well as the trend of migration to the Sunbelt continues. The 10 top states with positive net migration are almost all in the Sunbelt. Florida and Texas had the largest population increase, while California and New York had the largest outflow on an absolute basis.

Apartment REITs have several advantages in the current high interest rate and inflationary environment. For one they can re-price their units typically on an annual basis in order to keep up with inflation.

Another advantage is that with higher interest rates, it becomes more expensive to take out a mortgage on a home so renting becomes stickier. Finally, higher interest rates will make development and construction projects more costly, which should decrease the supply of new stock coming on to the market.

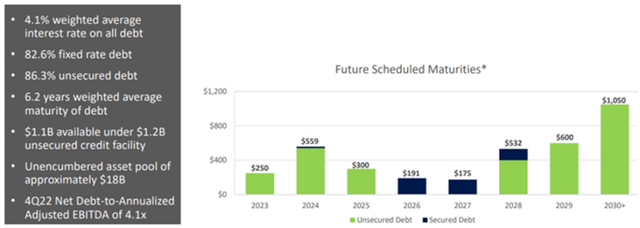

Camden has excellent debt metrics and a well staggered maturity schedule. They have an A- credit rating, their debt is 82.6% fixed rate, and 86.3% of their debt is unsecured. CPT has a Debt to adjusted EBITDA of 4.1x, a fixed charge coverage ratio of 6.4x and unencumbered assets of approximately $18 billion. They have a weighted average interest rate of 4.1% and a weighted average term to maturity of 6.2 years.

They have approximately $250 million due in 2023, or 6.8% of their total maturities. The debt schedule shown below excludes their revolving credit facility, but as of December 31, 2022, they had approximately $1.1 billion available to them under their $1.2 billion credit facility.

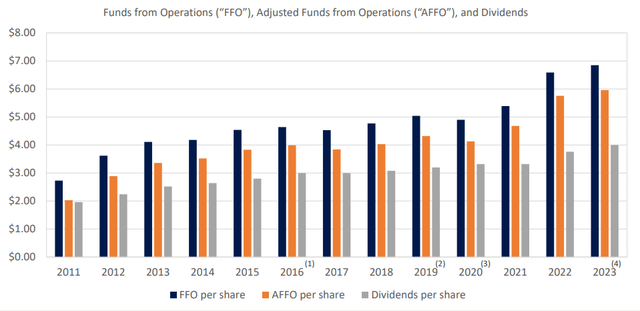

While somewhat lumpy, CPT has a clear upward trajectory on its FFO, AFFO and dividend per share since 2011. Over this time period CPT's dividend has a compound growth rate of 6.33% and as shown in the chart below, their AFFO has easily covered the dividend in each year with the AFFO payout ratio coming in at 65.28% in 2022.

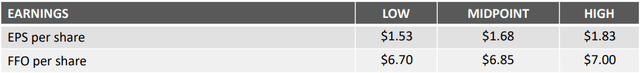

Over the last 10 years, CPT has an average FFO growth rate of 6.17%. Analysts expect FFO growth of 4% in 2023, 5% in 2024, and 4% in 2025. In their 2023 guidance, CPT guided for $6.70 per share at the low end and $7.00 at the high end for a mid-point of $6.85. This is largely in line with analysts' estimates and would represent approximately a 4% year-over-year increase in their funds from operations.

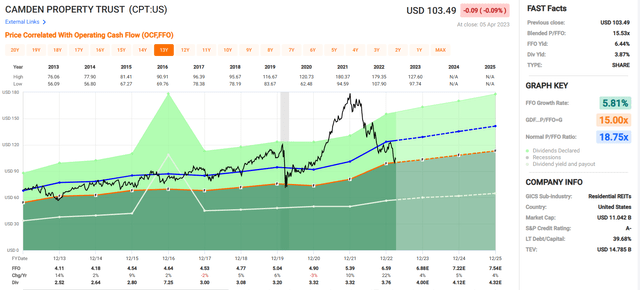

Camden pays a 3.87% dividend yield that is well covered and trades at a P/FFO of 15.53x, which is well below its normal P/FFO of 18.75x. Over the last decade CPT's FFO per share has increased in 8 out of the last 10 years and they have either increased or maintained their dividend each year over this period.

One thing to point out on the chart below is that the large dividend spike in 2016 was a special dividend of $4.25 so what looks like a large cut in 2017 is just the dividend going back to its normal quarterly payout.

Between the macroeconomics driving the industry, their low leverage and payout ratios, and the high FFO and dividend growth rates, there is a lot to like about this company. At iREIT, we rate Camden Property Trust stock a BUY.

In Closing…

As Jane Bryant Quinn said, "The market timer's Hall of Fame is an empty room."

I've been writing on Seeking Alpha for over 13 years now and "there is an overwhelming body of evidence to support the view that believing in the ability of market timers is the equivalent of believing astrologers can predict the future." - Larry Swedroe

I am an exponent of the philosophy that the main objective of common stock investment should be pricing, not timing; and by pricing I mean the endeavor to buy securities at prices which are attractive, letting timing take care of itself. - Benjamin Graham

Subscribe to Get the Sweet 16 REIT Report

When you subscribe to iREIT on Alpha you will get a free copy of our Sweet 16 REIT report in addition to access to all of our tools and resources.

Also, every new member will get a free copy of my new book, REITs For Dummies (summer 2023). Take the 2-week FREE trial and I can assure you that you will enjoy being part of the iREIT family.

This article was written by

Brad Thomas is the CEO of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 100,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) iREIT on Alpha (Seeking Alpha), and (2) The Dividend Kings (Seeking Alpha), and (3) Wide Moat Research. He is also the editor of The Forbes Real Estate Investor.

Thomas has also been featured in Barron's, Forbes Magazine, Kiplinger’s, US News & World Report, Money, NPR, Institutional Investor, GlobeStreet, CNN, Newsmax, and Fox.

He is the #1 contributing analyst on Seeking Alpha in 2014, 2015, 2016, 2017, 2018, 2019, 2020, 2021, and 2022 (based on page views) and has over 108,000 followers (on Seeking Alpha). Thomas is also the author of The Intelligent REIT Investor Guide (Wiley) and is writing a new book, REITs For Dummies.

Thomas received a Bachelor of Science degree in Business/Economics from Presbyterian College and he is married with 5 wonderful kids. He has over 30 years of real estate investing experience and is one of the most prolific writers on Seeking Alpha. To learn more about Brad visit HERE.Analyst’s Disclosure: I/we have a beneficial long position in the shares of CPT, O, PLD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Author's note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.