Marcus & Millichap: Weakening Headwinds Present An Attractive Growth Opportunity

Summary

- Aggressive federal tightening has significantly disrupted the commercial real estate market and created a dislocation between valuation and price, reducing sales volumes.

- Despite this, Marcus & Millichap has posted record revenues; indicating that as rate hikes begin to slow, they can further capitalise on their private client market for sustainable growth.

- Strength in financial position and health reflects high efficiency at utilising its other business arms to responsibly finance initiatives, unlocking greater cashflow and investment potential.

- Several operational efficiency ratios highlight Marcus & Millichap to be one of the most competitive firms in the sector, allowing for capitalization on market share upon cycle reversal.

- An independent DCF analysis reveals a potential margin of safety of around 14% from current levels, demonstrating a reasonable level of value at current prices.

CHUNYIP WONG

Investment Thesis

Marcus & Millichap (NYSE:MMI) may currently present an attractive value buy, as we believe it is poised to capture a greater market share on the brink of a cycle turnaround. Continued strength in fundamentals despite recent economic volatility indicates that weakening headwinds may release MMI towards a new all-time high within the next 3 years.

FED Induced Dislocation

MMI are a brokerage firm operating throughout the United States and Canada, with specific business areas focused on commercial real estate (CRE) investment, financing, research and advisory services. The share price of MMI is down 43% over the last 12 months at the time of writing, as a result of declining commercial property sales volume in the face of interest rate volatility.

Aggressive financial tightening from the federal reserve has been a constant throughout recent memory, in an attempt to wrestle with inflation. The pace at which interest rate hikes have occurred has shocked several markets, particularly disrupting those revolving around finance. This is a theme further evident in the recent banking system crisis.

One variable which requires particular thought when considering the CRE sector is mortgage performance, many banks possess CRE on their balance sheets, which poses a threat amidst recent disruption. Short term lease renewals and refinancing on maturing loans are very real concerns.

Weakening Headwinds

Moving forwards, it seems increasingly likely that financial sectors will remain directionless and reactive for the remaining half of the year as markets absorb the dislocation experienced and lenders remain cautious. MMI will likely remain crab like in this period as price discovery is unlikely.

Ultimately, recessionary fears will dominate investor sentiment in the short term; however, many have suggested an economic slowdown is more likely, including MMI CEO Hessam Nadji in a recent interview with Yahoo Finance Live. Hessam argues that employment and consumer markets appear strong, which should generate further clarity on the likelihood of recession in the months to come.

In light of this, the most recent interest rate rise of 0.25% can be seen as the beginning of the end of the fed's tightening, as the rise was expected to be consistent with others at 0.5%. This is a clear indication that macroeconomic headwinds are weakening, which will allow investors to turn their attention to finely recalibrating their commercial investment valuations.

MMI will look towards its unique private client market, highly fragmented in its nature, to offer a swift recovery through the heightened transaction volumes and greater commissions on offer.

Sustainable Growth

Despite macro headwinds, MMI experienced record revenue generation of $1.3 billion in 2022, representing a solid compounded annual growth rate of 16% over the last 3 years. This past year also produced its second highest ever earnings of $104 million. To generate record revenues amidst the market volatility experienced over the last year is a clear demonstration of strength and an indicator that the growth experienced is sustainable.

MMI also continues to demonstrate commitment to future growth through investment into technology and infrastructure, with capital expenditures rising to $11.7 million over the last 12 months, representing a CAGR of 7% over the last 3 years.

A slight risk is free cashflow, which has fallen significantly over the last 12 months from $249 million to $2 million. Overall, this is not all that concerning when considering both the aggressive investment commitment as well as the progressive strength of cashflow over previous periods. Nevertheless, this has served to raise the accrual ratio of MMI; which can be used as an indication of lower future profitability. Investors will be eager to see growing free cashflows in future periods.

The financial health and position of MMI for us is the most impressive metric, as it's balance sheet boasts a healthy current ratio of 3.47 and quick ratio of 3.22. Manageable levels of debt mean that the interest coverage ratio sits at over 223. Overall, this results in an Altman-Z score of 5.23. These figures paint a picture of stable financial foundations which may pave the way for MMI to greater capitalize on the overall market share once the downcycle reverses.

It seems clear that MMI is able to efficiently utilize its other business arms to achieve sustainable financing which in turn may result in greater cashflow yields, opening the potential for share buybacks when considering the relative undervaluation, explored further later in this analysis.

Competitive Edge

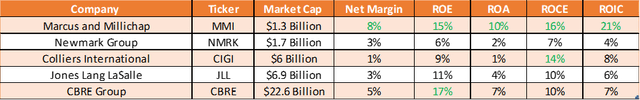

The following table compares what we consider the most critical operational efficiency metrics between immediate competitors and comparable companies within this sector. Companies compared include Newmark Group (NASDAQ:NMRK), Colliers International (NASDAQ:CIGI), Jones Lang LaSalle (NYSE:JLL) and CBRE Group (NYSE:CBRE).

Operational Efficiency Comparison Between Companies within Sector (WR Investment Group)

It can be observed that MMI possesses the most competitive edge in this sector when considering the efficiency of generating profit with the resources available. This is a clear reflection of the experience and quality of the management team, which will be key in unlocking a greater share of the market in the years to come. MMI may attribute this success to its customer-centric value services, focused on client satisfaction and long-term growth.

Reasonable Undervaluation

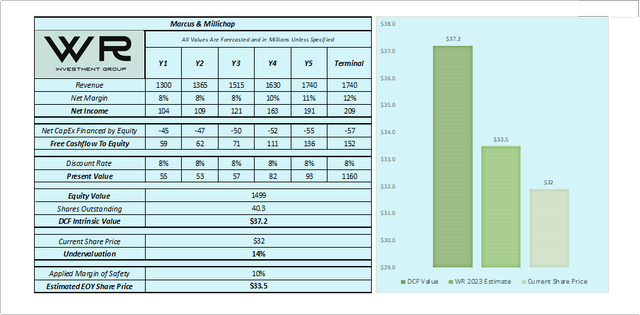

MMI is currently trading with a P/E ratio of 12.3, representing a discount of 18% from the sectors average of 15. A simplified equity based discounted cashflow analysis has been performed, presented in the figure below. Relatively conservative inputs have been utilized such as a terminal rate of 0% and discount rate of 8%. This is in an effort to provide a reasonable margin of safety within the result. There are several natural assumptions regarding variables such as revenue growth, net margin and capital expenditure across the next 5 years which will be differ to assumed values.

MMI Share Price Discounted Cashflow Analysis (WR Investment Group)

We can speculate that the intrinsic value of one share of MMI lies around $37.20, representing a margin of safety of around 14% from current levels. Applying a margin of 10% leads to our price prediction of $33.50 by the years end, representing a decent level of value considering the safety inputs utilized. This seems relatively consistent with the expectation of the market as it waits to enter a new phase of price discovery

Conclusion

In conclusion, rapidly rising interest rates as part of a strategy to lower inflation have caused significant shocks throughout the commercial real estate market and created a dislocation between buyer/seller expectations, and hence valuation and price. This has served to reduce sales volumes and create a substantial level of lender hesitation.

Despite these headwinds, MMI have posted record revenues and continue to commit to investment in technology and infrastructure; indicating that the management team are confident that as rate hikes begin to slow, they can further capitalize on their fragmented private client market with greater volumes and commissions for further sustainable growth.

A significant level of financial health can be observed which demonstrates MMI has been responsible and efficient at utilizing its other business areas to execute finance initiatives, unlocking greater cashflow and investment potential which could open the door to share buybacks.

MMI maintain a significant competitive edge within the sector, as several operational efficiency ratios highlight the strength of generating returns on available resources. This positions MMI well in the event of a cycle reversal' allowing for capitalization on market share. Overall, this renders MMI a buy for us when considering an apparent undervaluation of 14% at current prices.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MMI over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.