Continue To Avoid Everbridge

Summary

- The strong negative relationship between revenue and operating earnings lingers. If selling more doesn't bring profitability, what does?

- In spite of the lackluster results, the shares are not cheap at the moment. I think this sets up disaster.

- The calls I recommended for those who insist on staying long did less badly previously. I would recommend a similar approach for bulls.

TERADAT SANTIVIVUT

We're coming up on the one year anniversary of my "calls more attractive" article on Everbridge, Inc. (NASDAQ:EVBG), and in that time the shares are down about 36% against a loss of 6.55% for the S&P 500. The company has released financial results since then, obviously, so I thought I'd review the name again. What I considered to be a risky bet at $50 may turn out to be a decent investment at $31.81. I'll make that determination by looking at the financial statements, and comparing those to the current valuation. In addition, in the previous article, I recommended that people who insist on staying long this stock manifest that perspective by using call options. I am absolutely champing at the bit to write about how that trade worked out. I hope I'm not spoiling any surprises here, but on a risk adjusted basis the "calls in lieu of shares" was a winning strategy.

Welcome to the "thesis statement" paragraph. I put one of these in each of my articles to give you the chance to get into the article, read it, and get out before being exposed to too much bragging, bad humour, correct spelling or any of the other things people might complain about. I'm of the view that the Everbridge story remains largely the same. The company continues to bleed money, and the strong negative relationship between revenue and profits lingers. While I think the capital structure is reasonably strong, I'd only be willing to buy these shares at a discount. Unfortunately, they remain very richly priced in my view. The combination of ongoing losses plus rich valuation is enough to keep me away. For those of you who insist on buying, I would recommend calls in lieu of shares. This strategy worked out far less badly than stock ownership last time, and I would recommend it again. In a world where you can earn a 4.6% return risk free, why would you buy this?

Financial Snapshot

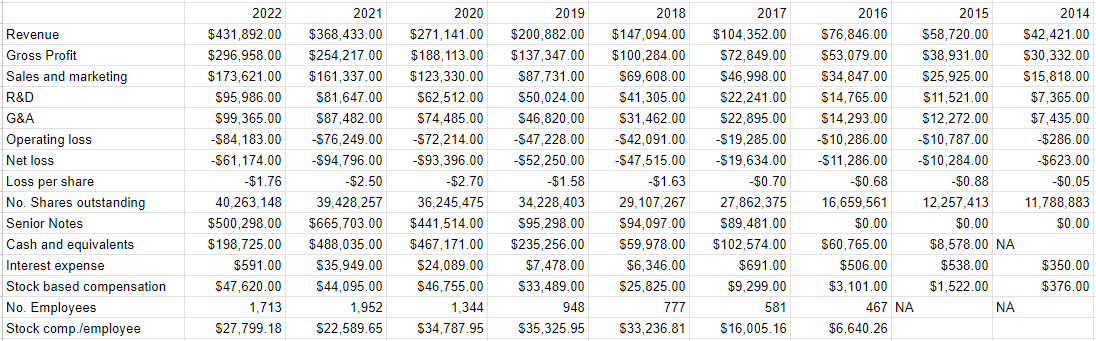

After reviewing financials for as long as I have, you start to see patterns emerge, and the most recent year for Everbridge was very much like previous ones. The company grew both revenue and losses, and it seems that the more the company sells, the more it loses. I've written about this previously when I pointed out that last year the relationship between revenue and net income were very strongly negatively correlated (r=-.968). With that as background, we see that, once again, revenue in 2022 was up by about 17% compared to 2021, but net loss has shrunk by 35%, which is encouraging. Before we get too encouraged, though, I feel a need to point out that operating losses expanded from last year to this year by 10%. Net income was "less bad" in large measure because of a $12.1 million uptick in gain on extinguishment in debt and a $50.5 million positive swing in "other" income. It may be the case that such things may not reflect a permanent change to the financial health of the firm.

In fairness, though, interest expense was about $30 million lower in 2022 than it was in 2021. Relatedly, the capital structure is still reasonably strong in my view. Cash represents about 23% of total liabilities, and about $165 million worth of senior notes have been retired.

Finally, while it's true that shareholders have lost a fair bit of money on the stock over the past year, they may take some solace in the fact that employees have done relatively well. Stock based compensation per employee rose 23% from 2021 to 2022, so there's that. I hope that offers some consolation for the shareholders who have lost money over the past year.

For my part, I am open minded. Although the "sell more and lose more" model is largely intact in my view, I'd be willing to buy this stock at the right price.

Everbridge Financials (Everbridge investor relations)

The Stock

One of the most important, and most painful, lessons I ever learned is that a company is different from the stock that supposedly represents it. A company can be growing revenue and earnings nicely, but if the stock is overpriced, the shares will tank. This relationship can work in the reverse, too. If a company has a fair bit of "hair" on it, and the market knows that, it may be a decent investment if the overall market is too pessimistic. I've come to the conclusion that the most important thing about stocks is the disconnect between market expectations and subsequent reality. If the expectations are too pessimistic, for instance, there may be profit to be made in even the most troubled business.

This is why I insist on only ever buying cheap stocks, because there's a strong relationship between "cheap" and "priced too pessimistically." This obviously doesn't always work out perfectly, but it's the approach that I try to take. When a stock is cheap, that's a clear sign that the market's not too optimistic about its future, so the stock is far less likely to hit the painful air pocket in the immediate future.

My regular readers know that I measure whether or not a stock is cheap in a few ways, ranging from the simple to the more complex. On the simple side, I look at the ratio of stock price to some measure of economic value, like earnings, free cash flow, and the like. Ideally, I want to see a stock trading at a discount to both the overall market and its own history. When I last reviewed Everbridge, the market was paying $5.30 for $1 of sales, and was paying 4.4 times book value for the stock, which I considered, and consider, to be quite rich. Fast forward a year, and the shares are 37% cheaper on a price to sales basis, coming in at a still elevated 3.357, but the market is still paying approximately the same for book value per the following:

The stock price has come down, price to book value is about the same, so we conclude that book value has deteriorated fairly significantly.

My regulars know that I think ratios can be instructive, but I want to confirm (or not) what they're "saying" by trying to work out what the market is "thinking" about a given investment. If you read my stuff regularly, you know that the way I do this is by turning to the work of Professor Stephen Penman and his book "Accounting for Value" for this. In this book, Penman walks investors through how they can apply some pretty basic math to a standard finance formula in order to work out what the market is "thinking" about a given company's future growth. This involves isolating the "g" (growth) variable in this formula. In case you find Penman's writing a bit opaque, you might want to try "Expectations Investing" by Mauboussin and Rappaport. These two have also introduced the idea of using the stock price itself as a source of information, and we can infer what the market is currently "expecting" about the future.

Applying this approach to Everbridge at the moment suggests the market is assuming that this company will grow earnings at a rate of ~6.47% in perpetuity. I consider that to be a very optimistic forecast given the past several years of financial history. To indulge in my tendency to belabour an argument to the point of tedium, it seems that the analyst community is of the view that EPS will jump to about $1.50 this year, and $1.82 next year. The company has never earned positive earnings, so I consider this to be symptomatic of the analyst community's tendency to see the glass as not just being "half full", but "overflowing." I would say of the current valuation that "cheaper" is certainly not the same thing as "cheap", and I would say that it makes sense to continue to avoid this name, especially in light of the fact that it's possible to earn a risk free 4.67% at the moment.

Call Option Review

I'm of the view that investors must seek the best risk adjusted returns, and this involves spending the least amount of capital to achieve the same results. In my previous missive on this name, I suggested that those people who insist on staying long here express that bullishness by buying call options, as these offer much of the upside at a fraction of the cost of the stock. In particular, I recommended the November 2022 calls with a strike of $50, which were priced at $10.20-$12. Since the shares collapsed in price, these obviously expired worthless on the third Friday of November of last year. While losing potentially $12 per lot is painful, it's far less painful than it was to stockholders who were down about $20 per share on the day of expiration. In my view, risking less to earn the same amount, or lose less is one of the ways investors succeed, so I'd recommend that approach for people who insist on disagreeing with me here and buying this stock. I think calls make more sense.

In particular, I like the January 2024 calls with a strike of $35. These last traded hands at $5.50. So for a fraction of the cost of stock ownership, an investor gets access to most of the upside in this name over the next nine months. If, as I suspect will continue to happen, the shares languish, the investor will lose, but they'll potentially lose far less than the stockholders. Investing is about earning risk adjust returns, and my preference would be to continue to avoid this name. If you insist on buying it, though, I would recommend call options as a way to minimize what I consider to be the inevitable pain here.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.