XLC: Bullish Technical Features Unfolding, Rating Upgrade

Summary

- The Communication Services sector was a major loser in 2022.

- Light investor positioning coming into this year set the stage for a growth style comeback.

- With shares exhibiting a bullish reversal, I am upgrading XLC to a hold, but I'm also watching one key price on the chart for a potential breakout.

FangXiaNuo/E+ via Getty Images

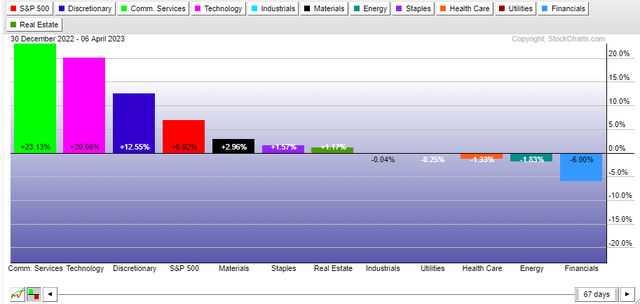

The Communication Services sector has been the strongest performer so far in 2023. Bucking what so many market strategists had called for coming into the year, shares of names like Meta Platforms (META) and Alphabet (GOOGL) (GOOG) have rebounded impressively amid a pullback in yields and a severe underweight among many investors to growth-heavy sectors following last year’s plunge in the space.

I now see the valuation picture as decent while the technical situation has improved sharply. While muted EPS growth is seen this year, I think much of that pessimism appears to have been priced in over recent quarters, and investors are now looking ahead.

I am upgrading the fund to a hold, and am watching one key technical level.

Year-to-Date Sector Returns: XLC Top of the Pack

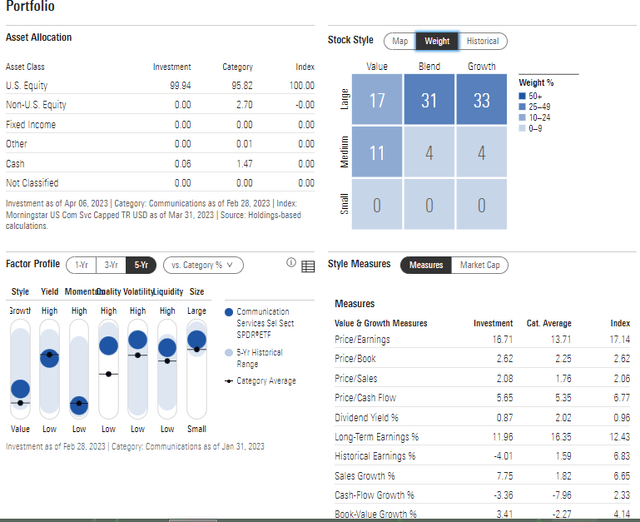

Digging into the portfolio, Communication Services Select Sector SPDR Fund (NYSEARCA:XLC) is interesting in the fact that it is not as ‘growthy’ as you might imagine following price action among its largest components in recent months. The Morningstar Style Box puts the fund nearly evenly distributed among value, blend, and growth. Meta Platforms was one of a handful of mega-cap tech(ish) names that were considered by some to be value in nature as of the end of 2022 due to its still-decent earnings profile amid an intense stock price selloff.

The fund features a yield of under 1% while its forward price-to-earnings ratio is about on par with the broad market’s at just under 19 times. With a price-to-sales ratio barely above 2, it is not overly expensive. Long-term earnings growth trends suggest the normalized forward operating PEG ratio is actually attractive at under 2. Momentum is listed as low right now, but I imagine several of the ETF’s holdings will be tossed into the popular momentum funds in due time.

XLC: Portfolio & Factor Profiles

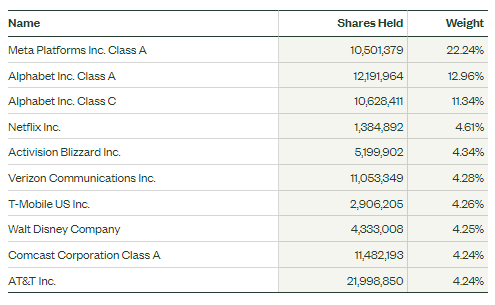

XLC is a concentrated portfolio with more than half of the allocation weighted into the top two positions. So, monitoring trends in Meta Platforms and Alphabet is key. Those companies report results during the middle part of the earnings season ahead.

XLC: Top 10 Holdings

SSGA Funds

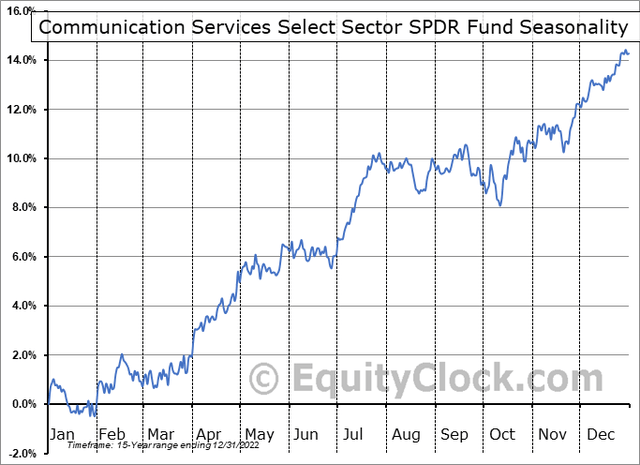

Seasonally, XLC tends to move sharply higher now through late July. Consolidation tends to take place later in Q3 through the first handful of weeks of Q4. So, now is a favorable time for an overweight position in the Communication Services sector, according to what data suggests from Equity Clock.

XLC: Favorable Seasonal Trends

The Technical Take

Late last year, I was bearish on XLC, but that proved to be the wrong call. While there was near-term volatility in late October and November, a bullish rounded bottom was being formed. I now see key resistance in the $59 to $61 range. A breakout above that zone would imply a bullish measured move price objective to near $77. That would put the fund back to where it traded in early last year. What is also appealing about the technical situation is the rising RSI momentum indicator.

Notice in the chart below that both momentum is on the mend and there are bullish volume trends during recent upward thrusts in the share price. Overall, the chart is constructive, and a rally above $61 would only serve to further augment the bullish technical narrative. A drop under $51, though, would be problematic and put the uptrend off the November low in major jeopardy.

XLC: Bullish Rounded Bottom Forming, Eyeing Low $60s Resistance

The Bottom Line

I am upgrading XLC from a sell to a hold. My rating last year was wrong, and with new data and a refreshed outlook, I see a bullish technical feature unfolding on this fairly valued fund.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.