Markets

The market remained in positive terrain for six days in a row, though it was highly volatile session on April 10. Auto, technology, metal and oil & gas stocks supported the market, whereas selling was seen in banking & financial services, and FMCG stocks.

The BSE Sensex gained 13.54 points to close at 59,847, while the Nifty50 closed above the 17,600-mark for the first time since March 8, rising 25 points to 17,624 and formed small bodied bearish candle with long upper shadow on the daily charts, indicating selling pressure at higher levels.

"This pattern indicates a tiredness of bulls at the crucial hurdle of 17,600-17,700 levels, which are opening downside gap of March 10 and down sloping trendline, connected from the top of December 2022. This pattern could be a minor setback for bulls for the short term," said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

Hence, he feels there is a possibility of minor downward correction from the highs, but the short-term trend of Nifty remains positive.

"The presence of crucial overhead resistance and an emergence of minor weakness from the highs could indicate further consolidation or minor downward correction for the Nifty from near 17,650-17,700 levels in the coming sessions. Any dips from here could be a buying opportunity and immediate support is at 17,510 levels," Nagaraj said.

The broader markets also extended gains, with the Nifty Midcap 100 and Smallcap 100 indices climbing 0.4 percent and 0.3 percent, respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data and not just the current month.

Key support and resistance levels on Nifty

The pivot charts indicate that the Nifty may get support at 17,602, followed by 17,579 and 17,543. If the index advances, 17,675 is the initial key resistance level to watch out for, followed by 17,698 and 17,735.

The Bank Nifty saw some profit booking after having a run up in previous seven consecutive sessions. The index fell 206 points to 40,835 and formed bearish candlestick pattern on the daily timeframe.

"The index if fails to sustain above the level of 41,200, we can witness some profit booking towards 40,600-40,500 levels. The upper resistance if taken out will lead to further short covering towards the 42,000 level," Kunal Shah, Senior Technical Analyst at LKP Securities said.

The Bank Nifty may take support at 40,743, followed by 40,646 and 40,488. Key resistance levels are expected to be 41,058, then 41,156, and 41,313.

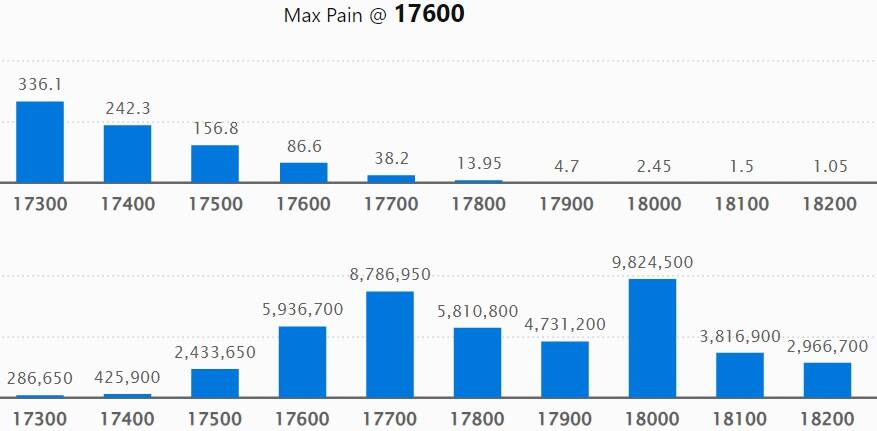

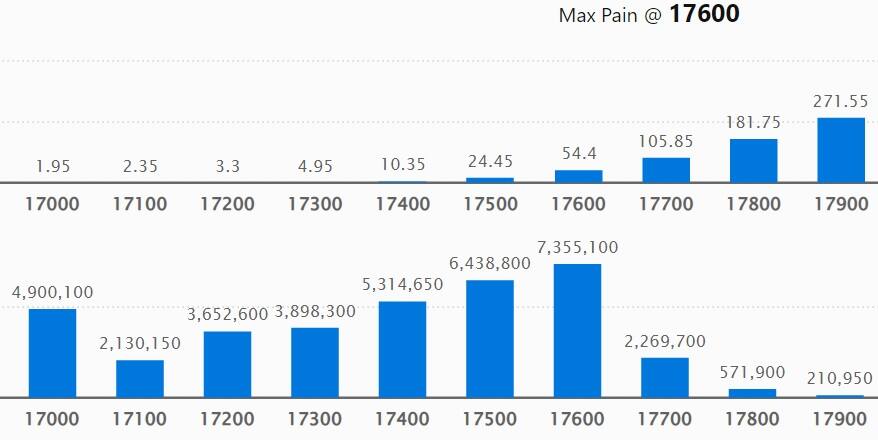

On the weekly options front, the maximum Call open interest (OI) was at 18,000 strike, with 98.24 lakh contracts, which is expected to be a crucial level for the Nifty in the coming sessions.

This was followed by 17,700 strike, comprising 87.86 lakh contracts, and 17,600 strike, with more than 59.36 lakh contracts.

Call writing was seen at 17,700 strike, which added 56.26 lakh contracts, followed by 18,000 strike, which accumulated 38.85 lakh contracts, and 17,800 strike which added 26.75 lakh contracts.

Call unwinding was at 18,300 strike, which shed 5.05 lakh contracts, followed by 18,200 strike, which shed 3.31 lakh contracts, and then 18,400 strike, which shed 2.16 lakh contracts.

The maximum Put open interest was at 17,600 strike, with 73.55 lakh contracts, which is expected to act as support in the coming session.

This was followed by the 17,500 strike, comprising 64.38 lakh contracts, and the 17,400 strike where there were 53.14 lakh contracts.

Put writing was seen at 17,600 strike, which added 39.44 lakh contracts, followed by 17,400 strike, which added 21.21 lakh contracts, and 17,500 strike, which added 17.29 lakh contracts.

We have seen Put unwinding at 16,600 strike, which shed 6.62 lakh contracts, followed by 16,700 strike, which shed 6.01 lakh contracts, and 16,800 strike, which shed 2.73 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. The highest delivery was seen in Alkem Laboratories, SRF, Bosch, Bata India, and Abbott India, among others.

An increase in open interest (OI) and price typically indicates a build-up of long positions. Based on the OI percentage, 67 stocks, including Tata Motors, Godrej Properties, ONGC, City Union Bank, and Chambal Fertilizers, saw long build-ups.

A decline in OI and price generally indicates a long unwinding. Based on the OI percentage, 17 stocks, including M&M Financial Services, Cholamandalam Investment, HDFC, IndusInd Bank, and HDFC Bank, saw a long unwinding.

48 stocks see a short build-up

An increase in OI along with a price decrease indicates a build-up of short positions. Based on the OI percentage, 48 stocks, including Voltas, Gujarat Gas, Havells India, Bosch, and Jubilant Foodworks, saw a short buildup.

A decrease in OI along with a price increase is an indication of short-covering. Based on the OI percentage, 60 stocks were on the short-covering list. These included Indraprastha Gas, Honeywell Automation, Crompton Greaves Consumer Electricals, Titan Company, and Jindal Steel & Power.

(For more bulk deals, click here)

Investors' meetings on April 11

Deep Industries: Officials of the company will interact with analysts and investors.

Allcargo Logistics: Company officials will meet investors and analysts in US non-deal roadshow organised by Jefferies.

Stocks in the news

Delta Corp: The gaming and hospitality corporation will be in focus ahead of its March FY23 quarter earnings. The company will also consider dividend, if any.

State Bank of India: The country's largest lender said its Executive Committee of the Central Board will be meeting on April 18 to consider the long term fund raising in single or multiple tranches of up to $2 billion, through a public offer and/or private placement of senior unsecured notes in US dollar or any other convertible foreign currency during FY24.

IRB Infrastructure Developers: The highway construction company has recorded toll collection at Rs 369.9 crore for the month of March 2023, growing 20.6 percent over toll collection of Rs 306.6 crore in same month last year. The growth was 5.2 percent compared to February 2023.

Vedanta: The billionaire Anil Agarwal-owned company is going to consider issuance of NCDs (non-convertible debentures) on a private placement basis on April 13. In addition, the Supreme Court has permitted Vedanta to carry out the activities at copper smelter plant at Chennai's Thoothukodi for its upkeep, after considering the report of the High Powered Expert Committee and recommendations of the state government.

Bank of Baroda: The total business of the public sector lender crossed Rs 21 lakh crore milestone, rising 16.8 percent YoY to Rs 21.77 lakh crore in the quarter ended March FY23. Total advances grew by 19 percent YoY and 5.4 percent QoQ to Rs 9.74 lakh crore as of March 2023, and deposits rose by 15.1 percent YoY and 4.7 percent QoQ to Rs 12.04 lakh crore.

Shilpa Medicare: The pharma company has received final approval from US Food and Drug Administration (USFDA) for its ANDA, Apremilast tablets, which are available in 10 mg, 20 mg, and 30 mg strengths. The drug is used for the treatment of adult patients with active psoriatic arthritis. Apremilast is a generic equivalent of reference listed drug OTEZLA of Celgene.

Schaeffler India: The ball and rolling bearing manufacturer will trade ex-dividend with effect from April 11. The company has announced final dividend of Rs 24 per share.

Fund Flow

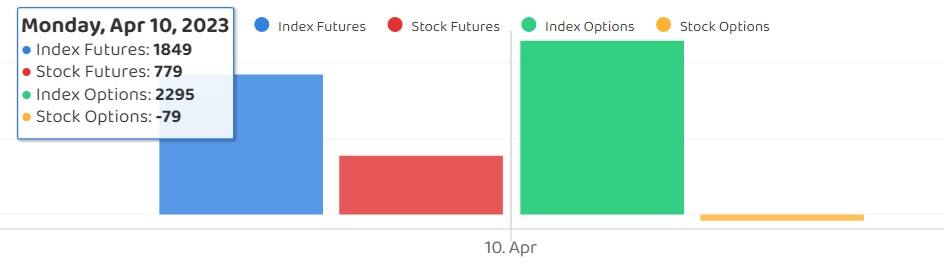

Foreign institutional investors (FII) bought shares worth Rs 882.52 crore, while domestic institutional investors (DII) purchased shares worth Rs 351.50 crore on April 10, National Stock Exchange's provisional data showed.

Stocks under F&O ban on NSE

The National Stock Exchange has not added any stock to its F&O ban list for April 11.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.