Blackstone Mortgage: High Dividends, Low Price And Solid Collateral Provide Good Investment Opportunity

Summary

- The real estate market is in a relatively volatile environment but has shown to be quite resilient.

- BXMT has a long history of strong financial performance and high dividend distribution, with the added benefit of having the largest alternative investment asset manager to back them up.

- Low price per share offers the potential for significant price appreciation in the future.

- Loans are 100% floating interest rate and the fund managed to collect 100% of the interest payable in 2022, despite problematic economic environment.

sl-f

Introduction

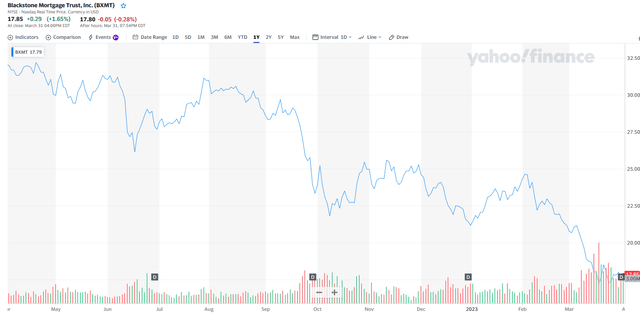

The share price for Blackstone Mortgage Trust, Inc. (NYSE:BXMT) is at $17.85, an almost all-time low, and this represents a potentially very lucrative investment opportunity. At current prices, the stock has a forward annual dividend yield of almost 14%, which is well above the sector median of 3.69%. Furthermore, BXMT has a history of paying its dividends to investors: it has done it regularly for the past 30 quarters. It is true that the price has fallen significantly in the past years, roughly 44% in the past year alone, but if you're looking at an investment such BXMT it's likely that price is not your first priority. What I focus on when looking at the value BXMT can bring is at the level and consistency of their dividends.

Nevertheless, even looking at the price alone, I believe this stock is quite undervalued compared to its financials. Using a simple dividend discount model with quite conservative assumptions, such as no dividend growth, I target a price per share of $24 - a roughly 40% increase.

Business Model and Key Financial Data

With a roughly $26.8 billion portfolio, BXMT operates as a lender in the commercial real estate sector. The company provides first mortgage loans to real estate owners and operators, with a focus on senior loans secured by income-producing properties. The loans are typically short-term (3-5 years), and are 100% floating-rate, protecting them from changing market interest rates. Furthermore, the Loan to Value (LTV) of the collaterals falls within the 50% to 70% range, with a weighted-average origination LTV of 64% - a relatively safe range to recoup investment value if the borrower defaults.

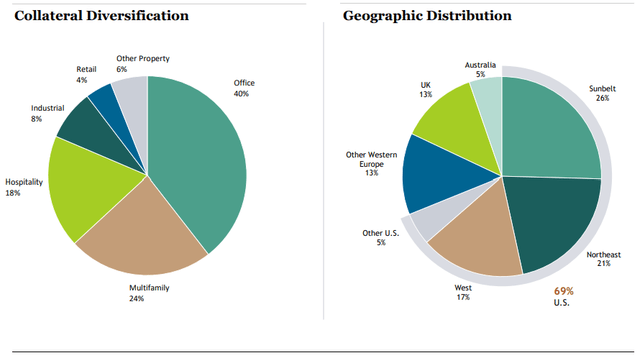

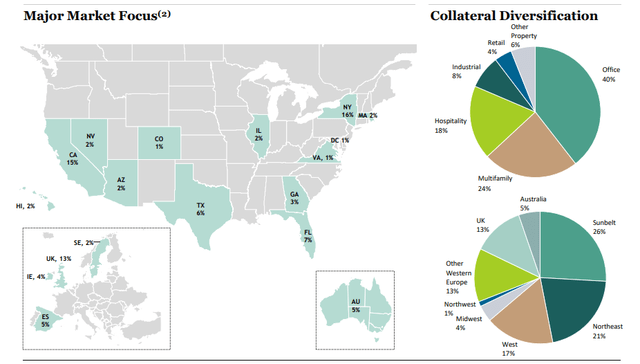

According to BXMT's latest quarterly report, the three main industries to which loans have been provided are office, multifamily properties and hospitality which altogether account for 82% of the portfolio. Geographically, the fund is also quite concentrated in the US, with only 31% of investments being located outside of the United States.

Collateral and Geographic Diversification (Blackstone Mortgage Trust) Market Focus and Diversification (Blackstone Mortgage Trust)

Although the diversification could be better, BXMT has had solid financial performance in the past. Despite a roughly 400 bp increase in U.S. short rates the fund has managed to maintain 100% interest collection in 2022. Dividend coverage is also at a good level, with a 2022 dividend of $2.48 being covered by a $2.87 distributable EPS.

Financial Performance

Performance on the stock market has not been favorable for BXMT investors, who have seen the share price fall roughly 44% in the past year, and 16% only in the past month. This is not far from the general market performance of the REIT industry, which has been punished by a changing interest rate market and a consequent cooling down of activity.

BXMT Share Price (Yahoo Finance)

Furthermore, several institutional investors have reduced their BXMT portfolio allocation in the past year, contributing to an extent to the stock's decline. This is likely due to these investors' aim of reducing exposure to the real estate market, which has been more volatile than normal due to the changing interest rates.

According to CBRE, 2023 will be a challenging year for real estate as inflation is still high and therefore the market expects the Fed to keep raising rates until inflation reaches the 2% target. However, as corporate finances seem to be in good shape, analysts don't expect excessive layoffs and therefore it shouldn't affect general mortgage affordability. Finally, CBRE points out that the housing shortage should benefit the multifamily sector, which is good for BXMT. Hospitality and Industrial are also poised to be resilient regardless of the current economic environment. Although there are some doubts regarding the Office investments due to increasing digitalization, I believe that offices are here to stay, at least partially, with most employers opting for a hybrid model.

BXMT has a track record of strong financial performance. The company has consistently delivered strong returns on equity, with an average ROE of 10.6% over the past five years. BXMT's net interest margin (NIM), a key measure of profitability for a lender, has also remained strong, averaging 2.7% over the past five years. The company's loan portfolio has grown significantly in recent years, with total assets increasing from $10 billion in 2015 to $26.8 billion in 2023.

Valuation

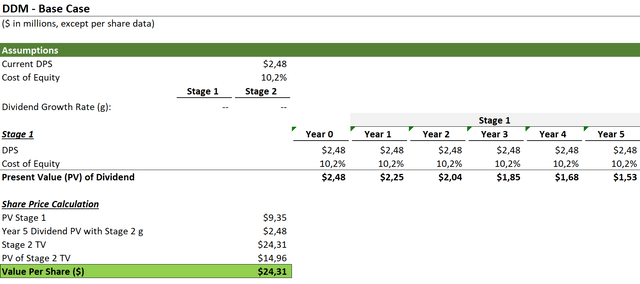

Since the main attractiveness of BXMT is its high dividend, I used a two-stage dividend discount model to value it. I decided to go for the two-stage version because the next five years might be particularly volatile and not representative of the longer term outlook. For my computations below, I used the cost of equity published by Damodaran.

The first model below is the base case, in which dividend stays constant. I believe this is a quite realistic scenario as BXMT might want to avoid not paying dividends but also not increase before the economy stabilizes. With these assumptions BXMT is quite undervalued.

DDM - Base Case (Personal Calculations)

In the more pessimistic case I opted for a negative growth of -10% dividend growth every year for the next 5 years, for then to settle at a 0% growth.

DDM - Pessimistic Scenario (Personal Calculations)

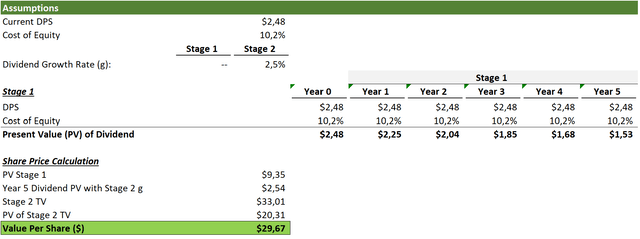

Finally, for the more optimistic scenario I still opted for a 0% dividend growth for the first 5 years, but a 2.5% growth after that.

DDM - Optimistic Scenario (Persona Calculations)

Finally, assigning a 50% weight to the base case and 25% each for the pessimistic and optimistic, we still get a share price of roughly $24 - 40% higher than current prices.

Competitive Landscape

There are several competitors that offer similar investment opportunities as BXMT, however, this fund has the advantage of being backed by the largest alternative investment fund in the world. Below there is a list of other REITs that have similar business models. As it can be seen, performance in the last year has been quite negative for all funds.

| Fund | Share Price | Market Cap | P/E | 1-Yr Performance |

| BXMT | $17.85 | $3.08B | 12.49 | -37.72% |

| NLY | $19.11 | $9.43B | 3.82 | -20.41% |

| STWD | $17.69 | $5.5B | 6.27 | -20.32% |

| AGNC | $10.08 | $5.79B | -3.97 | -11.73% |

| RITM | $8.00 | $3.79B | 4.47 | -16.75 |

Source: Yahoo Finance

Risks

Although BXMT is protected from interest rate rises due to the floating nature of their loans, the current real estate market is suffering and the fund is still exposed do the owners and operators not being able to meet payments and perhaps defaulting. Therefore, investors should be very careful in approaching investing, directly or indirectly, in the real estate market as there is no certainty in how high the interest rates can go. However, as Reuters points out, the 6% interest rate fall in home prices is quite negligible compared to the 45% rise prices experienced in the post-pandemic environment.

The more concrete and consequential risk for BXMT is definitively the fall of fair valuation of its loans collaterals. In fact, owners and operators of the underlying real estate could go bankrupt, dragging down BXMT with them. While the assets BXMT has are more liquid than the what a traditional company might have, the potential need of taking over or selling the property due to the borrower's default can easily lead to a severe impairment. If this happens for a sufficient amount of borrows, BXMT could also become unable to payout dividends, which would clearly make the share price crumble, or even default.

Conclusion

Investors should be careful if they want to invest in BXMT as the near-term economic environment is quite unsure and could potentially be detrimental for the underlying businesses in the fund's portfolio. However, the historically low price, together with the very high dividend yield and it's consistency, could provide a very interesting capital appreciation and income stream, especially for long term investors.

For investors that wish to gain exposure to the real estate market and that have a long-term horizon this could be a great opportunity.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.