Brookfield Corporation Looks Attractive No Matter How I Look At It

Summary

- Brookfield Corporation looks undervalued on a sum-of-the-parts and a "Look-Through" Earnings basis.

- I estimate that BN is trading with a 30% holding discount to the value of the underlying assets.

- BN is priced at 11 times FFO while management expects a low double-digit FFO CAGR over the next few years.

- BAM is priced at 19 times FFO and looks attractive as well, especially with the high-teens growth prospects.

- I reiterate my "strong buy" rating on BN stock and initiate a "buy" rating on BAM stock.

TomasSereda/iStock via Getty Images

Introduction

Nearly eleven months ago I wrote my very first article, "Brookfield Asset Management - Asset Management Spinoff To Unlock Value", on Seeking Alpha. In this article, I want to give an update on the former Brookfield Asset Management, now Brookfield Corporation (NYSE:BN) (TSX:BN:CA).

As for the structure of this update article, I will briefly lay out my initial thesis and go over what has happened since then. I will give my current take on Brookfield Corporation and also briefly address the newly formed entity, the new Brookfield Asset Management (NYSE:BAM) (TSX:BAM:CA).

Thesis review

My thesis was that valuing Brookfield's listed and non-listed parts besides the asset management business (the "Manager") allowed us to calculate an implied valuation of the Manager.

The listed investments were the stakes in Brookfield Renewable Partners (NYSE:BEP) (NYSE:BEPC), Brookfield Infrastructure Partners (NYSE:BIP) (NYSE:BIPC) and Brookfield Business Partners (NYSE:BBU) (NYSE:BBUC). At the time of my initial article, these stakes amounted to a valuation of $22.23 billion. For the non-listed investments, I assumed a valuation of $18.66 billion for Brookfield Property Group (the real estate arm of Brookfield) and $7.77 billion for the "Other Investments". Summed up, I assumed the value of these investments at $48.72 billion.

With Brookfield trading at a market capitalization of $77.62 billion back then, this implied a valuation of $28.9 billion for the manager. Here is what I wrote back then:

The FFO-Yield of 3.05% as per managements implied $80 billion valuation still seems too high in my opinion. I think paying a 5% FFO-Yield, implying a 4.5% dividend yield, for a capital-light asset management business growing base earnings (fee-related earnings) with a mid-teens CAGR which has shown excellent deployment of capital and growth of FFO in the past seems more than reasonable and offers quite a margin of safety. A 5% FFO-Yield would result in an equity value of $48.82 billion for the AMB.

Source: Initial article - Valuation of the Asset Management Business

The management implied a possible valuation of $80 billion in the Q1 2022 earnings call. I estimated the Manager to trade at a 4.5% dividend yield for a total valuation of around $48.82 billion and concluded that with a sum-of-the-parts approach, Brookfield was undervalued.

Today, the Manager (BAM Ticker) is trading at $31.62 per share with a $1.28 annualized dividend. The dividend yield stands at 4.05% while the market capitalization amounts to $51.7 billion, a bit higher than my estimate back then.

What happened since my last article?

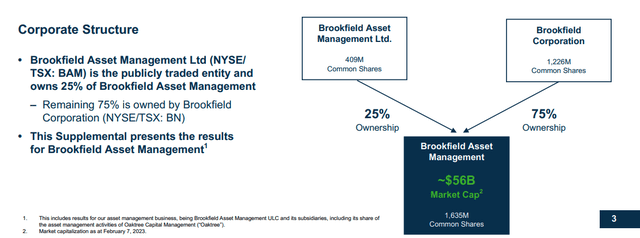

On December 9th, 2022, Brookfield completed the distribution of a 25% interest in the Manager to shareholders. As can be seen in the snippet of BAM's Q4-22 supplement release, BAM holds 25% ownership in the manager while BN holds the remaining 75%:

Corporate Structure (BAM Q4-22 Supplement)

The ownership stakes in the other businesses haven't changed.

Regarding price change, the former BAM traded at $47.71 back then. One former BAM share as of the time of my last article equals one BN share and a quarter of a BAM share today. With BN trading at $31.54 and BAM at $31.62 right now, the current price for the same equity interest amounts to:

$31.54 + (25% x $31.62) = $39.45

The received dividends amounted to $0.81. On a comparable basis, the total return amounts to around minus 15.6%. Since I rated Brookfield a "strong buy" back then, I need to check if my thesis is still intact and what might be the problem. I will do so by looking at Brookfield Corporation in two ways: (1) Sum-of-the-parts (update from my initial article) and (2) "Look-Through" Earnings.

Sum-of-the-parts

To value BN on a sum-of-the-parts basis, we need to factor in the ownership stakes in the listed investments, gauge a valuation for the non-listed investments and add/subtract other items like unrealized carry, cash and debt. All numbers can be taken from BN's Q4 Supplemental Information.

The value of the ownership stakes in the listed investments can be seen in the table below:

| Ticker | Shares | Price per share ($) | Market Value ($billion) |

| BAM | 1,226,500,000 | 31.62 | 38.8 |

| BEP | 312,000,000 | 30.44 | 9.5 |

| BIP | 209,400,000 | 33.90 | 7.1 |

| BBU | 141,700,000 | 17.62 | 2.5 |

| Sum | 57.9 |

For the Brookfield Property Group (BPG), I will use 50% of the IFRS value Brookfield is giving us in the aforementioned document. This would put the value of BPG at $15.9 billion. The IFRS value of the insurance business is stated at $4 billion. With LTM FFO for the insurance business of $388 million, this indicates a price/FFO ratio of around 10, a reasonable number in my opinion. So the non-listed investments should be worth around $19.9 billion.

Here is the complete overview of my sum-of-the-parts valuation:

| Parts | Value in $million |

| Listed Investments | 57,874 |

| Non-listed Investments | 19,930 |

| Unrealized Carried Interest, end of period, net | 5,609 |

| Corporate cash and financial assets | 2,893 |

| Other Investments | 3,494 |

| Debt and preferred capital | -15,765 |

| Working Capital | -944 |

| Sum | 73,091 |

In my last article, I concluded that without taking into account the "other items", the value of the listed and non-listed investments should be around $97 billion. This included the now distributed 25% interest in the manager, so we need to adjust this number by around $13 billion (25% of the Manager). The resulting $84 billion is still higher than the $73 billion above which is not a good sign.

As I already stated at the beginning of this article, the valuation of the manager is nearly in line with my estimate back then. The decrease in value is solely a result of the decline in price for the ownership stakes in the listed and non-listed investments, as can be seen in the table below:

| Stake | Price in $ (last article) | Current price in $ | %change |

BEP | 34.15 | 30.44 | -10.86 |

| BIP | 39.72 | 33.90 | -14.65 |

| BBU | 23.38 | 17.62 | -24.64 |

BEP, BIP and BBU are capital-intensive businesses and are clearly affected by the rising interest rate environment. This could be alarming because valuing Brookfield on a sum-of-the-parts basis makes little sense when the parts decline in value.

To check if the declining prices are warranted, I decided to take a look at the underlying earnings of the business units. For this purpose, I used the reported FFO (in $million):

| Stake | LTM FFO in May 2022 | FY2022 FFO | %change |

| BEP | 362 | 432 | 19.3 |

| BIP | 421 | 497 | 18.1 |

| BBU | 661 | 820 | 24.1 |

| BPG | 933 | 953 | 2.1 |

| Other Investments | 352 | 471 | 33.8 |

| Sum | 2,729 | 3,173 | 16.3 |

FFO increased in every single business unit. On the BN level, it increased by 16.3% over the past 3 quarters. So while the underlying cash flows increased, the market price decreased. As long as the underlying cash flows are increasing, this doesn't worry me at all.

With BN currently trading at a market capitalization of $51.4 billion while my assumed sum-of-the-parts value is around $73.1 billion, the market currently assigns around a 30% holding discount to BN. This seems largely exaggerated, especially since many of BN's investments are easy to value because they are separately listed entities.

On a sum-of-the-parts basis, BN looks even more undervalued than it did at the time of my last article.

Look-Through Earnings

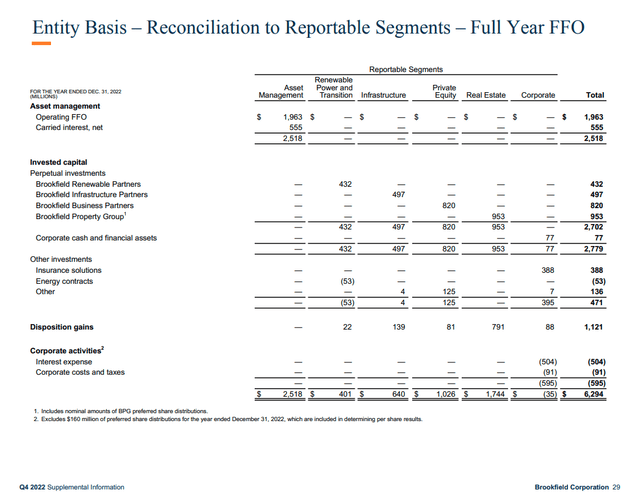

In Berkshire Hathaway's 1990 letter to shareholders, Warren Buffett laid out his take on "Look-Through" Earnings. For holding companies such as Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) or Brookfield Corporation, we need to take into account all of the earnings that are attributable to the holding company, disregarding if they were distributed or retained. Luckily, Brookfield is reporting these earnings for us, so we don't need to calculate the share of the retained earnings that is not reported in BN's financial statements. Brookfield reports "Distributable Earnings" and FFO. I will use FFO excluding disposition gains (I call it "Core FFO"). The slide from the Q4 2022 Supplemental Information below shows the FY2022 FFO by business unit:

Full Year 2022 FFO (BN Q4-22 Supplement)

Excluding disposition gains, FY2022 Core FFO amounted to $5,173 million.

Now here comes a problem. The FFO from "Asset management" includes a 100% share of FFO until the distribution of the 25% interest in December. So this number isn't a good starting point to value BN because, in FY2023, 25% of these earnings are not attributable to BN anymore.

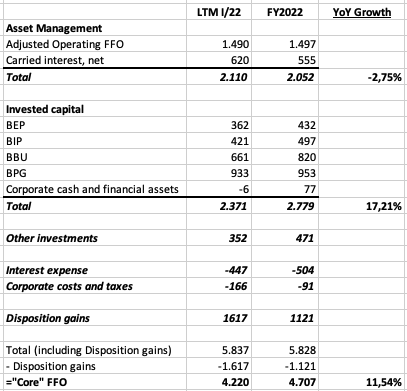

I opted to factor out 25% of the operating FFO for FY2022 and compare this to the comparable number for the TTM in May 2022. Here is the result:

Comparable FFO - Q1/22 LTM vs. FY22 (Compiled by Author from company reports)

Since my last article, BN grew total FFO by 11.54% over the past three quarters while the share price declined by a bit more than 15%. The decline in FFO from the Asset Management business is misleading because Brookfield restructured some of the reporting units.

With BN currently trading at a market capitalization of $51.4 billion, the current Price/FFO is around 11. This corresponds to an FFO yield of 9.16% which is a rather low valuation in my opinion.

What about growth?

While the 9.16% FFO yield looks attractive, we need to look at growth prospects throughout BN's business units. I will only address the Manager (BAM), the infrastructure business (BIP), the renewable business (BEP) and the insurance business.

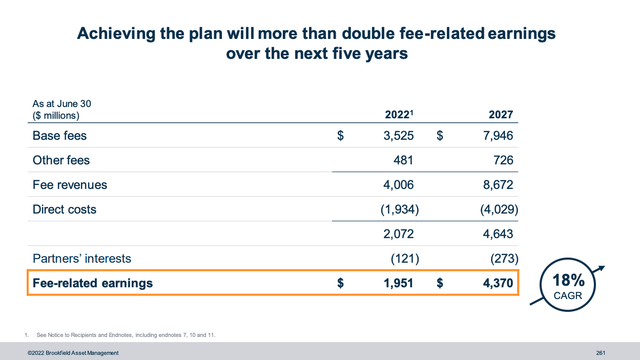

BAM aims for a CAGR in fee-related earnings of 18% until 2027, as can be seen in the slide from BN's investor presentation below:

BAM growth targets until 2027 (BN 2022 IR day presentation)

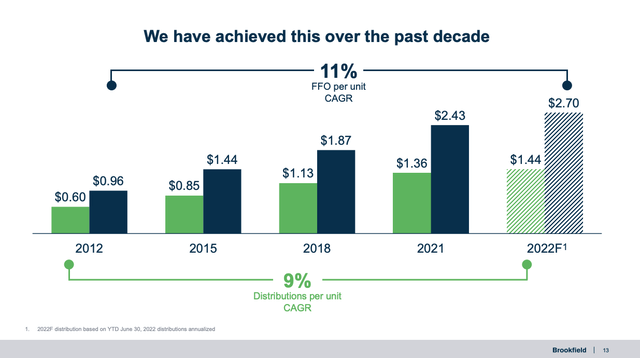

BIP achieved 11% CAGR in FFO per unit over the past decade:

BIP growth over the last decade (BIP 2022 Investor Day presentation)

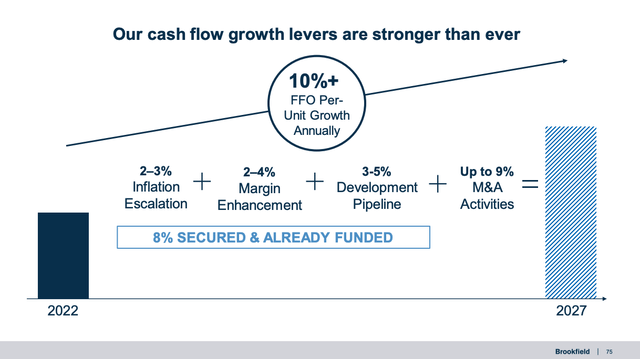

BEP is targeting 10%+ FFO per unit growth until 2027:

BEP growth targets until 2027 (BEP 2022 IR day presentation)

As for the insurance solutions business, there are no clearly stated growth targets, probably because it is such a new part of Brookfield. In the 2022 investor day presentation, it is stated that Brookfield wants to "Focus on compounding book equity at 20%+ for many years to come".

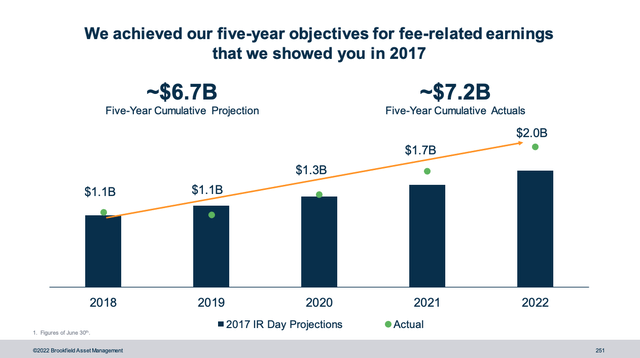

Assuming BAM reaches its target of 18% growth CAGR and the other three business units grow with a 10% CAGR while BPG and BBU don't grow at all, FFO CAGR until 2027 on the BN level would amount to 11.75%. Now I don't say that these growth rates will definitely be achieved, but Brookfield has a history of overdelivering on their growth ambitions, as can be seen in the slide below:

BN 5-year performance (BN 2022 IR day presentation)

Over the past 5 years, Brookfield easily beat the guidance it laid out in its 2017 IR day.

My point is that even when we drastically reduce the targeted growth rates, BN still looks undervalued at a 9.16% FFO yield. If I were to cut the growth targets in half, the total FFO on the BN level would still grow by a CAGR of 5.66%.

A simple DCF valuation assuming $2.89 in FFO (9.16% x $31.54 BN share price), 5.66% growth for 5 years and 2% in line with inflation thereafter already results in value per share of $42.96 (assuming a 10% discount rate). Note that a DCF valuation is not the best approach here because we are using FFO and not free cash flow. In my opinion, it still allows us to gauge the present value of the cash flows.

In conclusion, taking into account the growth targets, BN looks deeply undervalued on a "Look-Through" Earnings basis, even when we were to cut the growth targets in half.

What about BAM?

Since everyone who read my last article will now hold shares of BN and BAM (if they didn't sell one of both already), I need to address BAM as well.

By investing in BAM, you exclude all of the asset-heavy business units (renewables, infrastructure, private equity and real estate) from your investment. However, you will still benefit partially from BN growing its capital base because the assets are managed by BAM. The downside is that you have to pay a higher price. With 1,635,300,00 shares outstanding at a price of $31.62, BAM's market capitalization stands at $51.7 billion. I will just use FFO here as well. FY2022 Total FFO was $2,736 million, so you are paying close to 19 times FFO here compared to 11 times for the consolidated BN FFO. This makes sense because BAM is projected to grow earnings at a much higher rate than BN's other business units.

The other main difference is that BAM is paying out 90% of distributable earnings as a dividend, so the dividend yield is much higher (currently 4%) compared to BN.

I think the decision regarding which of the two to hold comes down to preference. Do you want dividend income? Then BAM is your pick. Do you consider yourself a deep-value investor and prefer not to be taxed on dividends but rather for the company to reinvest profits? Then BN is your pick.

Another thing to consider is that Brookfield CEO Bruce Flatt wrote the following in the Q4 2022 letter to shareholders:

With a net asset value per share which we estimate to be vastly higher than our share price, we expect to continue to use our cash resources to repurchase shares in the market. If the discount persists, we will also consider other options, including a tender offer.

Source: BN CEO Bruce Flatt - Q4 2022 BN letter to shareholders

BN might start to fight the huge valuation discount by performing share buybacks. In my opinion, this makes sense at the current valuation. He also hints that a tender offer would be an option. This leads me to the next section: Risks.

Risks

In my opinion, the potential tender offer mentioned above is the main risk that has not been talked about so far. If the discount to the value of the assets persists and a potential tender offer goes through, BN shareholders might be forced to give away their shares for a price far below what they are worth. Now I don't see why anyone would accept a tender offer far below the value of the underlying assets, but you never know. We have seen a similar transaction when Brookfield took private Brookfield Property Partners in 2021.

Another risk remains unchanged from my last article, the possibility of a major misstep by BN's management team. BN's business depends on the reputation and the trust of the customers that are investing in their funds. A major failed acquisition or another kind of "scandal" could shake up the trust of BN's investor base, leading to fewer fund commitments.

Conclusion

No matter how I look at it, BN looks deeply undervalued. My sum-of-the-parts calculation implies that BN is trading at a 30% holding discount. This seems largely exaggerated because most parts of the business can be easily valued. On a "Look-Through" Earnings basis, BN is trading at 11 times FFO while management expects FFO to grow in the low double digits over the next few years. Even when cutting growth assumptions in half, paying 11 times FFO for a company growing mid-single digits looks like a great deal.

Regarding BAM, the higher price of 19 times FFO is a result of the higher growth expectations. The higher price seems reasonable. BAM is far less complex than BN and BAM investors will still partially benefit from the growth of BN's capital base because the assets are managed by BAM.

As BAM is paying out 90% of earnings as dividends, BAM is the right pick if investors want dividend income. BN on the other hand is a deep value play and a bit of a bet that management will be able to close the holding discount gap.

In conclusion, I reiterate my "strong buy" rating on BN and initiate a "buy" rating on BAM.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BN:CA, BAM:CA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.