KSA: Good Times Ahead For Saudi Equities

Summary

- The iShares MSCI Saudi Arabia ETF offers investors access to Saudi equities, a historically closed-off section of the emerging markets universe.

- With the Saudi government still in the early stages of its economic reforms, the runway for earnings growth and valuation upside remains extensive.

- KSA is well-positioned to capitalize on broader economic growth trends via its outsized exposure to the banking sector.

JohnnyGreig

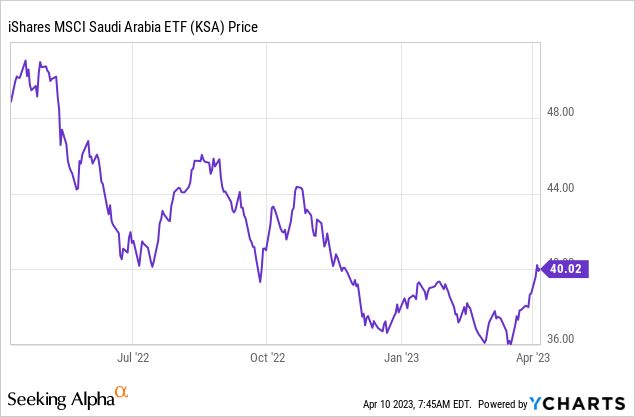

In absolute terms, the Saudi market remains as oil-dependent as ever; this means when oil prices rise, Saudi equities tend to outperform. Saudi Arabia is also one of the few equity markets that benefit from higher US interest rates via its USD peg, increasing its relative appeal as a portfolio diversifier in the 'emerging market' (EM) class. While the weaker oil outlook this year had led to the iShares MSCI Saudi Arabia ETF's (NYSEARCA:KSA) underperformance vs. its EM counterpart, the recent OPEC+ supply cut announcement points toward continued strength for Saudi equities. Cyclically, a 'price floor' for oil and demand tailwinds from the China re-opening bodes well for the Saudi economy, while on a mid to long-term basis, the added fiscal room allows for accelerated reforms across sectors. The Saudi valuation premium, traditionally a key hurdle for investors, has also narrowed in recent months, presenting a compelling entry point for investors.

Fund Overview - Concentrated Exposure to Saudi Arabian Equities

The US-listed iShares MSCI Saudi Arabia ETF seeks to track, before fees and expenses, the performance of the MSCI Saudi Arabia IMI 25/50 Index, which is comprised of large, mid, and small-cap Saudi equities (~99% of the free float-adjusted market cap). The ETF held ~$913m of net assets at the time of writing and charged a 0.7% expense ratio, making it one of the more costly ETFs relative to its closest comparable, the Franklin FTSE Saudi Arabia ETF (FLSA), though the fees are in line with the iShares emerging market ETF (EEM). A summary of key facts about the ETF is listed in the graphic below:

iShares

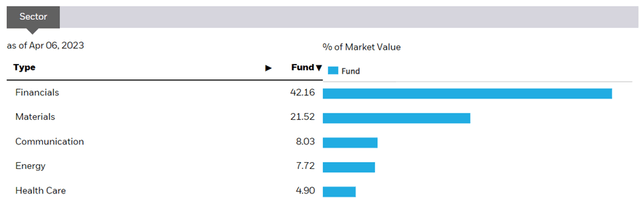

The fund is spread across 110 holdings, with the largest sector allocation going to Financials at 42.2%, followed by Materials at 21.5% and Communication at 8.0%. The only other allocation exceeding the 5% threshold is Energy at 7.7%. Unlike many other emerging market funds, KSA has limited exposure to the consumer, with a combined staples and discretionary allocation of 7.5%. On a cumulative basis, the top five sectors accounted for ~84% of the total portfolio, making KSA one of the more top-heavy ETFs from a sector standpoint. Despite Saudi's close ties to cyclical energy prices, the fund's outsized exposure to financials has kept its equity beta low at 0.62, reflecting its relative defensiveness.

iShares

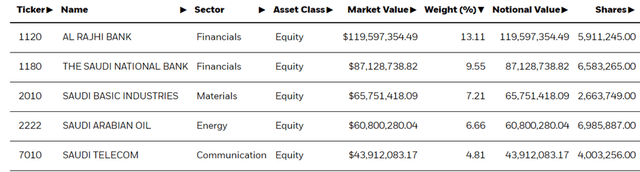

The single-stock allocation reflects the fund's banking concentration, with Islamic banking leader Al Rajhi Bank leading the way at 13.1%. The second largest holding is Saudi Arabia's largest commercial bank, Saudi National Bank, at 9.6%, followed by Saudi chemical manufacturing company SABIC at 7.2% of the portfolio. Other key holdings include petroleum and natural gas giant Saudi Aramco (ARMCO) at 6.7% and Saudi Telecom at 4.8%. In total, the top five holdings account for ~41% of the overall portfolio, making KSA a relatively concentrated emerging market ETF. The fund's underlying earnings and book value valuation multiples are at a premium to the global emerging market equity universe, though investors get a superior earnings growth runway and compounding potential in return. With the premium also somewhat narrowing in anticipation of a weaker oil price outlook in recent months, the valuation is less of a hurdle today.

iShares

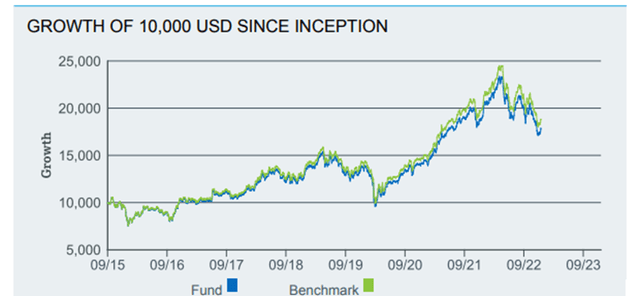

Fund Performance – Serial Compounder with a Decent Income Yield

On a YTD basis, the ETF has risen by 4.1% and has compounded at an impressive 8.2% rate in market price and NAV terms since its inception in 2015. Outside of last year's >5% drawdown, the fund has posted consistently positive gains through the cycles, defying concerns about the Saudi economy's oil-driven cyclicality. Per the latest reporting, the three and five-year returns stand at 19.9% and 8.2%, respectively, closely tracking its benchmark MSCI Saudi Arabia IMI 25/50 Index.

iShares

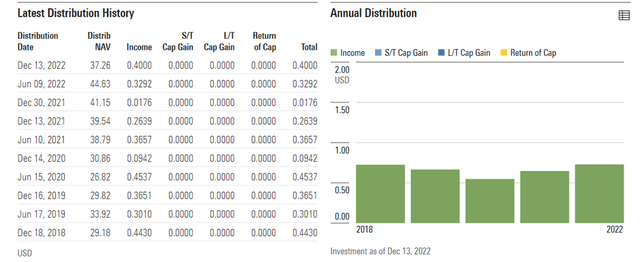

The semi-annual distribution is derived entirely from income, with the fund's holdings in cash-generative sectors like financials, materials, and communications supporting a steady capital return through the cycles. At a trailing twelve-month yield of 2.0%, KSA isn't the highest-yielding emerging market ETF, but the income portion is a nice supplement to the earnings growth potential of KSA's portfolio holdings.

Morningstar

Supportive Oil Price Outlook Keeps the Budget Balanced

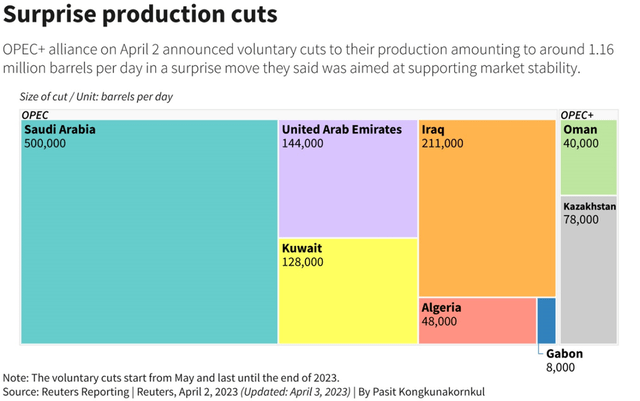

The oil price outlook is looking more constructive than many had previously expected. Not only due to the positive demand impact from China's re-opening but also from the latest OPEC+ oil cuts amounting to ~1.1m barrels/day. While Saudi Arabia will also take a ~500kbpd cut, the extent of the fiscal hit (or benefit) will depend on the demand elasticity of oil prices.

Reuters

But more importantly, using supply cuts to help maintain oil stability ahead of a potential global recession keeps the Saudi budget balanced (note the fiscal break-even runs at <$70). In turn, this should allow for a further de-levering of (already low) public debt levels, enhancing the fiscal room for key growth initiatives and mega-projects. Given KSA's exposure to the broader economy via banks, higher government revenues and fiscal spending should translate into more earnings growth for the portfolio.

Economic Reforms Signal More Long-Term Upside for Saudi Equities

Backed by the fiscal headroom, the Saudi government should have more than enough runway to accelerate its planned reform initiatives under the 'Vision 2030' plan. For context, 'Vision 2030' is intended to diversify the Saudi economy beyond its oil dependence, creating more non-oil tax revenue streams and increasing overall employment in non-oil sectors.

Saudi Government

A key beneficiary of the long-term plan is KSA's largest sector allocation, financials, given the prominence of the 'Financial Sector Development Program' (FSDP) within the 'Vision 2030' blueprint. Key targets include ~5% annualized banking asset growth to SAR4.6tn by 2030 and expanding the percentage of SME loan contribution to 20% of loans by 2030 (vs. ~6% in 2019). Efforts to boost home ownership by ~23% to 70% by 2030 via the transformation of the housing market also bodes well for loan growth. Finally, planned capital markets expansion via increased public listings, as well as financial market liberalization, should catalyze the inclusion of Saudi Arabian equities in leading global indices, underpinning future upside for stock valuations.

Good Times Ahead for Saudi Equities

In contrast with expectations for energy weakness this year, this month's OPEC+ oil supply cut should set a price floor for oil and keep the Saudi budget balanced. While Saudi equities have traditionally served as a play on oil, they also offer diversification benefits for EM mandates via the USD-pegged currency. And over the long term, reform efforts are underway to diversify the economy beyond oil, led by the 'Vision 2030' initiative. The financial sector, KSA's main sector allocation, stands out as among the biggest beneficiaries here, while the buildout of a more vibrant capital market (last year was a huge year for IPOs in the Saudi market) bodes well for equity valuations. While KSA trades approximately five turns above its emerging markets ETF counterpart, the extended runway for earnings growth and ROE expansion justifies the premium, in my view.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.