What I Wish I Knew Before Investing In REITs

Summary

- REITs can be very rewarding investments.

- z.

- I review 5 mistakes that you should avoid as a REIT investor.

- We're currently running a sale for our private investing group, High Yield Landlord, where members get access to portfolios, market alerts, real-time chat, and more. Learn More »

Baris-Ozer

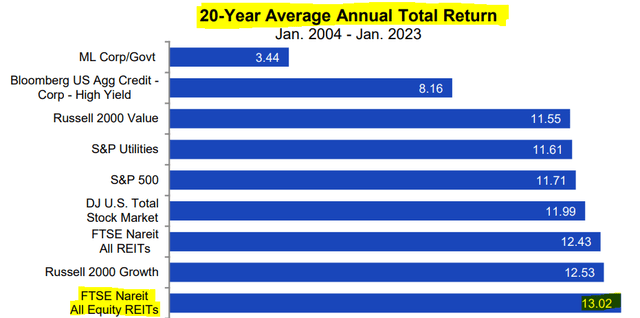

REITs (VNQ), or Real Estate Investment Trusts, can be incredibly rewarding investments.

On average, they have generated about 13% annual returns over the past decades, and that's despite going through three major crises: the great financial, the pandemic, and the recent surge in inflation & interest rates.

And that's just the average performance of the sector.

Quite a few individual REITs did a lot better than that.

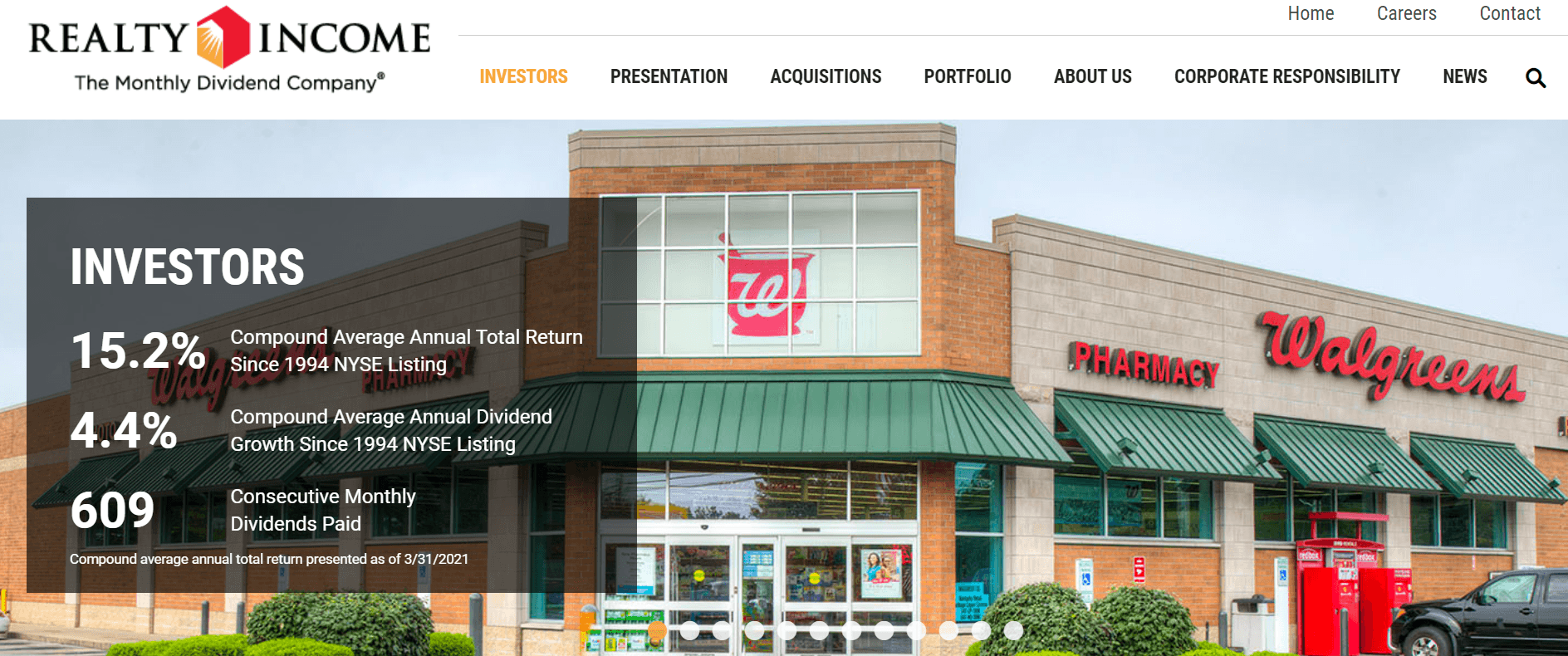

Just to give you a few examples: Realty Income (O), American Tower (AMT), and Prologis (PLD) have managed to compound at closer to 15% per year:

Realty Income

But unfortunately, I get the feeling that most REIT investors have done a lot worse than that.

I have posted 100s of articles on REIT investing here on Seeking Alpha and it seems that most readers perceive REITs as poor investments with a high risk of losses. I can't prove this, but it seems that most individual investors consistently pick the wrong REITs and end up paying the consequences.

In today's article, I want to take a step back and discuss the biggest mistakes that I see investors make when investing in REITs.

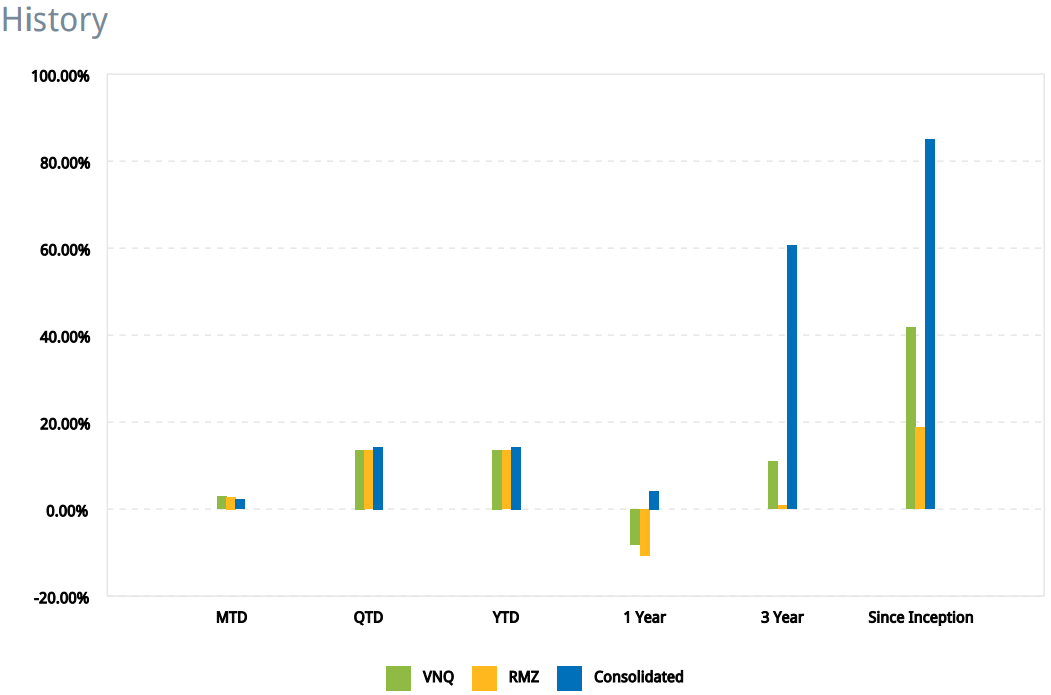

I am far from perfect and I make some of these mistakes myself, but I have been investing in REITs for a long time, and overall, I have done quite well over time, outperforming major benchmarks:

Interactive Brokers

Here are 5 mistakes to avoid at all costs:

#1 Mistake: Focusing on Yield Instead of Total Returns

Most investors seem to buy REITs for their dividend income.

They perceive them as income investments with limited growth potential and so they will target the highest-yielding REITs in hopes of earning higher returns.

But in reality, REITs are not just income investments, they are total return vehicles. They have even outperformed the S&P 500 (SPY) and Tech Stocks (QQQ) over many time periods and more than half of their returns have come from growth and appreciation.

So it is not enough to just look for the highest dividend yield. The highest-yielding REITs have historically actually been some of the worst performers in most cases because they will either:

- Have too much leverage

- Not retain enough cash flow for growth

- Lack liquidity to properly maintain properties

- Suffer conflicts of interest

- Or own riskier properties that have a high yield, but poor growth prospects

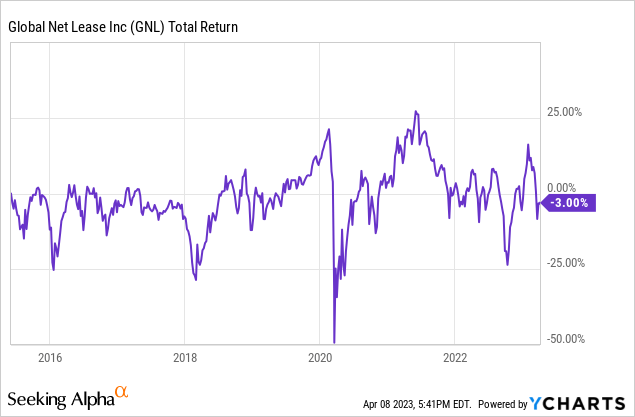

It may feel great to earn a 12% dividend yield from a REIT like Global Net Lease (GNL), but it really doesn't help you if the share price keeps declining because the REIT fails to create value for shareholders:

Investors would be much better off investing in lower-yielding REITs that have solid business models and strong growth prospects.

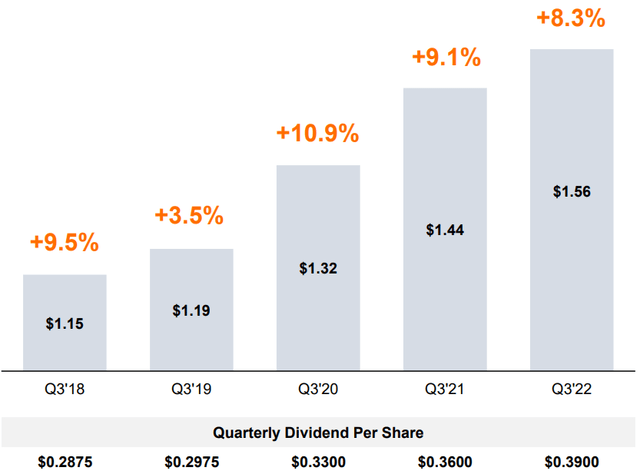

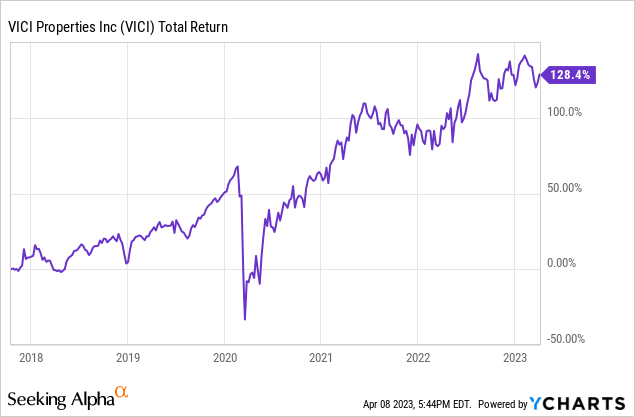

To give you an example: VICI Properties (VICI) pays a 5% dividend yield, which may not seem that attractive, but it has also been able to grow its cash flow and dividend at a rapid pace:

This year, it has again guided to grow its cash flow by 10%:

5% dividend yield + 10% growth = ~15% annual total returns

You would be much better off investing in the lower-yielding, but faster-growth REITs in most cases.

Even better: try to find such REITs that are temporarily discounted and offered at a high yield. That's what we try to do at High Yield Landlord to outperform the market.

#2 Mistake: Not Diversifying Enough

You need to take risks to earn returns. Naturally, sometime, risk factors will play out and will you suffer losses. It does not matter how good of an investor you are. Even Warren Buffett suffers large losses on some investments.

And unfortunately, it seems that most REIT investors are not diversifying enough and so a single loss can ruin their entire performance and their perception of the REIT sector.

To give you an example: I suffered large losses on Medical Properties Trust (MPW) and Uniti Group (UNIT) over the last year. They are some of my most speculative REIT investments. But because they are just 2 fairly small positions in my portfolio of 24 REITs, the losses were manageable. The gains on a single large position like RCI Hospitality (RICK) made up for it.

#3 Mistake: Ignoring Foreign Markets

Related to mistake #2 - most investors make the mistake of only looking at US REITs and they don't invest abroad.

This is a mistake because including foreign REITs in your portfolio could allow you to lower its risk - all while boosting its returns.

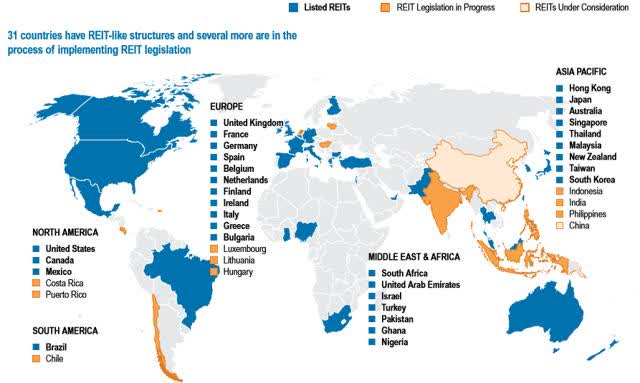

There are over 30 countries with REIT-like structures:

EPRA

Risks are lowered thanks to the diversification benefits. To give you an example: my Canadian apartment REIT Boardwalk (BEI.UN / OTCPK:BOWFF) is today performing a lot better than most US apartment REITs because it enjoys more favorable market conditions.

Returns can be boosted because the best opportunities are sometimes abroad. Today, the cheapest real estate investment firms are arguably in Germany. I think that many of the listed German companies such as Vonovia (VNA / OTCPK:VONOY) are very opportunistic. I recently covered it in a separate article that you can read by clicking here.

Don't ignore these opportunities.

#4 Mistake: Focusing Too Much on Quarterly Results

REITs can be very volatile in the short run and it will often cause investors to overreact, especially if some negative news comes out.

Example: a REIT may announce that it suffered some temporary setbacks in its quarterly results and it will rapidly sell off.

This is a mistake in my opinion.

On the contrary, I think that such situations can lead to great buying opportunities. Investors tend to forget that real estate, and by extension REITs, should be valued based on decades of expected cash flow. Therefore, the impact of a poor quarter or two should be very minimal on the valuation, and yet, often, share prices will vary very significantly.

Don't overreact. Most often, quarterly results are just noise.

#5 Mistake: Focusing Only on FFO... And Forgetting About NAVs

Most investors value REITs with a multiple of their FFO, which is a rough estimate of their cash flow.

We call this the FFO multiple.

It is widely used by investors because it is easy to access. REITs share their FFO in their result announcements and also provide FFO guidance in most cases.

But more sophisticated REIT investors will also pay attention to the NAV, which stands for net asset value. It is the value of the properties, net of debt.

It is a very useful metric because it allows you to evaluate how much you are paying for the REIT relative to the value of its assets.

Sometimes, a REIT may seem undervalued based on its relatively low FFO multiple, but in reality, it will be priced expensively relative to the value of its assets. Omega Healthcare Investors (OHI) was a good example of that a few years back.

At High Yield Landlord, we put a lot of effort into estimating NAVs because it allows us to identify good buying opportunities.

A good example would be BSR REIT (OTCPK:BSRTF / HOM.U). It owns Texan apartment communities with rapidly growing rents but its real estate is currently priced at just 70 cents on the dollar.

BSR REIT

The 30% discount is a great deal in our opinion and so we are buying it.

The 'Landlord Approach' to REIT Investing

A final tip that I want to give you is that you should seek to invest in REITs as if you were buying rental properties.

- Buy good real estate.

- Focus on the long-term prospects.

- Ignore the short-term noise, unless it leads to buying opportunities.

- Don't put all your eggs into one basket.

- Let the returns compound over time.

- And try your best to get a good deal of course.

I think that this simple approach will yield much better results than most other REIT investors.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Join 2,500+ Subscribers...

At Just 1/2 Of The Regular Rate!

We want to give you the opportunity to try High Yield Landlord at a much lower price for one year, so you can see if it's a good fit for you. We are the largest and best-rated real estate investing group on Seeking Alpha with a perfect 5/5 rating from 500+ reviews and our members happily pay $470 per year.

For a limited time, you can save $235 and we are also giving you a 2-week free trial so you have everything to gain and nothing to lose.

This article was written by

Jussi Askola is a former private equity real estate investor with experience working for a +$250 million investment firm in Dallas, Texas; and performing property acquisition in Germany. Today, he is the author of "High Yield Landlord” - the #1 ranked real estate service on Seeking Alpha. Join us for a 2-week free trial and get access to all my highest conviction investment ideas. Click here to learn more!

Jussi is also the President of Leonberg Capital - a value-oriented investment boutique specializing in mispriced real estate securities often trading at high discounts to NAV and excessive yields. In addition to having passed all CFA exams, Jussi holds a BSc in Real Estate Finance from University Nürtingen-Geislingen (Germany) and a BSc in Property Management from University of South Wales (UK). He has authored award-winning academic papers on REIT investing, been featured on numerous financial media outlets, has over 50,000 followers on SeekingAlpha, and built relationships with many top REIT executives.

DISCLAIMER: Jussi Askola is not a Registered Investment Advisor or Financial Planner. The information in his articles and his comments on SeekingAlpha.com or elsewhere is provided for information purposes only. Do your own research or seek the advice of a qualified professional. You are responsible for your own investment decisions. High Yield Landlord is managed by Leonberg Capital.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RICK; MPW; UNIT; HOM.U; BEI.UN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.