Viomi: Underwhelming Q4 Results And I'm No Longer Bullish (Rating Downgrade)

Summary

- Viomi's Q4 2022 net revenues slumped by 31.7% to $132 million, while the net loss stood at $15.4 million.

- The pace of the recovery of revenues to pre-pandemic levels seems slow and unpredictable, and VIOT seems reluctant to repurchase shares despite its negative EV.

- In my view, 2023 could be challenging from a financial standpoint, and there are no catalysts on the horizon for the share price.

- Forsaken Value and Yield members get exclusive access to our real-world portfolio. See all our investments here »

cemagraphics

Introduction

In January, I wrote a bullish article on SA about Chinese Internet of Things (IoT) company Viomi Technology (NASDAQ: NASDAQ:VIOT) in which I said that I expected its financial results to improve over the coming quarters as China ended its zero Covid policy in December.

Well, I was wrong as the company's recently released 2022 financial report showed that Q4 2022 revenues slumped by 31.7% year on year while the net loss soared to $15.4 million. The road to recovery of financial results to pre-pandemic seems unpredictable and I'm changing my rating on the stock to neutral.

Overview of the Q4 2022 financial results

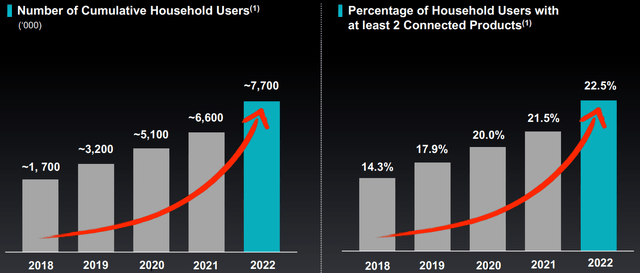

In case you're not familiar with Viomi or my earlier coverage, here's a brief description of the business. The company is involved in the sale of IoT-enabled smart home products including refrigerators, dishwashers, ovens, washing machines, air conditioners, and robot vacuum cleaners among others. Viomi's portfolio currently includes more than 60 products, and the company has amassed over 6,100 registered patents and more than 3,800 authorized patents. It focuses on China's young and modern middle-class consumers and about 7.7 million households had at least one of its devices at the end of December 2022. This is about 0.3 million households more than in September 2022. Some 22.5% of the household users had at least two connected Viomi devices at the end of the year, compared to 22.3% at the end of September.

Turning our attention to the Q4 2022 financial results, Viomi CEO Xiaoping Chen warned during the Q3 2022 earnings call that sales were expected to decline year on year despite good progress in product innovation, brand promotion, and channel expansion as China abandoned its draconian zero COVID policy in December. With this wording, I was expecting a modest drop in sales in the single digits. Instead, Q4 net revenues crashed by 31.7% to just 910.6 million Chinese yuan renminbi ($132 million). The net loss came in at 106.3 million renminbi ($15.4 million) which is even worse than Q3 when it stood at 81.2 million renminbi ($11.4 million). The silver lining is that the gross profit margin for Q4 was just over 23%, which is significantly higher than the 20% expectations set during the Q3 earnings call.

During its Q4 earnings call, Viomi blamed the weak revenues during the period on macroeconomic headwinds as well as the impact of the COVID pandemic and I find this explanation inadequate. Looking at the breakdown by product category, I was pleasantly surprised by home water solutions sales as they rose by 6% year on year to 279.2 million renminbi (US$40.5 million). The quarter on quarter growth was 133% as Viomi launched several new products during the year, including the 1200G Quanxian AI water purifier. Unfortunately, IoT @ Home portfolio solutions, which account for the lion's share of sales, experienced a challenging quarter with revenues crashing by 48.1% to 359.2 million renminbi ($52.1 million), mainly due to stock keeping unit adjustments for smart kitchen products. Revenues from small appliances and others decreased by 39.3% to 155.9 million renminbi ($22.6 million) as a result of product portfolio adjustments while sales of consumables inched down by just 3.5% to 116.2 million renminbi ($16.8 million), likely thanks to the growing client base.

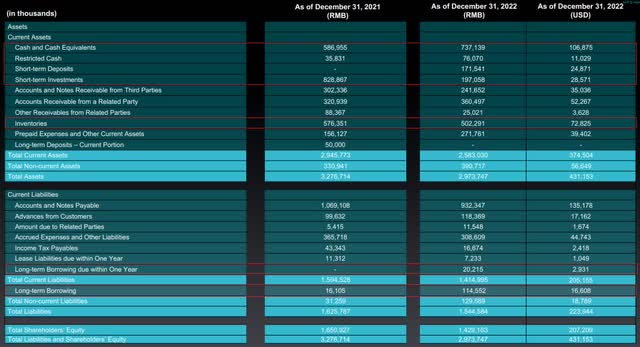

Turning our attention to the balance sheet, cash and cash equivalents and short term deposits and investments rose by 4.3% quarter on quarter to $171.3 million as inventories and prepaid expenses declined by 14.3% to $72.8 million. In October, Viomi announced a $10 million share repurchase program and I expected this to become an important catalyst for the share price over the coming months. I find it disappointing that the treasury stock increased by just $0.5 million during the quarter. It seems that Viomi is in no hurry to repurchase shares despite its strong balance sheet, and this could explain some of the recent share price weakness. The company had barely any debts as of December 2022 and its enterprise value is minus $86.8 million as of the time of writing.

Looking at what to expect for 2023, I think that this could be another challenging year for Viomi as the pace of the recovery of revenues to pre-pandemic levels seems slow and unpredictable. The company revealed in its Q4 2022 earnings call that it has introduced some of its products to overseas markets. However, I expect sales abroad to be inconsequential in 2023 as a result of limited marketing spending. In my view, it's likely that Viomi will stay in the red this year. With no catalysts in sight for the share price considering the company doesn't seem eager to repurchase shares, I think this could be a bad time to open a position.

So, how do you play this? Well, I think that short selling is dangerous as the EV is negative and the bad news seems to be priced into the share price. Data from Fintel shows that the short borrow fee rate stands at just 3.91% as of the time of writing but there are no call options available for Viomi. Overall, I think that investors should avoid this stock and I'm open to changing my rating to bullish if Q1 2023 results show an acceleration in the rate of revenue growth and improved profitability.

Investor takeaway

It seems my expectations for the financial performance of Viomi for Q4 2022 were set too high and that the company could have a long road ahead to get its financial performance back to pre-pandemic levels. The balance sheet is strong, and the enterprise value is negative at the moment which is why I find it surprising that Viomi is not using its vast cash reserves to buy back shares.

Overall, I think that 2023 could be challenging from a financial standpoint and that there are no catalysts on the horizon for the share price. That being said, short selling seems dangerous. I think risk-averse investors should avoid this stock unless financial results improve in the near future.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

If you like this article, consider joining Forsaken Value and Yield. I post my portfolio and shortlist there and you can also find exclusive ideas from our community of investors. I like to focus on undervalued companies that the market is ignoring, like an island of misfit toys. Both long and short ideas.

So, what can you expect to get from this service?

- Exclusive articles

- Access to my portfolio and watchlist

- Interviews, ideas, portfolios, watchlists, and comments from other investors I've invited to the service

- A chat room with access to me and the other investors

This article was written by

I have been investing in stocks since 2007. I have no preference for sectors or countries - I'm as comfortable owning a part of a cement miner in Peru as holding shares in a wheat farming firm in Bulgaria. If it's a value stock - great. If the dividend or share buyback yield is high - even better.

- Disclosure: I am not a financial adviser. All articles are my opinion - they are not suggestions to buy or sell any securities. Perform your own due diligence and consult a financial professional before trading.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not a financial adviser. All articles are my opinion - they are not suggestions to buy or sell any securities. Perform your own due diligence and consult a financial professional before trading.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.