Big Opportunity In The Panic: 2 Fat Yields Up To 9%

Summary

- Legendary fund manager John Neff was a fan of big yields.

- Investment success does not require glamour stocks or bull markets. - John Neff.

- Mr. Neff saw healthy dividend income as a defense against market swings.

- We are buying 2 deeply discounted dividends with up to 9% yields during this panic.

- For income investors, it is a great way to boost your income!

- Looking for a portfolio of ideas like this one? Members of High Dividend Opportunities get exclusive access to our subscriber-only portfolios. Learn More »

Petra Richli

Co-produced with Hidden Opportunities

John Neff managed Vanguard's Windsor Fund for 31 years (from 1964 till his retirement in 1995). Under his watch, Windsor Fund outperformed the S&P 500 in 23 out of 31 years with a 13.7% annual return, with dividends making a notable influence.

Though The Vanguard Group and its founder John Bogle are associated with autopilot index funds and often preached that fund managers seldom beat the market, Mr. Bogle made a notable exception for John Neff's focus on ignored cyclical industrial stocks that paid large dividends to shareholders.

"We almost always have insisted on a good yield on cyclicals. It gives you some kind of bulwark in case you're wrong." – John Neff

Dividends played a starring role in the Windsor Fund, and Mr. Neff liked his portfolios concentrated in stocks that paid steady (preferably rising) dividends. He was also known to prefer market sectors and companies that he called "dull stuff."

During 1994-1995, the Fed pursued a monetary policy tightening cycle where Chairman Greenspan led the FOMC almost to double the Fed funds rate with just seven increases. Investors were concerned that this might end the decades-long economic expansion (not unlike today's climate). Here was Mr. Neff's response in an interview from February 1995.

.....All these people are captives of historical parallels, and say the average postwar expansion lasted so long, and this one is near an end…

[Then, speaking about his picks that fell hard following record earnings and dividend raises]

….this is about as good as you get, and of course, they're increasing the dividend nicely - John Neff, Feb 1995

We are going to be income buyers in bull and bear markets. Structurally high-yielding securities are selling-off in fear and trading at cheap valuations. We will use this opportunity to boost our passive income and inch closer to our retirement goals.

Two value picks up to +9% yields, as Mr. Neff said, "buy on the sound of cannons."

Pick #1: HQH - Yield 9.1%

The United States spends more on health care than any other high-income country. This highly non-cyclical sector provides a defensive tilt to the portfolio amid market turmoil. The demand for medicines is relatively inelastic; people will cut down on fancy dinners and vacations but not on their pills. That should allow Big Pharma companies to maintain their profitability during economic slowdowns. Further, the fundamentals for the industry remain strong, making it suitable for long-term investment.

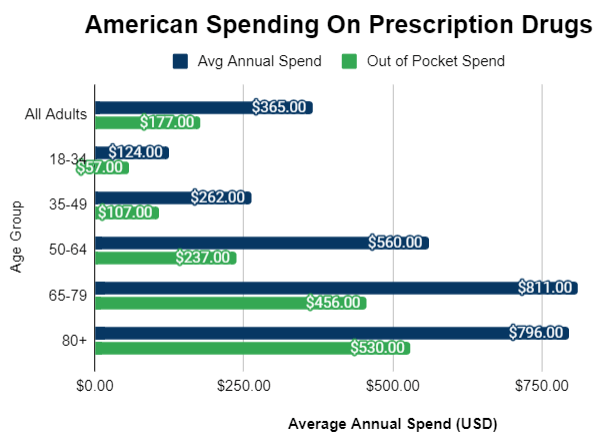

More than 131 million people (66% of all adults) in the U.S. use prescription drugs. Utilization is exceptionally high among older people and those with chronic conditions. Notably, over 50% of these expenses are out-of-pocket. Source

Author's representation - data from georgetown.edu

According to a report from the Administration For Community Living, ~17% of people in the U.S. (more than 1 in 6 Americans) were 65 or older in 2020.

That represents 55.7 million people, an increase of 15.2 million since 2010. The report further projects the numbers to climb to roughly 80.8 million people above 65 by 2040!

The American population is aging fast, and the healthcare industry will be more critical than ever. With an increasing number of Americans purchasing prescription drugs yearly, don't you want to collect your cut?

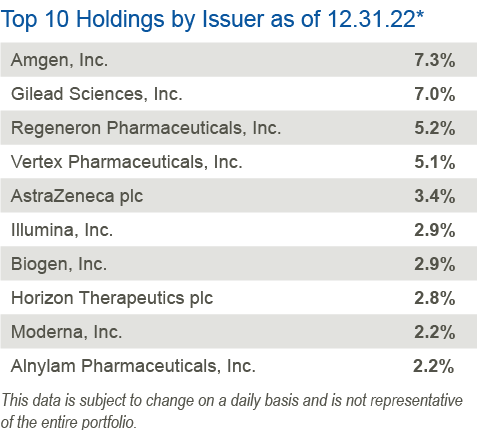

Tekla Healthcare Investors (HQH) is a healthcare-focused CEF with 77% of its portfolio comprising leading biotechnology and pharmaceutical companies. Source

Tekla Healthcare Investors

HQH is well-diversified across 150 holdings. This positions investors well to benefit from the long-term tailwinds for the industry while providing adequate protection against some notable industry risks from a concentration position, such as steep regulatory fines, lawsuits, and patent expirations.

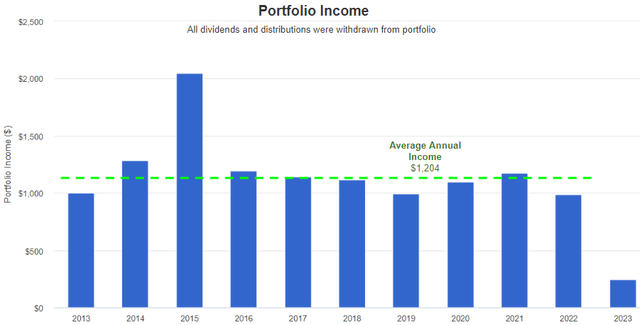

*HQH has a managed distribution policy permitting the fund to make quarterly distributions at a rate of 2% of its net assets. Since NAV varies based on market conditions, so are HQH's distributions. But the fund has rewarded investors with reliable income over time. Looking at the past ten-year performance, we see a 12% average annual income. Data Source: Portfolio Visualizer

Portfolio Visualizer

HQH trades at a massive 14% discount to NAV, presenting an attractive opportunity to initiate/ add to your position. Management recently announced a share repurchase program allowing HQH to purchase up to 12% of its outstanding shares through July 14, 2023.

HQH does not utilize leverage in its investment strategy, making it suitable for investors worried about leveraged funds in a rising rate environment. Since the CEF's distributions are variable, and including our distribution projection of $0.405 for May, we calculate an impressive 9.1% yield.

The U.S. healthcare industry has maintained inelastic demand through varying market conditions. Tekla's HQH provides opportunities to invest in healthcare with a complete focus on current income production. Long-term fundamentals support the industry, and HQH is a sector-focused and deeply discounted CEF offering a 9.1% yield.

Pick #2: AM - Yield 8.6%

With recession fears and demand concerns, energy prices continue to exhibit volatility in 2023. However, infrastructure that supports the hydrocarbon industry is differentiated from other energy sub-sectors by its largely fee-based business model. This drives more stable cash flows regardless of commodity price fluctuations, and these cash flows support generous dividend payouts to shareholders.

Being a cleaner fuel, natural gas is essential in achieving global net-zero targets. And midstream companies (MLPs and C-Corps) are critical to ensure the secure storage, transportation, and processing of vital energy commodities. Due to the current political landscape, regulatory pressures, and high initial investment costs, few companies own and operate much of America's critical midstream infrastructure, making existing players vital for energy independence.

Antero Midstream Corporation (AM) owns and operates an integrated system of gathering pipelines, compressor stations, and processing and fractionation plants in West Virginia and Ohio. In addition, the company owns and operates two independent water handling systems that support completion activities. These midstream assets primarily serve Antero Resources (AR), the second-largest Natural Gas Liquids ('NGL') producer in the U.S.

Note: AM is a U.S. C-corp issuing a 1099 for investors. It is a suitable high-yield midstream company for investors who shy away from MLPs issuing K-1s.

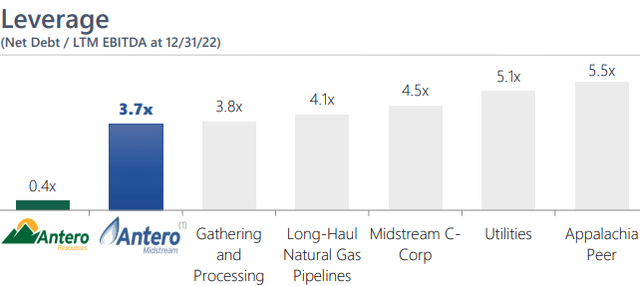

100% of AM's contracts are fee-based and have contractual escalators to provide inflation protection. AM's assets primarily provide midstream support to AR, and both companies have a symbiotic relationship; AR owns about 29% of AM. AR itself has a strong balance sheet with ~$1 billion in debt and an industry-low leverage of 0.4x. It expects leverage to rise slightly to 0.7x by year-end 2023. AM's 3.7x leverage ratio is significantly lower than industry peer groups, and is projected to be even lower by 2024. Source

February 2023 Investor Presentation

AM expects to produce $1-1.3 billion in cumulative Free Cash Flow "After Dividends" through 2027. For FY 2023, the company projects a 7% increase in Adjusted EBITDA through organic growth from the QL Capital Partners Drilling Partnership and a full-year contribution of its recent acquisitions. At the same time, the company guides a 23% decrease in capital expenses.

"The ability to generate EBITDA growth with declining capital is truly unique in the midstream space and illustrates the significant operational leverage our assets have." – Brendan Krueger, CFO

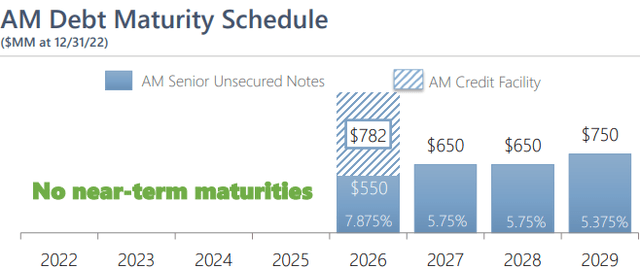

AM expects to use FCF after dividends to reduce leverage further, declining to 3x by the end of 2024. The company also has a comfortable debt schedule with no maturities until 2026.

February 2023 Investor Presentation

While wind, solar, and hydrogen may play a part, natural gas will continue to be vital in generating more electricity to support the growing world population for the foreseeable future. At its current price, AM provides an attractive 8.6% yield. Declining leverage, shrinking Capex, EBITDA growth, and big well-covered dividends – AM has it all, making it an excellent midstream pick for a fearful economy.

Conclusion

John Neff was a buyer of cheap and predictable businesses that paid big dividends. Most importantly, he was a contrarian who often questioned (and profited significantly from) the market's herd mentality and purchased the most unloved companies. Mr. Neff's success can largely be attributed to dividends paid by his picks, a notable reason for his market outperformance. At High Dividend Opportunities, we maintain a diversified portfolio of 45+ dividend payers with an average yield of +9%. With a yield at this level, your income, like Mr. Neff's investment success, doesn't have to depend on meme stocks and bull market confirmations.

You can wait to buy when the market bottoms. Or, you can buy periodically while collecting handsome dividends. I prefer the latter since I like to pursue my preferred hobbies during the day instead of watching price charts and market news. This method works for me and gives me regular paychecks to redeploy into the market's discounted segments. Two picks with up to 9% yields to grow your income in this skeptical market.

If you want full access to our Model Portfolio and our current Top Picks, join us at High Dividend Opportunities for a 2-week free trial.

We are the largest income investor and retiree community on Seeking Alpha with +6000 members actively working together to make amazing retirements happen. With over 45 picks and a +9% overall yield, you can supercharge your retirement portfolio right away.

We are offering a limited-time sale get 28% off your first year. Get started!

Start Your 2-Week Free Trial Today!

This article was written by

I am a former Investment and Commercial Banker with over 35 years experience in the field. I have been advising both individuals and institutional clients on high-yield investment strategies since 1991. As author of High Dividend Opportunities, the #1 service on Seeking Alpha for the 6th year in a row.

Our unique Income Method fuels our portfolio and generates yields of +9% along side steady capital gains. We have generated 16% average annual returns for our members, so they see their portfolio's grow even while living off of their income! 7500+ members have joined us already, come and give our service a try! Join us for a 2-week free trial and get access to our model portfolio targeting 9-10% overall yield. No one needs to invest alone.

In addition to being a former Certified Public Accountant ("CPA") from the State of Arizona (License # 8693-E), I hold a BS Degree from Indiana University, Bloomington, and a Masters degree from Thunderbird School of Global Management (Arizona). I currently serve as a CEO of Aiko Capital Ltd, an investment research company incorporated in the UK. My Research and Articles have been featured on Forbes, Yahoo Finance, TheStreet, Seeking Alpha, Investing.com, ETFdailynews, NASDAQ.Com, FXEmpire, and others.

The service is supported by a large team of seasoned income authors who specialize in all sub-sectors of the high-yield space to bring you the best available opportunities. By having 6 experts on your side who invest in our own recommendations, you can count on the best advice!

In addition to myself, our experts include:

3) Philip Mause

4) PendragonY

We cover all aspects and sectors in the high yield space! For more information on “High Dividend Opportunities” please check out our landing page:

High Dividend Opportunities ('HDO') is a service by Aiko Capital Ltd, a limited company - All rights are reserved.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AM, HQH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Treading Softly, Beyond Saving, PendragonY, and Hidden Opportunities all are supporting contributors for High Dividend Opportunities. Any recommendation posted in this article is not indefinite. We closely monitor all of our positions. We issue Buy and Sell alerts on our recommendations, which are exclusive to our members.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.