Tellurian Soars On Long-Shot Deal

Summary

- Tellurian announced a binding letter of intent involving a $1 billion sale-leaseback transaction.

- This move could bring a tremendous amount of capital to the company, but the transaction is not guaranteed to go through just yet.

- There is risk here, and management would be best advised to focus on the company's side business.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

CHUNYIP WONG

Beyond any doubt, one of the most interesting investment opportunities on the market today is Tellurian (NYSE:TELL). The core piece of the company revolves around an initiative called Driftwood LNG. This is essentially a terminal and a pipeline connected to the terminal that will be responsible for the production and distribution of liquefied natural gas. In addition to this, the company engages in some other activities, the most notable being its upstream operations that involve the exploration and production of natural gas. On April 6th, shares of the company rose as much as 32.2%, ultimately closing up 20.3%, after news broke of a significant sale-leaseback transaction. This, combined with other changes the company has seen, may make it a viable prospect now, but only for investors who are alright with uncertainty.

A big move

My goal in writing this article is not to rehash many of the core aspects of the company. I did this in a prior article that I would encourage you to read. The short version is that management has been trying, really unsuccessfully, to raise billions of dollars in order to build out the Driftwood LNG project. When I last wrote about the company last year, it was estimated that the overall phase one of the project, which would include two plants capable of producing 11 mtpa of LNG per year, would cost about $12.8 billion. As time has gone on, that number has increased to $13.6 billion.

For the past several months, it looked as though the company would be unsuccessful in raising the capital needed for the project to come to fruition. Despite initially having significant volume commitments, and even though the company offered terms on debt that were more than generous, it was unable to raise debt or equity last year that would approach anything close to what it would need to complete the project. I asserted in my prior article on the company that the market may just not believe in the economics of the transaction. Based on an investor presentation from February of this year, management said that phase one of the project would be capable of generating operating cash flow of $4.3 billion. If the other three plants were to ever be built, that number would jump to $10.7 billion per annum.

Most recently, things were looking particularly disappointing. At the tail end of February, for instance, a very important date passed. This was February 28th, and was the day in which its agreement with Gunvor Singapore Pte Ltd was at risk of being terminated since Tellurian has yet to meet certain conditions set by Gunvor. The agreement in question is rather significant since Gunvor had previously agreed to a 10-year contract involving the purchase of 3 million tonnes per annum of LNG In what was estimated to be worth $12 billion in revenue over the life of the contract. This particular deadline was extended two different times, and we have yet to hear from management as to whether or not another extension was agreed upon. This follows the loss of two other sizable deals that the company reported on last September. One of these was of identical size as the Gunvor deal.

The loss of purchase agreements significantly increases the risk of any investor coming in to finance the construction of the project in question. This is why shares of the company have been under pressure in recent months. However, investors were granted a rare victory on April 6th, when shares skyrocketed in response to the company announcing that it had agreed to sell off approximately 800 acres of land owned and/or leased by Driftwood LNG that is slated to be used for the LNG facility. The agreement has not been made final. Instead, a binding letter of intent has been signed by an unnamed institutional investor with $120 billion in assets under management.

The purchase price of the land is $1 billion. In addition, Tellurian has signed on to lease the land back from the investor over the next 40 years. This means that the business will receive a significant amount of capital upfront that it can use to further its goals. However, it will also mean that the firm will be forced to pay to lease the land moving forward, with pricing such that the investor should achieve a capitalization rate of 8.75%, with an annual rent escalator of 3%. This deal does come with some strings attached, however. For starters, Tellurian must post a letter of credit that equals 12 months' worth of rent. In short, this will mean that the investment company making this move we'll get at least 12 months' worth of rent even if something were to happen with Tellurian.

More significant than this is the requirement in the agreement that the equity investors in Driftwood LNG or its affiliates be joint and several contingent guarantors of the master lease agreement. There is also the requirement that the contingent guarantors hold an investment grade rating of BBB or higher. The joint and several stipulation means that, even if something were to happen with Tellurian, the equity investors in the project would have to make good on the lease for its remaining duration. For a company that is already struggling to find capital in order to complete this project, this would be a hard point to convince investors to be comfortable with. Ultimately, if these conditions are not met by July 14th of this year, then the binding letter of intent will terminate at the end of July. So at this point, there is no guarantee that this transaction will even be completed.

Where some value might lie

I remain highly skeptical of the Driftwood LNG project. While it is possible that it could be an economically viable opportunity that could generate significant upside, the market has already made clear that it's unwilling to fund it. Normally, this would lead me to be very bearish on the company in question. But that, perhaps surprisingly, is not the case today. To understand why, we first need to distinguish between what happens if the company does achieve this sale-leaseback transaction and what happens if it does not. If it does, then, based on the data available to me, the company would actually have an enterprise value that is negative to the tune of $119 million. And if the company does not, then this number is quite a bit higher at $881 million.

While the management team at Tellurian has made abundantly clear that its goal is to get this LNG facility up and running, the firm also does have other operations under its belt. The most significant involves its upstream operations. At present, these consist of nearly 28,000 net acres of land, 60% of which is undeveloped. All of the products extracted from this property so far have been natural gas. Overall production in the final quarter of the 2022 fiscal year came in at 225 million Mcf per day. That's up significantly from the 55 million Mcf of gas per day that the company was producing only one year earlier.

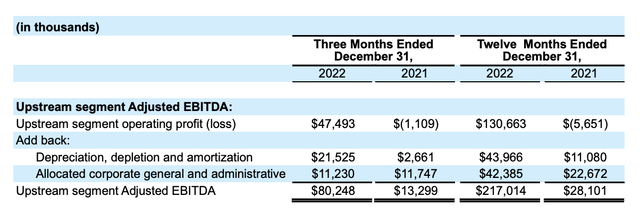

From these properties, the company produced segment operating profits of $130.7 million during 2022. Meanwhile, EBITDA was even higher at $217 million. With additional acquisitions and investments made in the final quarter of the year, it's highly probable that production will climb even more in 2023. Unfortunately, management has not provided much in the way of guidance on this front. The picture is also complicated by how volatile natural gas prices have been. As of this writing, it is around $2 per Mcf. That's down from the $5.55 per Mcf average experienced in the final quarter of last year.

Obviously, if Tellurian succeeds in getting the $1 billion locked in for its sale-leaseback transaction, the negative enterprise value implies tremendous upside for shareholders. But even if that doesn't come to fruition, I would argue that the stock has attractive potential as a player in the oil and gas production market. Even ignoring the aforementioned transaction, using data from 2022, the upstream segment would translate to an EV to EBITDA multiple of 4.1. Although management has high hopes for the company’s LNG operations, a case could be made that, even with the sale-leaseback transaction potentially falling through, the company might be better off just focusing on its natural gas production activities. As a note, the data shown in my table does indicated that the price to operating cash flow multiple of the business would increase should the sale-leaseback transaction takes effect. This is because it’s assumed that the company would still be on the hook for the annual lease payments, but in exchange they would receive a tremendous amount of capital to work with in order to grow further.

Takeaway

Fundamentally speaking, Tellurian seems to be healthy at this point in time. Investors are incredibly optimistic about the recent sale-leaseback announcement. But as it stands, it's unclear whether management will be able to meet all of the requirements set by the institutional investor that's working with them. Frankly, even if this does not come to pass, a case could be made that the company does have some upside because of its natural gas activities. Of course, there is another element to the picture as well. And this is one of reputation.

Not only does management look bad because of its inability to raise capital for the LNG project; it also looks bad because of some other peculiar moves that a company that's struggling to raise capital would normally not make. For instance, in December of 2021, the business donated $25 million to the National Forest Foundation for Nationwide Reforestation. And late last year, management allocated $9 million in company funds to a university with the purpose of advancing global energy research. These kinds of moves are irresponsible in and of themselves. But this doesn't necessarily mean that investors shouldn't take this opportunity seriously. Given how cheap the company is, if we were to look at it as a natural gas producer, I do think that some optimism could be warranted from here. As a speculative prospect, it could be appealing, but because of the uncertainty and history of questionable management decisions, I can't rate TELL stock any higher than a 'hold'.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.