JJN: Nickel Was The Worst-Performing LME Metal In Q1

Summary

- Base metals declined in Q1. Nickel led the way lower.

- Nickel volatility has been wild. A rally to record highs on a significant short position in early 2022.

- Nickel is a critical green metal. Climate change initiatives require more nickel.

- Russia is a leading nickel producer and exporter. The war in Ukraine threatens supplies.

- JJN is a nickel ETN that reflects low liquidity in the nickel forward market.

- Looking for more investing ideas like this one? Get them exclusively at Hecht Commodity Report. Learn More »

Waldemarus

The London Metals Exchange is the home of nonferrous metals trading. Copper, aluminum, nickel, lead, zinc, and tin trade on the LME.

Copper is the leading base metal, and many of the other metals tend to follow copper prices higher or lower. Copper, aluminum, and zinc are the most liquid LME metals, while lead, nickel, and tin tend to experience less volume and open interest. Less liquidity tends to increase price variance as bids to buy disappear during price declines and offers to sell evaporate during rallies.

Nickel has a long history of extreme price variance. While the LME’s most liquid nickel contract is the three-month forwards, the price spreads for nickel for different delivery dates can be highly volatile as they reflect supply and demand factors impacted by logistics, supply and demand locations, and speculative issues.

Nickel is a chemical element with the symbol Ni and atomic number 28. It's a silver-white metal that is hard and ductile. Nickel resists corrosion and is used to plate other metals, like steel, to protect from rust. Nickel is the fifth most abundant element on earth, with Indonesia accounting for most nickel mining.

Base metals declined in Q1

The base metals sector, which includes copper, aluminum, nickel, lead, zinc, and tin forwards that trade on the London Metals Exchange, declined 2.91% over the first three months of 2023. LME nickel was the worst-performing commodity in the base metals sector, falling 20.67% in Q1.

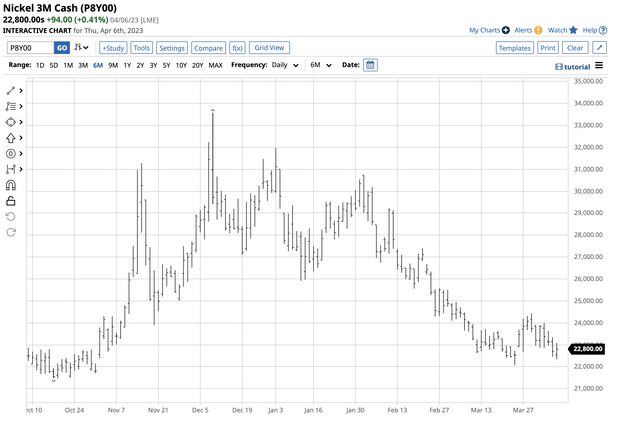

Six-Month Chart of LME Nickel Forwards (Barchart)

The chart shows that three-month nickel forwards closed at $30,048 on December 30, 2022, and fell to $23,838 per metric ton on March 31, 2023. Nickel was 4.35% lower in early Q2 at the $22,800 level on April 6, 2023, as the selling and bearish trend continued. Nickel far underperformed the rest of the sector:

- LME copper rose 7.45% in Q1

- Aluminum moved 1.47% higher in Q1

- Lead fell 8.11% over the three months.

- Zinc was down 1.68% over the period

- Tin rose 4.14% in Q1

Nickel is no stranger to wide price variance.

Nickel volatility has been wild

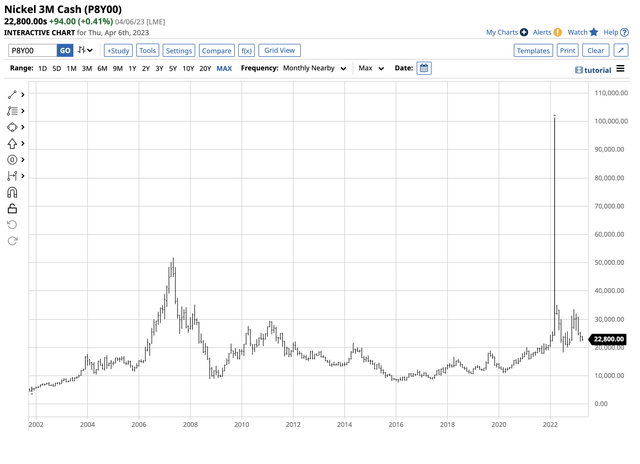

The long-term chart dating back to 2001 highlights LME nickel’s penchant for volatility.

Long-Term Chart of LME Nickel Forwards (Barchart)

The chart highlights that nickel rose to $51,800 per ton in May 2007 and fell to $7,550 in February 2016. In March 2022, as Russia invaded Ukraine, the price spiked to double the level at the 2007 peak when it reached $101,365 per ton. A dominant Chinese market participant with a significant short position caused the explosive rally as Russia is a top nickel producer.

The world’s leading nickel producers are:

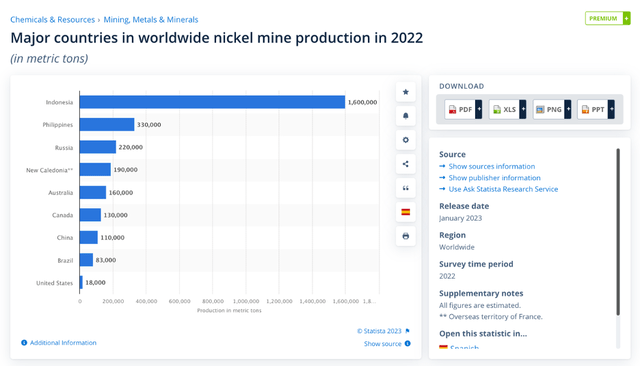

Chart of the Leading Nickel-Producing Countries (Statista)

As the chart highlights, Russia is the third top nickel-producing country behind Indonesia and The Philippines and ahead of New Caledonia, Australia, Canada, China, and Brazil. The war in Ukraine, sanctions on Russia, and Russian retaliation against “unfriendly” countries supporting Ukraine caused the thinly traded nickel market to explode. A substantial short position pushed the price above $100,000 per ton before it ran out of upside steam.

The rise caused turmoil in the Chinese-owned LME, which ceased nickel trading for a while and arranged for a highly contentious lower peak to curb the losses. More recently, in 2023, another scandal hit the nickel market as JPMorgan discovered that 54 metric tons of nickel it purchased and stored in a Rotterdam warehouse, often trusted by nickel market participants, worth around $1.3 million, were hefty bags filled with rocks.

Nickel is a critical green metal

Nickel’s resistance to corrosion at high temperatures has long made the metal critical for stainless steel production. While nickel also is used for armor plating, boat propeller shafts, and turbine blades, it's also crucial for batteries, including the rechargeable nickel-cadmium batteries and nickel-metal hydride batteries used in hybrid vehicles and EVs. Nickel has a long history as the metal of choice in coinage.

Meanwhile, nickel’s role in green energy initiatives turbocharged the demand. Tesla’s Elon Musk recently urged mining companies to boost nickel production as he plans to increase EV output.

Russia is significant for the nickel market

While Russia is the third-leading nickel producing country, it has the world’s fourth most reserves at 7.5 million metric tons. Russian OJSC MMC Norilsk Nickel is one of the world’s largest nickel mining companies. Indonesia, Australia, and Brazil have the three leading reserves.

LME nickel prices surged in March 2022 to over $100,000 per ton on the back of a speculative short position. The peak was unsustainable, and in early April, the price was less than one-quarter of the level at the high. As the demand rises, the thin nickel market will likely resume its upward trajectory after its consolidation.

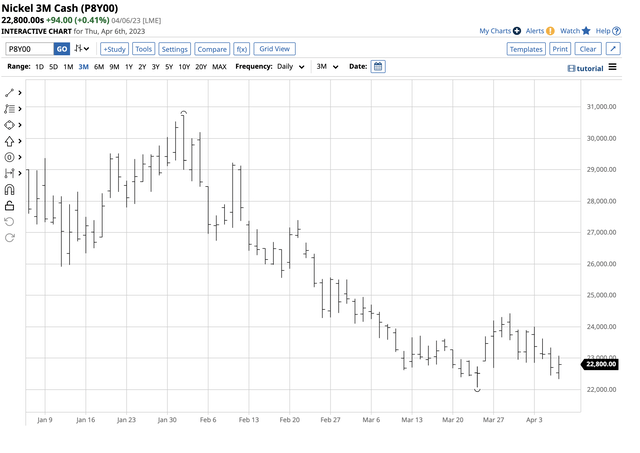

Three-Month Chart of LME Nickel Forwards (Barchart)

The chart highlights nickel’s price consolidation between $22,000 and $25,000 per ton in March 2023. After wild price swings in 2022, the metal is forming a base that could give way to higher prices.

JJN is a nickel ETN

The most direct route for a risk position in the volatile and thinly traded nickel market is via the London Metal Exchange forwards. However, accessing the LME is challenging for most investors and traders. Nickel mining stocks such as Brazil’s VALE (VALE), Glencore (OTCPK:GLNCY), BHP Billiton (BHP), and others have nickel and other commodity exposure.

The fund summary for the iPath Series B Bloomberg Nickel Subindex Total Return ETN (NYSEARCA:JJN) states:

Fund Profile for the JJN ETN Product (Seeking Alpha)

At $30.23 per share, JJN had $32.468 million in assets under management. JJN trades an average of 10,706 shares daily and charges a 0.45% management fee.

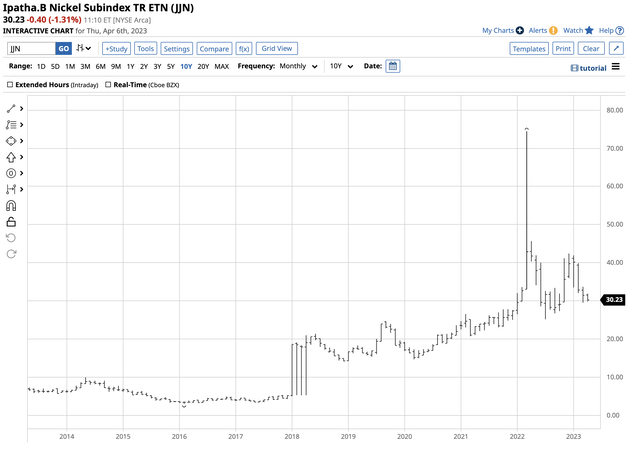

Ten-Year Chart of the JJN ETN Product (Barchart)

The chart shows the spike in JJN to $74.45 per share in March 2022 when the LME prices soared above the $100,000 per ton level. JJN is one of the only products that track the nickel price. The LME forwards suffer from low liquidity, translating to thin conditions in JJN. However, over the long run, the ETN will likely move higher and lower with nickel prices, and it is the only alternative to the LME forward market.

The worst-performing commodities during one period tend to recover and become the best during subsequent periods, and vice versa. Nickel led the way on the upside in early 2022 and the downside in early 2023. Demand from China and green energy initiatives could push nickel prices higher over the coming months and years after the consolidation period ends. Below $25,000 per ton, the risk-reward dynamics favor the upside

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from a top-ranked author in commodities, forex, and precious metals. My weekly report covers the market movements of over 29 different commodities and provides bullish, bearish, and neutral calls; directional trading recommendations, and actionable ideas for traders. I am offering a free trial and discount for new subscribers for a limited time.

This article was written by

Andy spent nearly 35 years on Wall Street, including two decades on the trading desk of Phillip Brothers, which became Salomon Brothers and ultimately part of Citigroup.

Over the past two decades, he has researched, structured and executed some of the largest trades ever made, involving massive quantities of precious metals and bulk commodities.Andy understands the market in a way many traders can’t imagine. He’s booked vessels, armored cars, and trains to transport and store a broad range of commodities. And he’s worked directly with The United Nations and the legendary trading group Phibro.

Today, Andy remains in close contact with sources around the world and his network of traders.

“I have a vast Rolodex of information in my head… so many bull and bear markets. When something happens, I don’t have to think. I just react. History does tend to repeat itself over and over.”

His friends and mentors include highly regarded energy and precious metals traders, supply line specialists and international shipping companies that give him vast insight into the market.

Andy’s writing and analysis are on many market-based websites including CQG. Andy lectures at colleges and Universities. He also contributes to Traders Magazine. He consults for companies involved in producing and consuming commodities. Andy’s first book How to Make Money with Commodities, published by McGraw-Hill was released in 2013 and has received excellent reviews. Andy held a Series 3 and Series 30 license from the National Futures Association and a collaborator and strategist with hedge funds. Andy is the commodity expert for the website about.com and blogs on his own site dynamiccommodities.com. He is a frequent contributor on Stock News- https://stocknews.com/authors/?author=andrew-hecht

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.