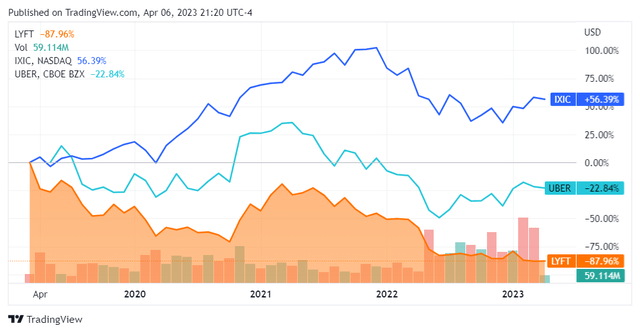

Lyft: Why The Correction Will Likely Continue

Summary

- Lyft returned to revenue growth in 2022, but only posted a top line figure 13% above what it had in the year before the pandemic.

- It has also been spending extensively to maintain that level of growth, with COGS and OpEX never under 120% total for all of 2022.

- The company also lost more cash in 2022 than 2021 while taking on more debt.

- These factors, along with the tough economics of Lyft's core business, keep me skeptical that this company will do anything but shrink from a market capitalization perspective.

jetcityimage/iStock Editorial via Getty Images

Overview

Lyft (NASDAQ:LYFT) has been in the news lately as the company has recently appointed a new CEO, David Risher. Having experienced consistent underperformance for its stock price, and in many respects its business, this was perhaps an overdue move. Nonetheless, this doesn’t change the economics of the business that Lyft is in, the competitive pressures that it faces, or the newly-constrained capital environment in which it operates.

I have long been bearish on Lyft and have continually been more keen on its bigger, badder, brother – Uber (UBER). While I believe this is a relatively common view amongst analysts, I don’t want to simply assume that I’m correct in some way or another due to this becoming consensus. Rather, I think consensus opinions often require the most questioning – by virtue of the fact that people accept them most readily.

This is the lens that I would like to now apply to Lyft. I want to take a fresh look at its financials with a particular eye towards its overall performance in 2022. Additionally, I will add in a few comments regarding the ongoing operating environment as well as the strategic context that Lyft operates in.

Financials

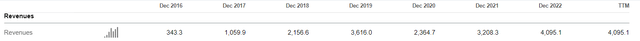

All else aside, this is still a growing company. While taking a moment to get back on its feet after the pandemic crushed its business, Lyft returned to form in fiscal year 2022.

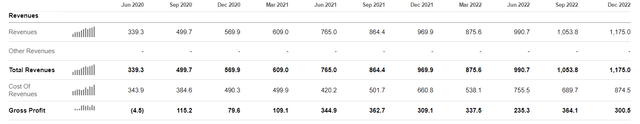

We must contextualize these numbers, however. While these growth rates are quite robust YoY, a lot of this is just the company making up lost ground. 2020 and 2021 saw Lyft post numbers lower than its pre-pandemic figure. Only 2022 saw a return to growth. This growth, however, was middling; its 2022 revenues were only 13.2% higher than its 2019 numbers.

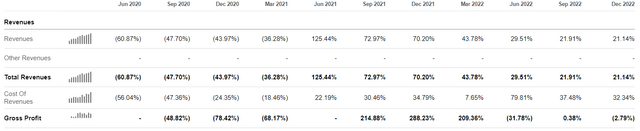

Additionally I am concerned by the fact that there have been down quarters throughout the past year. While generally growing from the pandemic bottom of Q2 2020, March 2022 saw a conspicuous decline. I can appreciate that the holiday season may have been better for it than the first quarter, but this is still not something that I like to see – and it is a far cry from what we saw with Uber. The large decrease in cost of revenues from Q4 2021 to Q1 2022 makes me inclined to believe that a lot of that growth was propped up with marketing and driver incentive spend. The stratospheric increase of cost of revenues in the subsequent quarter, Q2 2022, seem to confirm the tight correlation between the company spending money and making money – not exactly an indicator of a sticky product.

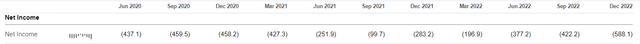

Net income has also continued to get worse throughout 2022. While income reporting for this kind of entity is complex and subject to various adjustments, I would think that the company would have been able to at least move this closer to 0 throughout a year of growth – but it hasn’t.

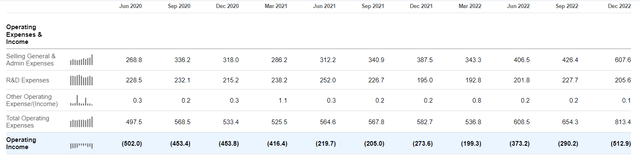

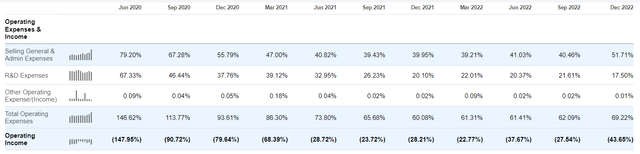

Indeed, the operating income picture shows that this has been the case. Lyft’s cost structure doesn’t appear to be improving at its core. While 2022 was a growth year for revenue, we should note that operating expenditures also grew across the board, with a particular increase in SG&A expenses. This looks to be further proof for what I had suspected earlier – that this company has to spend more than $1 to earn $1. At no point during 2022 did the cost of goods sold percentage plus the operating expense percentage equal less than 120%, driving sustained losses for the bottom line.

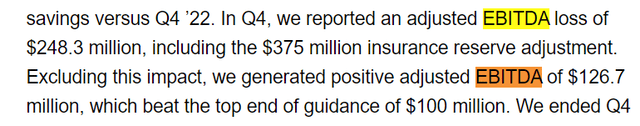

While there has been traction around adjusted EBITDA, the company still posted a loss on this metric for Q4 2022 due to one-off adjustments. However, it is a notable positive that adjusted EBITDA became positive if we don’t include the adjustment.

Adjusted EBITDA, however, is a highly complex and imperfect metric. Indeed it is one that is subject to ongoing revision, including at Lyft. I am also in the camp of investors that prefers to look past this metric and right at the cash flow.

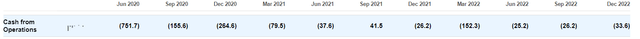

Here the picture is not too good. Lyft is still losing cash from operations, having done so almost every quarter out of the last 10.

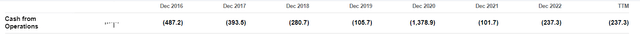

Of further concern is the fact that this metric deteriorated between 2021 and 2022. While it seemed that Lyft had perhaps cracked the code around its business, 2022 showed that it in fact did not. I consider this metric critical for any growth business and am dismayed to see the results here.

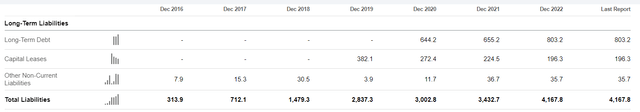

These financials don’t give me confidence in Lyft. While it's always good to see growing revenues, a closer look reveals that this growth is being propped up by heavy spending and an increased YoY operating cash loss. For a company that also increased its debt levels throughout 2022, this is all the more concerning.

Strategic Considerations For Lyft’s Business

The problem with Lyft as I see it is that it is the smaller player in a duopolistic market that relies on network effects. While this may sound like a sentence out of an economics textbook, it is indeed the case. Lyft competes directly with Uber on rideshare. While there are a few other players, all of them together are simply not big enough to really be in the same league as Lyft and Uber. As such, we can consider this market a ‘duopoly’ – a market where two players dominate the market. I think that’s a fair way to consider rideshare in the United States and most developed markets generally. We won’t consider markets in developing countries as these constitute a significantly smaller piece of the revenue pie.

The rideshare market, in turn, relies on network effects. This is because each of these businesses relies on a two-sided network: riders and drivers. A loss on either side impacts the value of the entire network. Less drivers mean higher prices and longer wait times, leading to less riders. Less riders indicate fewer earnings for drivers and longer wait times, leading to less drivers. This creates very powerful self-reinforcing effects – a spiral, if you will. It appears to me that Lyft has been fighting off this spiral by consistently taking a hit on its unit economics. Through ongoing marketing spend, driver incentives, and the like, Lyft has been able to continue operating while continuing to lose money – losing more money in 2022 than it did in 2021 on a cash basis. This isn’t a game it can afford to keep playing forever.

Furthermore, we must consider that cost of capital is always a consideration. In a duopolistic growth market it is all the more important, since you are going head-to-head with a competitor that also has a number attached to all of their debt issuance. Here, Lyft is also on its back foot. As a smaller, less diversified, player, it just isn’t possible for it to get a better cost of capital than Uber. This creates another element working against it in the game it is playing – and another reason that I believe Lyft will be on the clock.

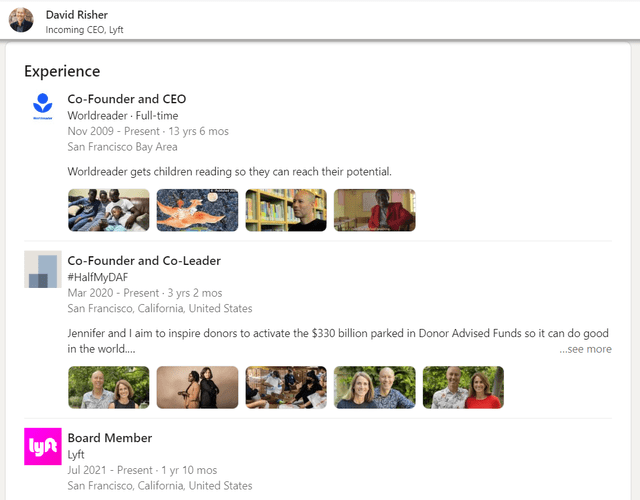

Considering all of these economics, it would be difficult for any CEO to turn things around. The new CEO, while having been a technology executive, has spent the last 13 years running a non-profit. While I’m sure that he is competent, as an investor I don’t believe this is the ideal background for someone who needs to rapidly make a company profitable. Perhaps I’ll stand corrected – or perhaps I’ll be right on the money. I don’t consider this an ideal hire at this time.

Conclusion

Lyft just doesn’t have much going for it. Frankly, I don’t really see anything going for it at all. Everything from the financials, to the economics, to the new CEO, make me marginally more concerned about this company’s operating prospects. I don’t think this is a company that can continue growing and become profitable. The new CEO has also been explicit in saying that it ‘isn’t for sale’.

As such I think that the new strategy for Lyft is that it is trying to become a lean, niche, player while establishing profitable unit economics. There does seem to be a coterie of hardcore Lyft users that always prefer the service. I don’t think that’s too many people, however, and the tough consumer environment could make them act more ‘rationally’ than before. As such I think it’s due to correct even more, and become somewhere closer to a $500M - $1B market cap company. I’ll reiterate my sell rating on this stock.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.