PCK: Pay Attention To Duration, Tech And The Debt Ceiling

Summary

- PIMCO California Municipal Income Fund II has high duration, which works on a rate pivot, but it's quite aggressive in that regard.

- Furthermore, as far as financing conditions for municipalities go, there's been less demand for munis as there's a decent amount of high-yield stuff, and debt ceiling concerns are real.

- Moreover, California has specific speculative factors around the tech sector and general prosperity of California.

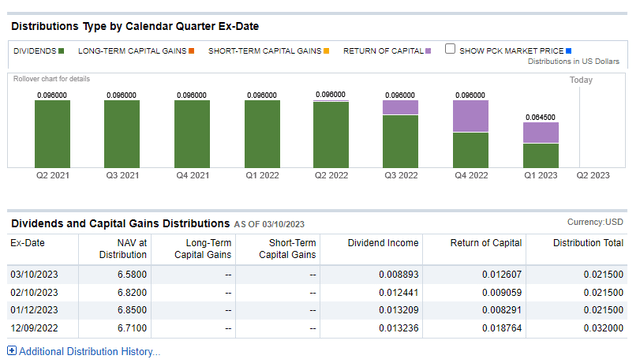

- PCK has also cut their distributions. While we think there's an argument for them as a Fed pivot becomes a possibility, we'd exercise caution due to the myriad factors at play.

- Looking for a helping hand in the market? Members of The Value Lab get exclusive ideas and guidance to navigate any climate. Learn More »

Ryan Herron

The PIMCO California Municipal Income Fund II (NYSE:PCK) contains exposures to various securities that have financed various public works in California. PCK is exposure to this portfolio through common stock, where these funds also issue preferred shares.

There is a decent case for munis, but we see some idiosyncratic issues, although only as speculative factors, for California. Moreover, the debt ceiling is another more general speculative issue that investors need to respect for fixed income. Financing conditions aren't that great in the muni space either, and while it doesn't affect incomes it does affect values. Finally, investors should be aware of the duration risks for PCK, although duration could be desirable for a Fed pivot bet. Also distributions have been cut for this fund. Overall, with the added fact that there isn't much of a discount to NAV and the expense ratios are high, we don't really see the appeal here of PCK given forces going against fixed income, even if munis have some relative benefits.

PCK Basics

Let's start with the key information that has lately affected this fund: the distributions have been cut. This has triggered some selling, even if it isn't of fundamental concern.

The duration of the munis within this fund are long, with the effective maturity at 14.8 years. expense ratios are pretty high at almost 1.3%, with more expense including leverage employed by the fund which is variable for a total of 5.3% management fees and interest expenses. The big allocations are to state and local governments, hospitals and pollution control, accounting for over 50% cumulatively of the allocations. Current discount to NAV is around 8%.

Munis

Municipal bonds are the name of the game here, and there are some positives we can start off with that concern the general asset class. Muni funds are generally yielding high, over 4% as PCK does, and tax equivalent yields are looking pretty strong relative to similar credit-rated institutions. California is around AA rated in general, which means ordinarily risk-premia will be pretty low. Munis are actually quite attractive, and have been trading systematically cheaply for some months now. PCK in particular trades at a discount to NAV. But there are some datapoints that investors should consider that may explain relative indifference by markets towards munis.

Firstly, banks that work with muni bond issuances reported that the sometimes high-yielding elements in the sector has meant lower primary issuances and primary investor demand. California in particular also has slightly higher credit concerns of late, with the tech layoffs and the faltering of major employment ecosystems like startups. Another issue is that major pension systems are under pressure in California due to the higher rates and deadened PE markets.

Major sources of capital gains tax like investments but also real estate where velocity of transactions are falling due to unfavourable real estate market dynamics aren't helping matters either. Banking fragility exacerbates the issues.

Finally, the debt ceiling is something that can impact local governments. Part of the impasse around the debt ceiling concerns government spending considered to be more discretionary, and many of these will impact municipality finances. California is a big spender and is in the crosshairs. In the even worse case scenario where no good resolution is met in due course and the credit situation of the U.S. becomes a greater concern all fixed income is at risk in the U.S. Regardless, the financial situations of municipalities and their financing conditions are not incrementing in a positive direction.

Bottom Line

Munis are probably structurally a little undervalued. What's more is that PIMCO California Municipal Income Fund II trades below its muni NAV, adding another layer of discount. The yields are good too. But ultimately there is duration risk, and the fund's income will perform poorly as rates continue to rise a little bit. There are good reason to suspect that fragility in the financial systems may lead to a sooner pivot, in which case duration will work positively for the fund, but there is an inherent volatility and certainly more scope for the dividends to eat way at the asset values and cause some value decay. More distribution cuts will scare income investors away, and cause lessened total return. Also, while munis may be cheap, financial conditions are likely to worsen for municipalities, possibly more than for households.

It's hard to be bearish, but there are certainly speculative factors that could intensify and impact intermediate values for PIMCO California Municipal Income Fund II. We'd be careful with this one.

Thanks to our global coverage we've ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it's for you.

This article was written by

Formerly Bocconi's Valkyrie Trading Society, seeks to provide a consistent and honest voice through this blog and our Marketplace Service, the Value Lab, with a focus on high conviction and obscure developed market ideas.

DISCLOSURE: All of our articles and communications, including on the Value Lab, are only opinions and should not be treated as investment advice. We are not investment advisors. Consult an investment professional and take care to do your own due diligence.

DISCLOSURE: Some of Valkyrie's former and/or current members also have contributed individually or through shared accounts on Seeking Alpha. Currently: Guney Kaya contributes on his own now, and members have contributed on Mare Evidence Lab.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.