EVG: Discount Widens, But Still Cautious

Summary

- EVG has recently sunk to a larger discount making it relatively more attractive since our last update, but not at quite a "Buy" level yet.

- The fund's short-duration focus had helped it reduce moves lower in the last year, but only mildly.

- The fund pays a managed distribution based on 10% of its NAV, which resets monthly, but the latest distribution appears to have changed this policy.

- This idea was discussed in more depth with members of my private investing community, CEF/ETF Income Laboratory. Learn More »

da-kuk

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on April 8th, 2023.

With interest rates increasing in the last year, it made sense that investors were more interested in short-duration funds. One of those funds was the Eaton Vance Short Duration Diversified Income Fund (NYSE:EVG). This is a multi-sector bond fund and last reported a leverage-adjusted duration of 1.40 years. That's actually lower than the ~2 years it showed in our last update.

While signs point to rate hikes being nearer to the end than the beginning, some investors still hold this fund, so it's worth updating. Since our last update, the fund has delivered a positive total return due to its distributions. The share price has stayed essentially flat since then, though it's more of a coincidence as it certainly wasn't a straight trajectory.

EVG Performance Since Prior Update (Seeking Alpha)

The Basics

- 1-Year Z-score: -1.19

- Discount: 2.89%

- Distribution Yield: 9.12%

- Expense Ratio: 1.47%

- Leverage: 18.09%

- Managed Assets: $203 million

- Structure: Perpetual

EVG is a relatively simple fund; they "seek to provide a high level of current income." The secondary objective is to "also seek capital appreciation to the extent consistent with its primary goal of high income."

To do this, their investment policy is rather flexible as well. The fund "will invest at least 25% of its net assets in each of the following three investment categories: [i] senior, secured floating rate loans made to corporate and other business entities, which are typically rated below investment grade; [ii] bank deposits denominated in foreign currencies, debt obligations of foreign governmental and corporate issuers, including emerging market issuers, which are denominated in foreign currencies or U.S. dollars, and positions in foreign currencies; and [iii] mortgage-backed securities that are issued, backed or otherwise guaranteed by the U.S. Government or its agencies or instrumentalities or that are issued by private issuers."

EVG utilizes leverage, and I noted previously that they ramped up leverage at the beginning of 2022. I suspected they soon regretted that decision, and by the end of their fiscal year, they listed only $32 million in borrowings. Going from $43 million down to $32 million might not seem that dramatic. For a small fund, it can still have quite an impact on income generation. Additionally, it would also miss that the fund had $61 million when they reported their semi-annual report at the end of April 30th, 2022.

EVG Annual Report (Eaton Vance)

They also listed leverage due to "derivatives," which I've not seen other funds list.

EVG Leverage End of Fiscal 2022 (Eaton Vance)

Then, by the end of the calendar year 2022, they listed only the "derivatives" as leverage. Indicating that they were at 0% withdrawn on their credit facility.

EVG Leverage End of 2022 (Eaton Vance)

Now, with their latest N-PORT, they listed having $30 million in borrowings again at the end of January 31st, 2023. Suffice it to say, they appear to be quite active in their implementation of leverage and will take borrowings up and down wildly.

Since their borrowings are based on a floating rate, it would mean higher leverage costs in the last year. Taking their leverage down on an absolute basis would reduce some of this impact. Additionally, they hedged against higher rates by going short on U.S. Treasury futures.

EVG Futures Contracts (Eaton Vance)

They implement other derivative strategies in their portfolio, such as swaps and currency contracts. As we'll see below when discussing the distribution, they didn't generally impact the fund positively as swaps lost money, and the currency transactions were mixed.

The fund's expense ratio comes to 1.47%, and when including leverage, it came to 2.22%.

Performance - Discount Getting Closer To A More Interesting Level

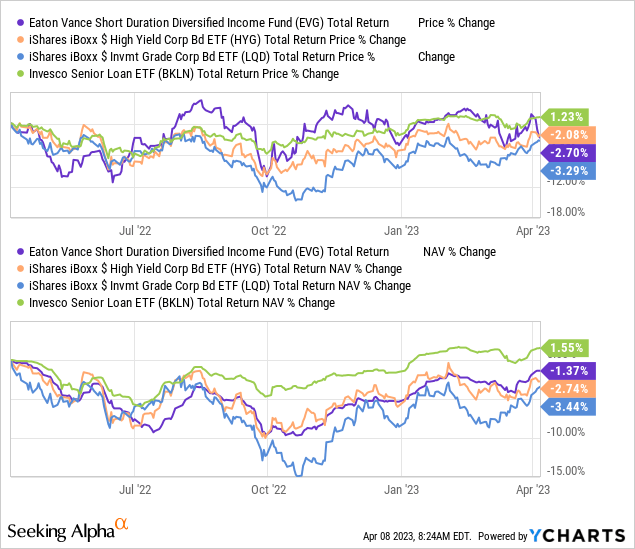

One of my criticisms in our last update on this fund was that it didn't provide any meaningful downside protection. It held up relatively better than other fixed-income ETFs we compared it to, but not meaningfully.

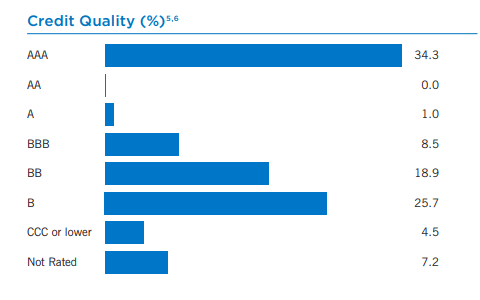

That is still somewhat the case if we compare EVG's performance to the iShares iBoxx High Yield Corporate Bond ETF (HYG) and iShares iBoxx Investment Grade Corporate Bond ETF (LQD). I've also included the Invesco Senior Loan ETF (BKLN), as EVG's portfolio spans a diverse mix of debt securities, including bank loans. The fund's portfolio actually has the largest allocation to AAA credit quality, with the second largest weighting to B credit quality. That gives it a fairly balanced portfolio.

Here are the results in the last year, where we once again see that EVG only beats out HYG and LQD slightly. In fact, I'd say for most of the last year, the fund actually correlated quite closely to HYG despite being a multi-sector bond fund with a lower duration. HYG's duration is 3.77 years. That would have suggested that any interest rate moves should impact HYG's underlying portfolio by more than double at this point.

Ycharts

One of the reasons for this, besides a higher expense ratio and portfolio positioning, would be that the fund is leveraged. Any declines in the portfolio are going to be amplified for EVG relative to these ETFs that don't utilize leverage.

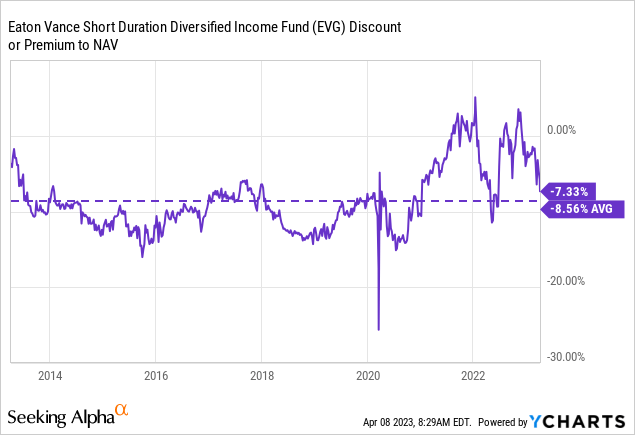

Where EVG becomes more appealing at this time is due to the fund's discount opening up. Discounts are one of the key focuses of CEF valuations. A particular focus would be the fund's current discount relative to its longer-term average. Short-term, the fund's discount is looking great, as the fund has been flirting with a premium in the last couple of years now.

Ycharts

However, it gives us quite a different look over the longer term. While we are getting closer to this longer-term average, we are still slightly above it. So I'd ultimately want to see an even wider discount from here before getting too excited, and that is why I would continue to view the fund as more of a "Hold/Neutral" for now.

Distribution - Managed Plan

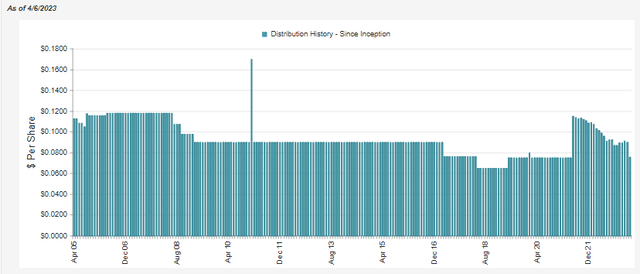

I believe that one of the things that pushed the fund to detract from its longer-term discount range was the managed 10% distribution plan that was put into place. CEF investors love yield; unfortunately, the drive for 'yield' is sometimes at a level that isn't necessarily warranted.

Investors also tend to lean into funds that pay stable distributions, so what's unusual here is that they put into place a managed plan but one that resets monthly. That means that every month, an investor gets a different payout, which generally leads to some investors avoiding the fund.

However, it's also worth noting that this last month was a particularly far drop. It didn't align with the 10% distribution plan they put into place. Instead, it was closer to 8.5% of NAV. I don't see any confirmation that their managed plan has changed with the latest distribution announcement. In looking back at the original announcement, there also wasn't any timeline set out for the conditional distribution rate increase. However, distribution policies are always subject to change. In this case, getting some confirmation would have been nice to know what is going on. At this point, it would appear we can only wait to see what happens going forward.

EVG Distribution History (CEFConnect)

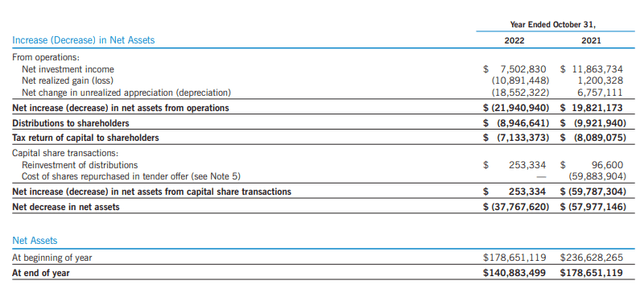

At this point, the monthly distribution is back down to the level it was before this plan was implemented. This was due to the hits the portfolio took due to increasing interest rates and the whole equity and debt market selling off. However, another contributing factor was simply that this fund couldn't generate the 10%+ that it needed to maintain the distribution in the first place. That meant paying out assets from the fund and not just the income. Despite the floating rate exposure in the fund, it would appear a reduction in leverage still meant a declining NII year-over-year.

EVG Annual Report (Eaton Vance)

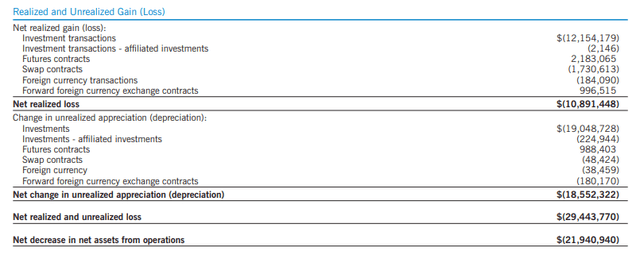

That's nothing new in CEFs either, but as a fixed-income fund, we generally would want to see net investment income cover the entire distribution. On the other hand, some fixed-income funds also utilize various derivatives; as we touched on above, EVG is one of them. In the prior year, their future contracts had resulted in positive gains, but their swap contracts resulted in losses.

Additionally, the fund's foreign currency transactions also contributed to losses, but the forward foreign currency exchange contracts did make some gains. Overall, the losses realized on the underlying portfolio, the bread and butter of the fund, were significant to overshadow these derivatives.

EVG Realized/Unrealized Gains/Losses (Eaton Vance)

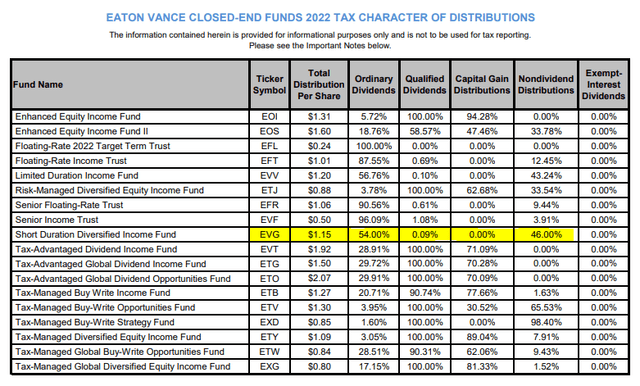

With all that being said, it's not too surprising that we would see the fund's distribution classifications show a substantial breakdown to non-dividend distributions (AKA return of capital.)

EVG Distribution Tax Classification (Eaton Vance)

Whether the fund's managed distribution policy is still 10% or 8.5% now, neither seems attainable at this point due to a reduction in leverage. This is reflected by the fund's 4.70% NII ratio in fiscal 2022. Again, we actually saw a decrease in the fund's NII due to taking leverage down, as it stood at a 5.16% NII ratio in the prior year. That was despite the fund's floating rate exposure and what I had noted as an increase in leverage previously.

It isn't impossible [to see distribution coverage improve], as more portfolio shifts, combined with higher leverage and higher rates, could push it there. It is just a large gap to cover. Every time the fund doesn't cover the distribution through NII or capital gains, that would mean more erosion for the fund. That puts it in a situation where it becomes harder and harder to keep the distributions flattish. There will always be variations in the distribution, but it would be relatively more stable if it were being covered.

At least, the lack of coverage should continue based on not being attainable from NII. If rates start to decrease, the fund could experience some gains from its underlying portfolio.

EVG's Portfolio

This fund was incredibly busy in the last year, with a 182% portfolio turnover. That's even higher than the last year when it was 76%. Given the significant shift in the portfolio's duration, it would appear they are busy reducing the duration even further. As noted, it went down to 1.4 years from the 2.1 years it was in our prior update. On an absolute basis, not a meaningful amount, probably, but on a relative basis, that meant a reduction of 33.33%.

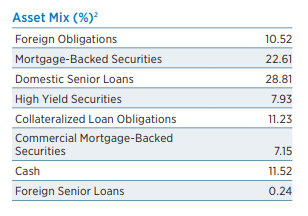

The largest exposure here is to the domestic senior loans. That makes sense as these floating rate loans help reduce duration because higher rates positively impact them. As rates rise, these loans begin to yield even more. The reverse then becomes true when rates eventually go back down, so that should also be considered. Here's the asset mix as of the end of 2022.

EVG Asset Mix (Eaton Vance)

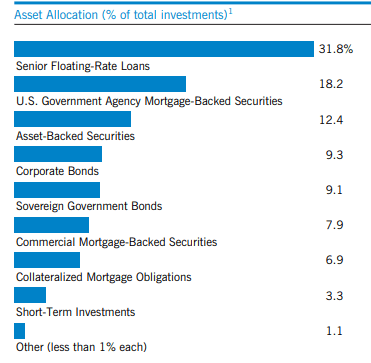

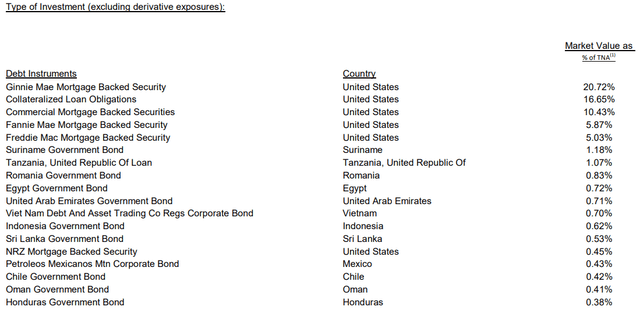

The next largest asset allocation is to MBSs. While that might send up a red flag for some investors immediately due to an expected recession, it isn't so dire in this case. That's because, even though it doesn't break it down in this display above from their fact sheet, it does break it down in their annual and semi-annual reports. What MBS we see here is the "U.S. Government Agency MBS." Here's the asset mix as of the end of the fiscal year period of October 2022.

EVG Portfolio Exposure (Eaton Vance)

While the fund does have some seriously high turnover, agency MBS continued to be the fund's largest exposure. If we flip back to the fund's latest available fact sheet, we see that the majority of the portfolio is classified as AAA credit quality. Thus, we can safely assume that it was still carrying a sizeable allocation to agency MBS a quarter later.

EVG Portfolio Credit Quality (Eaton Vance)

When looking at the top holdings at the end of February 28th, 2023, we can see again that agency MBS makes up most of the fund. They don't provide a more specific breakdown as to each holding, as they hold roughly 609 different positions. However, it does give us another updated view of the exposure the fund is carrying on a broader level.

EVG Top Exposure (Eaton Vance)

Conclusion

EVG is an interesting multi-sector fixed-income fund. However, despite its rather short duration, it hasn't been able to put up significantly better results. As we saw in the last year, it was only a mild hedge against rapidly rising interest rates. The fund's management's wild use of leverage could have been a factor as they ramped up leverage at the beginning of the year, only to bring it down to nothing by the end of the year. Of course, we can easily criticize this move with the superpower of hindsight.

They appear to have been adding back more leverage once again. In this case, if we are near the end of the rate hikes for this cycle, adding leverage back at this time could be more opportune going forward. Conversely, if inflation starts to pop back up and the Fed has to hike more aggressively again, EVG could be caught up in some bad timing once again.

All that being said, I believe that I'd still like to see an even wider discount than we are trading at now to get more of my interest.

Profitable CEF and ETF income and arbitrage ideas

At the CEF/ETF Income Laboratory, we manage ~8%-yielding closed-end fund (CEF) and exchange-traded fund (ETF) portfolios to make income investing easy for you. Check out what our members have to say about our service.

To see all that our exclusive membership has to offer, sign up for a free trial by clicking on the button below!

This article was written by

---------------------------------------------------------------------------------------------------------------

I provide my work regularly to CEF/ETF Income Laboratory with articles that have an exclusivity period, this is noted in such articles. CEF/ETF Income Laboratory is a Marketplace Service provided by Stanford Chemist, right here on Seeking Alpha.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.