HPI: A Great Fixed-Income CEF, Albeit A Pricey One

Summary

- Investors are in desperate need of income to maintain their standard of living in the face of the highest inflation that we have seen in forty years.

- John Hancock Preferred Income Fund invests in a portfolio of preferred stocks and bonds in order to pay out a very high dividend yield.

- The HPI closed-end fund has a significant weighting to some of the largest banks in the United States, but it is probably still reasonably safe despite the sector's problems.

- The distribution is more consistent than most other fixed-income funds and it is probably sustainable going forward.

- The HPI CEF is currently trading at a premium to the net asset value, which is disappointing because otherwise it is a very good fund.

- Looking for a helping hand in the market? Members of Energy Profits in Dividends get exclusive ideas and guidance to navigate any climate. Learn More »

PM Images

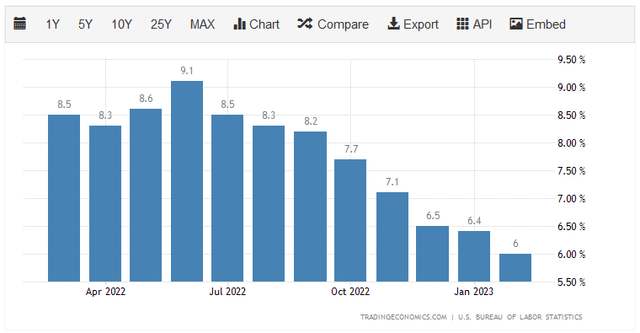

Without a doubt, one of the biggest problems facing average Americans today is the rapidly rising cost of living. This is clearly evident by looking at the inflation rate, which according to the consumer price index has been at more than 6% year-over-year over the past year:

This is a major reason why we have now had negative real wage growth for 23 straight months and why many people have been taking on second jobs or entering the gig economy just to maintain their standard of living. This is also the reason why credit card debt has been climbing and personal savings have been rapidly declining. In short, people are desperately in need of additional sources of income simply to keep themselves afloat.

Fortunately, as investors, we have better methods that we can employ in order to generate additional sources of income. After all, we can put our money to work for us. One of the best ways to do that is to purchase shares of a closed-end fund ("CEF") that specializes in the generation of income. These funds are admittedly not very well followed in the investment media and are not familiar to most financial advisors. Thus, it is not particularly easy to get information on them. This is a shame because these funds offer an easy way to obtain a portfolio of assets that can usually pay out a higher yield than just about anything else in the market.

In this article, we will discuss the John Hancock Preferred Income Fund (NYSE:HPI), which is one fund that falls into this category. This fund currently boasts a 9.47% yield, which is not only much better than the S&P 500 Index (SP500) but is clearly high enough to provide a very significant source of income. I have discussed this fund before, but several months have passed since that time so a great many things have changed. This article will therefore focus specifically on these changes as well as provide an updated analysis of the fund's financial condition. Therefore, let us investigate and see if the fund could be a good addition to your portfolio today.

About The Fund

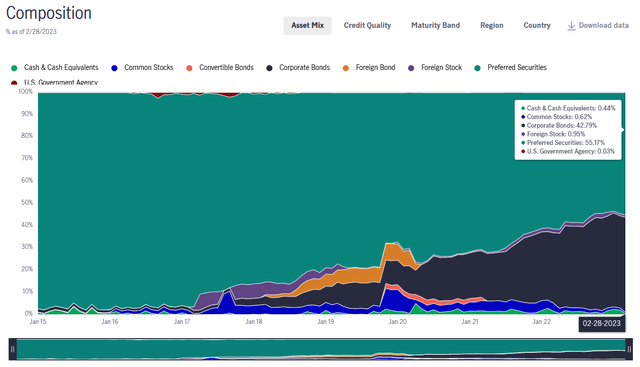

According to the fund's webpage, the John Hancock Preferred Income Fund has the stated objective of providing its investors with a high level of current income while still ensuring the preservation of capital. This is not exactly surprising considering that the name of this fund implies that it is a fixed-income fund. More specifically, the name of the fund implies that it invests specifically in preferred stock and indeed 55.17% of the fund is invested in preferred stock. The remainder of the fund is primarily in bonds, although there are a few other asset classes in the portfolio:

Preferred stock is admittedly less familiar to the average investor than common stock or bonds. This is partly because comparatively few companies issue it so there are not very many mutual funds that purchase it specifically. It also does not get nearly as much coverage in the financial media as either the stock or the bond markets. In short, preferred stock is something of a hybrid between common stock and bonds. As is the case with bonds, preferred stock pays its holders a dividend that is fixed at the time of issuance and not a dividend that is linked to the profitability of the issuing company. However, the payment of a dividend on preferred stock is also not considered a contractual obligation of the company as the payment on a bond. Thus, skipping the dividend payment owed to investors of the preferred stock will not result in the company becoming insolvent. However, the company cannot issue a dividend to its common stockholders if it does not also pay the dividend that is owed to the preferred stockholders. As most preferred stocks are issued by companies like utilities, banks, and midstream energy companies that place a great deal of importance on their common stock dividends, it is pretty rare for the preferred stockholders to not receive their payment.

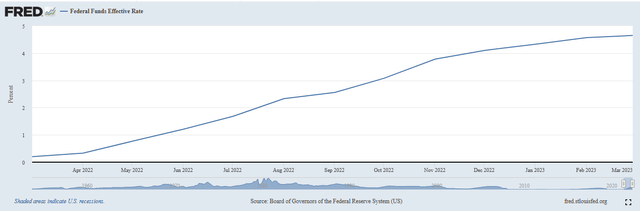

One of the defining characteristics of preferred stock and bonds is that these securities are fairly stable in price. This is mostly because of the fixed payments made to their investors. After all, a company will not increase or decrease the amount that it pays its creditors simply because of changes in its profits. This means that these securities will not usually change much in price in reaction to events that could have a material effect on a company's financial performance. The exception to this would be events that might be severe enough to cause a default, but such events are few and far between. Thus, the potential for capital gains here is fairly limited. This explains the fund's focus on income, as this will be how the majority of preferred stock and bond returns are provided to investors. However, the market prices of these securities do vary with interest rates. It is an inverse relationship, so when interest rates increase, fixed-income prices decrease, and vice versa. As everyone reading this is no doubt well aware, the Federal Reserve has been aggressively raising interest rates over the past year. In March 2020, the effective federal funds rate was 0.20% but today it is 4.65%:

Federal Reserve Bank of St. Louis

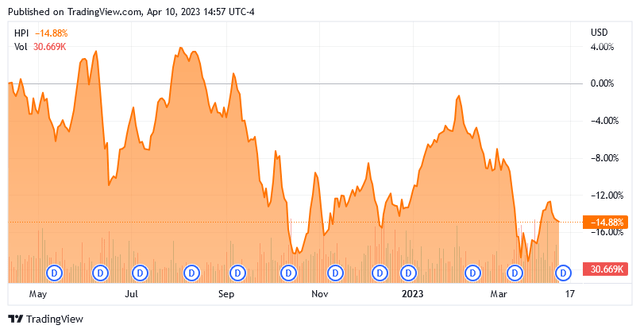

This has had a negative impact on most fixed-income funds since the value of the assets that they hold fell significantly in response to this. The John Hancock Preferred Income Fund is no exception to this as the fund is down 14.88% over the past year:

The reason for this is that bonds and preferred stock are issued at a price that provides an investor with a specified yield that depends on the market interest rate. This yield, of course, rises as the market interest rate does. Thus, older bonds in this environment will have a lower yield than brand-new ones, which means that nobody will buy an existing bond when they could get a brand-new one with identical characteristics but a higher yield. The older bonds thus decline in price until they offer the same effective yield to maturity as otherwise identical brand-new bonds. The same concept applies to preferred stock, although it has no maturity date and will sometimes offer an interest rate that changes with some benchmark in order to prevent the price from changing too much when interest rates change.

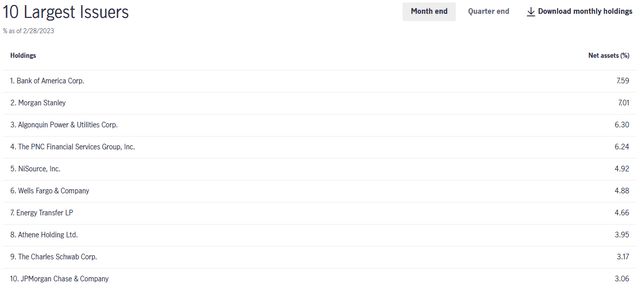

As I noted in my previous article on this fund, the John Hancock Preferred Income Fund has a very large weighting to banks and utilities. This is still the case, which we can see by looking at the largest positions in the fund. Here they are:

Curiously, the fund's website does not specifically state what percentage of the portfolio is invested in banks compared to companies in other sectors. Just the banks in the largest positions list account for 28.78% of the fund, however. It is also worth noting that the most recent data available is from February 28, 2023, which was well before the troubles that caused three American banks to collapse. It is conceivable that the fund reduced its holdings to that sector as the market became more fearful of banks in the aftermath of Silicon Valley Bank's collapse. However, most of the trouble in the United States was limited to the regional banks, not the giant international banks like most of the ones listed in the table above. The banks above are generally "too big to fail" banks that will undoubtedly receive copious amounts of government support in the event of financial problems. In addition to this, we have actually seen people pull their deposits out of smaller regional banks and put them into the major banks out of fear. The Financial Times pointed this out in mid-March following the collapse of Silicon Valley Bank. Thus, the banks that account for a large portion of the fund's holdings are probably reasonably safe. This is something that investors in this fund will probably find comforting.

Unfortunately, we do not see as much diversification in the fund's portfolio as we would like. As my long-time readers on the topic of closed-end funds are no doubt well aware, I do not like to see any single position in a fund's portfolio account for more than 5% of its assets. This is because that is approximately the level at which a position begins to expose the portfolio to idiosyncratic risk. Idiosyncratic, or company-specific, risk is that risk that any asset possesses that is independent of the market as a whole. This is the risk that we aim to eliminate via diversification, but if the asset accounts for too much of the portfolio, then it will not be completely diversified away. Thus, the concern is that some event may occur that causes the price of a given asset to decline when the market in an aggregate does not. If that asset accounts for too much of the portfolio, then it could end up dragging the entire fund down with it. As we can clearly see above, there are four issuers whose securities each represent at least 5% of the fund's portfolio. Of these outsized positions, four are banks. This is concerning and any potential investor should ensure that they are willing to be exposed to the risks of these companies individually before taking a position in the fund.

Leverage

As mentioned in the introduction, closed-end funds like the John Hancock Preferred Income Fund have the ability to earn and pay out a higher effective yield than that possessed by any of the underlying assets. One strategy that is used to accomplish this is leverage. Basically, the fund borrows money and then uses that borrowed money to purchase preferred stocks and bonds. As long as the purchased assets have a higher yield than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. As this fund is capable of borrowing money at institutional rates, which are significantly lower than retail rates, this will usually be the case.

However, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. Thus, we want to ensure that the fund is not using too much leverage because that would expose us to too much risk. I do not typically like to see a fund's leverage exceed a third as a percentage of its assets for this reason. Unfortunately, the John Hancock Preferred Income Fund fails to meet this requirement. As of the time of writing, the fund's levered assets comprise 39.42% of its portfolio. This is quite a bit above the level that we really want to see but it may not be so bad. As already mentioned, preferred stock and bonds tend to be somewhat more stable than common equity over time so the fund can probably sustain higher leverage than a common equity fund could. Its leverage is probably okay for this reason, but I would still feel a bit more comfortable if it were reduced.

Distribution Analysis

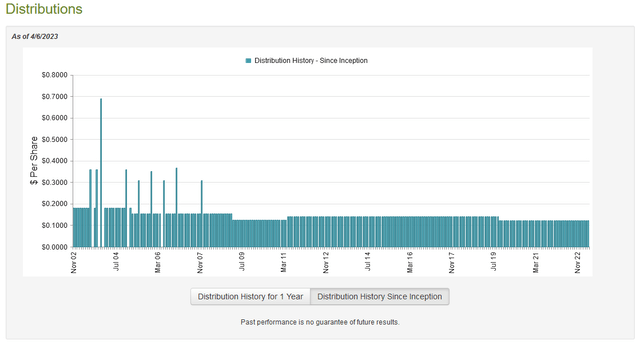

As mentioned earlier in this article, the primary objective of the John Hancock Preferred Income Fund is to provide its investors with a high level of current income. In order to achieve this objective, the fund invests primarily in preferred stock, which tends to have fairly respectable yields. The fund also includes bonds in the portfolio, which provide a secondary source of income. It then applies a layer of leverage to artificially boost the yield of the portfolio as a whole. As such, we can assume that the fund likely has a fairly high yield. This is certainly true as the fund currently pays out $0.1235 per share monthly ($1.482 per share annually), which gives it a 9.47% yield at the current price. The fund has generally been consistent with this yield as it is one of the few fixed-income funds that did not cut its distribution in the past twelve months:

As we can see, the fund's distribution has been consistent since October 2019. Even though it has changed throughout its history, the fund's distribution has generally not varied by very much regardless of the year. This is something that differentiates it from most other funds and is likely to appeal to those investors that are seeking a safe and consistent source of income to use to pay their bills or otherwise finance their lifestyles. We should certainly investigate though since the fact that this fund has been much more consistent than some of its peers is a bit strange. We should especially determine how sustainable this distribution is likely to be, since we do not want to be the bag holders if the fund is forced to cut its distribution. After all, such a scenario would reduce our incomes and almost certainly cause the fund's share price to decline.

Fortunately, we do have a very recent document that we can consult for the purposes of our analysis. The fund's most recent financial report corresponds to the six-month period that ended on January 31, 2023. This is one of the newest financial reports available for any closed-end fund and it is certainly much newer than the one that we had available to us the last time that we discussed this fund. This report should give us a very good idea of how well the fund navigated the challenging conditions that affected the fixed-income market last year. During the six-month period, the John Hancock Preferred Income Fund received a total of $14,607,549 in dividends and $8,860,436 in interest from the investments in its portfolio. After we net out the withholding taxes that the fund had to pay, it had a total investment income of $23,418,045 during the period. The fund paid its expenses out of this amount, leaving it with $14,968,310 available for shareholders. This was unfortunately not enough to cover the $19,559,824 that the fund actually paid out in distributions, though. This is something that may be concerning at first glance as the fund's net investment income is clearly insufficient to cover its distributions.

However, the fund does have other ways through which it can obtain the money that is needed to cover the distribution. For example, it might have capital gains. While those were difficult to come by for any fixed-income fund during 2022, the fund still reported net realized gains of $5,042,419 over the period. This was offset by net unrealized losses of $18,732,287 and overall, the fund's assets declined by $17,345,986 after accounting for all inflows and outflows. That is certainly concerning as it indicates that the fund failed to earn enough to cover its distributions. However, the fund's net realized gains combined with net investment income were sufficient to cover the distribution, so it did not do as poorly as we might think. The fund can probably maintain its distribution if it can continue to realize capital gains from the portfolio. That might be possible as the bond market has been fairly strong over the past few months, which undoubtedly provided the fund with some trading opportunities.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to earn a suboptimal return on that asset. In the case of a closed-end fund like the John Hancock Preferred Income Fund, the usual way to value it is by looking at the net asset value. A fund's net asset value is the total current market value of all of the fund's assets minus any outstanding debt. This is the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them at a price that is less than the net asset value. This is because such a scenario implies that we are buying the fund's assets for less than they are actually worth. This is, unfortunately, not the case with this fund today. As of April 6, 2023 (the most recent date for which data is currently available as of the time of writing), the John Hancock Preferred Income Fund had a net asset value of $14.98 per share but the shares currently trade for $15.65 each. This gives the fund's shares a 4.47% premium to the net asset value. While this is less than the 7.17% premium that the shares have traded at on average over the past month and this is a pretty good fixed-income fund, it is still not a good idea to purchase any fund at a premium to the net asset value. Thus, it is probably best to wait until the shares become available at a discount before buying.

Conclusion

In conclusion, the John Hancock Preferred Income Fund does appear to be one of the better fixed-income funds, although its price certainly reflects that. The fund does have a lot of banking sector exposure, which might concern some people, but the risks here are probably not too great. The distribution appears to be more sustainable than expected if the fund manages to generate some capital gains, which it could certainly do. The biggest problem here is that the John Hancock Preferred Income Fund price is a bit higher than we should ever pay for a fund.

At Energy Profits in Dividends, we seek to generate a 7%+ income yield by investing in a portfolio of energy stocks while minimizing our risk of principal loss. By subscribing, you will get access to our best ideas earlier than they are released to the general public (and many of them are not released at all) as well as far more in-depth research than we make available to everybody. In addition, all subscribers can read any of my work without a subscription to Seeking Alpha Premium!

We are currently offering a two-week free trial for the service, so check us out!

This article was written by

Traditionally, we have not always responded to comments but in order to improve the quality of our research, comments will be reviewed and we will respond to issues regarding errors or omissions. This does not include our premium service, "Energy Profits In Dividends" which is available from the Seeking Alpha Marketplace. This service does include detailed discussions with our team both on the reports themselves and in a private forum.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.