Akamai: 4 Reasons To Buy

Summary

- Akamai is facing increased competition on its CDN networks due to the entry of major players.

- Akamai's other business segments are growing rapidly, so revenue and earnings growth is still positive.

- Akamai has a high free cash flow margin of 23%. On average, 74% of this is returned to shareholders by share buybacks.

- The high short interest is also beneficial because sooner or later these speculators have to close their short position by buying the shares.

- Analysts expect growth in both revenue and adjusted earnings per share for the next few years. And that really makes the stock worth buying.

bin kontan/iStock via Getty Images

Introduction

Fast and secure web browsing is becoming increasingly important to reduce unnecessary stress and keep visitors on your website. 47% of customers leave a website if it does not load within 2 seconds. One solution to improve website performance and reduce delays is a content delivery network (CDN).

There are many content delivery network services available and Akamai (NASDAQ:AKAM) is the global leader. Akamai's customers include well-known companies such as Adobe (ADBE), Microsoft (MSFT), Oracle (ORCL), RedHat, PwC and Tesla (TSLA). Akamai has always focused on enterprises.

Akamai's strength lies in the large network it utilizes. The CDN market is expected to grow at a Compound Annual Growth Rate (CAGR) of 14.1% through 2025. The key drivers for the growth of the CDN market is the increasing need to enable uninterrupted live and rich content over the Internet. A CDN network and infrastructure protection is a service needed even in recessions. However, Akamai faces serious competition from emerging CDN networks. Therefore, it has diversified its product and service offerings to still continue to grow in this competitive market.

My bullish stance is characterized by:

- Revenue and earnings growth are expected for fiscal 2023. Also, the FCF margin of 23% is attractive.

- The share repurchase program is a tax-efficient way to return cash to shareholders and provides a cushion in a bear market.

- The share valuation is attractive.

- Short squeeze potential.

Results Are Mixed, But Outlook Is Good

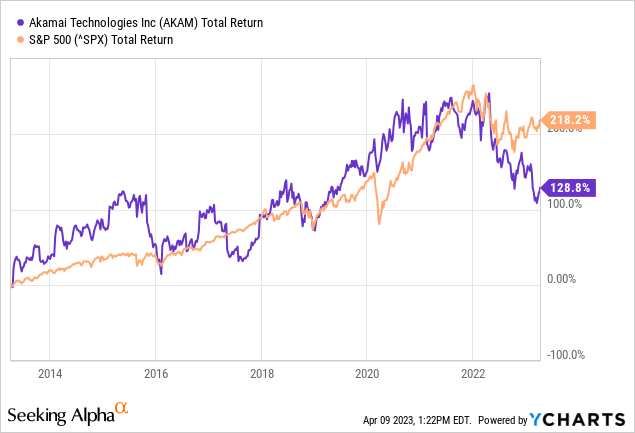

Akamai's stock price has been on a downward trend since early 2022. As a result, the stock appears very favorably valued. Still, the company has posted a strong performance over the past 4 years. Average annual revenue growth was 7.6%, and growth in adjusted EPS averaged 10.3% annually.

In 2022, Akamai posted revenue growth of 4% (8% at constant exchange rates). Adjusted operating income fell 6% from a year earlier and adjusted operating margin fell 3% to 29%.

I quote from their earnings report for the fourth quarter of 2022:

Revenue by solution:

- Security revenue for the fourth quarter was $400 million, up 10% year-over-year and up 14% when adjusted for foreign exchange.* Security revenue for 2022 was $1.542 billion, up 16% year-over-year and up 20% when adjusted for foreign exchange.*

- Delivery revenue for the fourth quarter was $415 million, down 12% year-over-year and down 8% when adjusted for foreign exchange.* Delivery revenue for 2022 was $1.669 billion, down 11% year-over-year and down 8% when adjusted for foreign exchange.*

- Compute revenue for the fourth quarter was $112 million, up 61% year-over-year and up 65% when adjusted for foreign exchange.* Compute revenue for 2022 was $405 million, up 60% year-over-year and up 64% when adjusted for foreign exchange.*

Revenues from the Security and Delivery business segments are nearly equal, but the Delivery segment declined 12% year-on-year last quarter. The CDN network currently faces significant competition from Microsoft, Amazon (AMZN), Alphabet (GOOG) (GOOGL), Cloudflare (NET) and the like. These companies offer virtually the same services as Akamai and are significant emerging players in the market.

Akamai is focusing on its rapidly expanding Security Technology Group in addition to its content delivery network. In addition to securing customers' websites, mobile apps, and application programming interfaces, Akamai also offers access control and infrastructure protection. In the final quarter of 2022, the Security Technology Group accounted for 43% of total revenues, up from 41% in the third quarter.

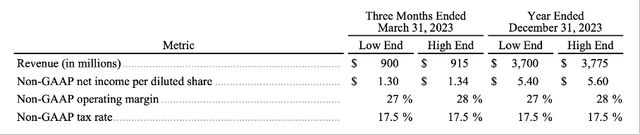

Fiscal 2023 outlook (Akamai's 4Q22 earnings release)

Share Repurchases

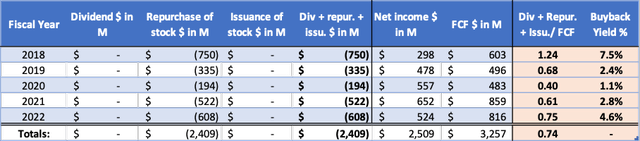

Akamai chooses to return cash to shareholders through share repurchases instead of dividends. Share repurchases are favored by non-income investors by avoiding dividend taxes. Demand increases when shares are repurchased, which can boost the share price. Also, the repurchase program provides the stock price with a cushion in a declining market because outstanding shares decrease while demand increases.

In 2022, management spent $608 million on share repurchases, representing a buyback yield of 4.6%. In recent years, 74% of free cash flow has been returned to shareholders, with the rest coming as cash on the balance sheet. So their program is sustainable over the long term.

Akamai's cash flow highlights (Annual reports and the analyst' own calculations)

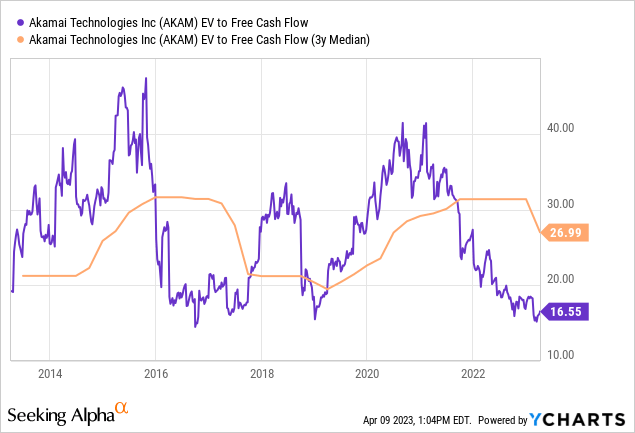

Valuation Is Favorable At This Price Level

To get an idea of the stock's valuation, we compare its current valuation with its historical valuation. Then we assess whether the stock is favorably valued for the near future.

The first graph I want to show is the ratio of enterprise value to free cash flow. This ratio includes cash and debt when valuing the stock and gives a clearer picture of the valuation than the PE ratio. The ratio is currently 16.6 and the company has historically been valued at a ratio of 27. I think the ratio of 27 is on the high side given the current economic climate. But the ratio of 16.6 is clearly on the low side (even close to a 10-year historical low). A ratio of 16.6 fits better with companies that are mature and where growth has stalled. And yes this was the case during the December 2022 earnings, but several analysts expect growth in earnings per share for the next few years. So the stock seems clearly undervalued.

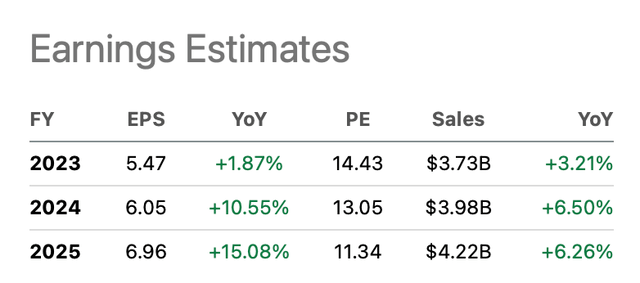

Analysts expect adjusted earnings per share to rise 11% in fiscal 2024 and 15% in fiscal 2025. Revenue is expected to increase by mid-teens. With a forward PE ratio of 13 in 2024, I think Akamai is clearly a good buy at this price level.

Akamai's earnings estimates (AKAM ticker page on Seeking Alpha)

Short Squeeze Potential

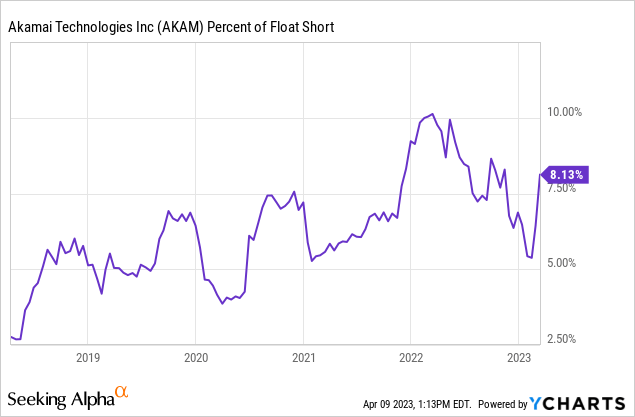

One catalyst for share price appreciation is high short interest. Currently, more than 8% of outstanding shares are sold short. While this may not seem like much, these speculators must buy the stock to close their position one day. This increases demand which could drive up the stock price.

The ratio was at its highest in early 2022, and from then on the price fell 32% to $79 currently. So I think the short sellers could close their position in the short term; which could push the stock price higher.

The company's strong fundamentals, favorable outlook and share buyback program do not indicate that the company is stagnant. Therefore, I see the high short interest as an additional growth catalyst.

Conclusion

Akamai is a global leader in content delivery network services and the content delivery network (CDN) market is expected to grow at a CAGR of 14.1% through 2025. Akamai posted revenue growth of 4% in 2022, but adjusted operating income fell by 6%. The company is facing increased competition on its CDN networks due to the entry of major players. Akamai's other business segments are growing rapidly, so revenue and earnings growth is still positive.

Akamai has a high free cash flow margin of 23%. On average, 74% of this is returned to shareholders by share buybacks. This gives the potential for share price appreciation. The high short interest is also beneficial because sooner or later these speculators have to close their short position by buying the shares. Furthermore, the valuation of the stock is very favorable. Analysts expect growth in both revenue and adjusted earnings per share for the next few years. And that really makes the stock worth buying.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.