RWM: An ETF Poised To Exploit A Collapse In Small Cap Stocks

Summary

- Small cap stocks are exhibiting a troublesome pattern, seen the last 2 times they broke down hard.

- The current market environment is characterized by flight-to-safety, and small caps increasingly offer higher risk as the economy deteriorates.

- RWM essentially shorts IWM, the Russell 2000 index, making this inverse ETF an ideal way to profit from falling small cap stocks.

syahrir maulana

By Rob Isbitts

US Small cap stocks have a reputation. Because they are smaller, they may have more long-term growth potential than larger, more mature companies. US Small caps also tend to have businesses that are more domestically-focused, as opposed to the global giants that dominate the S&P 500 and Nasdaq indexes. That's all part of the classic case for small cap stocks in bull markets. But I think in the current economic and stock market climate, the list of circumstances working against US small caps is piled high.

I recently initiated a position in ProShares Short Russell 2000 (NYSEARCA:RWM) in my personal portfolio, and regard it as part of a larger arsenal to try to capitalize on what I believe are the most vulnerable areas of the stock market as 2023 continues. In addition, with this report, I am adding RWM to the growing list of potentially useful ETFs that I believe are largely ignored and simply unknown to a large percentage of the investment public. RWM is yet another "undiscovered" ETF investors should know about, unless they believe that the stock market is a one-way rally for the rest of this year. I don't.

RWM: an answer for fading small cap hopes

RWM is an ETF that essentially aims to act as the mirror image of iShares Russell 2000 ETF (IWM), which tracks the most popular US small cap index. That index is arguably inexpensive on a fundamental basis, selling at about 11 times earnings. But can those earnings be believed? I'm not so sure. Small companies are in the early stages of getting hit from all sides, so to speak. Many are financially vulnerable to a weaker economy, and the Russell 2000 possesses a significant number of companies who rely heavily on debt to fund their potential growth. It was reported recently that 40% of the member stocks of the Russell 2000's more than 1,900 companies don't have positive earnings. That's more than 750 stocks that aren't making money! And conditions are not about to get easier.

One reason some investors choose iShares Core S&P Small-Cap ETF (IJR) as their small cap index tracker is because that index includes a profitability screen. The Russell 2000 and thus IWM does not.

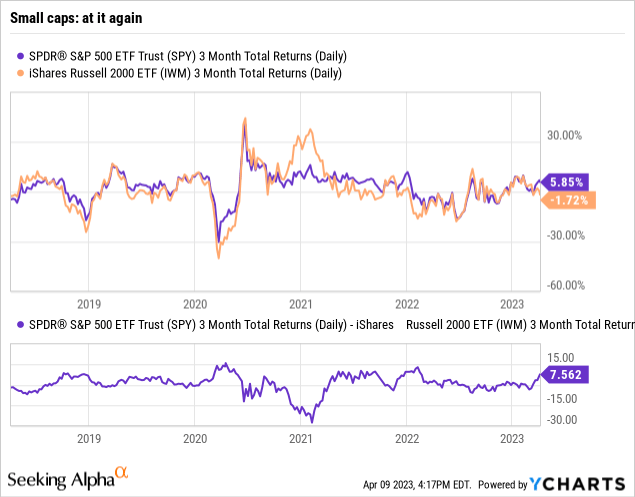

Furthermore, there is the situation depicted in the chart below. Small caps are starting to lag the S&P 500 in the same way they did prior to the 2020 and 2022 market tops. At the far right of the bottom part of the chart, you can see that over the past 3 months, IWM has trailed the S&P 500 by more than 7%, a figure that has been on the move upward very recently. This is not rock-solid evidence, but it is a price-driven red flag that serves as additional evidence that small caps, at least the Russell 2000 style of US small cap investing, may bear a bigger brunt of the next stock market air pocket than other major indexes.

As the chart shows, this is what tends to happen. When large cap stocks fall, IWM falls harder. And, for the first time in years, the increasingly fragile stage of small cap stocks as a collective is starting to weigh on investors' minds in a way that could have some staying power. To me, this is a case of the market starting to carve out a story, where an increasingly challenging fundamental narrative is starting to show up in what is ultimately the only thing that matters: price.

Single inverse ETFs: an overlooked investor tool for modern markets

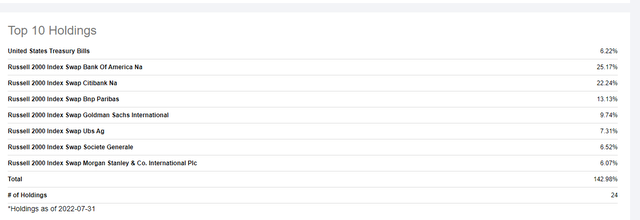

That brings me back to RWM. If I'm right about the increased risk of US small cap stocks being realized (i.e. price follows through to the downside), then RWM would seem to be an ideal way to profit from that. As with the rest of the ProShares lineup of single inverse ETFs, RWM uses a mix of swap contracts from an array of major global financial firms to try to deliver the opposite of what the Russell 2000 does. As I look out to the rest of 2023 and into 2024, if there is a flight to safety situation in some parts of the stock market, it is not likely to be with small caps. Thus, RWM serves to either profit from the next down leg in stocks in general, or from a situation like we've had recently, where it underperforms the larger cap market segment.

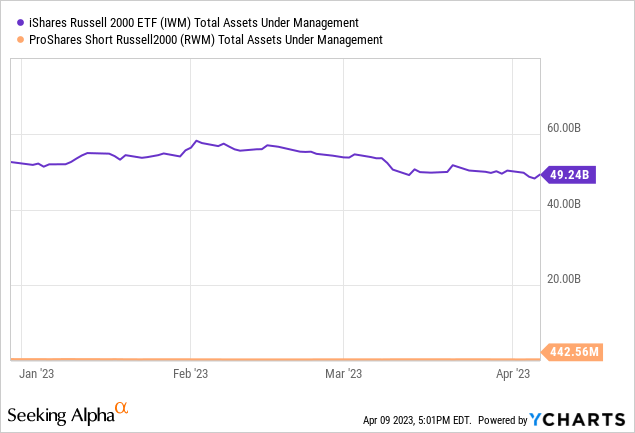

RWM is another one of those relatively "undiscovered" ETFs to me. At under $450mm in AUM, this fund is less than 1% the size of its opposite ETF, IWM, which has nearly $50B in AUM. That said, as shown below, its 30-day average share volume is picking up, and it has recently been trading around $70mm a day. That large percentage of total assets is a good indication of what single inverse ETFs are: a more tactical way to try to capitalize on declines in market segments, without using leverage.

Unique risks to inverse ETFs to be aware of

As ProShares states on its website, inverse ETFs, even non-levered ones like RWM, have some particular risks attached, which is why I described my use of them above as "tactical" and not "buy and hold." Here it is in ProShares' own words:

“Due to the compounding of daily returns, holding periods of greater than one day can result in returns that are significantly different than the target return, and ProShares' returns over periods other than one day will likely differ in amount and possibly direction from the target return for the same period. These effects may be more pronounced in funds with larger or inverse multiples and in funds with volatile benchmarks.”

RWM: a useful tool at a time of heightened uncertainty for US small cap stocks

RWM gets a Buy rating from me, as I think small caps are at least a laggard as the bear market cycle gets deeper. Small caps are off recently, so there's always a chance of a bear market bounce. We've seen plenty of those since January of last year. But my entire investment approach is about the tradeoff between reward and risk of major loss. And with the winds swirling around smaller, and often unprofitable companies who have to now borrow at higher interest rates, I see the risk of US small caps being much greater than the reward potential for awhile. Thus, my recent purchase of RWM as part of the "short" portion of my personal portfolio.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RWM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I also own IWM put options

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.